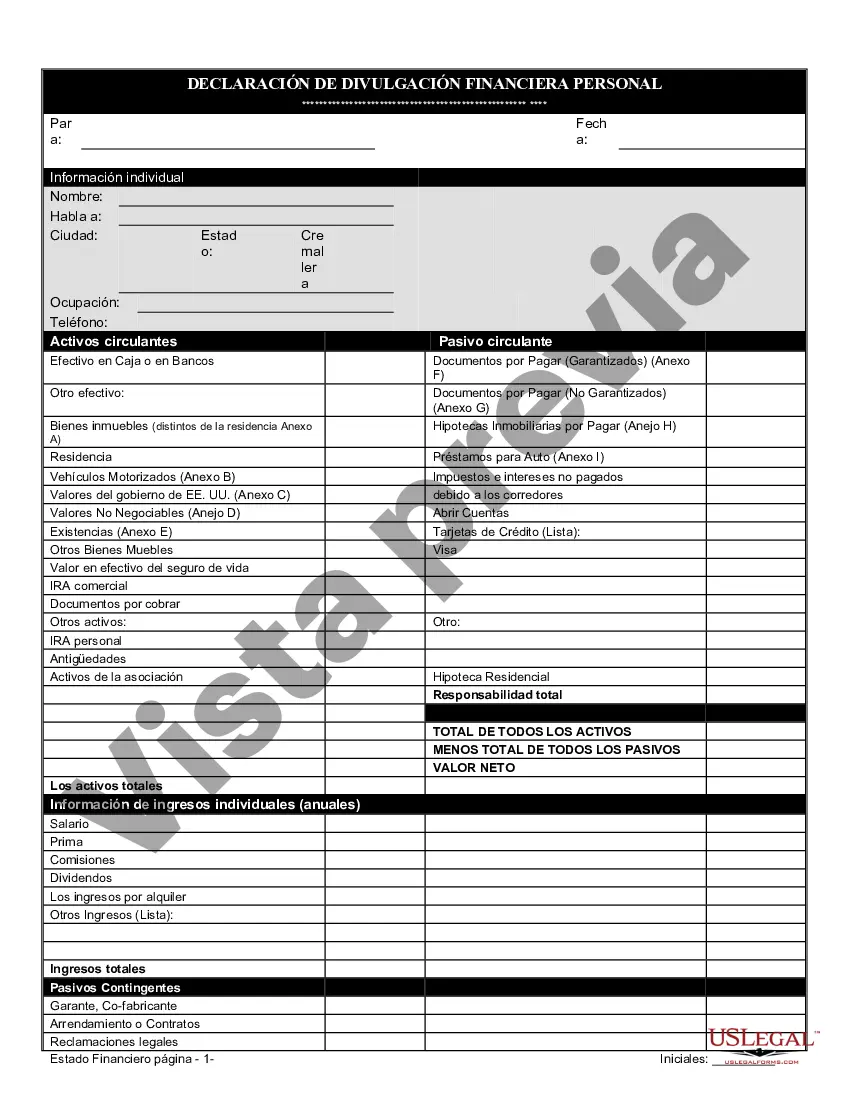

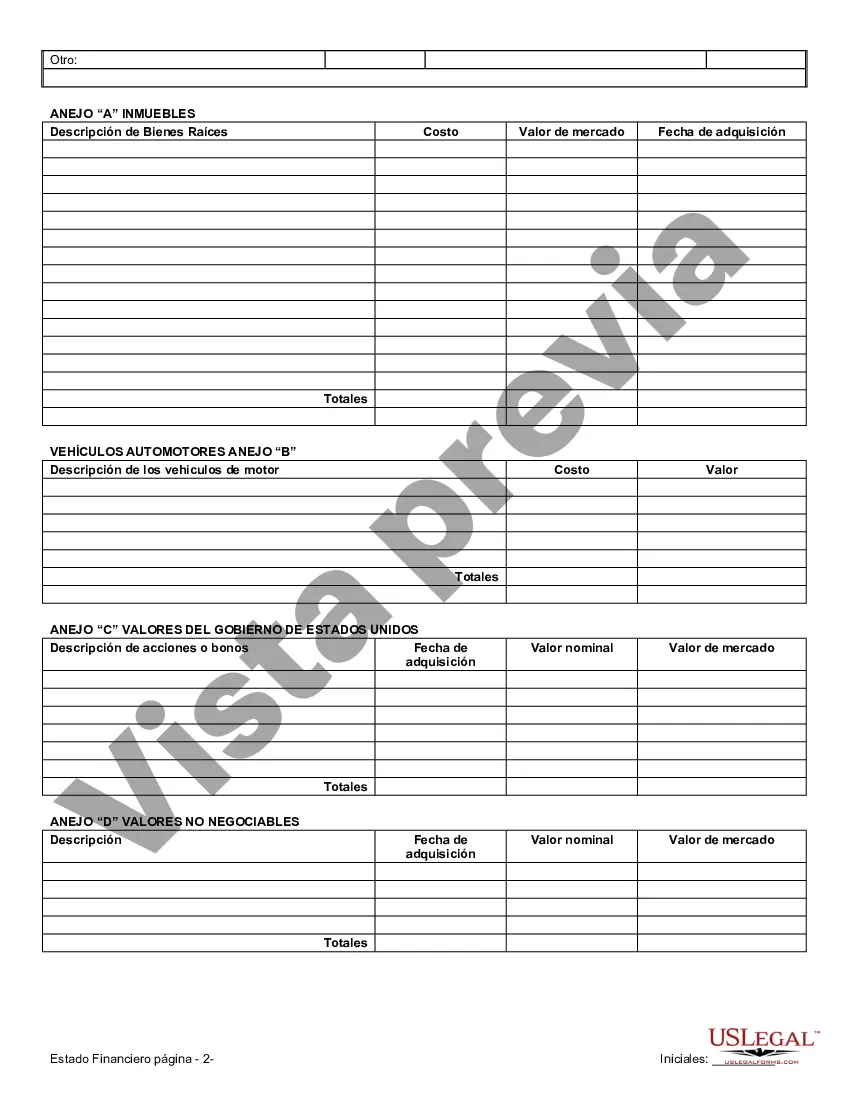

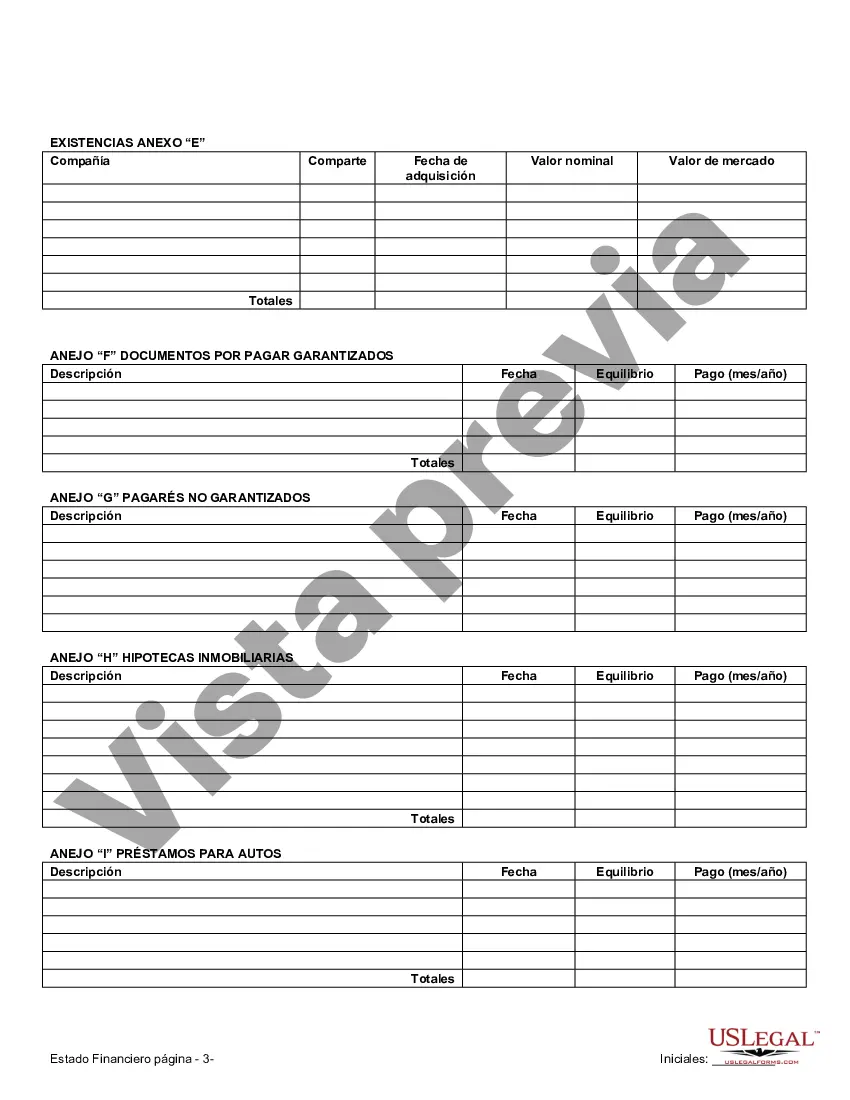

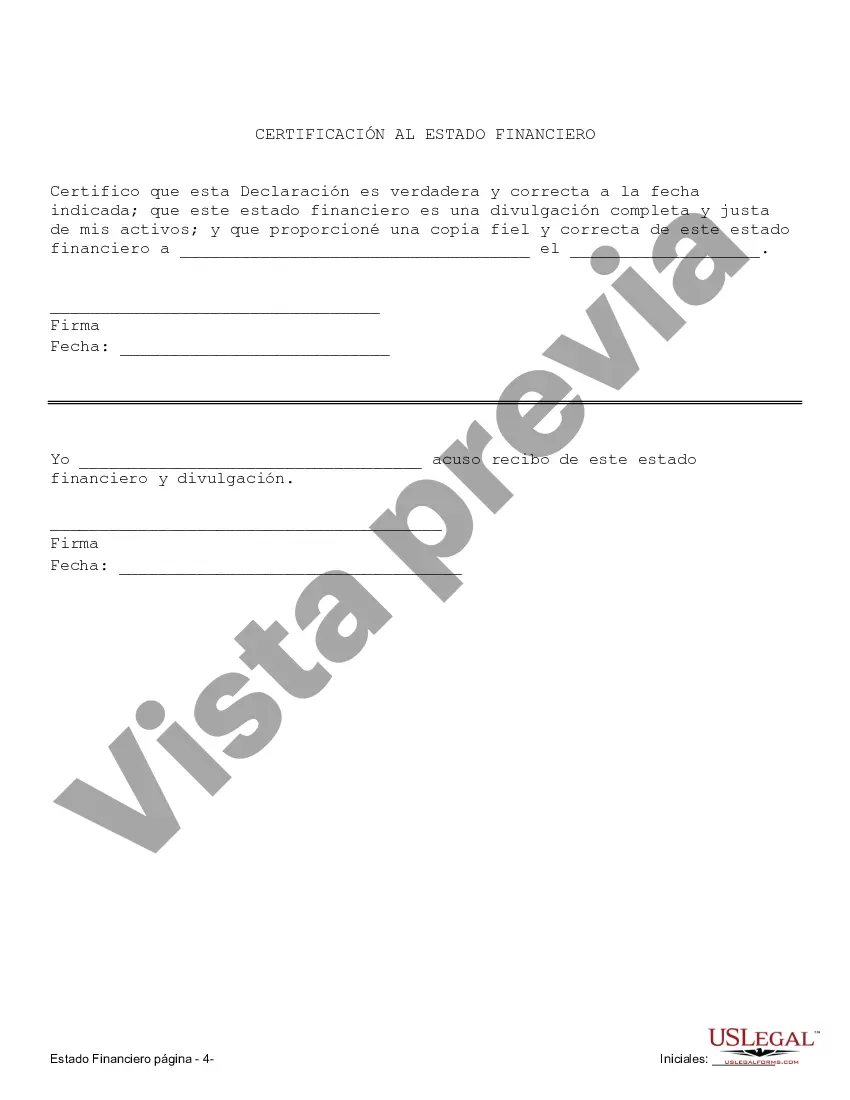

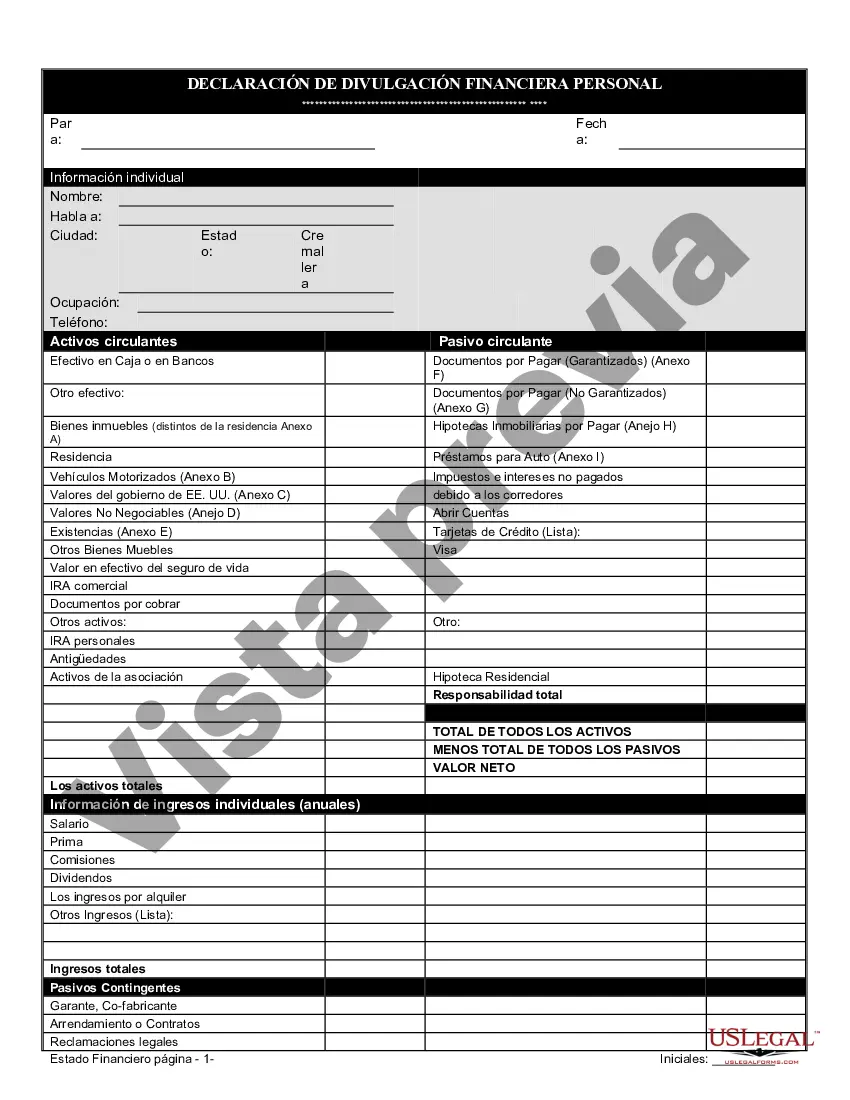

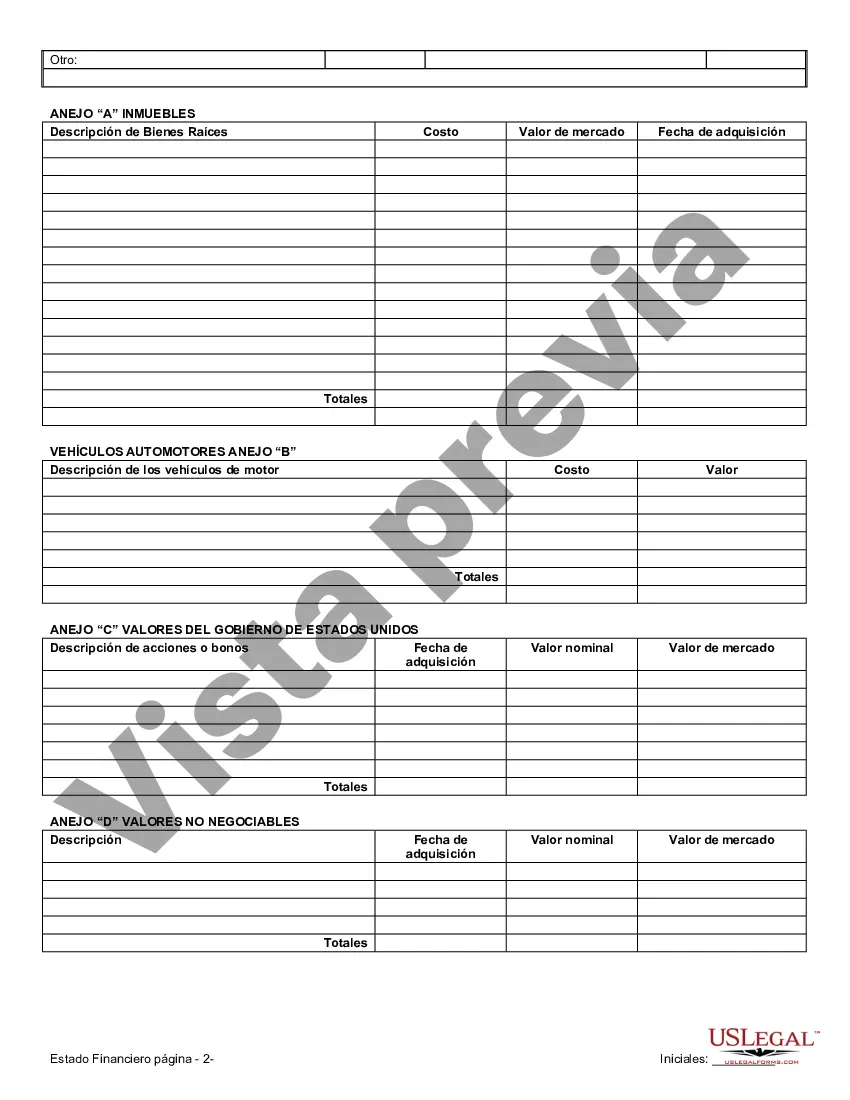

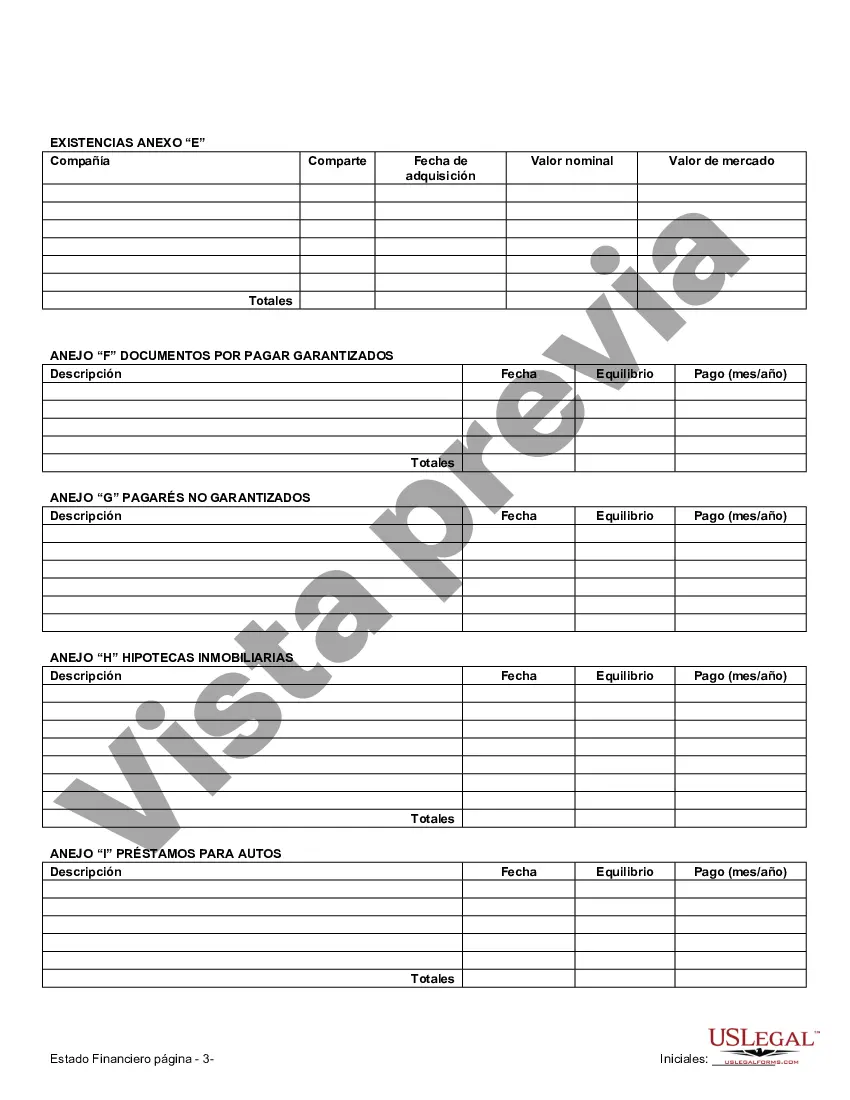

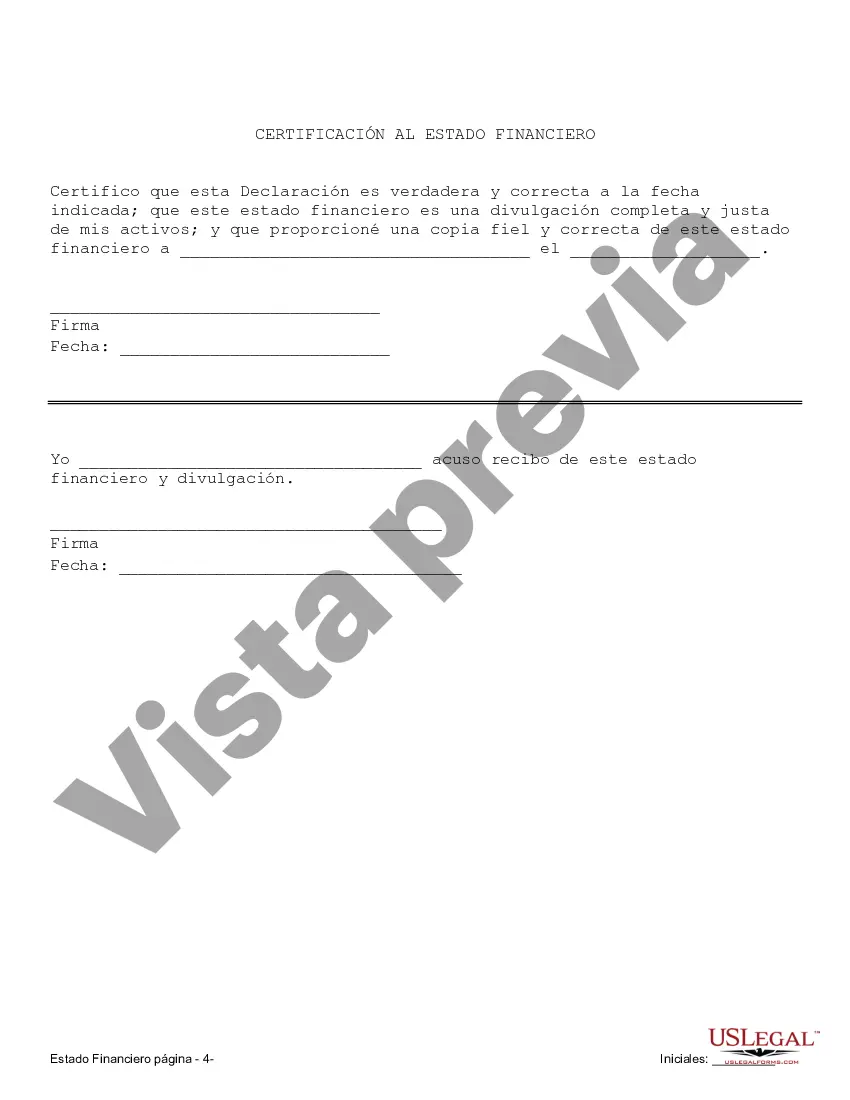

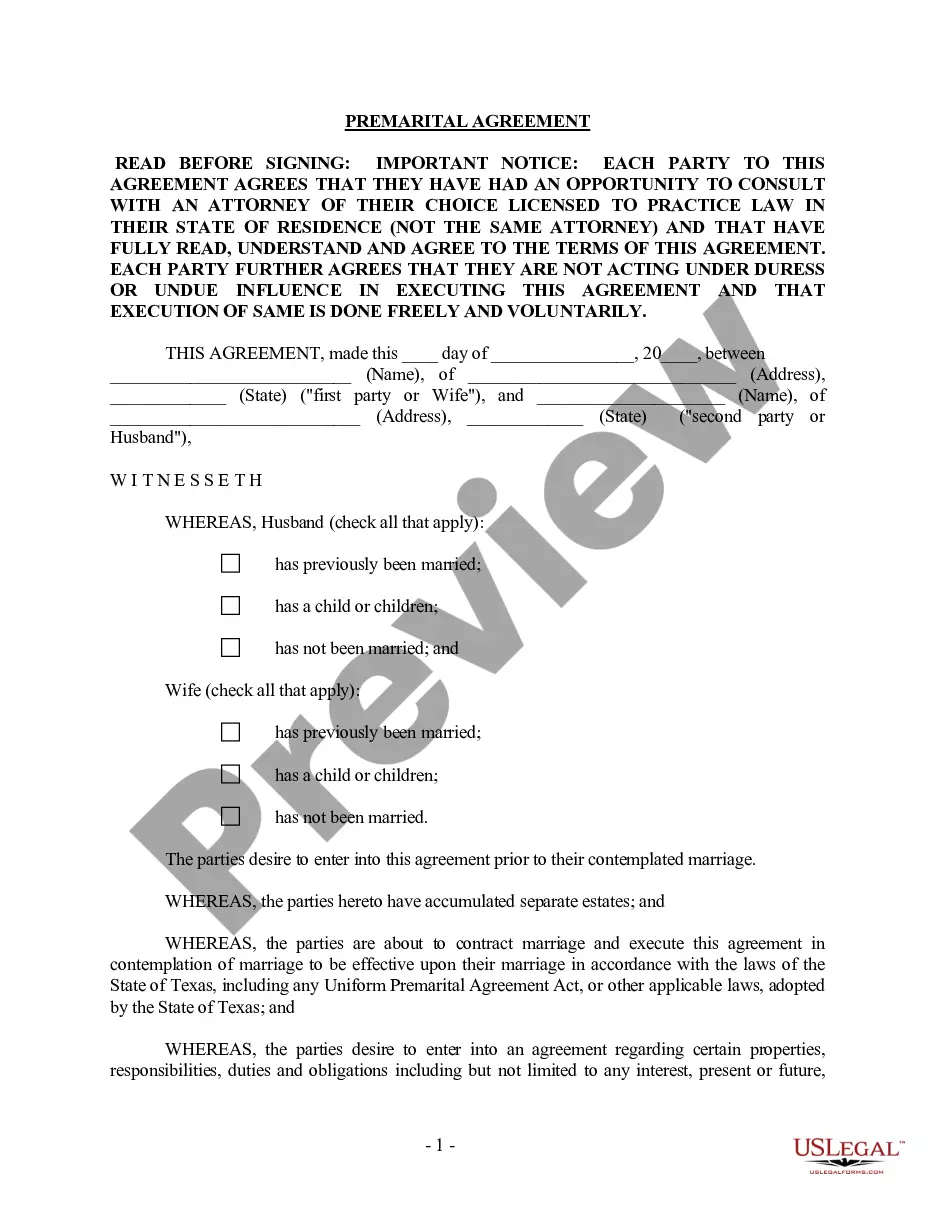

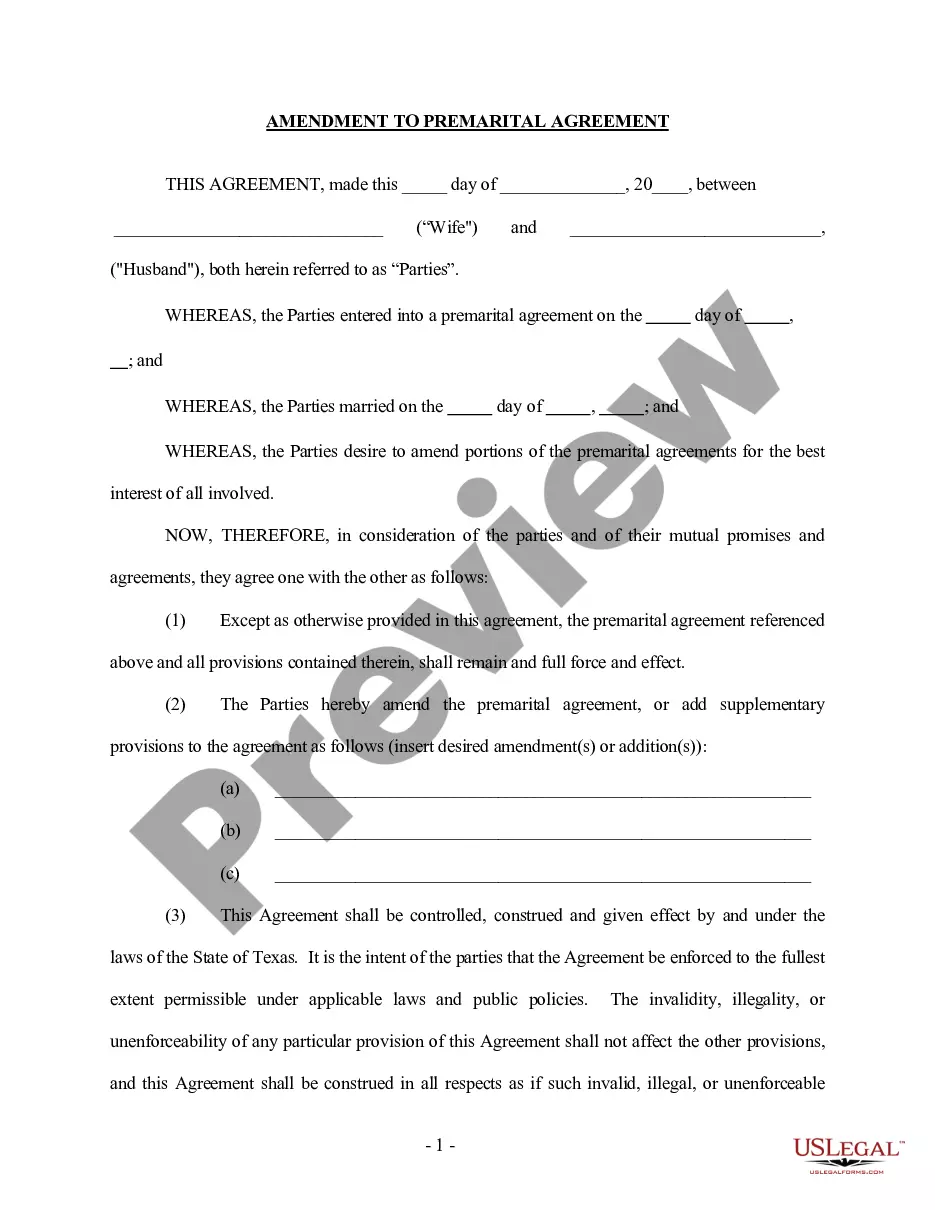

Carrollton Texas Financial Statements in Connection with Prenuptial Premarital Agreement: Explained When it comes to a prenuptial (also known as a premarital) agreement in Carrollton, Texas, financial statements play a crucial role. These documents provide an in-depth look at the financial aspects of both parties involved and help set the foundation for asset division and spousal support arrangements. In this article, we will delve into the different types of Carrollton Texas financial statements that are commonly used in connection with prenuptial agreements, ensuring you understand their importance and how they contribute to the overall agreement. 1. Personal Financial Statements: These detailed reports compile individual financial information, including income, assets, liabilities, and expenses. Each party involved in the prenuptial agreement must provide accurate and transparent personal financial statements to ensure a comprehensive understanding of their financial circumstances. 2. Income Statements: This statement outlines a person's income from various sources, such as employment, investments, rental properties, or businesses they own. Accurate income statements prevent any ambiguity and help determine potential spousal support obligations in the event of divorce or separation. 3. Balance Sheets: A balance sheet provides a snapshot of an individual's financial situation by listing all assets and liabilities. It allows both parties to evaluate their net worth and make fair decisions regarding asset distribution in the prenuptial agreement. 4. Bank Statements: Bank statements reflect a person's financial transactions, including deposits, withdrawals, and account balances. These statements are crucial for verifying the accuracy of income and expenses declared in the personal financial statements. 5. Tax Returns: Tax returns provide an overview of a person's income, deductions, and taxes paid. These documents serve as vital evidence for income verification and give insights into potential tax obligations or exemptions that should be considered in the prenuptial agreement. 6. Investment Statements: Including investment statements in the financial disclosure allows for a complete understanding of any investments, such as stocks, bonds, retirement accounts, or real estate. These statements provide insight into the growth, value, and potential future returns on these investments. 7. Debt Statements: Considering debts is essential when determining financial responsibilities and division of liabilities. Parties must provide accurate information about any outstanding debts, such as mortgages, loans, credit card balances, or other financial obligations. It is crucial that all these financial statements are complete, accurate, and up-to-date to avoid misunderstandings, disputes, or legal complications later on. Consulting with a financial advisor or attorney experienced in family law matters can help ensure the financial statements meet legal requirements and provide a solid foundation for your prenuptial agreement. Remember, Carrollton Texas financial statements only in connection with prenuptial agreements should be treated with utmost care and confidentiality. The information shared must be truthful, transparent, and mutually agreed upon to foster trust and maintain the integrity of the agreement.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Carrollton Texas Estados financieros solo en relación con el acuerdo prematrimonial prenupcial - Texas Financial Statements only in Connection with Prenuptial Premarital Agreement

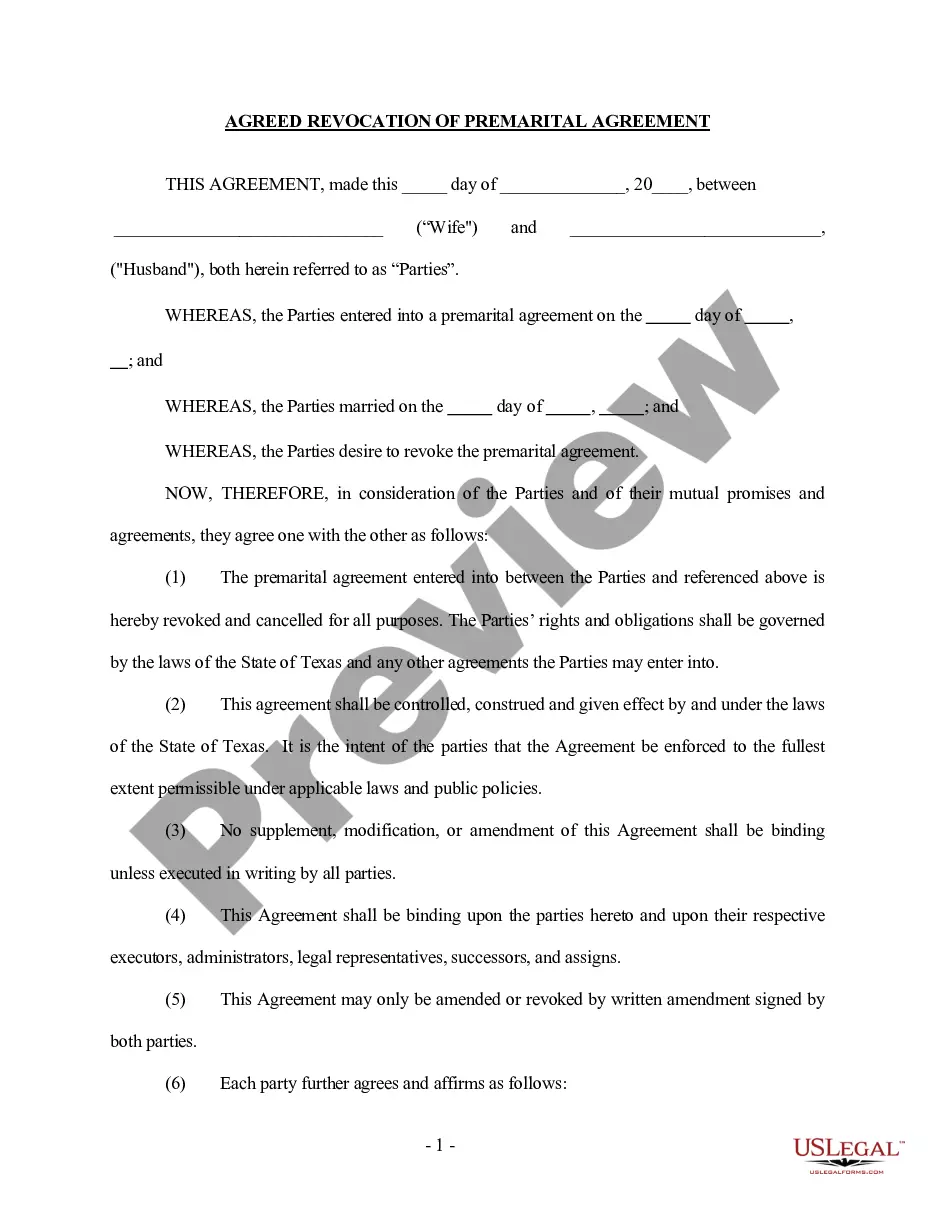

Description

How to fill out Carrollton Texas Estados Financieros Solo En Relación Con El Acuerdo Prematrimonial Prenupcial?

No matter what social or professional status, completing law-related forms is an unfortunate necessity in today’s professional environment. Too often, it’s virtually impossible for someone without any law background to draft such papers cfrom the ground up, mostly due to the convoluted jargon and legal subtleties they come with. This is where US Legal Forms comes in handy. Our service offers a massive collection with over 85,000 ready-to-use state-specific forms that work for pretty much any legal case. US Legal Forms also is an excellent resource for associates or legal counsels who want to to be more efficient time-wise utilizing our DYI tpapers.

No matter if you require the Carrollton Texas Financial Statements only in Connection with Prenuptial Premarital Agreement or any other document that will be good in your state or area, with US Legal Forms, everything is on hand. Here’s how you can get the Carrollton Texas Financial Statements only in Connection with Prenuptial Premarital Agreement quickly employing our trusted service. In case you are already a subscriber, you can go on and log in to your account to get the needed form.

Nevertheless, if you are unfamiliar with our platform, make sure to follow these steps prior to obtaining the Carrollton Texas Financial Statements only in Connection with Prenuptial Premarital Agreement:

- Ensure the form you have chosen is suitable for your area considering that the regulations of one state or area do not work for another state or area.

- Review the document and go through a short description (if available) of scenarios the document can be used for.

- In case the one you selected doesn’t suit your needs, you can start over and search for the necessary document.

- Click Buy now and pick the subscription plan that suits you the best.

- with your login information or register for one from scratch.

- Choose the payment gateway and proceed to download the Carrollton Texas Financial Statements only in Connection with Prenuptial Premarital Agreement once the payment is completed.

You’re all set! Now you can go on and print out the document or complete it online. If you have any problems getting your purchased forms, you can easily access them in the My Forms tab.

Whatever case you’re trying to sort out, US Legal Forms has got you covered. Try it out now and see for yourself.