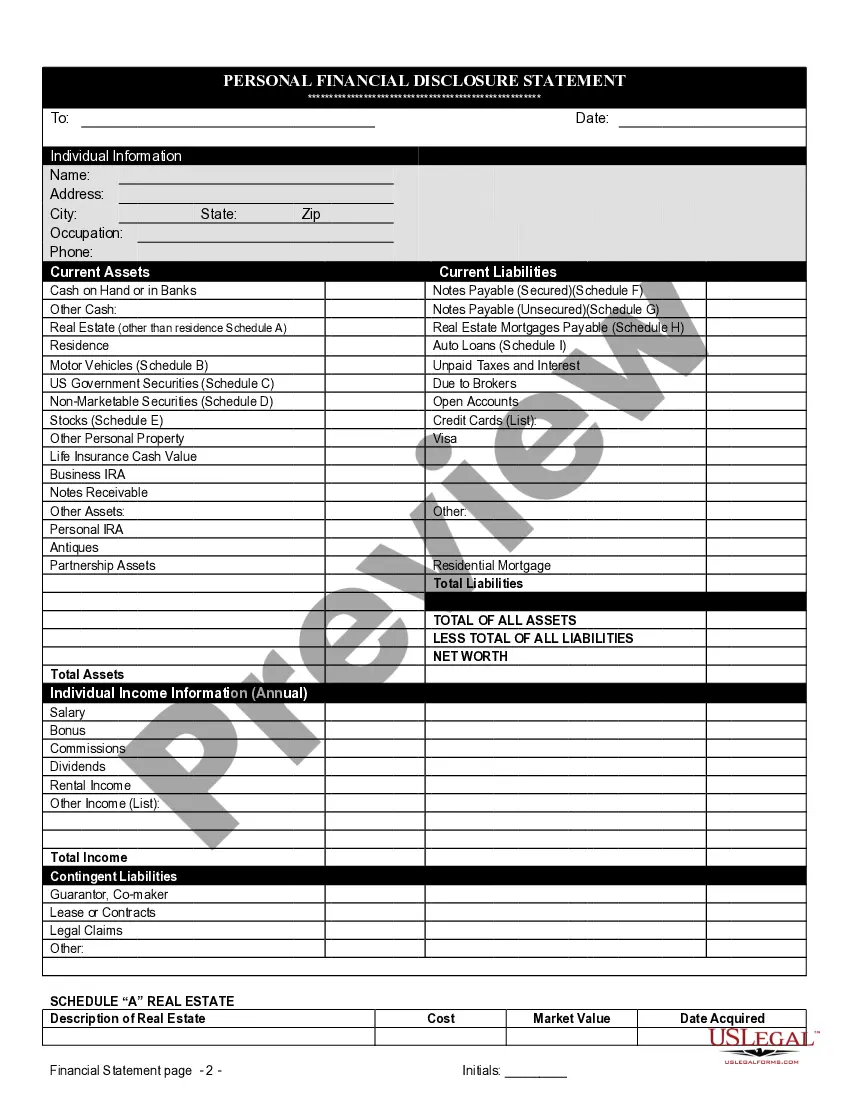

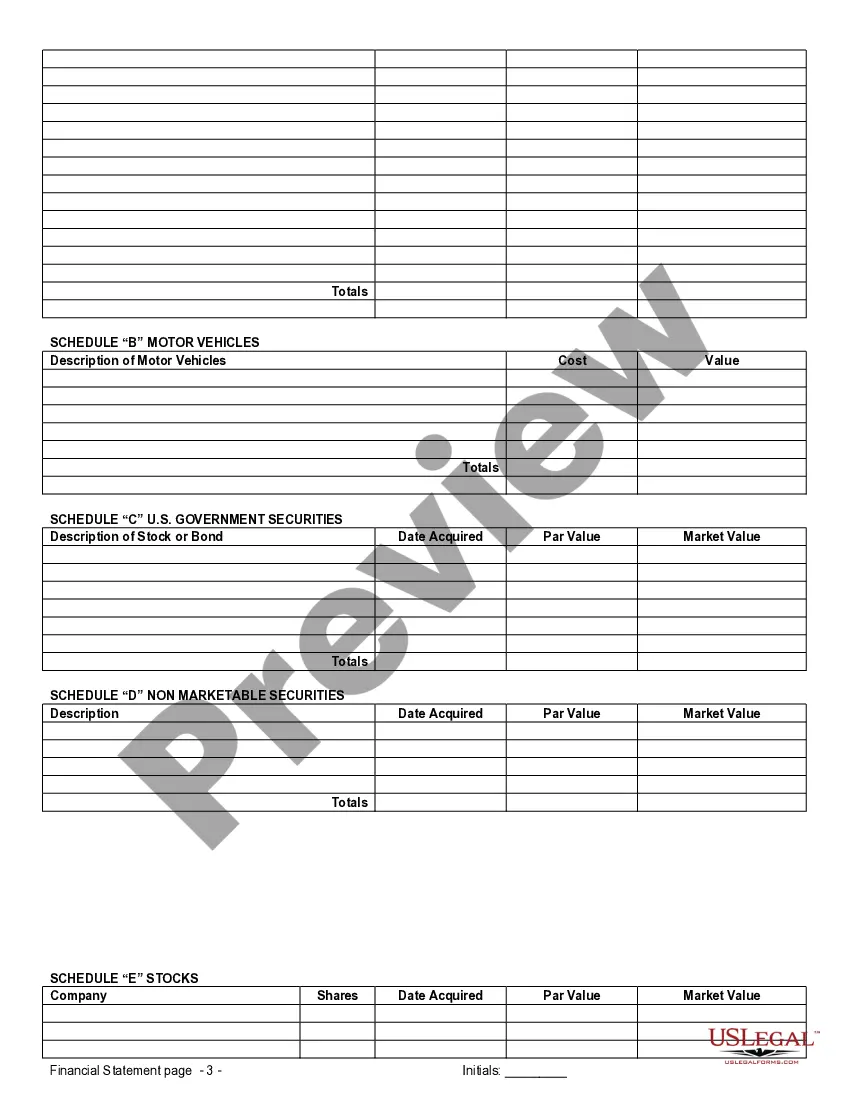

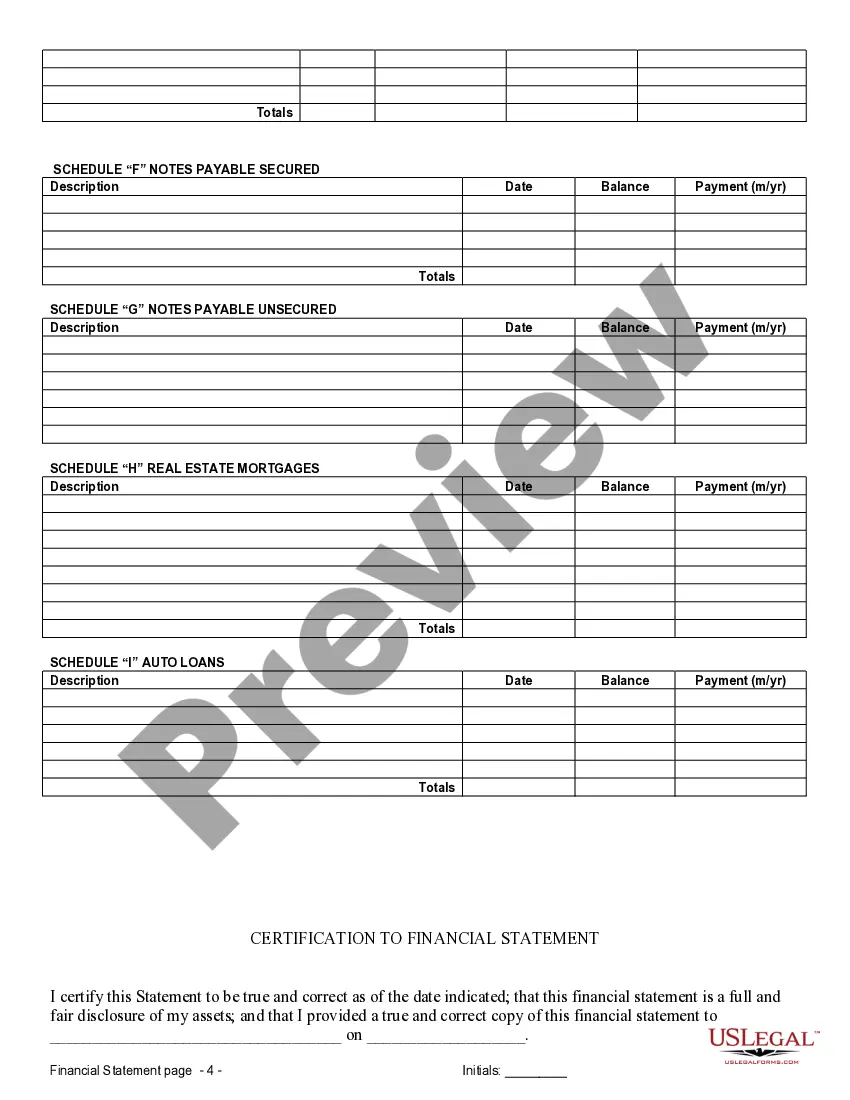

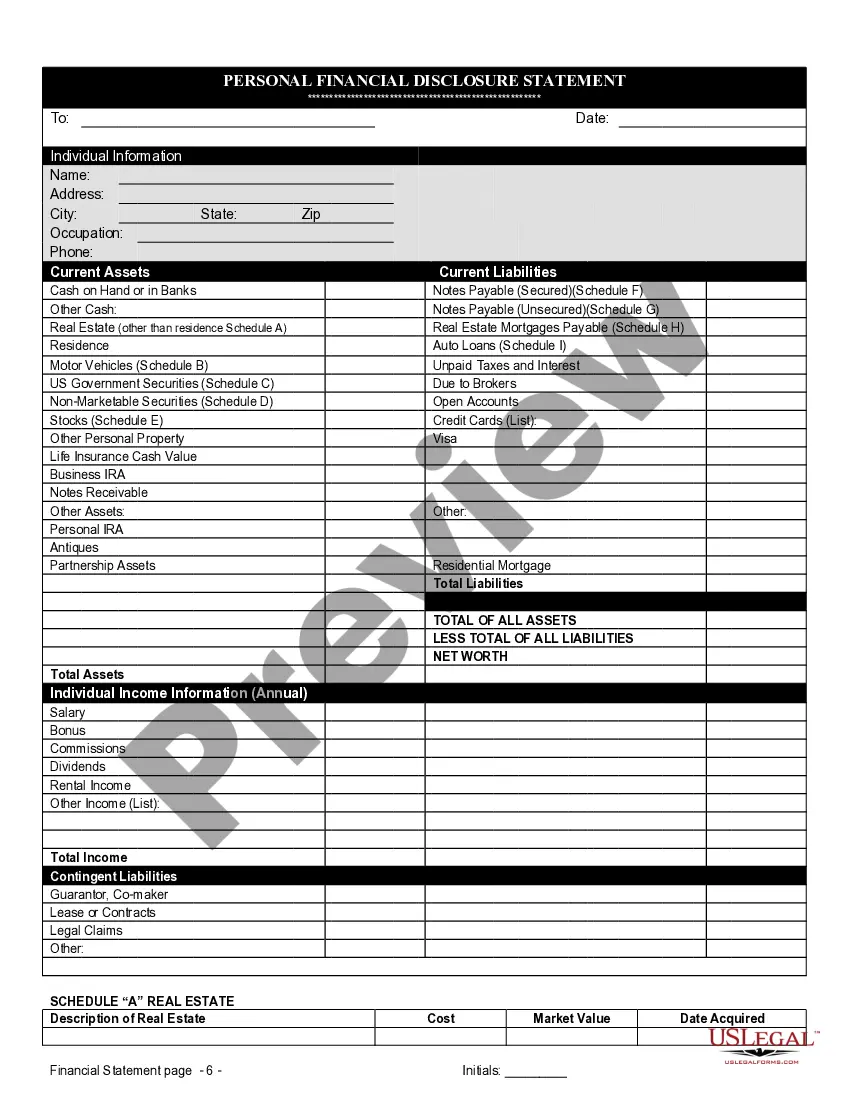

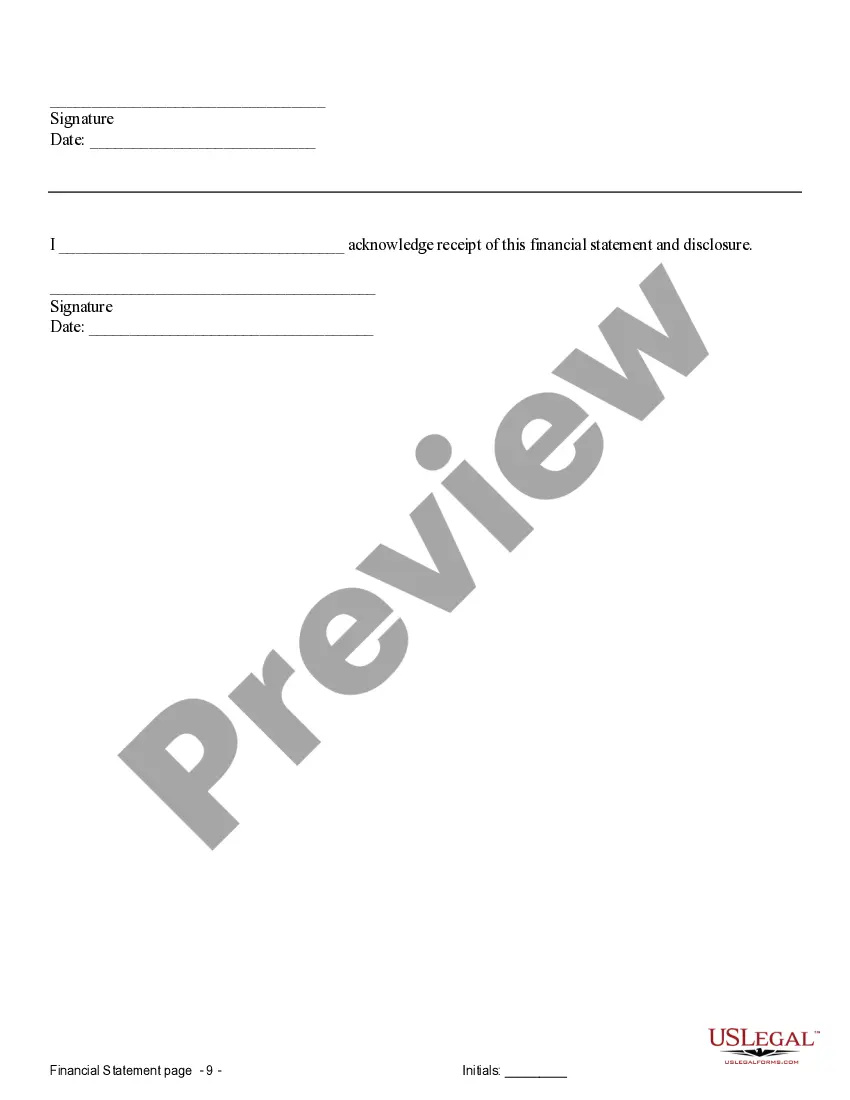

The financial statement disclosure form is for use in connection with the premarital agreement and must be completed accurately and completely. Both parties are required to complete a separate financial statement and provide a copy of the statement to the other party.

Irving Texas Financial Statements only in Connection with Prenuptial Premarital Agreement

Description

How to fill out Texas Financial Statements Only In Connection With Prenuptial Premarital Agreement?

Regardless of social or occupational standing, completing legal documents is an unfortunate requirement in today's society.

Often, it is nearly impossible for an individual without legal education to draft such documents from scratch, primarily due to the intricate terminology and legal nuances involved.

This is where US Legal Forms can come to the rescue.

Ensure that the document you have selected is appropriate for your region since the laws of one jurisdiction do not apply to another.

Review the document and read a brief summary (if available) of situations for which the document can be utilized.

- Our platform provides an extensive database with over 85,000 ready-to-use, state-specific forms suitable for nearly any legal scenario.

- US Legal Forms is also an invaluable resource for practitioners or legal advisors aiming to save time by using our DIY documents.

- Whether you need the Irving Texas Financial Statements solely concerning a Prenuptial Premarital Agreement or any other forms applicable in your state or area, with US Legal Forms, everything is accessible.

- Here’s how you can obtain the Irving Texas Financial Statements solely in relation to Prenuptial Premarital Agreement in minutes using our trustworthy service.

- If you are already a subscriber, you can continue to Log In to your account to retrieve the necessary form.

- However, if you are new to our platform, make sure to follow these instructions before acquiring the Irving Texas Financial Statements solely in connection with a Prenuptial Premarital Agreement.

Form popularity

FAQ

You can write your own postnuptial agreement in Texas as well. Like a prenuptial agreement, it must comply with legal guidelines to be effective. Many couples appreciate the peace of mind that comes from using platforms like US Legal Forms. They help to navigate the complexities involved, especially when managing your Irving Texas Financial Statements only in Connection with Prenuptial Premarital Agreement.

A handwritten prenuptial agreement can be legal in Texas, but it has to meet specific legal standards. It must be clear, with both parties freely consenting to its terms. While a handwritten prenup is possible, using templates from US Legal Forms can help you draft a more comprehensive document. This will support your efforts in managing your Irving Texas Financial Statements only in Connection with Prenuptial Premarital Agreement.

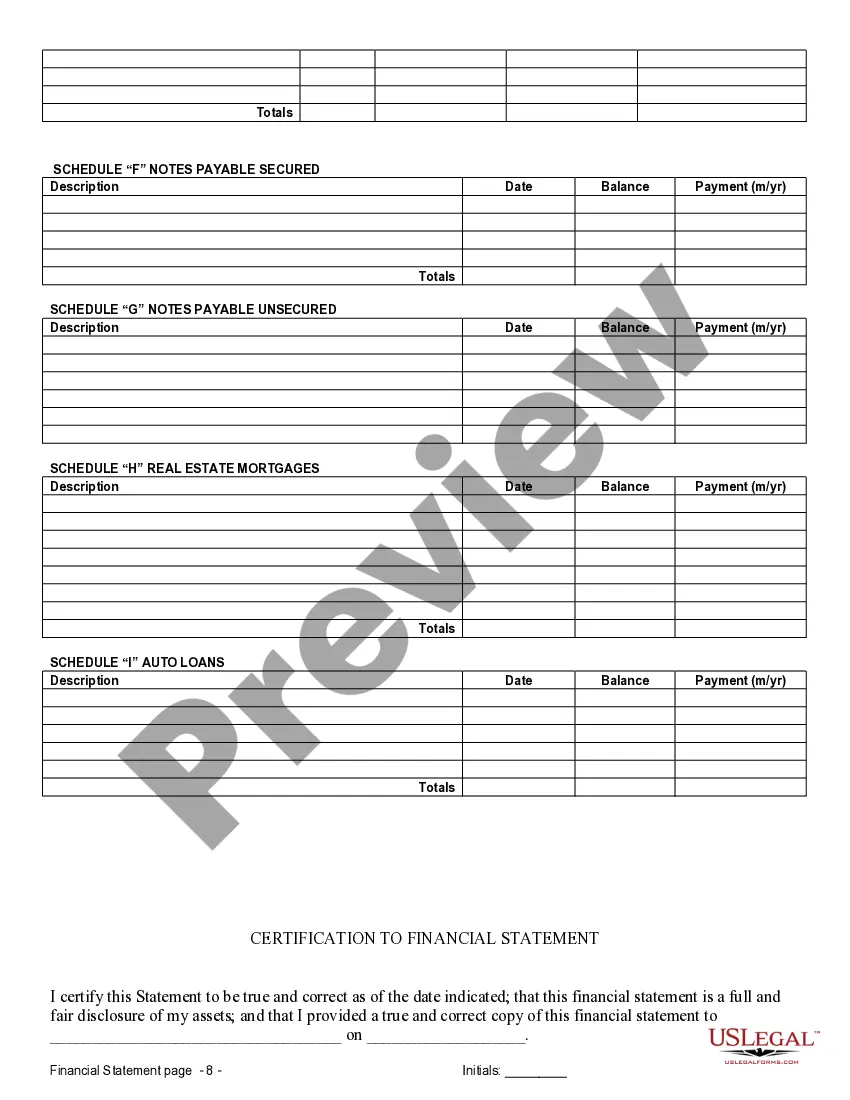

Several factors can lead to a prenuptial agreement being invalid in Texas. For instance, if one partner did not disclose significant financial information, that might nullify the agreement. Additionally, if the document was signed under duress or without adequate legal counsel, it could also be deemed invalid. Thus, utilizing proper resources, such as US Legal Forms, can ensure your Irving Texas Financial Statements only in Connection with Prenuptial Premarital Agreement provides transparency and fairness.

Yes, you can write your own prenuptial agreement in Texas. However, it's essential to ensure that it meets all legal requirements to be enforceable. Many couples choose to use resources like US Legal Forms to help create a valid document. This way, you can incorporate your Irving Texas Financial Statements only in Connection with Prenuptial Premarital Agreement effectively.

A prenuptial agreement can be a wise decision for couples in Texas, as it provides financial clarity and security. It addresses potential disputes over assets and debts, which can lead to smoother resolutions in case of divorce. By using Irving Texas Financial Statements only in Connection with Prenuptial Premarital Agreement, couples can create a customized solution tailored to their specific financial needs.

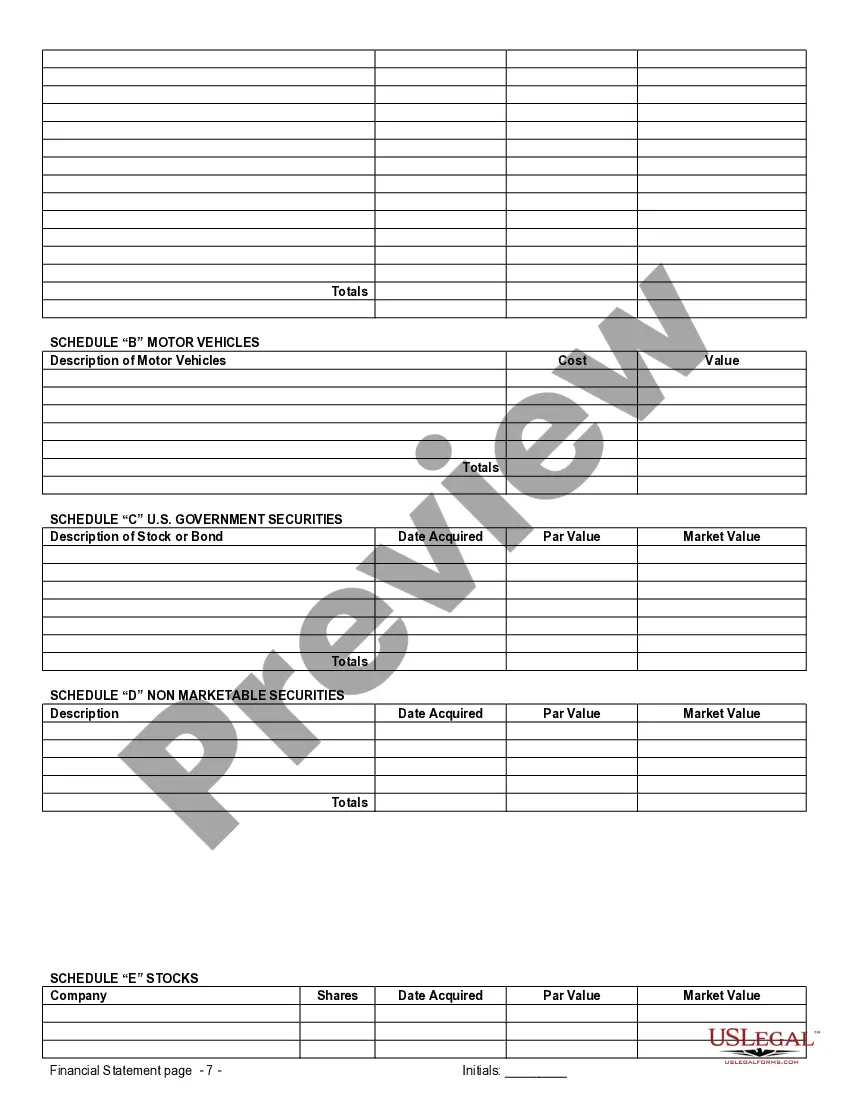

Writing a prenuptial agreement in Texas involves discussing your financial expectations openly with your partner. Start by listing all your assets, debts, and any unique clauses you'd like to include. Integrating Irving Texas Financial Statements only in Connection with Prenuptial Premarital Agreement into your discussions can provide clarity and structure to your agreement.

The Texas Family Code governs prenuptial agreements under Section 4.003. This section outlines the legal framework for how these agreements should be structured and enforced. Consulting Irving Texas Financial Statements only in Connection with Prenuptial Premarital Agreement can help you align your finances with the legal requirements specified in the Family Code.

Yes, you can write your own prenuptial agreement in Texas; however, it is advisable to seek legal guidance. Creating your own agreement can involve specific language and legal stipulations that ensure its enforceability. Consider incorporating Irving Texas Financial Statements only in Connection with Prenuptial Premarital Agreement to cover your financial positions comprehensively.

In Texas, to create a valid premarital agreement, both parties must voluntarily sign the document. Additionally, the agreement must be in writing and include the essential terms and conditions regarding property and financial matters. The use of Irving Texas Financial Statements only in Connection with Prenuptial Premarital Agreement further clarifies these aspects, ensuring protection of each party's interests.

A prenuptial agreement in Texas can be voided if it was created under fraudulent conditions or without adequate legal advice. Additionally, if one party did not sign or was not provided an opportunity to review the agreement, courts may consider it unenforceable. To avoid issues, ensure that all Irving Texas Financial Statements only in Connection with Prenuptial Premarital Agreement are transparent and legally sound.