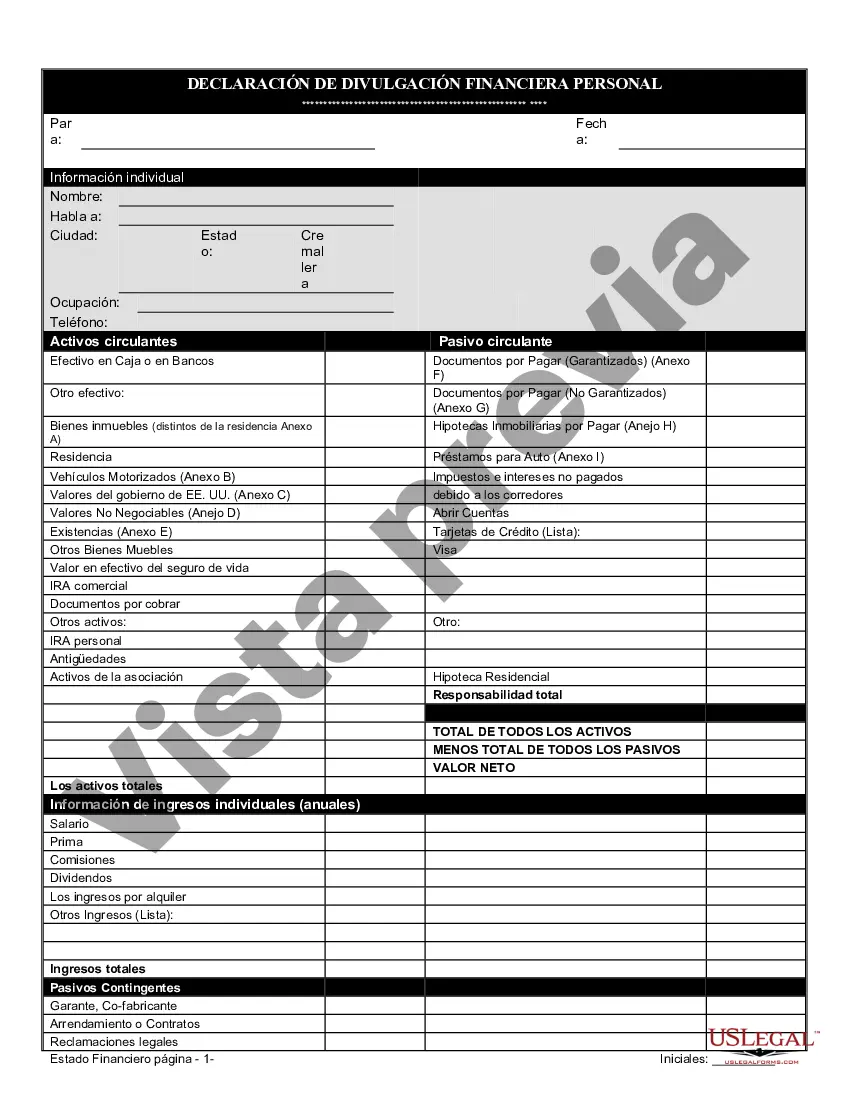

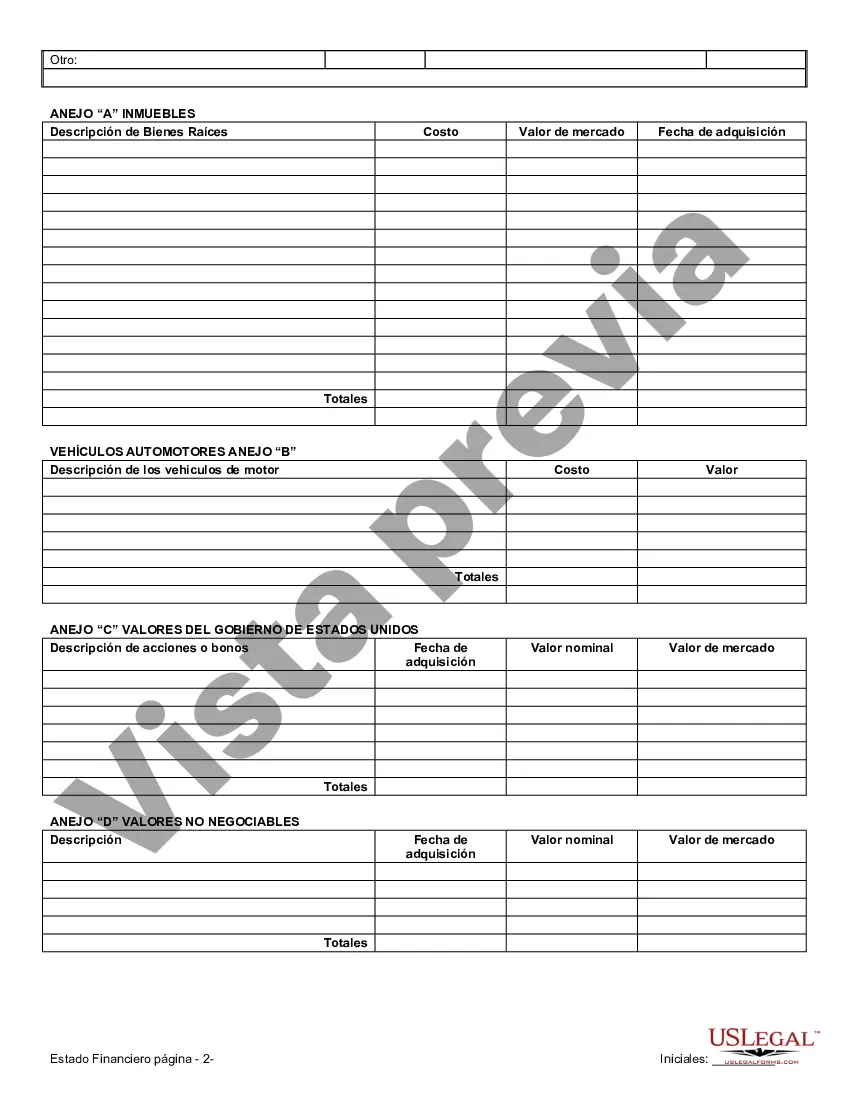

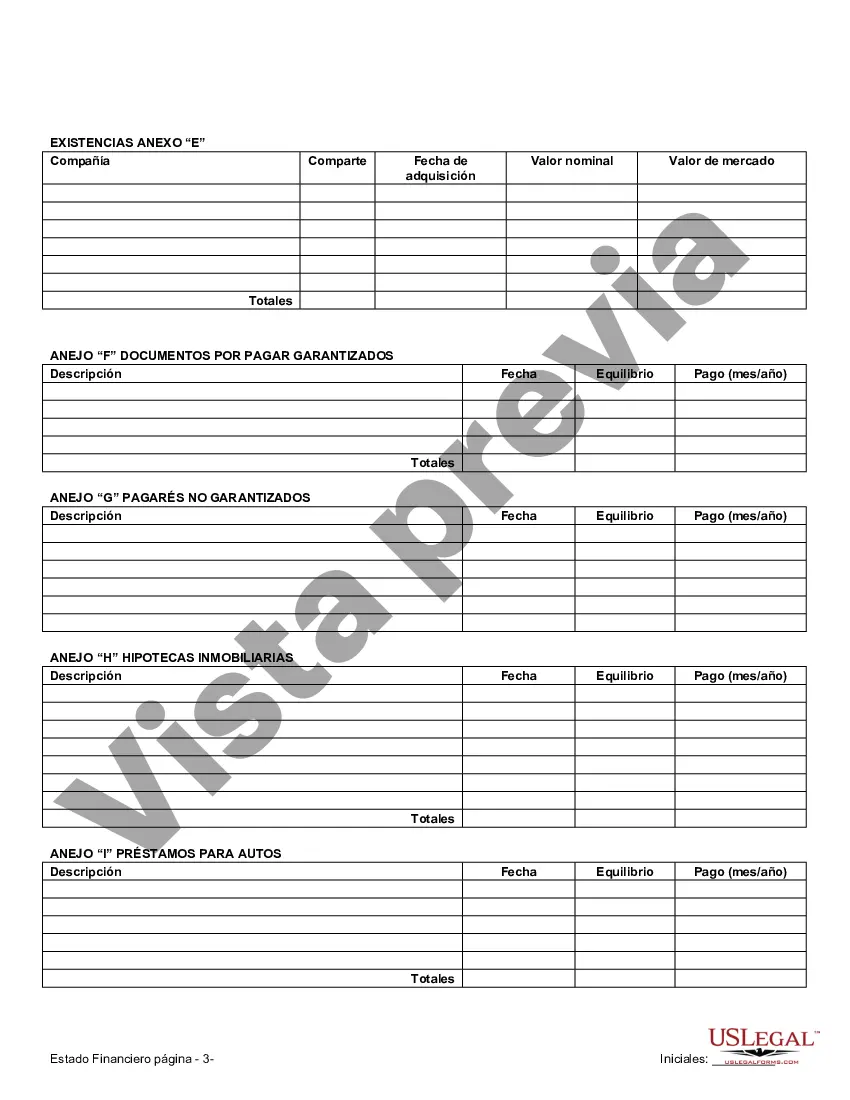

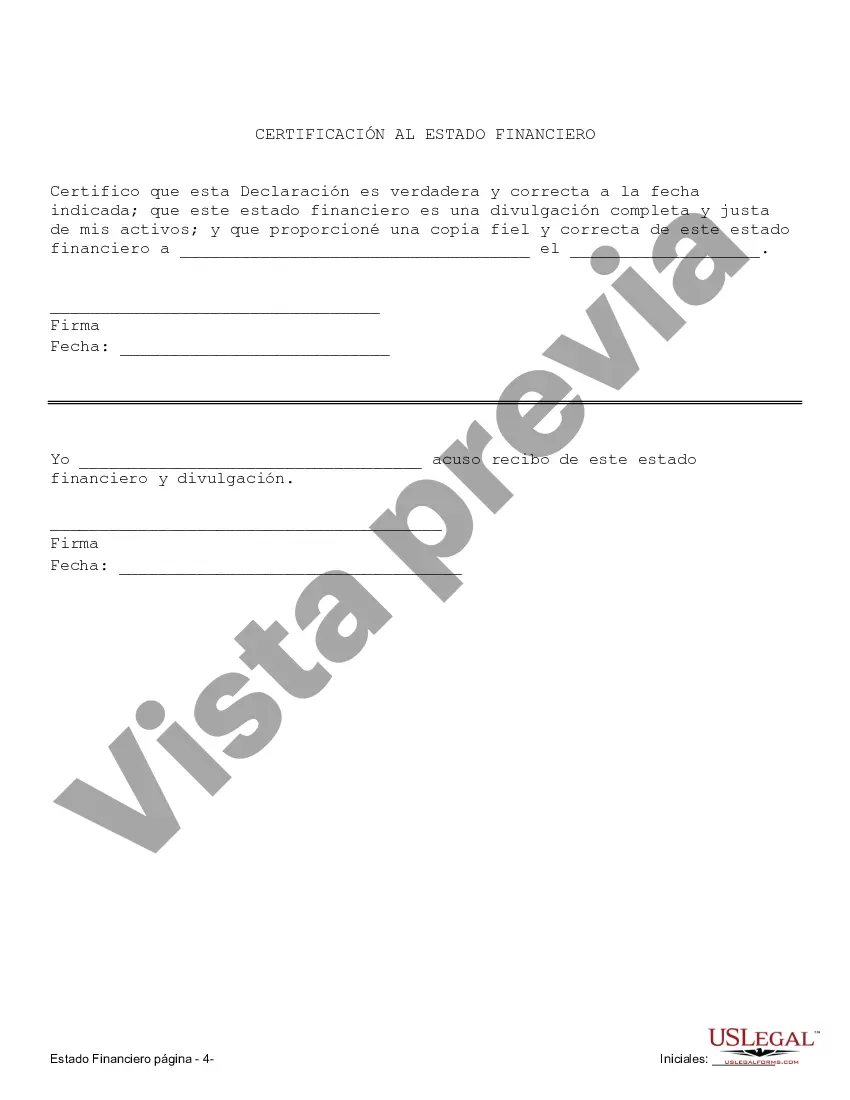

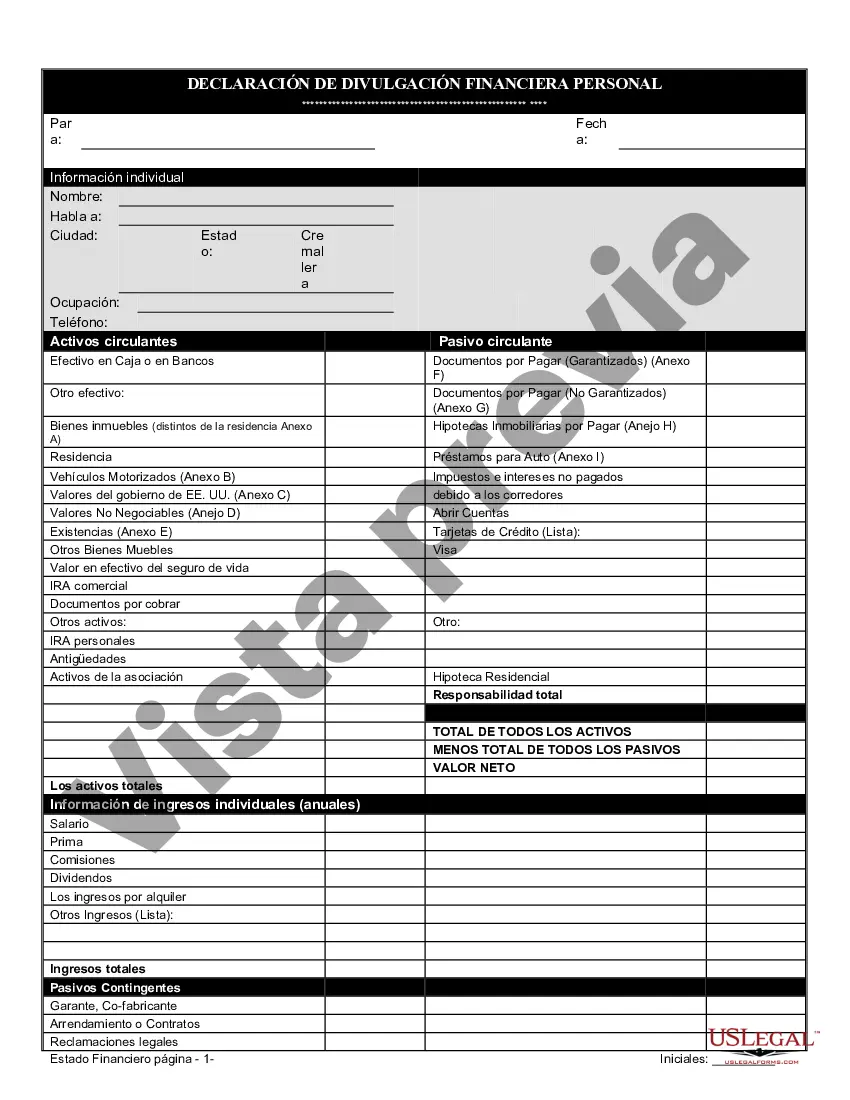

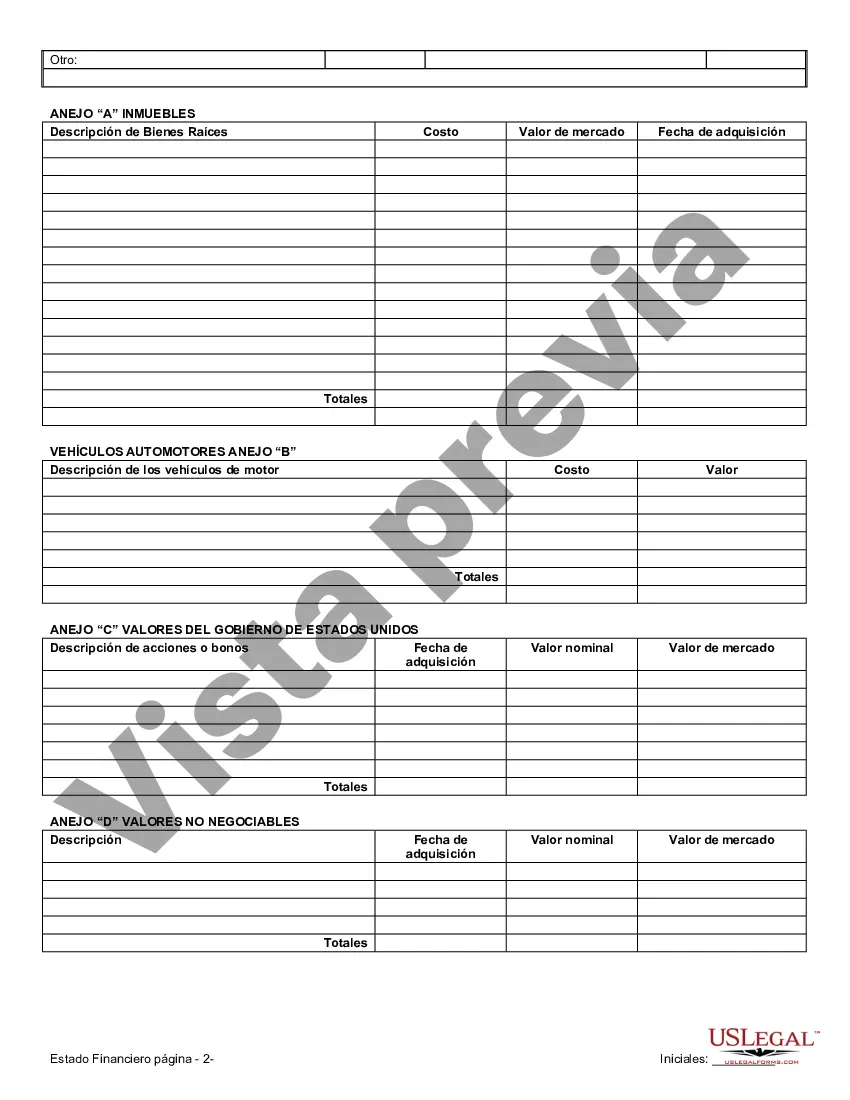

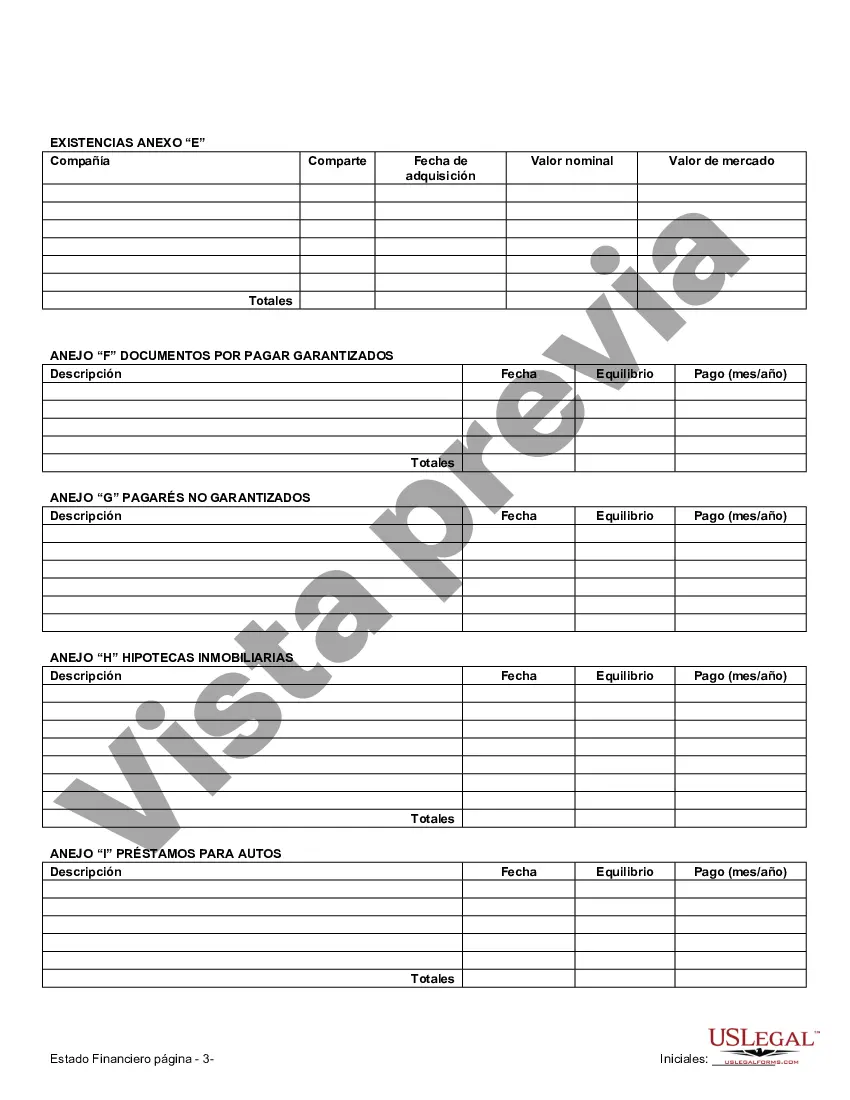

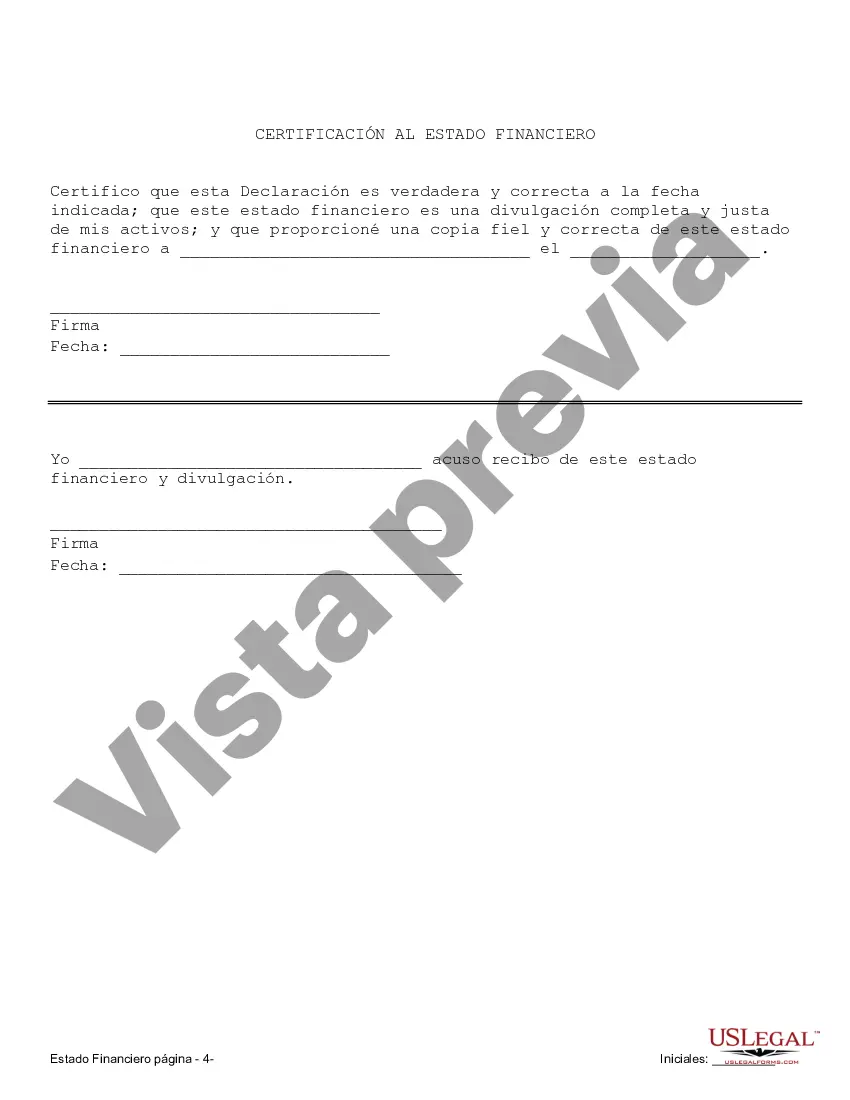

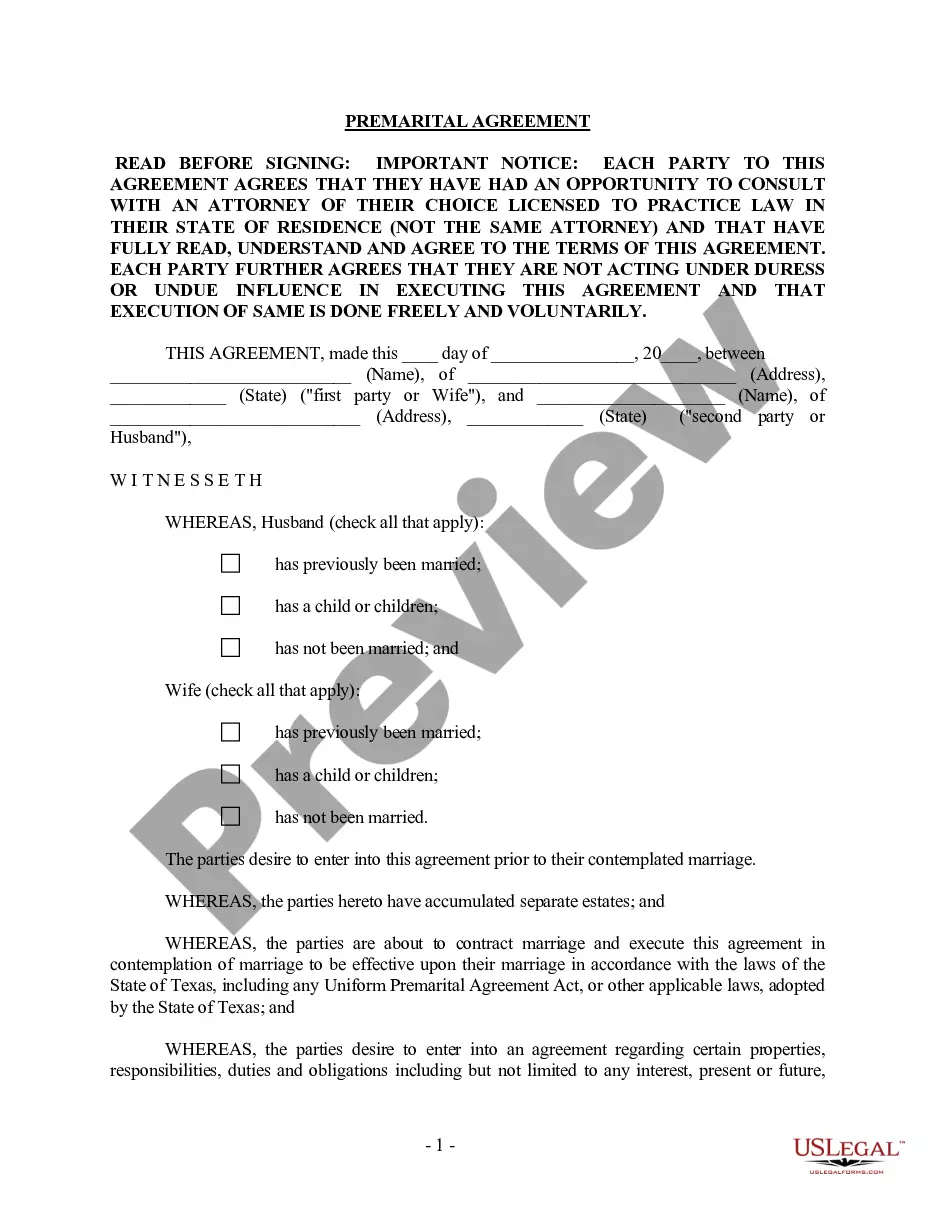

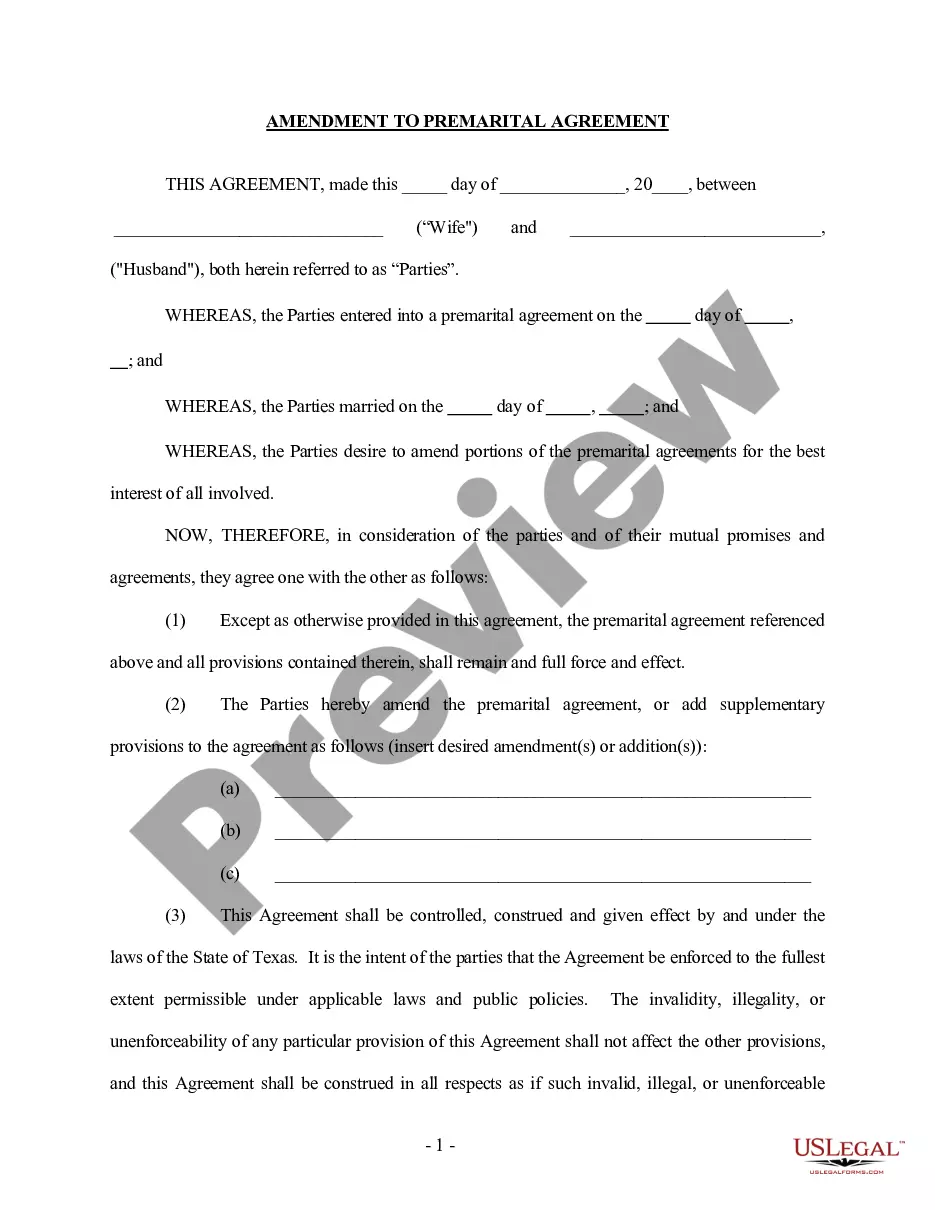

Lewisville Texas Financial Statements in Connection with Prenuptial Premarital Agreement When entering into a prenuptial or premarital agreement in Lewisville, Texas, it is crucial to have a comprehensive understanding of the financial situation of both parties involved. One key aspect in this process is the requirement for Lewisville Texas Financial Statements, which provide an accurate and detailed reflection of each party's financial standing. These financial statements play a vital role in ensuring transparency, fairness, and protection of each party's interests during the drafting and enforcement of a prenuptial agreement. There are various types of Lewisville Texas Financial Statements that can be utilized to fulfill the requirements of the prenuptial agreement. Understanding the purpose and characteristics of each type is important to ensure compliance with legal regulations. The following are the main types of financial statements commonly used in connection with a prenuptial or premarital agreement in Lewisville, Texas: 1. Personal Income Statement: This statement entails a detailed breakdown of an individual's income, including salary, bonuses, commissions, investments, rental income, and any other recurring sources of income. It provides an overview of the earnings and financial contributions one brings into the marriage. 2. Personal Balance Sheet: A personal balance sheet represents an individual's assets, liabilities, and net worth. It includes a comprehensive list of possessions such as real estate, vehicles, investments, retirement accounts, bank accounts, and any outstanding debts or loans. This statement allows for an evaluation of the individual's financial position and potential contributions to the marital estate. 3. Business Financial Statements: If either or both parties own businesses or have significant ownership interests in entities, it is essential to provide business financial statements. These statements may include profit and loss statements, balance sheets, cash flow statements, and tax returns for the business. Detailing these documents helps evaluate the business's value and potential income distribution. 4. Tax Returns: To gain a comprehensive understanding of an individual's financial history, tax returns for the past several years are often required. These returns provide insight into incomes, deductions, investments, and other financial activities. They assist in assessing the party's financial stability and verifying the accuracy of other financial statements presented. 5. Retirement Account Statements: Retirement accounts, such as 401(k), IRAs, pensions, or other investment portfolios, play a significant role in a couple's financial future. Providing retirement account statements showcases the value, contribution amounts, and beneficiary designations of these accounts. When preparing Lewisville Texas Financial Statements, accuracy, completeness, and accountability are crucial. It is essential to disclose all relevant financial information to ensure a fair evaluation of each party's financial situation. Failure to disclose financial information accurately may lead to the prenuptial agreement being challenged or deemed unenforceable in the future. In conclusion, Lewisville Texas Financial Statements are a critical component of the prenuptial agreement process in Lewisville, Texas. These statements provide an overview of each party's financial situation, ensuring transparency and fair decision-making during the drafting and enforcement of a prenuptial or premarital agreement. By including various types of financial statements such as personal income statements, personal balance sheets, business financial statements, tax returns, and retirement account statements, both parties can make informed decisions regarding their financial futures.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Lewisville Texas Estados financieros solo en relación con el acuerdo prematrimonial prenupcial - Texas Financial Statements only in Connection with Prenuptial Premarital Agreement

Description

How to fill out Lewisville Texas Estados Financieros Solo En Relación Con El Acuerdo Prematrimonial Prenupcial?

Regardless of social or professional status, completing legal documents is an unfortunate necessity in today’s professional environment. Very often, it’s almost impossible for someone with no legal background to create such paperwork cfrom the ground up, mostly because of the convoluted jargon and legal nuances they involve. This is where US Legal Forms can save the day. Our platform offers a massive catalog with more than 85,000 ready-to-use state-specific documents that work for pretty much any legal scenario. US Legal Forms also serves as a great asset for associates or legal counsels who want to save time using our DYI forms.

No matter if you need the Lewisville Texas Financial Statements only in Connection with Prenuptial Premarital Agreement or any other document that will be valid in your state or county, with US Legal Forms, everything is on hand. Here’s how to get the Lewisville Texas Financial Statements only in Connection with Prenuptial Premarital Agreement quickly using our trusted platform. In case you are presently a subscriber, you can proceed to log in to your account to download the appropriate form.

Nevertheless, in case you are a novice to our platform, ensure that you follow these steps before obtaining the Lewisville Texas Financial Statements only in Connection with Prenuptial Premarital Agreement:

- Ensure the form you have found is suitable for your area since the rules of one state or county do not work for another state or county.

- Preview the form and go through a quick outline (if provided) of cases the paper can be used for.

- If the form you chosen doesn’t suit your needs, you can start over and look for the needed form.

- Click Buy now and pick the subscription option you prefer the best.

- with your login information or register for one from scratch.

- Select the payment method and proceed to download the Lewisville Texas Financial Statements only in Connection with Prenuptial Premarital Agreement once the payment is completed.

You’re good to go! Now you can proceed to print the form or complete it online. In case you have any issues locating your purchased documents, you can quickly access them in the My Forms tab.

Whatever case you’re trying to sort out, US Legal Forms has got you covered. Give it a try today and see for yourself.