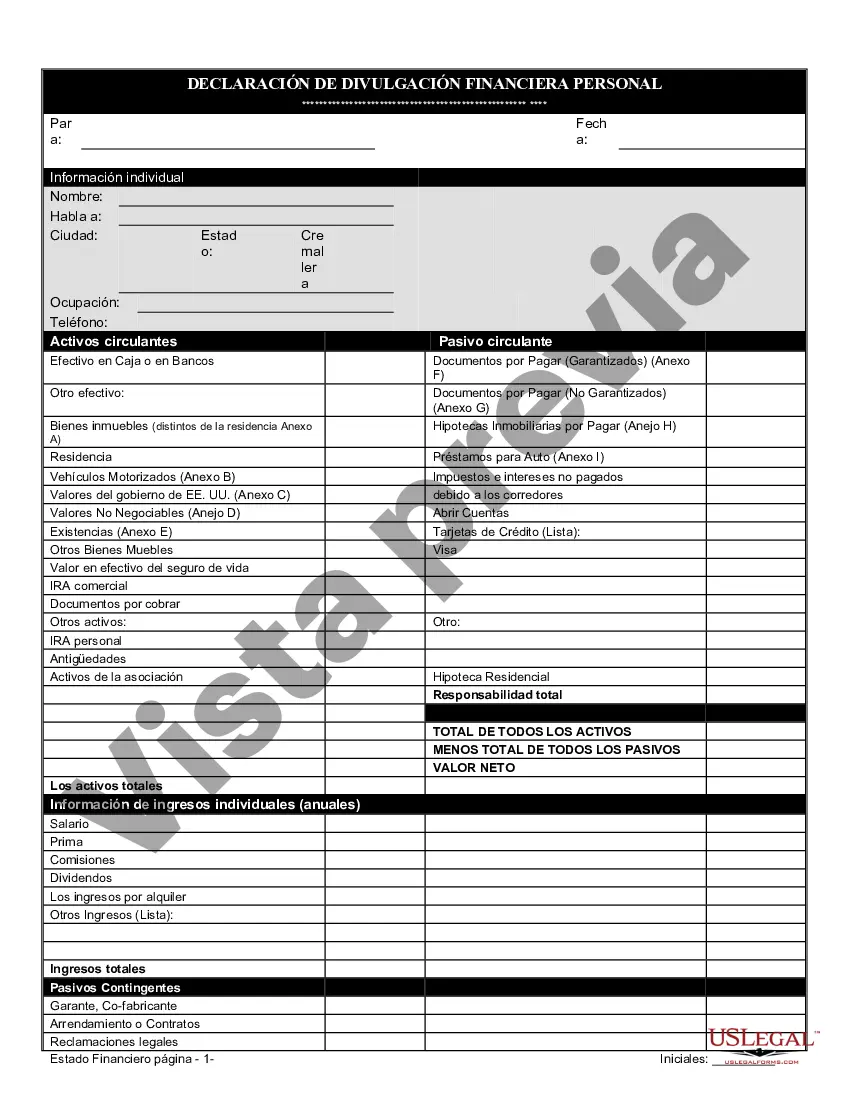

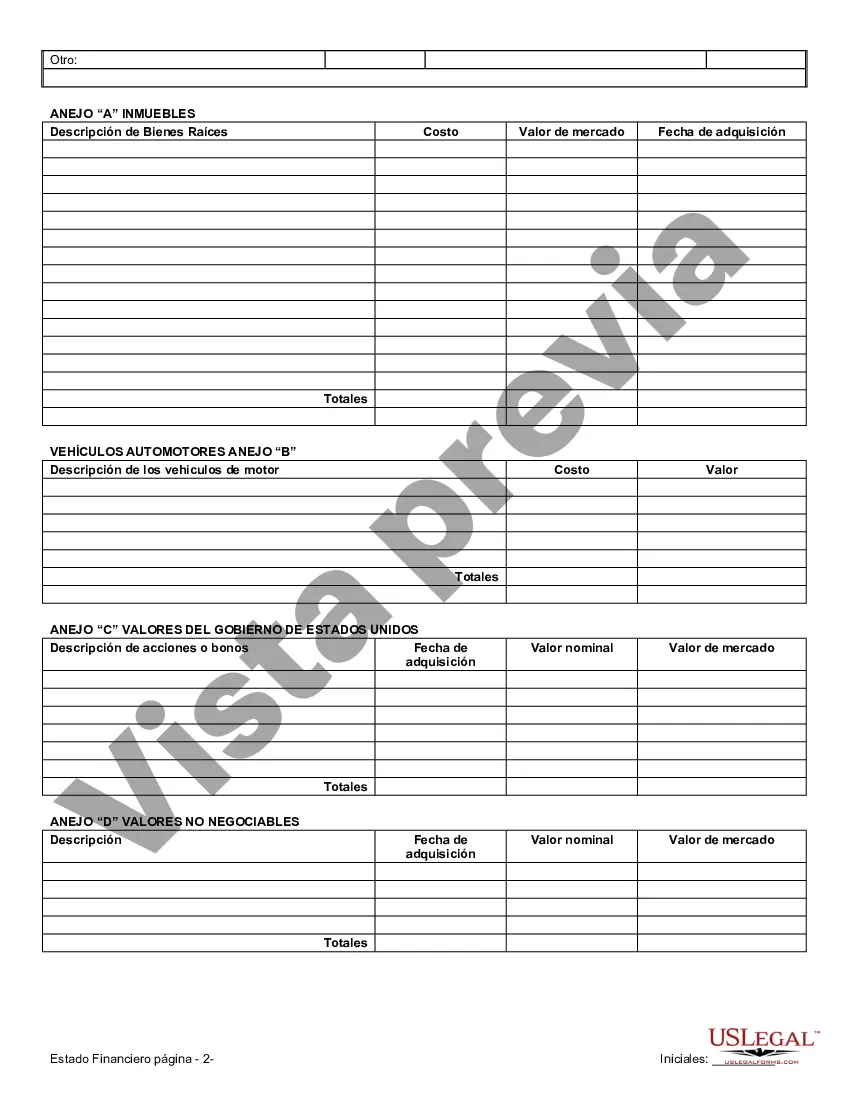

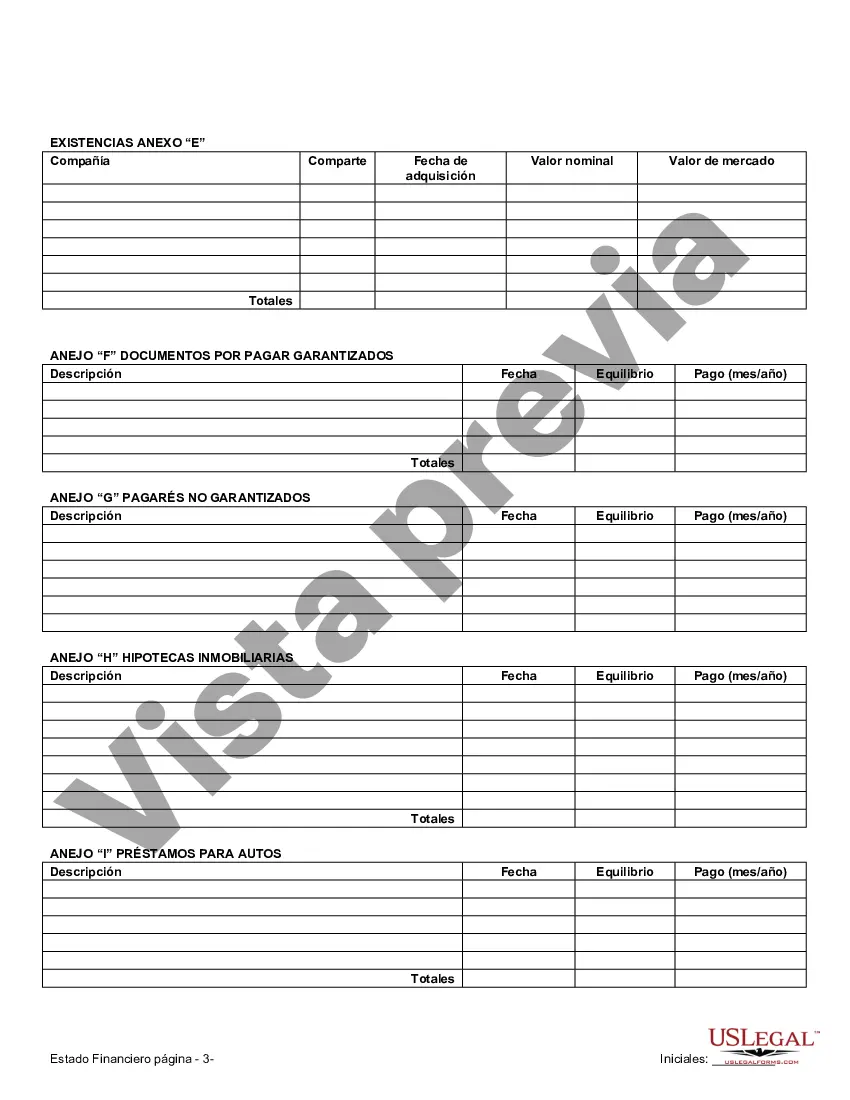

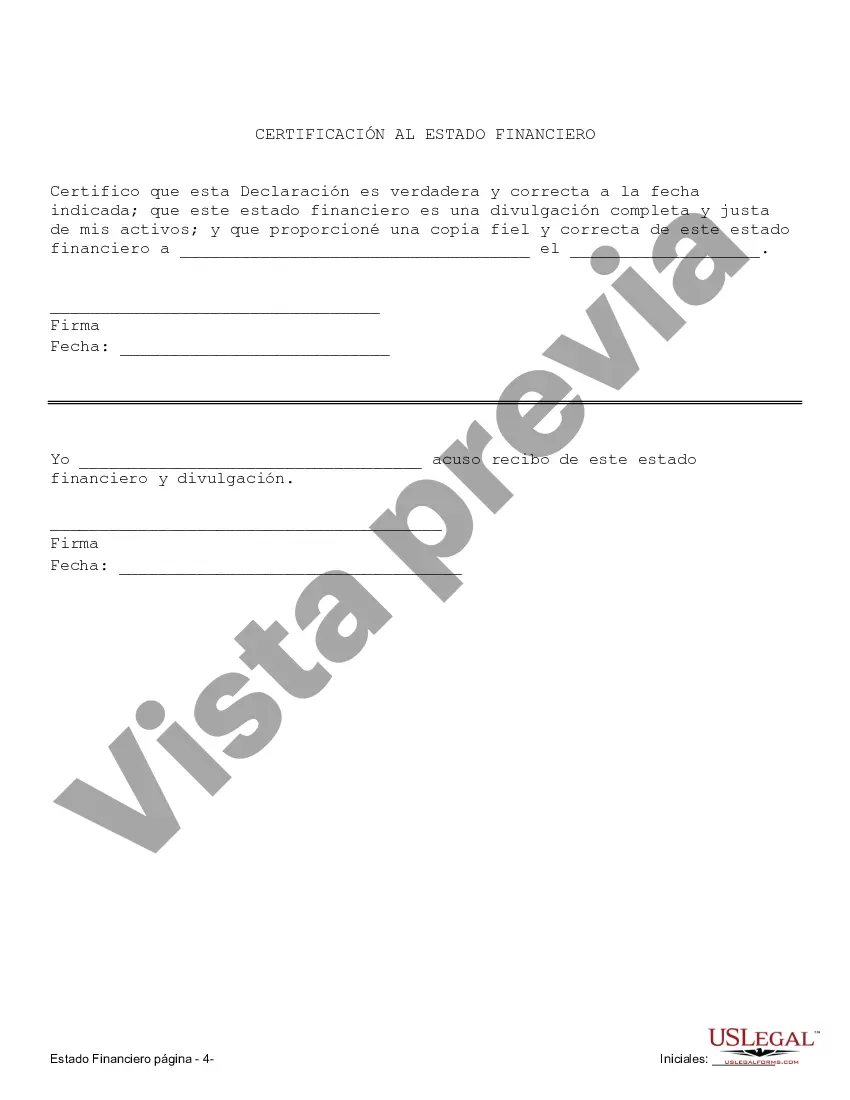

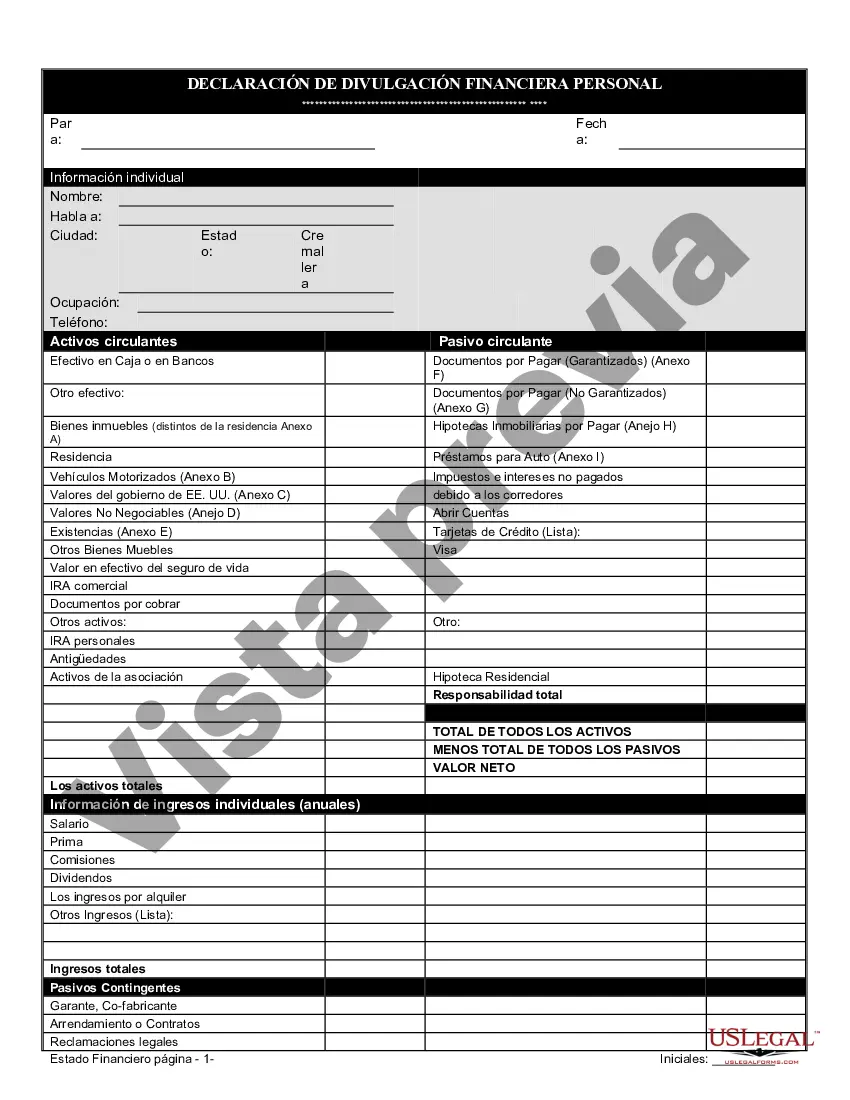

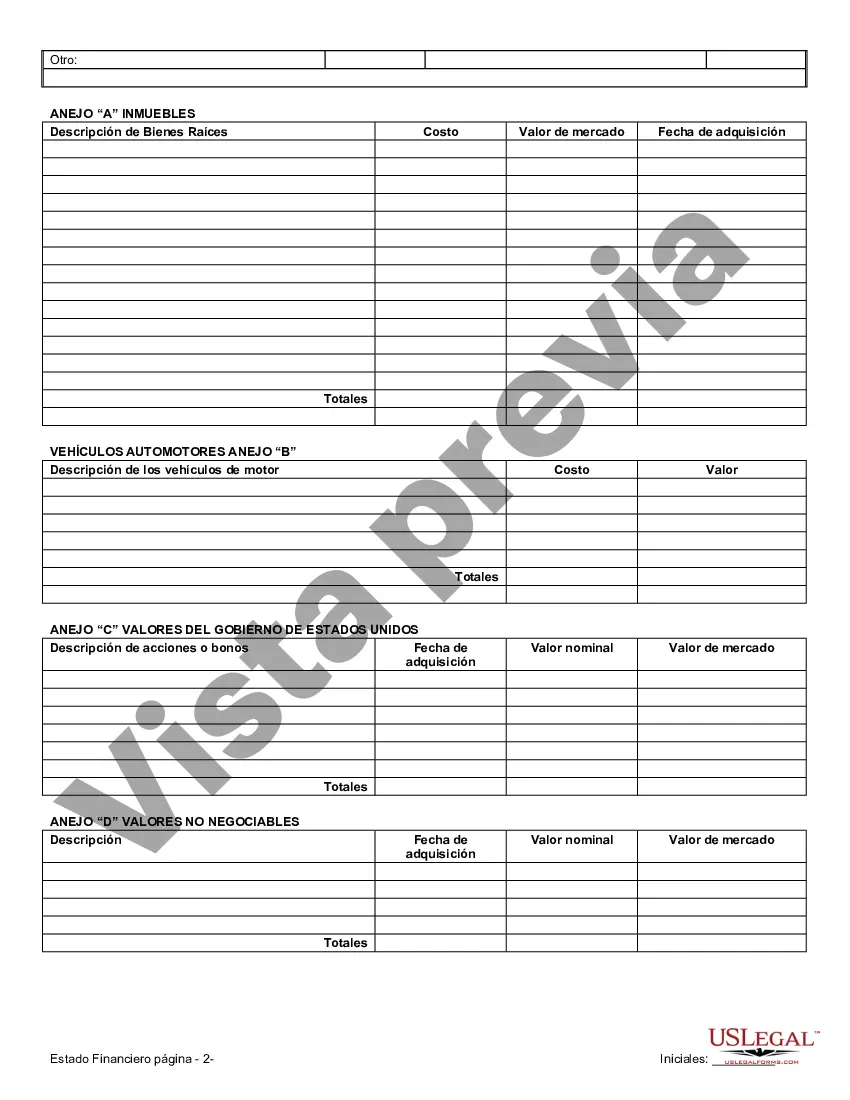

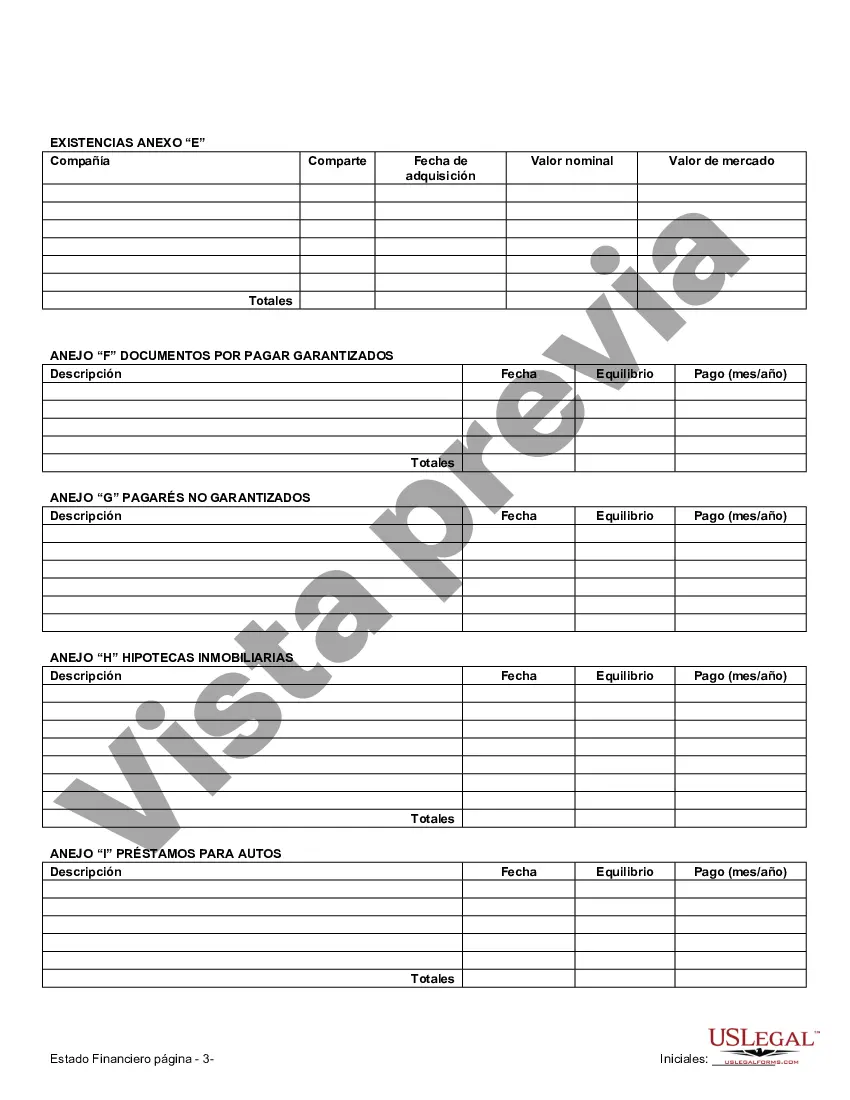

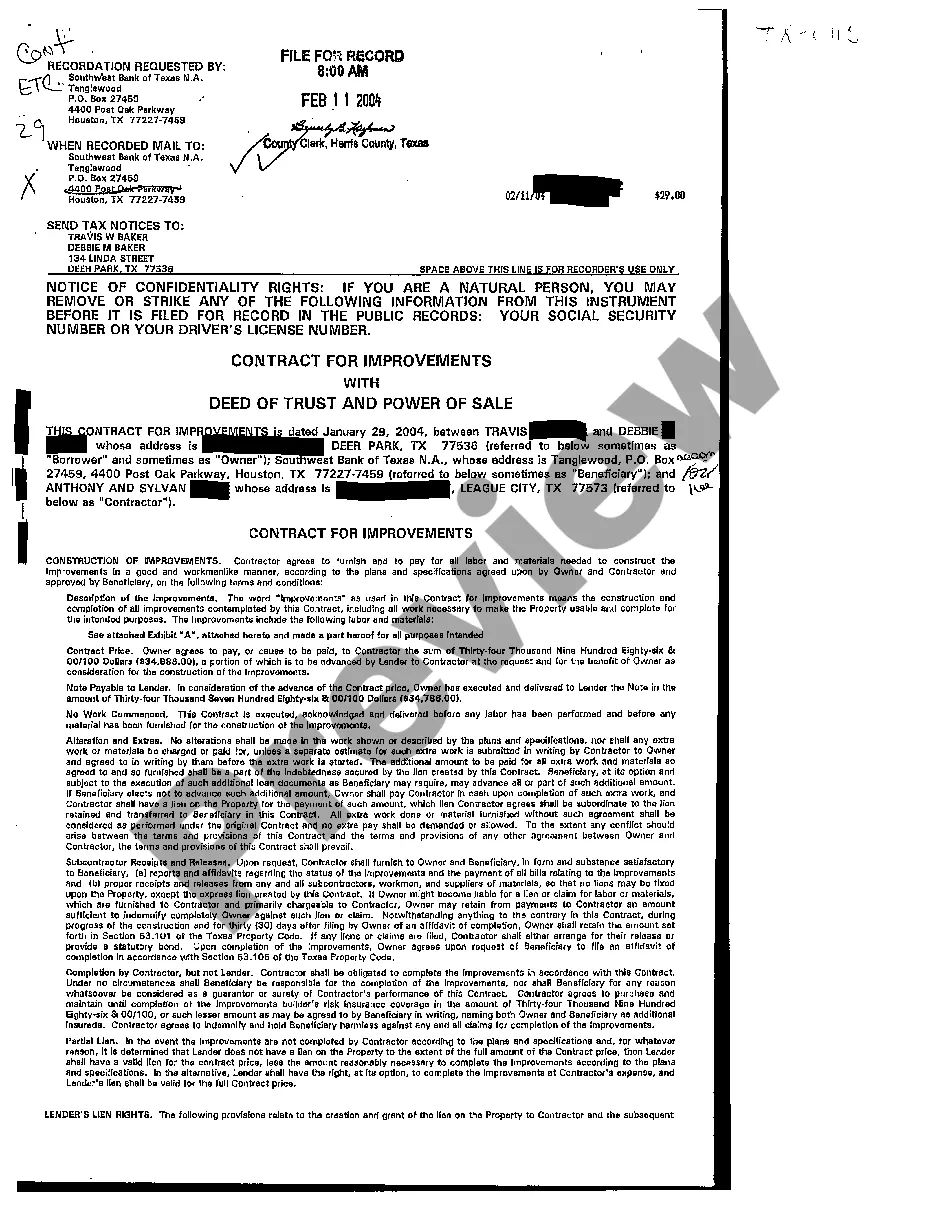

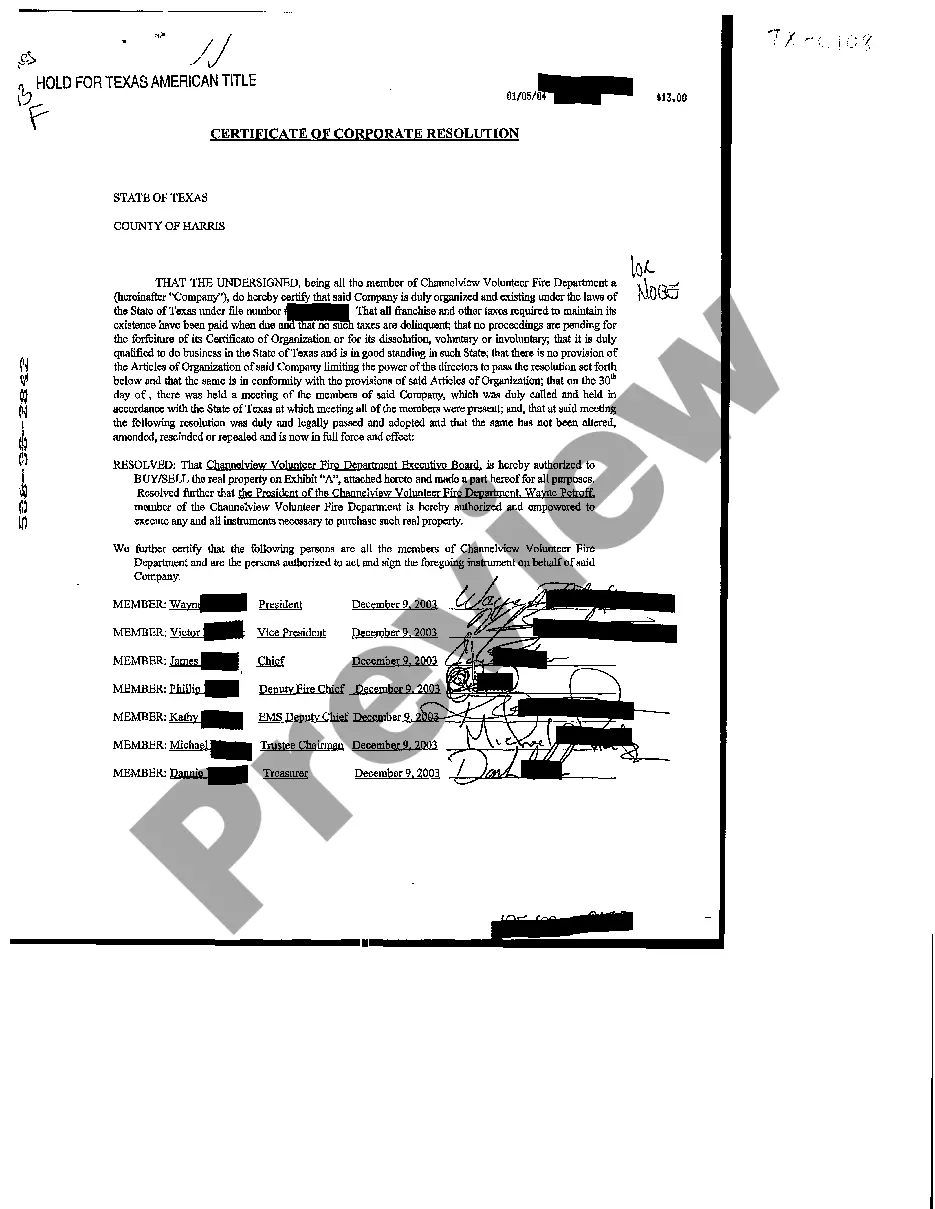

McAllen Texas Financial Statements in Connection with Prenuptial Premarital Agreement: A Detailed Description In McAllen, Texas, financial statements play a crucial role in drafting a comprehensive prenuptial or premarital agreement. These statements provide a clear and transparent overview of each individual's financial situation, ensuring that both parties are fully informed and understand their rights and responsibilities when entering into a marital contract. This article will delve into the different types of financial statements used specifically for prenuptial or premarital agreements in McAllen, Texas, shedding light on their significance and the keywords relevant to this topic. 1. Personal Balance Sheet: A personal balance sheet highlights an individual's assets, liabilities, and net worth. This statement is used to understand the financial standing of each party before getting married, enabling a fair division of assets and debts in case of a divorce. 2. Income Statement: An income statement outlines an individual's income and expenses over a particular period, providing information about their financial stability and spending habits. This statement helps determine spousal support or alimony if the marriage ends in divorce. 3. Bank Statements: Bank statements are vital documents that display an individual's financial transactions, including deposits, withdrawals, and account balances. These statements help evaluate an individual's financial behavior, source of income, and potential hidden assets. 4. Tax Returns: Tax returns are essential financial statements used in prenuptial agreements to verify an individual's reported income and tax obligations. These documents offer insights into any potential discrepancies or inaccuracies in an individual's financial history. 5. Real Estate or Property Statements: This type of financial statement includes property deeds, mortgage documents, property valuations, and any ownership details. It helps determine the distribution of assets and liabilities related to real estate in case of a divorce. 6. Business or Investment Statements: If either party owns a business or investments, detailed financial statements related to those assets are crucial in a prenuptial agreement. These statements help in establishing the division of business interests and investment gains or losses during a potential divorce. 7. Retirement Account Statements: Statements from retirement accounts like 401(k), IRA, or pension plans provide a comprehensive view of an individual's retirement savings. These statements assist in deciding whether retirement savings should be considered separate or marital property. 8. Insurance Policies: Current insurance policies, such as life insurance or disability insurance, should be included in the financial statements section. These policies may impact the division of assets, spousal support, or child support calculations. In conclusion, McAllen Texas financial statements in connection with prenuptial or premarital agreements are extensive and aim to ensure financial transparency between parties. Personal balance sheets, income statements, bank statements, tax returns, property statements, business or investment statements, retirement account statements, and insurance policies are crucial documents used to assess the financial status of each party involved. By providing accurate and complete financial information, both individuals can enter the marriage with a clear understanding of their financial rights and obligations.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.McAllen Texas Estados financieros solo en relación con el acuerdo prematrimonial prenupcial - Texas Financial Statements only in Connection with Prenuptial Premarital Agreement

Description

How to fill out McAllen Texas Estados Financieros Solo En Relación Con El Acuerdo Prematrimonial Prenupcial?

Do you need a reliable and inexpensive legal forms supplier to buy the McAllen Texas Financial Statements only in Connection with Prenuptial Premarital Agreement? US Legal Forms is your go-to solution.

Whether you require a simple arrangement to set rules for cohabitating with your partner or a set of forms to advance your separation or divorce through the court, we got you covered. Our platform provides over 85,000 up-to-date legal document templates for personal and business use. All templates that we give access to aren’t universal and frameworked in accordance with the requirements of separate state and area.

To download the form, you need to log in account, find the required template, and click the Download button next to it. Please remember that you can download your previously purchased document templates at any time in the My Forms tab.

Is the first time you visit our platform? No worries. You can set up an account with swift ease, but before that, make sure to do the following:

- Find out if the McAllen Texas Financial Statements only in Connection with Prenuptial Premarital Agreement conforms to the regulations of your state and local area.

- Read the form’s details (if available) to learn who and what the form is intended for.

- Restart the search if the template isn’t suitable for your legal scenario.

Now you can create your account. Then select the subscription plan and proceed to payment. Once the payment is completed, download the McAllen Texas Financial Statements only in Connection with Prenuptial Premarital Agreement in any available file format. You can return to the website at any time and redownload the form free of charge.

Getting up-to-date legal forms has never been easier. Give US Legal Forms a try today, and forget about spending your valuable time learning about legal paperwork online once and for all.