This package of forms contains a pre-incorporation agreement for the formers of a corporation to sign agreeing on how the corporate will be operated, who will be elected as officers and directors, salaries and many other corporate matters.

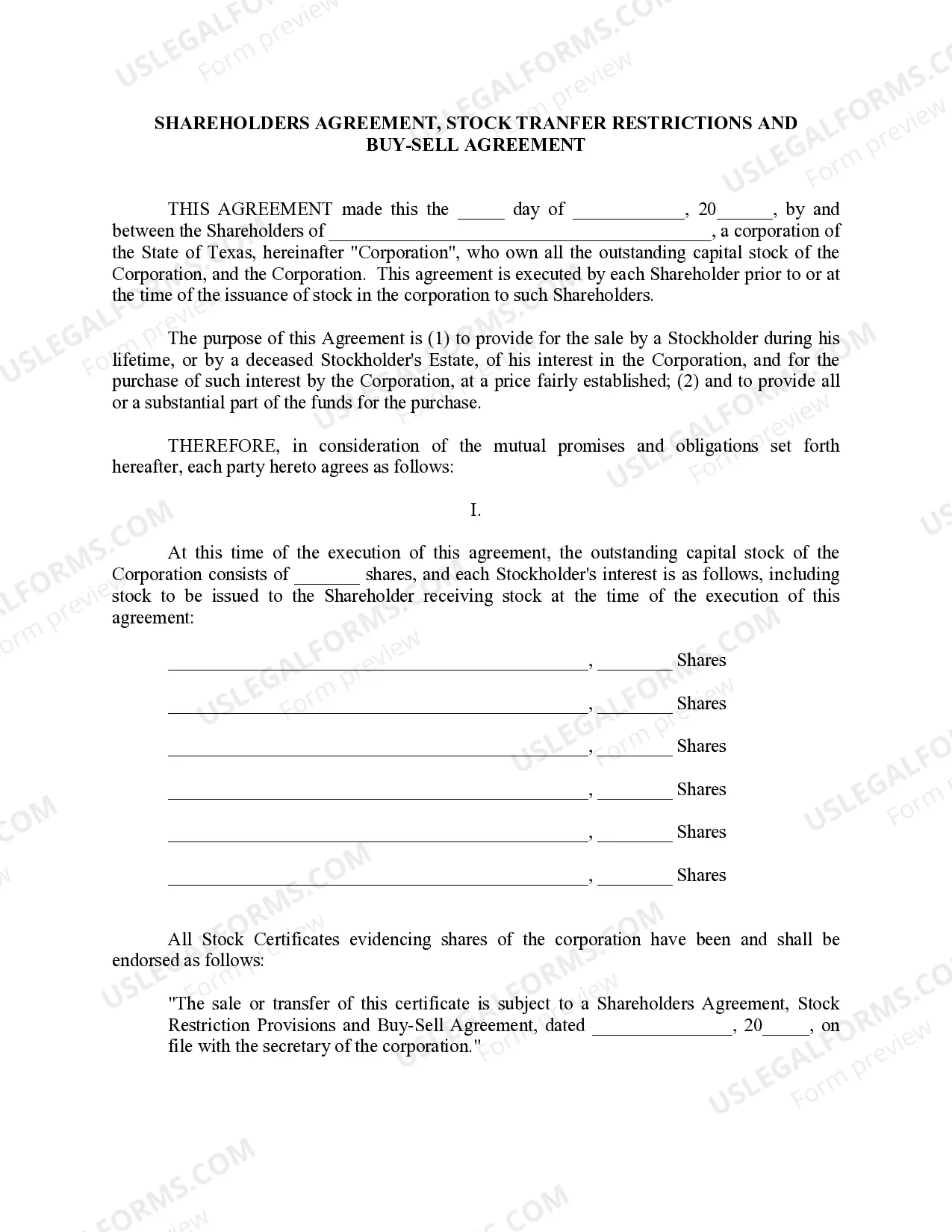

The Shareholders Agreement is signed by the shareholders to agree on how the shares of a deceased shareholder may be purchased and how shares of a person who desires to sell their stock may be obtained by the other shareholders or the corporation. Restrictions on the Sale of stock are included to accomplish the goals of the shareholders to keep the corporation under the control of the existing shareholders.

The Confidentiality Agreement is made between the shareholders wherein they agree to keep confidential certain corporate matters.

San Angelo, Texas Pre-Incorporation Agreement: A San Angelo Texas Pre-Incorporation Agreement is a legally binding document that outlines the initial steps and agreements taken by individuals or entities before incorporating a company in San Angelo, Texas. This agreement is crucial for organizing and formalizing the relationships and responsibilities between founders, potential shareholders, and other parties involved in the incorporation process. The San Angelo Texas Pre-Incorporation Agreement generally includes the following key elements: 1. Purpose: Clearly defines the objective and nature of the business the parties intend to incorporate. 2. Founding Members: Identifies the founders or individuals involved in the incorporation process. 3. Roles and Responsibilities: Outlines the specific roles and responsibilities of each founder or party, including their contributions to the company. 4. Equity Distribution: Establishes the initial allocation of shares or ownership in the company among the founders or shareholders. 5. Capital Contributions: Specifies the financial or non-financial assets each founder or party will contribute to the company. 6. Intellectual Property: Covers the ownership and protection of intellectual property rights related to the business. 7. Decision-making: Describes the decision-making process within the company, including voting rights and procedures. 8. Corporate Structure: Outlines the proposed corporate structure, including the selection of officers, directors, and any governing bodies. 9. Term and Termination: States the duration of the agreement and the circumstances under which it may be terminated. 10. Confidentiality: Addresses the non-disclosure of confidential information related to the company's operations, trade secrets, or any proprietary information. It's important to note that there may be different types or variations of the San Angelo Texas Pre-Incorporation Agreement tailored to specific industries or circumstances. For instance, there might be separate agreements for technology startups, real estate ventures, or partnerships in specialized sectors. San Angelo, Texas Shareholders Agreement: A San Angelo Texas Shareholders Agreement is a legally binding contract signed among the shareholders of a company incorporated in San Angelo, Texas. This agreement outlines the rights, obligations, and protections of the shareholders, setting the foundation for their relationship and governance within the company. Some key components of a San Angelo Texas Shareholders Agreement include: 1. Shareholders' Rights and Obligations: Enumerates the rights and obligations of each shareholder, including voting rights, information access, and dividend distribution. 2. Share Transfer: Establishes the conditions and procedures for transferring or selling shares, including any rights of first refusal or preemption. 3. Decision-making: Sets out the mechanism for making significant corporate decisions, such as board representation, appointment of executives, and approval for certain actions. 4. Dispute Resolution: Defines procedures for resolving disputes, whether through mediation, arbitration, or litigation, in order to prevent conflicts from negatively impacting the company's operations. 5. Non-Compete and Non-Solicitation: Addresses restrictions on shareholders competing with the company or soliciting its employees, customers, or suppliers. 6. Corporate Governance: Outlines governance mechanisms within the company, such as board meetings, annual general meetings, and the appointment of committees. 7. Minority Rights: Provides protection and rights for minority shareholders against potential abuse or oppression by majority shareholders. 8. Dividend Policy: Specifies the company's dividend policy and distribution methods. 9. Exit Strategy: Covers provisions related to the sale of the entire company or an individual shareholder's exit strategy, including rights of first refusal, drag-along and tag-along rights, etc. 10. Confidentiality Agreement: This may be part of or closely connected to the Shareholders Agreement, maintaining confidentiality among the shareholders and preventing them from disclosing sensitive company information. Multiple San Angelo Texas Shareholders Agreements may exist depending on the company's specific circumstances, such as agreements tailored for startups, joint ventures, or private equity investments. San Angelo, Texas Confidentiality Agreement: A San Angelo Texas Confidentiality Agreement, also known as a Non-Disclosure Agreement, is a legally binding contract that protects sensitive information exchanged between parties involved in a business transaction or relationship within the San Angelo, Texas jurisdiction. Such agreements safeguard the confidential and proprietary information shared during negotiations or collaborations and prevent its unauthorized use or disclosure. The key elements typically covered in a San Angelo Texas Confidentiality Agreement include: 1. Definition of Confidential Information: Clearly defines what constitutes confidential information, including trade secrets, proprietary information, financial data, customer lists, business strategies, and any other sensitive information relevant to the agreement. 2. Parties' Obligations: Outlines the responsibilities of each party to keep the disclosed information confidential, prohibiting its use for any purposes other than those stated in the agreement. 3. Non-Disclosure: Stipulates that the recipient of the confidential information shall not disclose it to any third party without obtaining prior written consent from the disclosing party. 4. Exceptions: Identifies any specific exceptions or exclusions to the confidentiality obligations, such as information that is already publicly known or independently developed by the recipient. 5. Duration: Determines the duration of the confidentiality obligations, typically ranging from a specific number of years or until the disclosed information becomes publicly available. 6. Remedies and Breach: Defines the remedies available to parties in case of a breach of the confidentiality provisions, including monetary damages, injunctive relief, or other appropriate remedies as determined by the court. Different types of San Angelo Texas Confidentiality Agreements might exist based on the nature of the business relationship, such as agreements specific to employment, partnerships, vendor relationships, or mergers and acquisitions.San Angelo, Texas Pre-Incorporation Agreement: A San Angelo Texas Pre-Incorporation Agreement is a legally binding document that outlines the initial steps and agreements taken by individuals or entities before incorporating a company in San Angelo, Texas. This agreement is crucial for organizing and formalizing the relationships and responsibilities between founders, potential shareholders, and other parties involved in the incorporation process. The San Angelo Texas Pre-Incorporation Agreement generally includes the following key elements: 1. Purpose: Clearly defines the objective and nature of the business the parties intend to incorporate. 2. Founding Members: Identifies the founders or individuals involved in the incorporation process. 3. Roles and Responsibilities: Outlines the specific roles and responsibilities of each founder or party, including their contributions to the company. 4. Equity Distribution: Establishes the initial allocation of shares or ownership in the company among the founders or shareholders. 5. Capital Contributions: Specifies the financial or non-financial assets each founder or party will contribute to the company. 6. Intellectual Property: Covers the ownership and protection of intellectual property rights related to the business. 7. Decision-making: Describes the decision-making process within the company, including voting rights and procedures. 8. Corporate Structure: Outlines the proposed corporate structure, including the selection of officers, directors, and any governing bodies. 9. Term and Termination: States the duration of the agreement and the circumstances under which it may be terminated. 10. Confidentiality: Addresses the non-disclosure of confidential information related to the company's operations, trade secrets, or any proprietary information. It's important to note that there may be different types or variations of the San Angelo Texas Pre-Incorporation Agreement tailored to specific industries or circumstances. For instance, there might be separate agreements for technology startups, real estate ventures, or partnerships in specialized sectors. San Angelo, Texas Shareholders Agreement: A San Angelo Texas Shareholders Agreement is a legally binding contract signed among the shareholders of a company incorporated in San Angelo, Texas. This agreement outlines the rights, obligations, and protections of the shareholders, setting the foundation for their relationship and governance within the company. Some key components of a San Angelo Texas Shareholders Agreement include: 1. Shareholders' Rights and Obligations: Enumerates the rights and obligations of each shareholder, including voting rights, information access, and dividend distribution. 2. Share Transfer: Establishes the conditions and procedures for transferring or selling shares, including any rights of first refusal or preemption. 3. Decision-making: Sets out the mechanism for making significant corporate decisions, such as board representation, appointment of executives, and approval for certain actions. 4. Dispute Resolution: Defines procedures for resolving disputes, whether through mediation, arbitration, or litigation, in order to prevent conflicts from negatively impacting the company's operations. 5. Non-Compete and Non-Solicitation: Addresses restrictions on shareholders competing with the company or soliciting its employees, customers, or suppliers. 6. Corporate Governance: Outlines governance mechanisms within the company, such as board meetings, annual general meetings, and the appointment of committees. 7. Minority Rights: Provides protection and rights for minority shareholders against potential abuse or oppression by majority shareholders. 8. Dividend Policy: Specifies the company's dividend policy and distribution methods. 9. Exit Strategy: Covers provisions related to the sale of the entire company or an individual shareholder's exit strategy, including rights of first refusal, drag-along and tag-along rights, etc. 10. Confidentiality Agreement: This may be part of or closely connected to the Shareholders Agreement, maintaining confidentiality among the shareholders and preventing them from disclosing sensitive company information. Multiple San Angelo Texas Shareholders Agreements may exist depending on the company's specific circumstances, such as agreements tailored for startups, joint ventures, or private equity investments. San Angelo, Texas Confidentiality Agreement: A San Angelo Texas Confidentiality Agreement, also known as a Non-Disclosure Agreement, is a legally binding contract that protects sensitive information exchanged between parties involved in a business transaction or relationship within the San Angelo, Texas jurisdiction. Such agreements safeguard the confidential and proprietary information shared during negotiations or collaborations and prevent its unauthorized use or disclosure. The key elements typically covered in a San Angelo Texas Confidentiality Agreement include: 1. Definition of Confidential Information: Clearly defines what constitutes confidential information, including trade secrets, proprietary information, financial data, customer lists, business strategies, and any other sensitive information relevant to the agreement. 2. Parties' Obligations: Outlines the responsibilities of each party to keep the disclosed information confidential, prohibiting its use for any purposes other than those stated in the agreement. 3. Non-Disclosure: Stipulates that the recipient of the confidential information shall not disclose it to any third party without obtaining prior written consent from the disclosing party. 4. Exceptions: Identifies any specific exceptions or exclusions to the confidentiality obligations, such as information that is already publicly known or independently developed by the recipient. 5. Duration: Determines the duration of the confidentiality obligations, typically ranging from a specific number of years or until the disclosed information becomes publicly available. 6. Remedies and Breach: Defines the remedies available to parties in case of a breach of the confidentiality provisions, including monetary damages, injunctive relief, or other appropriate remedies as determined by the court. Different types of San Angelo Texas Confidentiality Agreements might exist based on the nature of the business relationship, such as agreements specific to employment, partnerships, vendor relationships, or mergers and acquisitions.