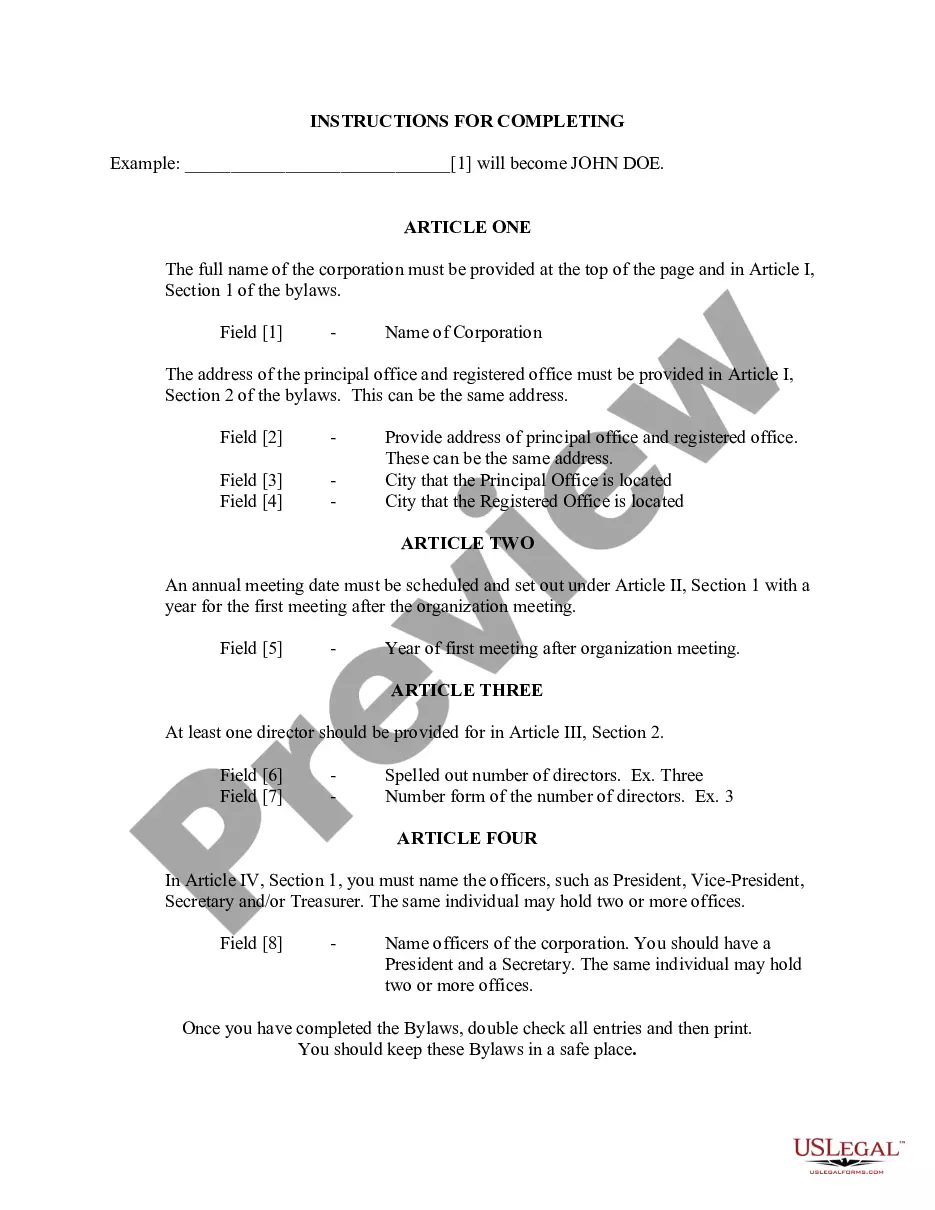

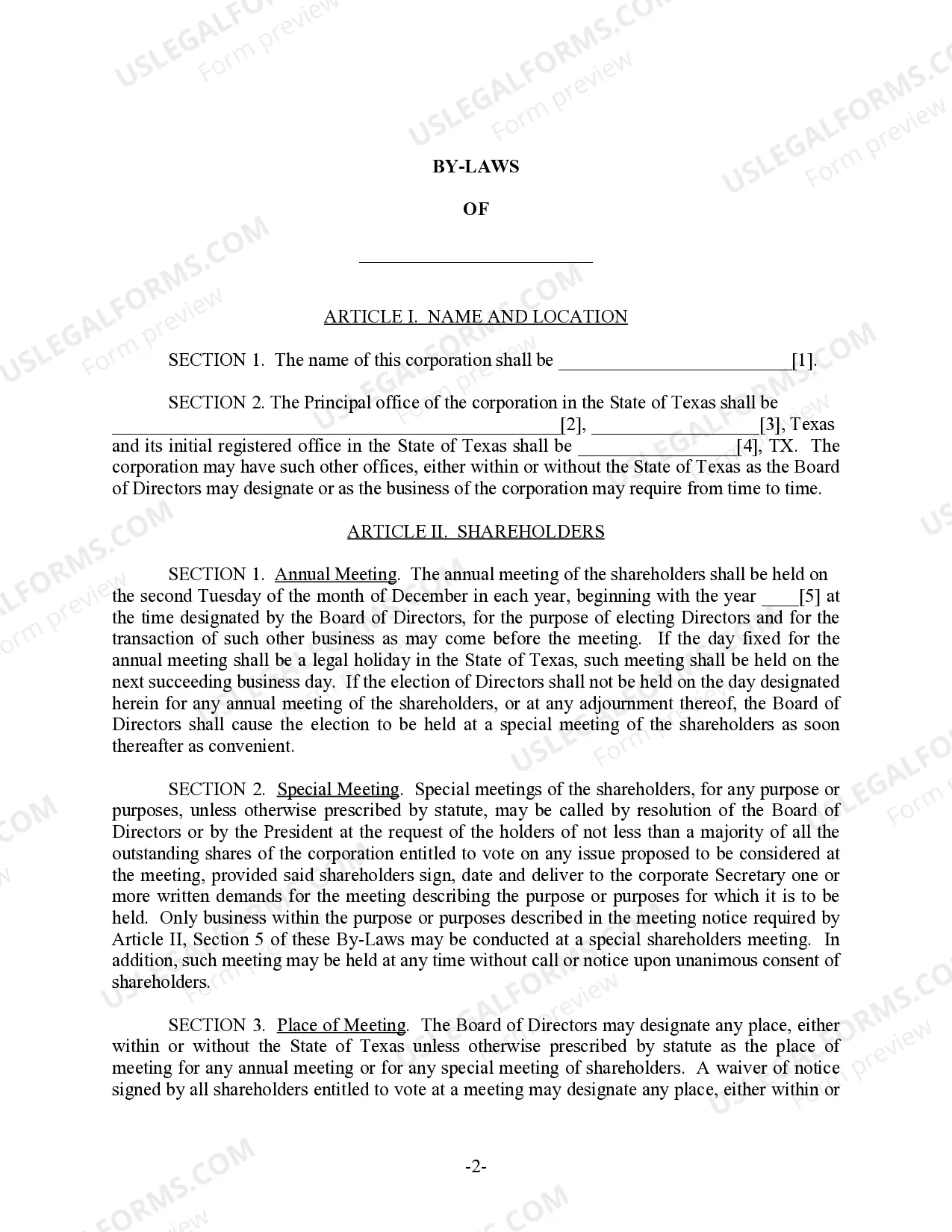

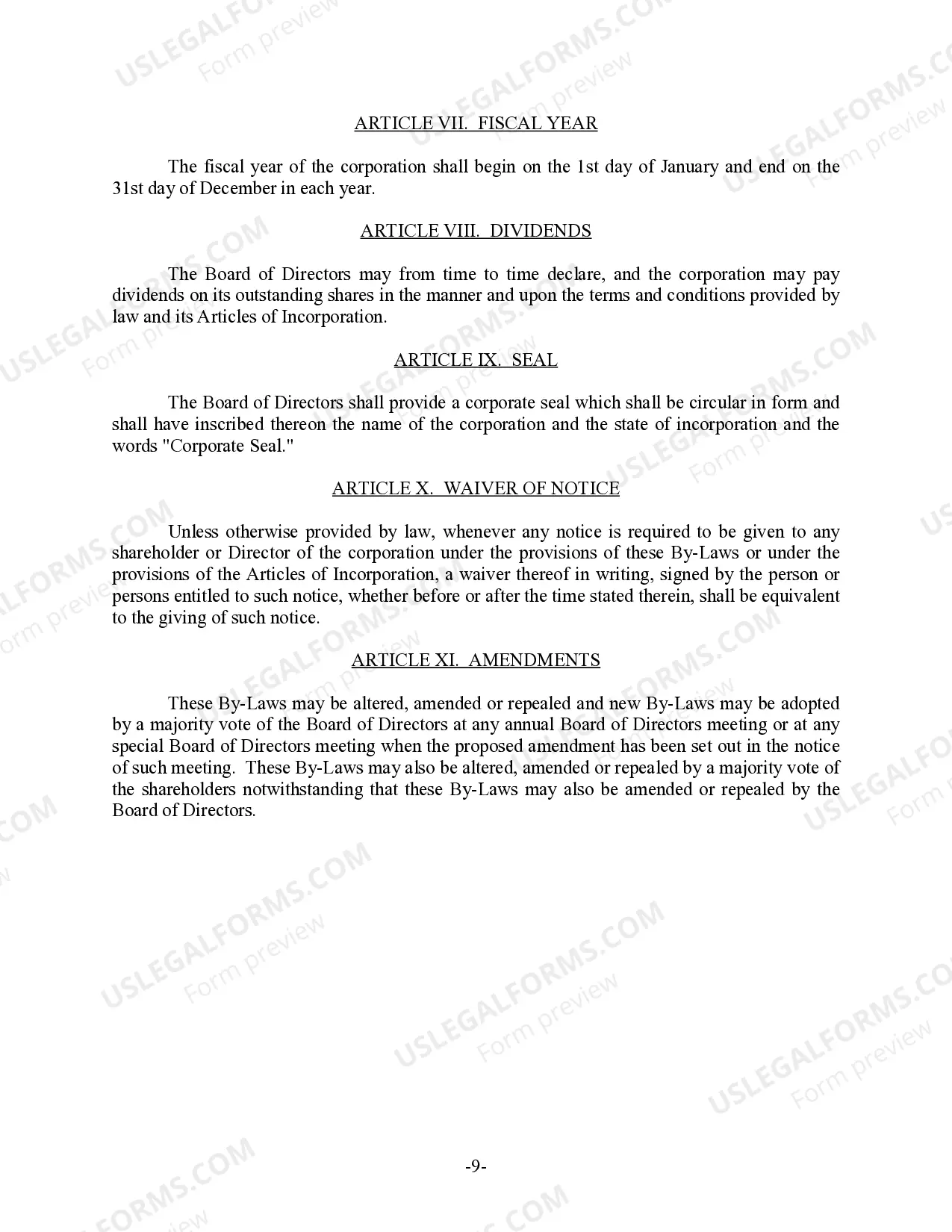

This form is By-Laws for a Business Corporation and contains provisons regarding how the corporation will be operated, as well as provisions governing shareholders meetings, officers, directors, voting of shares, stock records and more. Approximately 9 pages.

Collin Texas Bylaws for Corporation are a set of rules and regulations that govern the internal affairs of corporations operating in Collin County, Texas. These bylaws establish the structure and operating procedures for corporations, ensuring that their activities are carried out in compliance with state and local laws. The main purpose of Collin Texas Bylaws for Corporation is to outline the rights, duties, and responsibilities of the corporation's directors, officers, and shareholders. These bylaws typically cover various important aspects, including the composition and roles of the board of directors, the election and removal of officers, meeting requirements, voting procedures, stock ownership and transfer, and the overall management of the corporation. It is important to note that Collin Texas Bylaws for Corporation can vary depending on the specific type of corporation. Some common types of corporations that may have different sets of bylaws in Collin Texas include: 1. C-Corporation Bylaws: C-Corporations are the most common type of corporation and usually have intricate bylaws that dictate how the corporation will be managed, how profits and losses will be distributed, and what rights and obligations shareholders hold. 2. S-Corporation Bylaws: S-Corporations are a special type of corporation that provides certain tax advantages. The bylaws for S-Corporations may include provisions related to eligibility requirements for electing S-Corporation status, limitations on the number and types of shareholders, and restrictions on the transfer of shares. 3. Nonprofit Corporation Bylaws: Nonprofit corporations are formed for charitable, religious, educational, or other non-profit purposes. The bylaws for nonprofit corporations in Collin Texas may contain additional provisions related to tax-exempt status, board structure, and the purposes and activities of the organization. 4. Professional Corporation Bylaws: Professional corporations are typically formed by professionals such as doctors, lawyers, and accountants. The bylaws for professional corporations may include specific requirements related to licensing, qualifications, and restrictions on shareholder composition. The specific content and provisions of Collin Texas Bylaws for Corporation may vary depending on the corporation's needs, industry, and goals. It is essential for corporations to consult with legal professionals well-versed in Texas corporate law to draft comprehensive and tailored bylaws that align with their specific requirements while adhering to local regulations.Collin Texas Bylaws for Corporation are a set of rules and regulations that govern the internal affairs of corporations operating in Collin County, Texas. These bylaws establish the structure and operating procedures for corporations, ensuring that their activities are carried out in compliance with state and local laws. The main purpose of Collin Texas Bylaws for Corporation is to outline the rights, duties, and responsibilities of the corporation's directors, officers, and shareholders. These bylaws typically cover various important aspects, including the composition and roles of the board of directors, the election and removal of officers, meeting requirements, voting procedures, stock ownership and transfer, and the overall management of the corporation. It is important to note that Collin Texas Bylaws for Corporation can vary depending on the specific type of corporation. Some common types of corporations that may have different sets of bylaws in Collin Texas include: 1. C-Corporation Bylaws: C-Corporations are the most common type of corporation and usually have intricate bylaws that dictate how the corporation will be managed, how profits and losses will be distributed, and what rights and obligations shareholders hold. 2. S-Corporation Bylaws: S-Corporations are a special type of corporation that provides certain tax advantages. The bylaws for S-Corporations may include provisions related to eligibility requirements for electing S-Corporation status, limitations on the number and types of shareholders, and restrictions on the transfer of shares. 3. Nonprofit Corporation Bylaws: Nonprofit corporations are formed for charitable, religious, educational, or other non-profit purposes. The bylaws for nonprofit corporations in Collin Texas may contain additional provisions related to tax-exempt status, board structure, and the purposes and activities of the organization. 4. Professional Corporation Bylaws: Professional corporations are typically formed by professionals such as doctors, lawyers, and accountants. The bylaws for professional corporations may include specific requirements related to licensing, qualifications, and restrictions on shareholder composition. The specific content and provisions of Collin Texas Bylaws for Corporation may vary depending on the corporation's needs, industry, and goals. It is essential for corporations to consult with legal professionals well-versed in Texas corporate law to draft comprehensive and tailored bylaws that align with their specific requirements while adhering to local regulations.