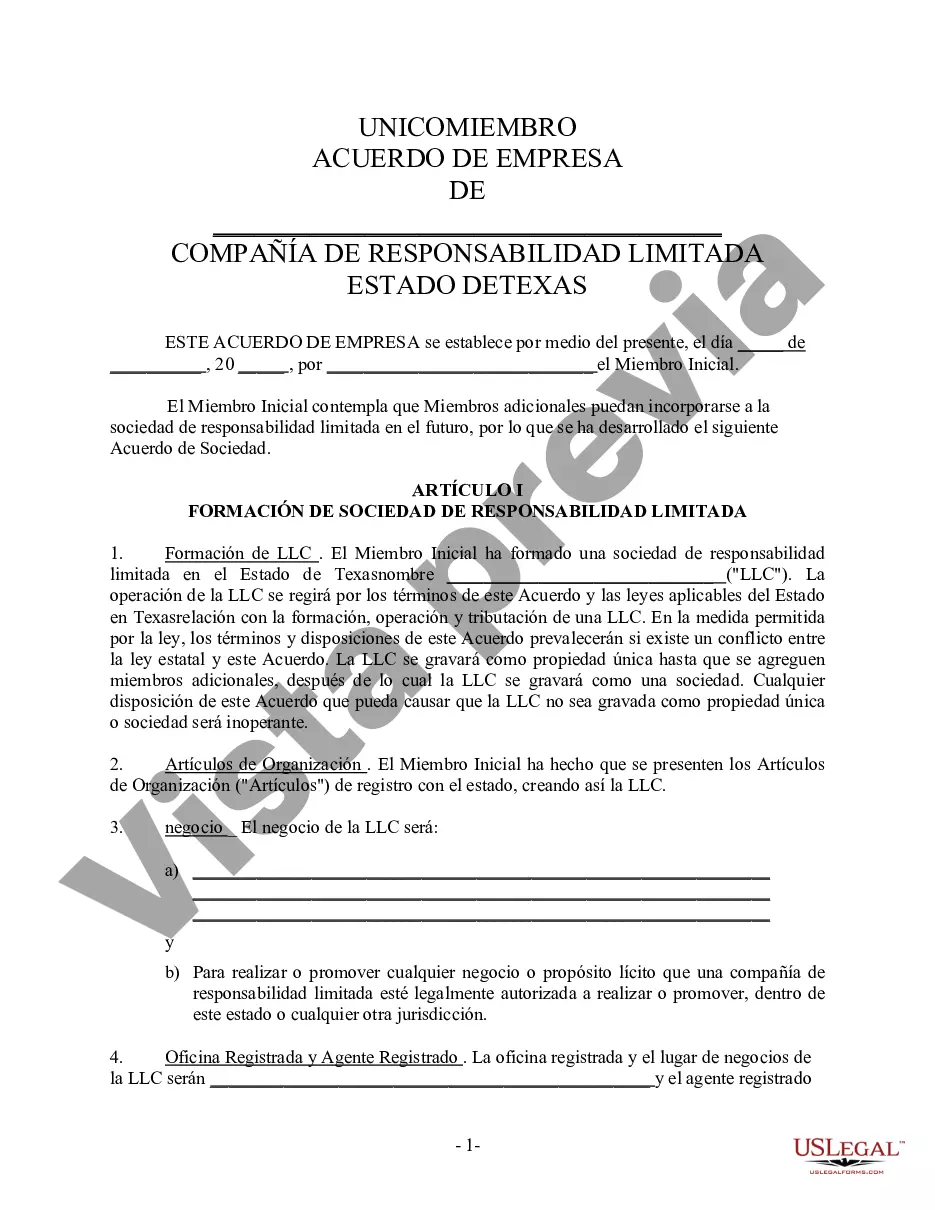

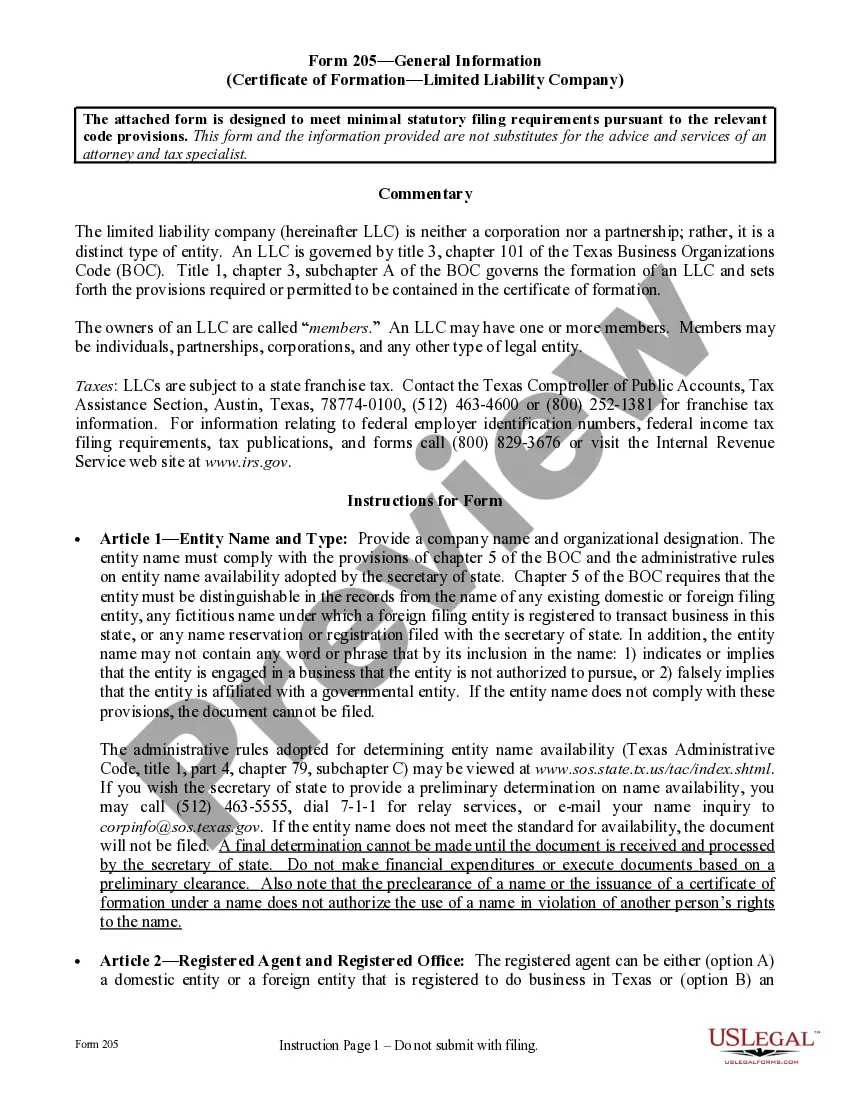

The Austin Texas Single Member Limited Liability Company (LLC) Company Agreement is a legal document that outlines the operating and organizational structure of a single-member LLC based in Austin, Texas. It serves as a contract between the single member (owner) and the LLC itself, detailing the rights, responsibilities, and duties of all parties involved. Keywords: Austin Texas, Single Member, Limited Liability Company, LLC, Company Agreement The Austin Texas Single Member Limited Liability Company (LLC) Company Agreement covers various important aspects of the LLC's operations, including ownership rights, financial contributions, profit allocation, management, decision-making, tax obligations, and dissolution procedures. It provides a clear framework for the LLC's functioning and helps prevent potential disputes or conflicts among the parties involved. Under the Austin Texas Single Member Limited Liability Company (LLC) Company Agreement, the single member's ownership rights are defined. This includes their initial capital contribution and the percentage of ownership they hold in the company. It also outlines the process for admitting additional members, if the single member wishes to expand the LLC in the future. Financial matters are also covered within the agreement. It outlines the LLC's financial structure, including how profits and losses will be allocated among the single member and any other potential members. This section may include provisions for distributions, reinvestment, or reserves. The agreement may also specify how additional capital contributions will be handled if necessary. The management of the LLC is a crucial aspect outlined in the Austin Texas Single Member Limited Liability Company (LLC) Company Agreement. It defines how the day-to-day operations will be conducted and lists the responsibilities and decision-making powers of the single member. It may outline the appointment of managers or specify whether the single member will handle all management decisions. This section may also establish rules for meetings, voting, and any required notifications. Tax-related provisions are an essential part of the Austin Texas Single Member Limited Liability Company (LLC) Company Agreement. It clarifies how the LLC's tax obligations will be handled, including the reporting and payment of federal, state, and local taxes. This section may provide guidance on filing requirements, tax elections, and any tax-related decision-making processes. Lastly, the agreement should include provisions for the dissolution or termination of the LLC. It outlines the procedures for winding down the business, distributing assets, and settling any remaining liabilities. It may also specify any requirements for notifying creditors or other parties affected by the dissolution. While there may not be different types of Austin Texas Single Member Limited Liability Company (LLC) Company Agreements, variations can occur based on the specific provisions included or unique circumstances of the single member's business. Each agreement will be tailored to meet the specific needs and goals of the single-member LLC operating in Austin, Texas.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Austin Texas Acuerdo de empresa LLC de responsabilidad limitada de un solo miembro - Texas Single Member Limited Liability Company LLC Company Agreement

Description

How to fill out Austin Texas Acuerdo De Empresa LLC De Responsabilidad Limitada De Un Solo Miembro?

Getting verified templates specific to your local regulations can be challenging unless you use the US Legal Forms library. It’s an online pool of more than 85,000 legal forms for both personal and professional needs and any real-life scenarios. All the documents are properly grouped by area of usage and jurisdiction areas, so locating the Austin Texas Single Member Limited Liability Company LLC Company Agreement gets as quick and easy as ABC.

For everyone already acquainted with our service and has used it before, obtaining the Austin Texas Single Member Limited Liability Company LLC Company Agreement takes just a few clicks. All you need to do is log in to your account, pick the document, and click Download to save it on your device. This process will take just a couple of additional steps to make for new users.

Follow the guidelines below to get started with the most extensive online form collection:

- Look at the Preview mode and form description. Make certain you’ve picked the correct one that meets your needs and fully corresponds to your local jurisdiction requirements.

- Look for another template, if needed. Once you find any inconsistency, utilize the Search tab above to obtain the correct one. If it suits you, move to the next step.

- Purchase the document. Click on the Buy Now button and choose the subscription plan you prefer. You should register an account to get access to the library’s resources.

- Make your purchase. Give your credit card details or use your PayPal account to pay for the service.

- Download the Austin Texas Single Member Limited Liability Company LLC Company Agreement. Save the template on your device to proceed with its completion and get access to it in the My Forms menu of your profile whenever you need it again.

Keeping paperwork neat and compliant with the law requirements has significant importance. Take advantage of the US Legal Forms library to always have essential document templates for any demands just at your hand!