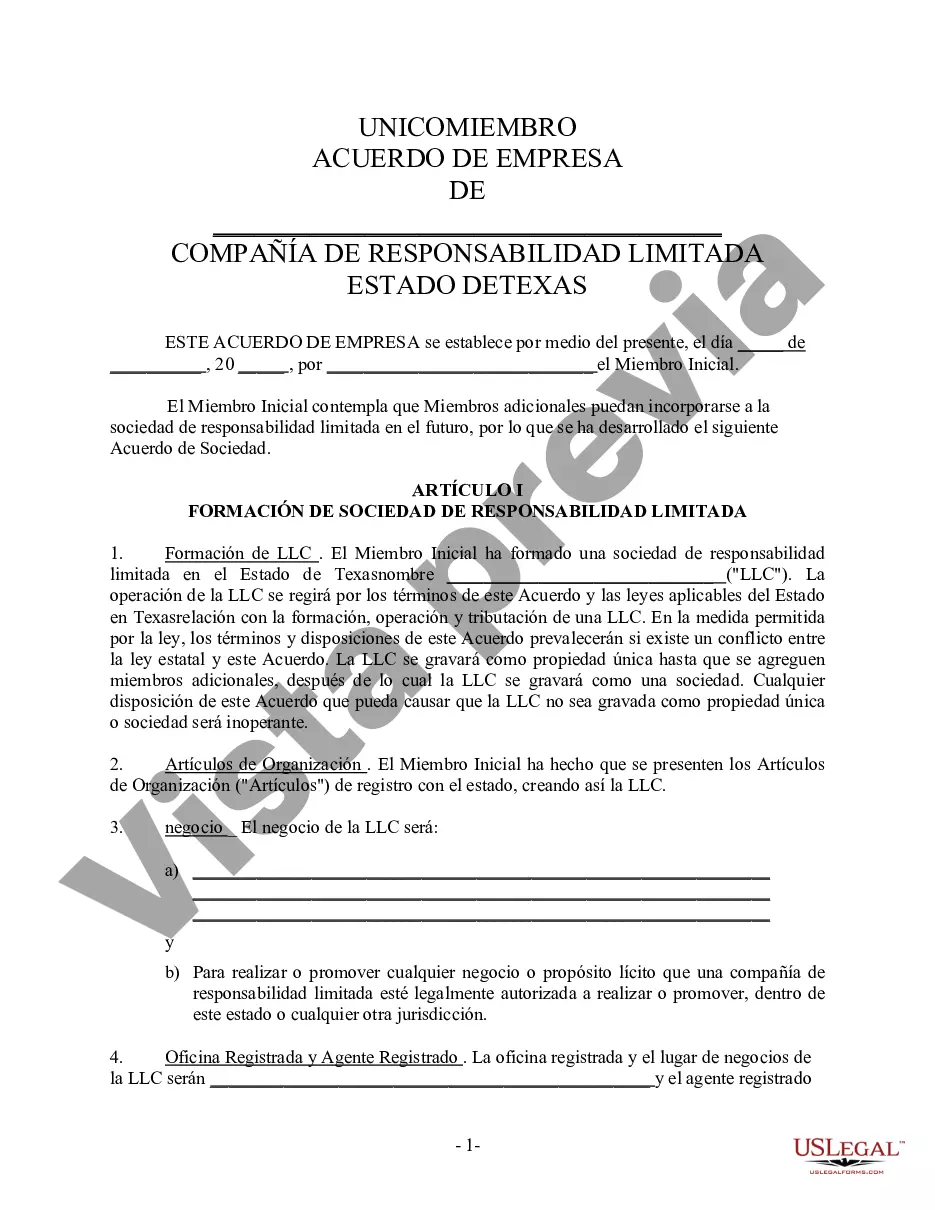

A San Antonio Texas Single Member Limited Liability Company (LLC) Company Agreement is a legal document that outlines the operational and management rules for a single-member LLC in San Antonio, Texas. This agreement is a crucial component of setting up and running a single-member LLC as it helps establish the internal workings and responsibilities for the business entity. The Single Member LLC Company Agreement for San Antonio, Texas includes specific provisions and clauses that address various aspects of the company, such as ownership, management, voting rights, capital contributions, profit distribution, taxation, and dissolution. It serves as a guidebook for the single-member LLC, providing a clear structure for the operation and management of the business. Key elements typically covered in a San Antonio Texas Single Member LLC Company Agreement include: 1. Ownership: This section defines the ownership structure of the LLC, stating that there is only one member who holds all ownership interest in the company. 2. Management: It outlines how the single-member LLC will be managed, whether by the member themselves or through the appointment of a manager. This includes the decision-making authority and responsibilities of the manager. 3. Voting Rights: This provision explains how voting rights are determined within the LLC, specifying if the member has full authority to make all decisions on their own or if certain decisions require a vote. 4. Capital Contributions: It details the initial capital investment made by the member to establish the LLC, along with provisions for any future contributions. This section may include guidelines on how additional capital contributions will be made and the corresponding changes in ownership percentages. 5. Profit Distribution: This provision outlines how profits and losses will be allocated among the member(s), typically based on the ownership percentage or any other agreed-upon arrangement. 6. Taxation: The Single Member LLC Company Agreement may address the tax structure of the LLC, including the LLC's tax identification number and how profits and losses will be reported for tax purposes. 7. Dissolution: This section specifies the circumstances under which the single-member LLC may be dissolved, such as bankruptcy, death of the member, or by mutual agreement. It lays out the procedures to be followed in case of dissolution, including how the company's assets will be distributed. While there may not be different types of San Antonio Texas Single Member LLC Company Agreements, the content and provisions within the agreement may vary depending on the specific needs and preferences of the single member and the nature of the business. It is always advisable to consult with legal professionals and tailor the agreement to suit the unique circumstances of the single-member LLC.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.San Antonio Texas Acuerdo de empresa LLC de responsabilidad limitada de un solo miembro - Texas Single Member Limited Liability Company LLC Company Agreement

Description

How to fill out San Antonio Texas Acuerdo De Empresa LLC De Responsabilidad Limitada De Un Solo Miembro?

We always strive to minimize or prevent legal damage when dealing with nuanced law-related or financial matters. To accomplish this, we sign up for attorney solutions that, as a rule, are extremely expensive. Nevertheless, not all legal matters are equally complex. Most of them can be dealt with by ourselves.

US Legal Forms is an online library of up-to-date DIY legal documents addressing anything from wills and powers of attorney to articles of incorporation and petitions for dissolution. Our platform helps you take your matters into your own hands without the need of using services of an attorney. We offer access to legal document templates that aren’t always openly available. Our templates are state- and area-specific, which significantly facilitates the search process.

Benefit from US Legal Forms whenever you need to get and download the San Antonio Texas Single Member Limited Liability Company LLC Company Agreement or any other document easily and securely. Simply log in to your account and click the Get button next to it. If you happened to lose the form, you can always download it again in the My Forms tab.

The process is just as straightforward if you’re unfamiliar with the platform! You can create your account in a matter of minutes.

- Make sure to check if the San Antonio Texas Single Member Limited Liability Company LLC Company Agreement adheres to the laws and regulations of your your state and area.

- Also, it’s imperative that you check out the form’s outline (if provided), and if you spot any discrepancies with what you were looking for in the first place, search for a different template.

- As soon as you’ve ensured that the San Antonio Texas Single Member Limited Liability Company LLC Company Agreement is proper for you, you can pick the subscription plan and make a payment.

- Then you can download the form in any suitable format.

For over 24 years of our presence on the market, we’ve served millions of people by providing ready to customize and up-to-date legal documents. Take advantage of US Legal Forms now to save efforts and resources!