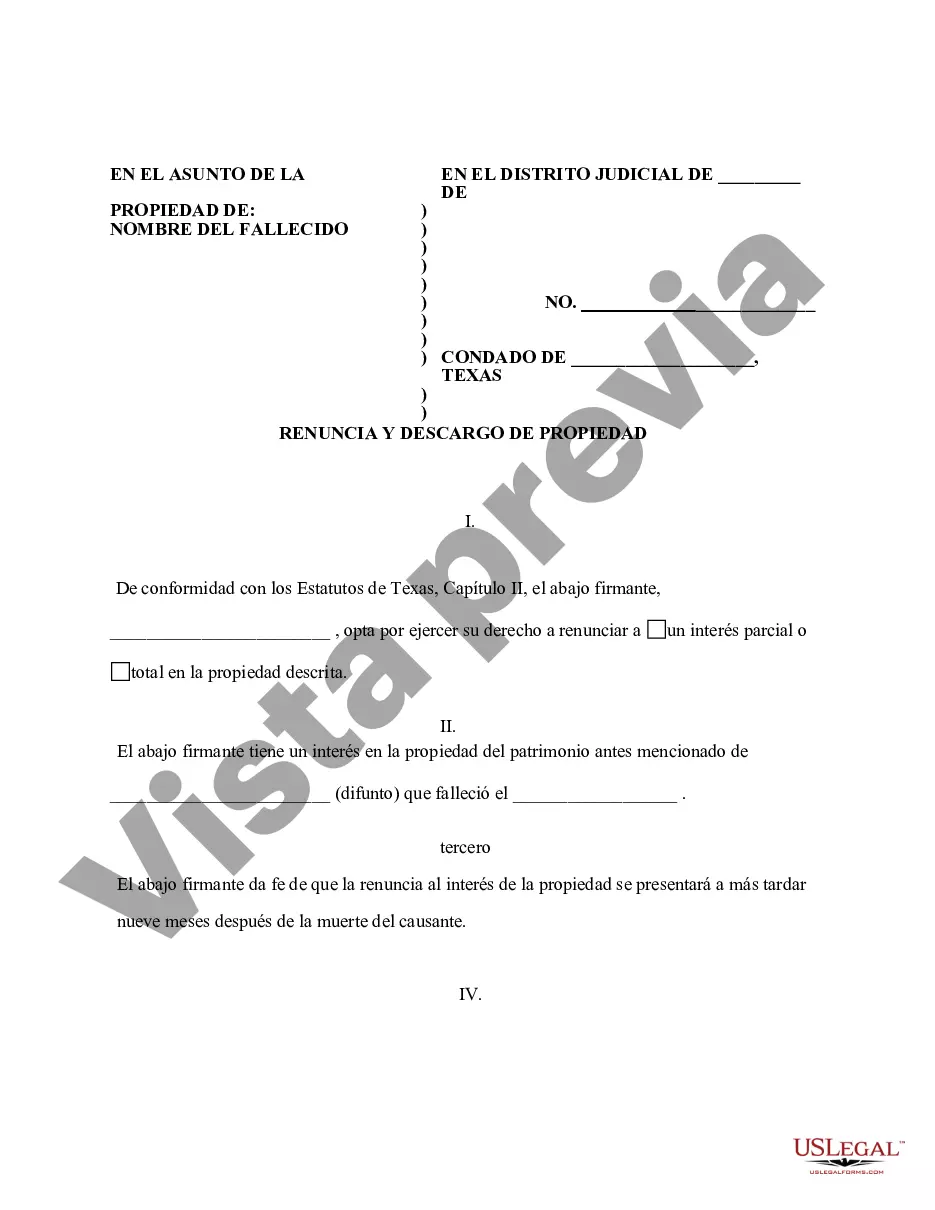

This form is a Renunciation and Disclaimer of Property acquired by the beneficiary through the last will and testament of the decedent where the beneficiary gained an interest in the property upon the death of the decedent, but, will terminate a portion of or the entire interest of the property pursuant to the Texas Statutes, Chapter II. The beneficiary attests that he/she will file the disclaimer no later than nine months after the death of the decedent in order to secure the validity of the disclaimer. The form also contains a state specific acknowledgment and a certificate of delivery.

Collin Texas Renunciation and Disclaimer of Property from Will by Testate is a legal mechanism through which an individual who is entitled to inherit property under a will voluntarily renounces or disclaims their right to the assets designated for them in the decedent's will. This renunciation and disclaimer serve the purpose of ensuring that the wishes of the testator are carried out as intended. The renunciation and disclaimer of property from a will buy testate in Collin Texas must comply with specific legal requirements set forth in the Texas Probate Code. It is crucial to understand that renunciation and disclaimer can only be made by individuals who have legal standing to do so, such as heirs, devises, or beneficiaries. There are different types of renunciation and disclaimer in Collin Texas, which include the following: 1. Renunciation of property before distribution: This type of renunciation occurs when an entitled individual chooses to renounce their inheritance rights even before the property distribution takes place. By signing a written renunciation, the individual acknowledges their intent to relinquish all rights to the property. 2. Partial renunciation of property: In some cases, an individual may decide to renounce only a portion of their entitled property, which allows them to retain some assets while declining others. This can be a strategic move to manage tax implications or personal circumstances. 3. Conditional disclaimer of property: Sometimes, individuals may choose to disclaim their inheritance rights based on certain conditions or circumstances outlined in the will. These conditions could include specific obligations or requirements that the beneficiary is unwilling or unable to fulfill. 4. Renunciation by a legal representative: If the entitled individual is deceased or incapacitated, their legal representative, such as an executor, administrator, guardian, or conservator, may renounce or disclaim the property on their behalf. It is vital for individuals considering a renunciation and disclaimer of property from a will in Collin Texas to seek professional advice from an experienced attorney. The attorney will guide them through the legal process, ensuring that all legal requirements are met, potential consequences are understood, and the individual's rights are protected. Overall, a Collin Texas renunciation and disclaimer of property from a will buy testate allows individuals to voluntarily give up their inheritance rights, whether in full or in part, when they are not interested in or unable to accept the assets designated for them in the decedent's will.Collin Texas Renunciation and Disclaimer of Property from Will by Testate is a legal mechanism through which an individual who is entitled to inherit property under a will voluntarily renounces or disclaims their right to the assets designated for them in the decedent's will. This renunciation and disclaimer serve the purpose of ensuring that the wishes of the testator are carried out as intended. The renunciation and disclaimer of property from a will buy testate in Collin Texas must comply with specific legal requirements set forth in the Texas Probate Code. It is crucial to understand that renunciation and disclaimer can only be made by individuals who have legal standing to do so, such as heirs, devises, or beneficiaries. There are different types of renunciation and disclaimer in Collin Texas, which include the following: 1. Renunciation of property before distribution: This type of renunciation occurs when an entitled individual chooses to renounce their inheritance rights even before the property distribution takes place. By signing a written renunciation, the individual acknowledges their intent to relinquish all rights to the property. 2. Partial renunciation of property: In some cases, an individual may decide to renounce only a portion of their entitled property, which allows them to retain some assets while declining others. This can be a strategic move to manage tax implications or personal circumstances. 3. Conditional disclaimer of property: Sometimes, individuals may choose to disclaim their inheritance rights based on certain conditions or circumstances outlined in the will. These conditions could include specific obligations or requirements that the beneficiary is unwilling or unable to fulfill. 4. Renunciation by a legal representative: If the entitled individual is deceased or incapacitated, their legal representative, such as an executor, administrator, guardian, or conservator, may renounce or disclaim the property on their behalf. It is vital for individuals considering a renunciation and disclaimer of property from a will in Collin Texas to seek professional advice from an experienced attorney. The attorney will guide them through the legal process, ensuring that all legal requirements are met, potential consequences are understood, and the individual's rights are protected. Overall, a Collin Texas renunciation and disclaimer of property from a will buy testate allows individuals to voluntarily give up their inheritance rights, whether in full or in part, when they are not interested in or unable to accept the assets designated for them in the decedent's will.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.