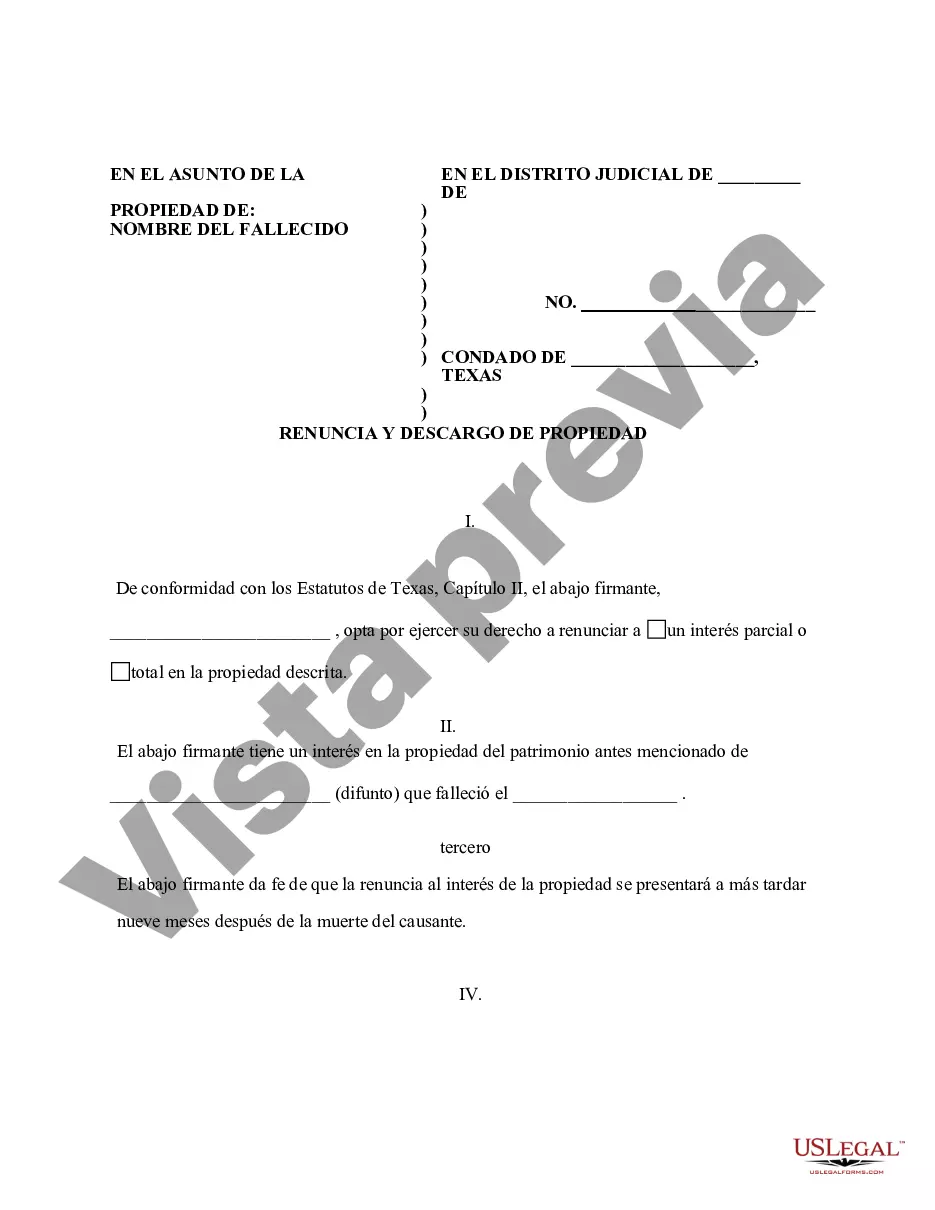

This form is a Renunciation and Disclaimer of Property acquired by the beneficiary through the last will and testament of the decedent where the beneficiary gained an interest in the property upon the death of the decedent, but, will terminate a portion of or the entire interest of the property pursuant to the Texas Statutes, Chapter II. The beneficiary attests that he/she will file the disclaimer no later than nine months after the death of the decedent in order to secure the validity of the disclaimer. The form also contains a state specific acknowledgment and a certificate of delivery.

A Dallas Texas Renunciation and Disclaimer of Property from Will by Testate is a legal document that allows a beneficiary named in a will to decline their right to inherit property. This renunciation and disclaimer effectively disqualifies the beneficiary from receiving any assets or benefits outlined in the will. The renunciation process is often undertaken when the beneficiary wishes to forgo their share of the inheritance or believes it is in their best interest to do so. The Renunciation and Disclaimer of Property from Will by Testate is governed by specific laws in Dallas, Texas, which vary depending on the circumstances and the type of property involved. There are several types of renunciation and disclaimer that can be made, including: 1. Complete Renunciation: In this scenario, the beneficiary relinquishes their entire interest in the property specified in the will. By renouncing, the beneficiary is essentially treating themselves as if they had predeceased the person who made the will, thereby allowing others to inherit their share. 2. Partial Renunciation: With a partial renunciation, the beneficiary chooses to waive only a portion of their inheritance. This could be due to personal circumstances, tax implications, or the desire to distribute assets among other beneficiaries more evenly. 3. Specific Property Renunciation: Here, the beneficiary renounces only particular assets or properties mentioned in the will, while retaining their right to other inheritances. This allows the beneficiary to decline property they may not want or burdensome assets they do not wish to manage. The process of renunciation and disclaimer in Dallas, Texas, typically involves filing a legal document or a written statement with the probate court that has jurisdiction over the will. This document must contain specific information such as the beneficiary's name, the testator's name (the person who made the will), a description of the property being renounced, and the beneficiary's explicit intention to renounce their claim. It's crucial to note that the ability to renounce and disclaim property from a will buy testate is time-sensitive and subject to deadlines. In Dallas, the beneficiary usually has a limited timeframe, often a few months, to complete the renunciation process. If the deadline is missed, the beneficiary will be legally bound to accept the inheritance as initially stated in the will. In conclusion, a Dallas Texas Renunciation and Disclaimer of Property from Will by Testate is a legal procedure that permits a beneficiary to renounce their right to inherit property as outlined in a will. The renunciation can be complete, partial, or specific to certain assets. It is essential for individuals considering renouncing their inheritance to consult with a qualified estate attorney to ensure all legal requirements are met and to obtain appropriate guidance throughout the process.A Dallas Texas Renunciation and Disclaimer of Property from Will by Testate is a legal document that allows a beneficiary named in a will to decline their right to inherit property. This renunciation and disclaimer effectively disqualifies the beneficiary from receiving any assets or benefits outlined in the will. The renunciation process is often undertaken when the beneficiary wishes to forgo their share of the inheritance or believes it is in their best interest to do so. The Renunciation and Disclaimer of Property from Will by Testate is governed by specific laws in Dallas, Texas, which vary depending on the circumstances and the type of property involved. There are several types of renunciation and disclaimer that can be made, including: 1. Complete Renunciation: In this scenario, the beneficiary relinquishes their entire interest in the property specified in the will. By renouncing, the beneficiary is essentially treating themselves as if they had predeceased the person who made the will, thereby allowing others to inherit their share. 2. Partial Renunciation: With a partial renunciation, the beneficiary chooses to waive only a portion of their inheritance. This could be due to personal circumstances, tax implications, or the desire to distribute assets among other beneficiaries more evenly. 3. Specific Property Renunciation: Here, the beneficiary renounces only particular assets or properties mentioned in the will, while retaining their right to other inheritances. This allows the beneficiary to decline property they may not want or burdensome assets they do not wish to manage. The process of renunciation and disclaimer in Dallas, Texas, typically involves filing a legal document or a written statement with the probate court that has jurisdiction over the will. This document must contain specific information such as the beneficiary's name, the testator's name (the person who made the will), a description of the property being renounced, and the beneficiary's explicit intention to renounce their claim. It's crucial to note that the ability to renounce and disclaim property from a will buy testate is time-sensitive and subject to deadlines. In Dallas, the beneficiary usually has a limited timeframe, often a few months, to complete the renunciation process. If the deadline is missed, the beneficiary will be legally bound to accept the inheritance as initially stated in the will. In conclusion, a Dallas Texas Renunciation and Disclaimer of Property from Will by Testate is a legal procedure that permits a beneficiary to renounce their right to inherit property as outlined in a will. The renunciation can be complete, partial, or specific to certain assets. It is essential for individuals considering renouncing their inheritance to consult with a qualified estate attorney to ensure all legal requirements are met and to obtain appropriate guidance throughout the process.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.