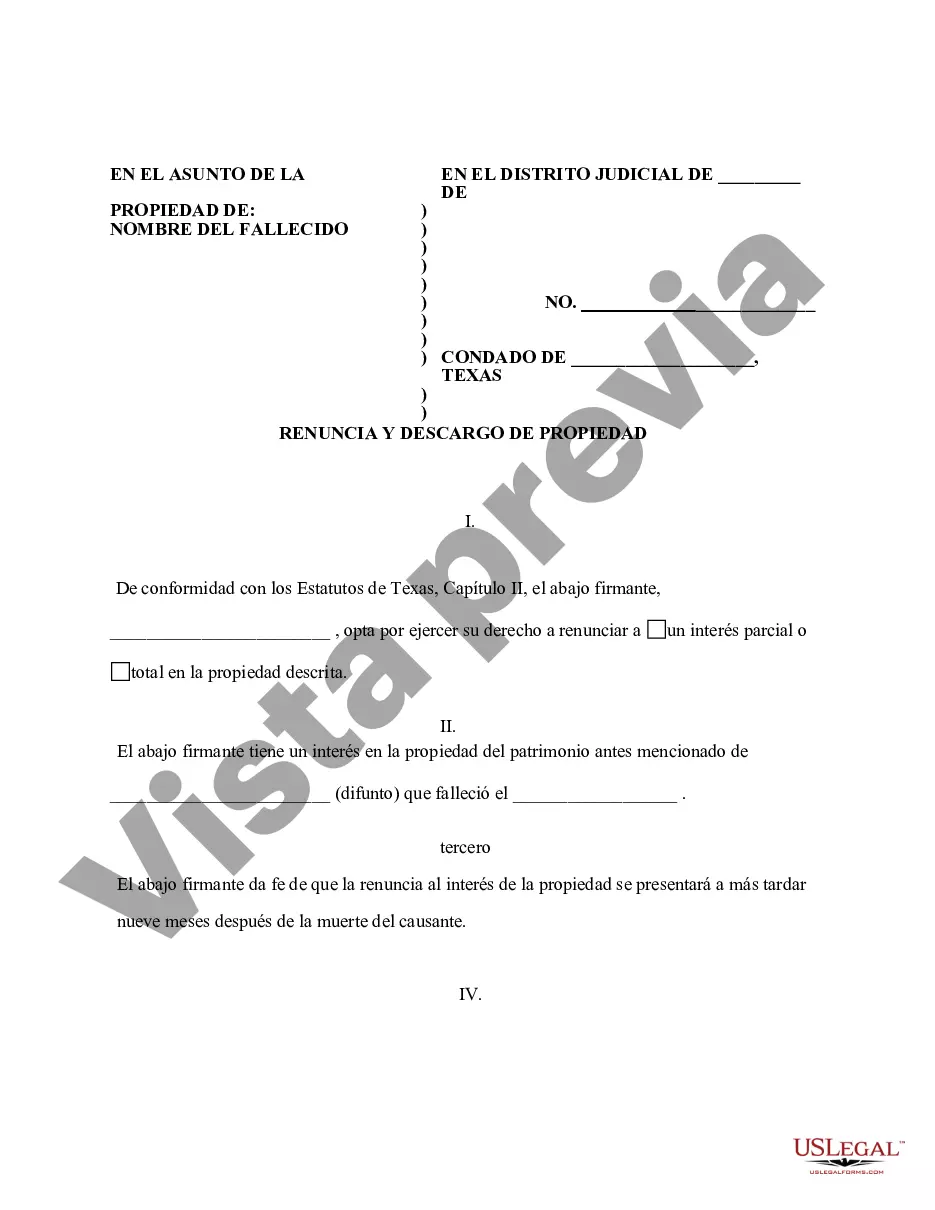

This form is a Renunciation and Disclaimer of Property acquired by the beneficiary through the last will and testament of the decedent where the beneficiary gained an interest in the property upon the death of the decedent, but, will terminate a portion of or the entire interest of the property pursuant to the Texas Statutes, Chapter II. The beneficiary attests that he/she will file the disclaimer no later than nine months after the death of the decedent in order to secure the validity of the disclaimer. The form also contains a state specific acknowledgment and a certificate of delivery.

Title: Understanding Wichita Falls Texas Renunciation And Disclaimer of Property from Will by Testate Introduction: In Wichita Falls, Texas, individuals have the right to renounce and disclaim property bequeathed to them in a will buy testate. This process enables heirs or beneficiaries to reject inherited assets under specific circumstances. By renouncing or disclaiming property, individuals can effectively transfer their inheritance to other recipients, waive rights or obligations associated with the property, or prevent potential tax burdens. This article provides a comprehensive overview of Wichita Falls Texas Renunciation and Disclaimer of Property from Will by Testate, exploring its types, procedures, and relevant legal aspects. 1. Types of Renunciation and Disclaimer: a) Total Renunciation: This involves a complete rejection of all property bequeathed to an individual in a will buy testate. The renouncing party willingly relinquishes their rights to the estate and any associated obligations. b) Partial Renunciation: Individuals may choose to renounce ownership of only specific assets or a percentage of their inheritance. This selective renunciation allows for a more controlled distribution of the estate. 2. Circumstances Leading to Renunciation or Disclaimer: a) Inheritance Tax Considerations: Renunciation may be preferred when accepting the property would result in substantial tax liabilities. By renouncing the inheritance, individuals can avoid potential financial burdens and minimize their tax obligations. b) Diverting Inheritance to Other Heirs: In some cases, beneficiaries may have their own complex financial situations or personal reasons for transferring their share of the inheritance to other heirs. Renunciation can facilitate the redistribution of assets according to the testator's wishes. c) Preservation of Government Benefits: Individuals receiving government assistance, such as Medicaid or Social Security, may choose to renounce inherited property to maintain their eligibility. This decision allows them to protect their existing benefits and avoid disqualification. 3. Procedures for Renunciation and Disclaimer: a) Written Documentation: Wichita Falls, Texas requires individuals to provide a written renunciation and disclaimer document, clearly stating their intent to surrender their rights to the property. b) Timely Filing: The renunciation and disclaimer document must be filed within a specific timeframe — usually within a designated period after the testator's death or after receiving notice of the bequest. c) Legal Compliance: The renunciation and disclaimer document must comply with relevant state laws, including proper formatting, signature requirements, and delivery to the appropriate parties or administrators. 4. Legal Considerations: a) Consultation with an Attorney: Given the complexity of renunciation and disclaimer procedures, it is advisable to seek legal counsel from an experienced attorney who specializes in estate planning and probate law. b) Impact on Other Beneficiaries: Renouncing or disclaiming property affects the distribution of assets, potentially altering the portions designated for other beneficiaries. It is crucial to consider the broader implications before proceeding with a renunciation. c) No Partial Renunciation After Acceptance: Once an individual accepts any part of their inheritance, they cannot renounce or disclaim the estate partially. Therefore, careful consideration should be given before making a decision. Conclusion: Wichita Falls Texas Renunciation and Disclaimer of Property from Will by Testate provide individuals with the option to relinquish their rights to inherited assets under specific circumstances. Understanding the types, procedures, and legal aspects surrounding renunciation and disclaimer is crucial for beneficiaries seeking to control their inheritance, minimize tax liabilities, or protect existing benefits. Seeking professional guidance is strongly recommended ensuring compliance with the relevant laws and to make well-informed decisions.Title: Understanding Wichita Falls Texas Renunciation And Disclaimer of Property from Will by Testate Introduction: In Wichita Falls, Texas, individuals have the right to renounce and disclaim property bequeathed to them in a will buy testate. This process enables heirs or beneficiaries to reject inherited assets under specific circumstances. By renouncing or disclaiming property, individuals can effectively transfer their inheritance to other recipients, waive rights or obligations associated with the property, or prevent potential tax burdens. This article provides a comprehensive overview of Wichita Falls Texas Renunciation and Disclaimer of Property from Will by Testate, exploring its types, procedures, and relevant legal aspects. 1. Types of Renunciation and Disclaimer: a) Total Renunciation: This involves a complete rejection of all property bequeathed to an individual in a will buy testate. The renouncing party willingly relinquishes their rights to the estate and any associated obligations. b) Partial Renunciation: Individuals may choose to renounce ownership of only specific assets or a percentage of their inheritance. This selective renunciation allows for a more controlled distribution of the estate. 2. Circumstances Leading to Renunciation or Disclaimer: a) Inheritance Tax Considerations: Renunciation may be preferred when accepting the property would result in substantial tax liabilities. By renouncing the inheritance, individuals can avoid potential financial burdens and minimize their tax obligations. b) Diverting Inheritance to Other Heirs: In some cases, beneficiaries may have their own complex financial situations or personal reasons for transferring their share of the inheritance to other heirs. Renunciation can facilitate the redistribution of assets according to the testator's wishes. c) Preservation of Government Benefits: Individuals receiving government assistance, such as Medicaid or Social Security, may choose to renounce inherited property to maintain their eligibility. This decision allows them to protect their existing benefits and avoid disqualification. 3. Procedures for Renunciation and Disclaimer: a) Written Documentation: Wichita Falls, Texas requires individuals to provide a written renunciation and disclaimer document, clearly stating their intent to surrender their rights to the property. b) Timely Filing: The renunciation and disclaimer document must be filed within a specific timeframe — usually within a designated period after the testator's death or after receiving notice of the bequest. c) Legal Compliance: The renunciation and disclaimer document must comply with relevant state laws, including proper formatting, signature requirements, and delivery to the appropriate parties or administrators. 4. Legal Considerations: a) Consultation with an Attorney: Given the complexity of renunciation and disclaimer procedures, it is advisable to seek legal counsel from an experienced attorney who specializes in estate planning and probate law. b) Impact on Other Beneficiaries: Renouncing or disclaiming property affects the distribution of assets, potentially altering the portions designated for other beneficiaries. It is crucial to consider the broader implications before proceeding with a renunciation. c) No Partial Renunciation After Acceptance: Once an individual accepts any part of their inheritance, they cannot renounce or disclaim the estate partially. Therefore, careful consideration should be given before making a decision. Conclusion: Wichita Falls Texas Renunciation and Disclaimer of Property from Will by Testate provide individuals with the option to relinquish their rights to inherited assets under specific circumstances. Understanding the types, procedures, and legal aspects surrounding renunciation and disclaimer is crucial for beneficiaries seeking to control their inheritance, minimize tax liabilities, or protect existing benefits. Seeking professional guidance is strongly recommended ensuring compliance with the relevant laws and to make well-informed decisions.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.