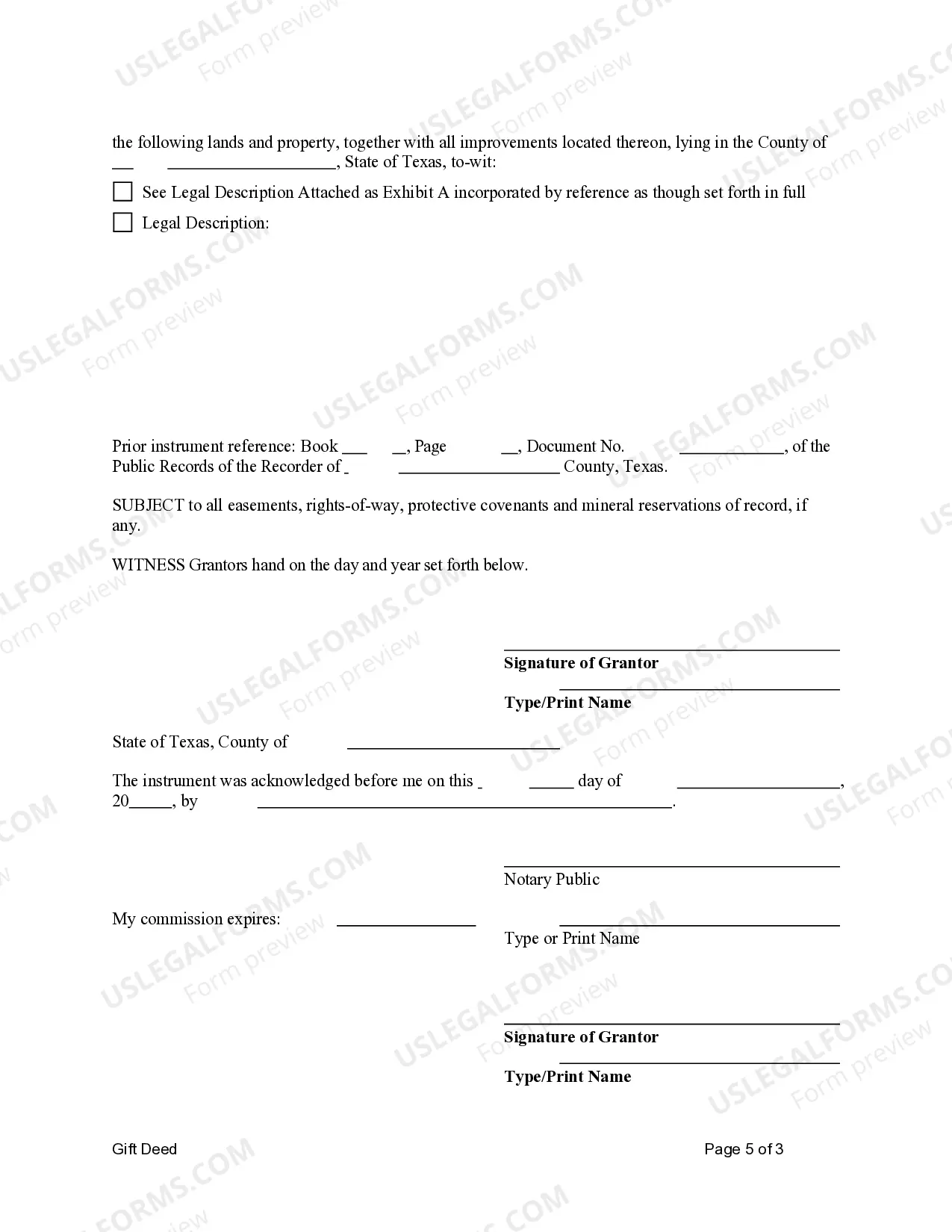

This form is a Gift Deed where the Grantors ate Husband and Wife, or Two Individuals, and the Grantees are Husband and Wife, or Two Individuals. Grantors convey and warrant the described property to the Grantees. This deed complies with all state statutory laws.

Dallas Texas Gift Deed Gift Deed from Husband and Wife, or Two Individuals, to Husband and Wife, or Two Individuals.

Description

How to fill out Texas Gift Deed Gift Deed From Husband And Wife, Or Two Individuals, To Husband And Wife, Or Two Individuals.?

If you are looking for a legitimate form template, it’s exceedingly challenging to discover a more user-friendly platform than the US Legal Forms site – one of the broadest libraries available online.

Here you can locate a vast number of form examples for business and personal needs categorized by types and states, or keywords.

With the enhanced search option, acquiring the most up-to-date Dallas Texas Gift Deed from Husband and Wife, or Two Individuals, to Husband and Wife, or Two Individuals is as simple as 1-2-3.

Complete the purchase. Use your credit card or PayPal to conclude the registration process.

Obtain the document. Choose the format and save it on your device.

- Moreover, the accuracy of each document is validated by a team of professional attorneys who regularly review the templates on our site and refresh them according to the latest state and county regulations.

- If you’re already familiar with our site and have an established account, all you need to do to obtain the Dallas Texas Gift Deed from Husband and Wife, or Two Individuals, to Husband and Wife, or Two Individuals is to sign in to your account and click the Download button.

- If you are using US Legal Forms for the first time, simply adhere to the instructions below.

- Make sure you have accessed the template you require. Review its details and use the Preview function (if available) to view its content. If it doesn’t suit your needs, utilize the Search bar at the top of the page to find the required document.

- Verify your choice. Click the Buy now button. Then select your desired subscription plan and enter information to register for an account.

Form popularity

FAQ

When you add someone to your deed, they gain an ownership interest in the property and have the right to use and manage it. This action can lead to shared responsibilities and financial implications, especially concerning property taxes and liabilities. In a Dallas Texas Gift Deed Gift Deed from Husband and Wife, or Two Individuals, to Husband and Wife, or Two Individuals, understanding the ramifications is essential for a smooth transition. Utilize the resources available on the US Legal Forms platform for guidance through this process.

Yes, when you add a spouse to a deed, it is generally viewed as a gift under Texas law. The act of transferring property ownership without expecting anything in return qualifies it as a gift deed. This concept is significant in a Dallas Texas Gift Deed Gift Deed from Husband and Wife, or Two Individuals, to Husband and Wife, or Two Individuals scenario. It is important to assess the potential tax and legal ramifications with the help of a knowledgeable attorney.

Adding a spouse to the deed can complicate property ownership, especially if marital disputes arise in the future. This could affect property rights and lead to unwanted legal battles. Therefore, when considering a Dallas Texas Gift Deed Gift Deed from Husband and Wife, or Two Individuals, to Husband and Wife, or Two Individuals, it is wise to evaluate your relationship dynamics and seek legal advice from professionals at US Legal Forms.

A quitclaim deed transfers whatever interest the grantor has in the property, without guaranteeing the title. Conversely, a gift deed explicitly conveys property as a gift, often with specific intentions stated. In a Dallas Texas Gift Deed Gift Deed from Husband and Wife, or Two Individuals, to Husband and Wife, or Two Individuals, the intent is to gift the property without expecting payment. Understanding these differences is crucial for effective estate planning.

In Texas, gift deeds must be in writing, signed by the grantor, and notarized to be legally valid. The grantor must clearly express the intention to make a gift and transfer the property. Additionally, when considering a Dallas Texas Gift Deed Gift Deed from Husband and Wife, or Two Individuals, to Husband and Wife, or Two Individuals, it's vital to consider any potential tax implications. Consulting the US Legal Forms platform can help guide you through the requirements.

Yes, adding someone to a deed is typically considered a gift under Texas law. When you transfer a property interest to another person without receiving anything in return, it qualifies as a gift deed. This is especially true in the context of a Dallas Texas Gift Deed Gift Deed from Husband and Wife, or Two Individuals, to Husband and Wife, or Two Individuals. However, it's important to consult with a legal professional to ensure compliance with all relevant laws.

Yes, it is often advisable for a married couple to include both names on the deed after purchasing a property. This practice not only establishes joint ownership but also promotes unity and shared responsibility in managing the property. When using a Dallas Texas Gift Deed Gift Deed from Husband and Wife, or Two Individuals, to Husband and Wife, or Two Individuals, joint names solidify your partnership and make future transactions smoother. Involving legal experts can help ensure your property deed meets the requirements.

The best way to title property for a married couple in Texas is usually as Joint Tenants with Right of Survivorship. This method ensures that if one spouse passes away, the property automatically transfers to the surviving spouse, providing peace of mind. When considering a property transfer, you might utilize a Dallas Texas Gift Deed Gift Deed from Husband and Wife, or Two Individuals, to Husband and Wife, or Two Individuals to establish a clear title. Consulting a legal specialist can also help you determine the best approach for your situation.

While both spouses are not required to be on the house title in Texas, having both names can provide various benefits. It enhances ownership rights and makes it easier for both spouses to make decisions regarding the property. Furthermore, when using a Dallas Texas Gift Deed Gift Deed from Husband and Wife, or Two Individuals, to Husband and Wife, or Two Individuals, including both names can strengthen joint ownership, ensuring a smooth transition in case of future changes.

To create a valid gift deed in Texas, the deed must clearly identify the donor and the recipient, outline that the transfer is a gift, and describe the property in detail. Additionally, both parties should sign the deed in the presence of a notary public. Using a Dallas Texas Gift Deed Gift Deed from Husband and Wife, or Two Individuals, to Husband and Wife, or Two Individuals can streamline this process. Ensure you comply with state laws to avoid any legal complications.