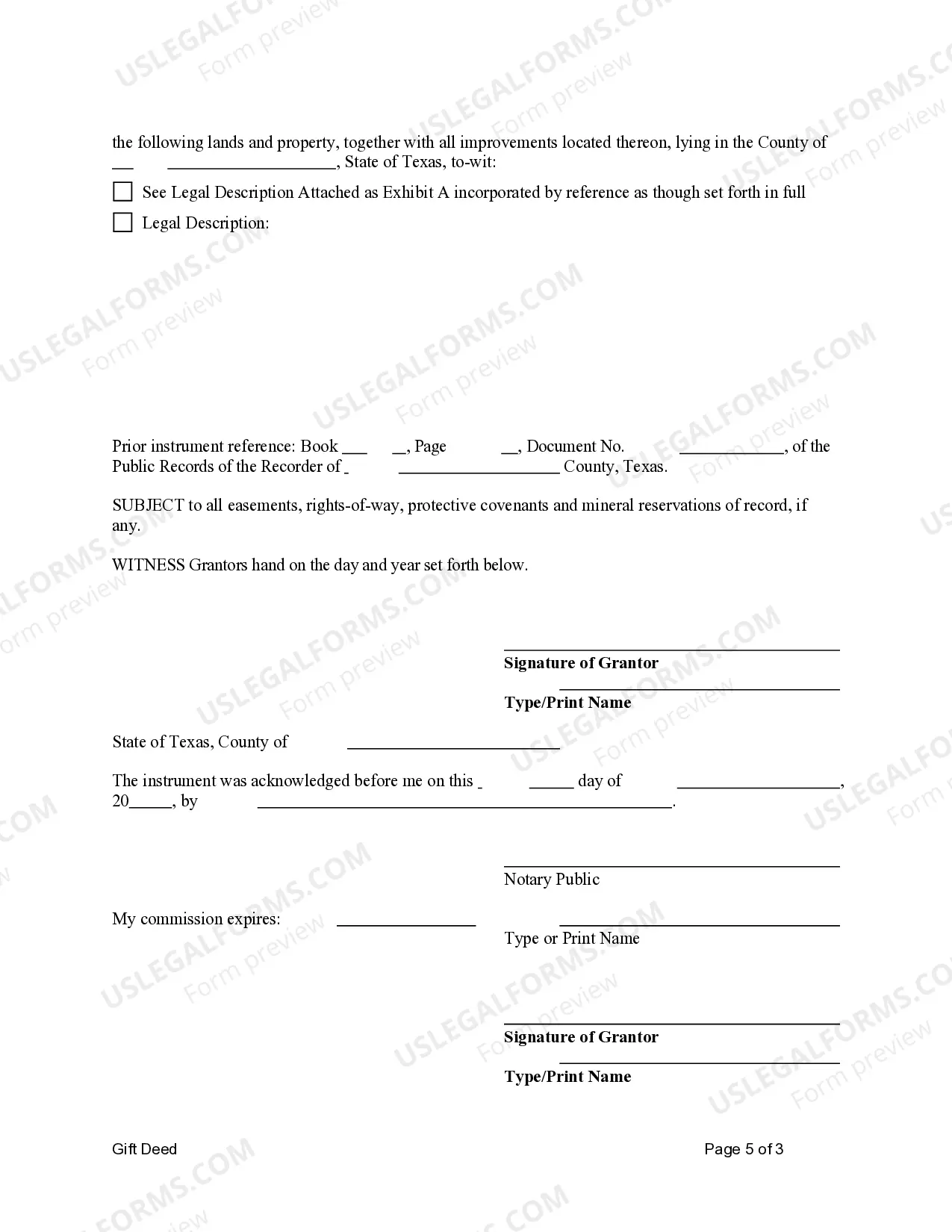

This form is a Gift Deed where the Grantors ate Husband and Wife, or Two Individuals, and the Grantees are Husband and Wife, or Two Individuals. Grantors convey and warrant the described property to the Grantees. This deed complies with all state statutory laws.

A Sugar Land Texas Gift Deed from Husband and Wife, or Two Individuals, to Husband and Wife, or Two Individuals, is a legal document used to transfer ownership of a property as a gift. This type of deed is commonly used in real estate transactions within Sugar Land, Texas, when a property is being gifted between spouses or individuals. The gift deed allows the current owners, who can be a married couple or two individuals, to transfer their interest in the property to the new owners, who can also be a married couple or two individuals, without any monetary exchange. This means that the transfer of ownership is based on the relationship between the parties involved, rather than a traditional sale. There are different variations of Sugar Land Texas Gift Deeds that might be used, depending on the specific circumstances: 1. Gift Deed from Husband and Wife to Husband and Wife: — This type of deed is used when a property owned jointly by a married couple is being gifted to both spouses. — The gift deed document will state the names of the husband and wife as the granters (current owners) and the names of the husband and wife as the grantees (new owners). 2. Gift Deed from Husband and Wife to Two Individuals: — This variation occurs when a property owned jointly by a married couple is being gifted to two individuals who are not married to each other. — The gift deed will identify the husband and wife as the granters and the names of the two individuals as the grantees. 3. Gift Deed from Two Individuals to Husband and Wife: — In this situation, two individuals, who are not married to each other, are gifting a property to a married couple. — The document will list the names of the two individuals as the granters and the names of the husband and wife as the grantees. 4. Gift Deed from Two Individuals to Two Individuals: — This type of gift deed involves the transfer of a property between two individuals who are not married to each other. — The gift deed will specify the names of the two individuals as the granters and the names of the other two individuals as the grantees. In all cases, the Sugar Land Texas Gift Deed must meet the legal requirements of the state, including a legal description of the property, the names and addresses of the granters and grantees, and a statement of the intent to make a gift without consideration. It is important for all parties involved in a gift deed transaction to consult with a qualified real estate attorney to ensure the deed is properly executed and recorded according to the laws of Sugar Land, Texas.A Sugar Land Texas Gift Deed from Husband and Wife, or Two Individuals, to Husband and Wife, or Two Individuals, is a legal document used to transfer ownership of a property as a gift. This type of deed is commonly used in real estate transactions within Sugar Land, Texas, when a property is being gifted between spouses or individuals. The gift deed allows the current owners, who can be a married couple or two individuals, to transfer their interest in the property to the new owners, who can also be a married couple or two individuals, without any monetary exchange. This means that the transfer of ownership is based on the relationship between the parties involved, rather than a traditional sale. There are different variations of Sugar Land Texas Gift Deeds that might be used, depending on the specific circumstances: 1. Gift Deed from Husband and Wife to Husband and Wife: — This type of deed is used when a property owned jointly by a married couple is being gifted to both spouses. — The gift deed document will state the names of the husband and wife as the granters (current owners) and the names of the husband and wife as the grantees (new owners). 2. Gift Deed from Husband and Wife to Two Individuals: — This variation occurs when a property owned jointly by a married couple is being gifted to two individuals who are not married to each other. — The gift deed will identify the husband and wife as the granters and the names of the two individuals as the grantees. 3. Gift Deed from Two Individuals to Husband and Wife: — In this situation, two individuals, who are not married to each other, are gifting a property to a married couple. — The document will list the names of the two individuals as the granters and the names of the husband and wife as the grantees. 4. Gift Deed from Two Individuals to Two Individuals: — This type of gift deed involves the transfer of a property between two individuals who are not married to each other. — The gift deed will specify the names of the two individuals as the granters and the names of the other two individuals as the grantees. In all cases, the Sugar Land Texas Gift Deed must meet the legal requirements of the state, including a legal description of the property, the names and addresses of the granters and grantees, and a statement of the intent to make a gift without consideration. It is important for all parties involved in a gift deed transaction to consult with a qualified real estate attorney to ensure the deed is properly executed and recorded according to the laws of Sugar Land, Texas.