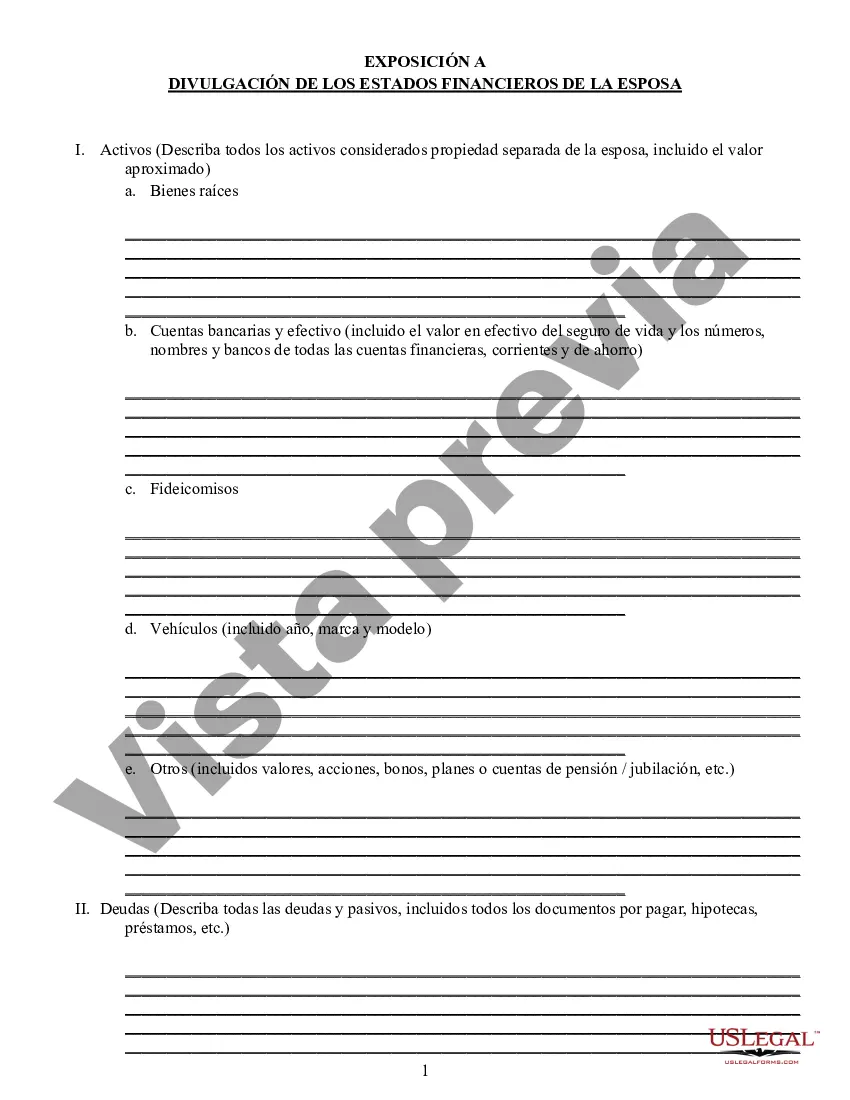

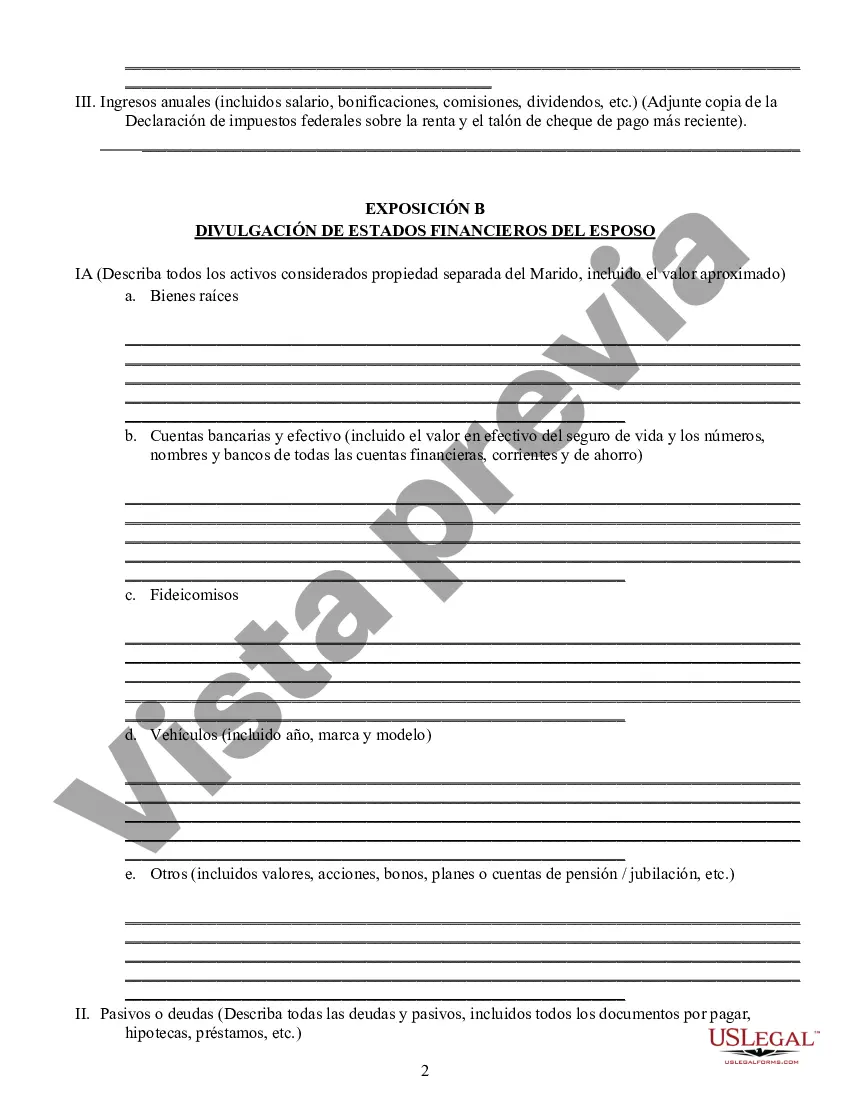

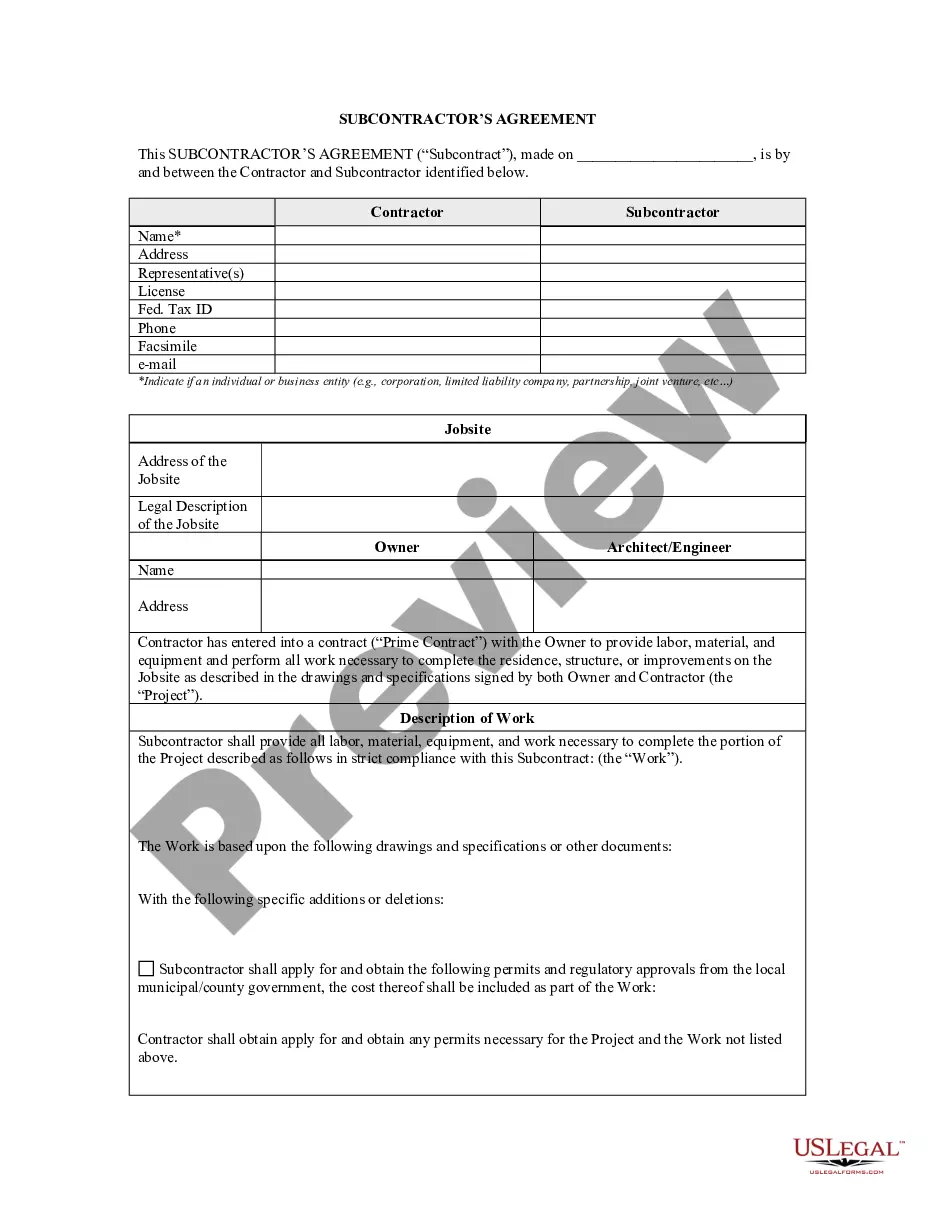

Title: Understanding the McKinney Postnuptial Property Agreement in Texas: Types and Detailed Description Introduction: The McKinney postnuptial property agreement holds significance in Texas, as it helps couples outline their property rights and obligations after marriage. In this article, we will provide an in-depth understanding of the McKinney postnuptial property agreement, its importance, and explore different types that exist. 1. Definition and Importance: The McKinney postnuptial property agreement serves as a legal contract entered into by married couples to define the division of assets, debts, and other financial matters in the event of divorce, separation, or death. It allows couples to determine property rights according to their preferences, ensuring transparency, and creating a sense of security. 2. Community Property Agreement: One type of McKinney postnuptial property agreement is the Community Property Agreement. In Texas, the default property regime is community property, where all assets acquired during the marriage are considered jointly owned. The agreement helps couples modify their property rights, potentially converting community property into separate property, and vice versa. 3. Separate Property Agreement: A Separate Property Agreement is another variant of the McKinney postnuptial property agreement. This agreement focuses on establishing the classification and protection of separate property owned by each spouse. It assists in clearly defining what property will remain separate, regardless of its acquisition during the marriage, ensuring its retention in the event of divorce or separation. 4. Detailed Description: McKinney postnuptial property agreements entail various crucial aspects: a. Assets and Debts: The agreement covers the identification, classification, and division of marital assets, ranging from real estate, investments, bank accounts, retirement savings, and personal property. It also addresses the allocation of debts, including mortgages, loans, and credit card obligations. b. Inheritance and Estate Planning: McKinney postnuptial property agreements allow couples to specify how they want inherited assets and future inheritance to be treated. It enables the determination of separate or community property status for inherited wealth, ensuring transparency and avoiding disputes. c. Spousal Support: These agreements often include provisions regarding spousal support or alimony. Couples can outline the amount, duration, and conditions surrounding any potential payments to be made to a spouse upon separation or divorce. d. Business and Professional Interests: If either spouse owns a business or professional practice, the agreement can outline how these assets will be handled in the event of divorce or separation. It provides protection against potential claims on crucial business assets and helps safeguard the financial stability of the enterprise. 5. Legal Considerations: It is crucial to seek legal guidance while drafting a McKinney postnuptial property agreement. To ensure enforceability, these agreements must comply with Texas laws and adhere to specific legal requirements, including full financial disclosure, voluntary consent, and fairness. Conclusion: McKinney postnuptial property agreements play a vital role in Texas, enabling married couples to affirmatively define their rights and obligations regarding property division. By understanding the various types and important considerations, couples can protect their assets and establish a fair framework for the unforeseen future. Seek professional legal advice to draft a McKinney postnuptial property agreement tailored to your unique needs and circumstances.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.McKinney Acuerdo de propiedad posnupcial - Texas - Texas Postnuptial Property Agreement

Description

How to fill out McKinney Acuerdo De Propiedad Posnupcial - Texas?

Getting verified templates specific to your local laws can be difficult unless you use the US Legal Forms library. It’s an online collection of more than 85,000 legal forms for both personal and professional needs and any real-life scenarios. All the documents are properly categorized by area of usage and jurisdiction areas, so locating the McKinney Postnuptial Property Agreement - Texas becomes as quick and easy as ABC.

For everyone already acquainted with our library and has used it before, obtaining the McKinney Postnuptial Property Agreement - Texas takes just a few clicks. All you need to do is log in to your account, pick the document, and click Download to save it on your device. This process will take just a few more actions to make for new users.

Adhere to the guidelines below to get started with the most extensive online form catalogue:

- Check the Preview mode and form description. Make certain you’ve chosen the correct one that meets your needs and totally corresponds to your local jurisdiction requirements.

- Look for another template, if needed. Once you find any inconsistency, utilize the Search tab above to obtain the correct one. If it suits you, move to the next step.

- Buy the document. Click on the Buy Now button and choose the subscription plan you prefer. You should register an account to get access to the library’s resources.

- Make your purchase. Provide your credit card details or use your PayPal account to pay for the service.

- Download the McKinney Postnuptial Property Agreement - Texas. Save the template on your device to proceed with its completion and obtain access to it in the My Forms menu of your profile whenever you need it again.

Keeping paperwork neat and compliant with the law requirements has major importance. Benefit from the US Legal Forms library to always have essential document templates for any needs just at your hand!