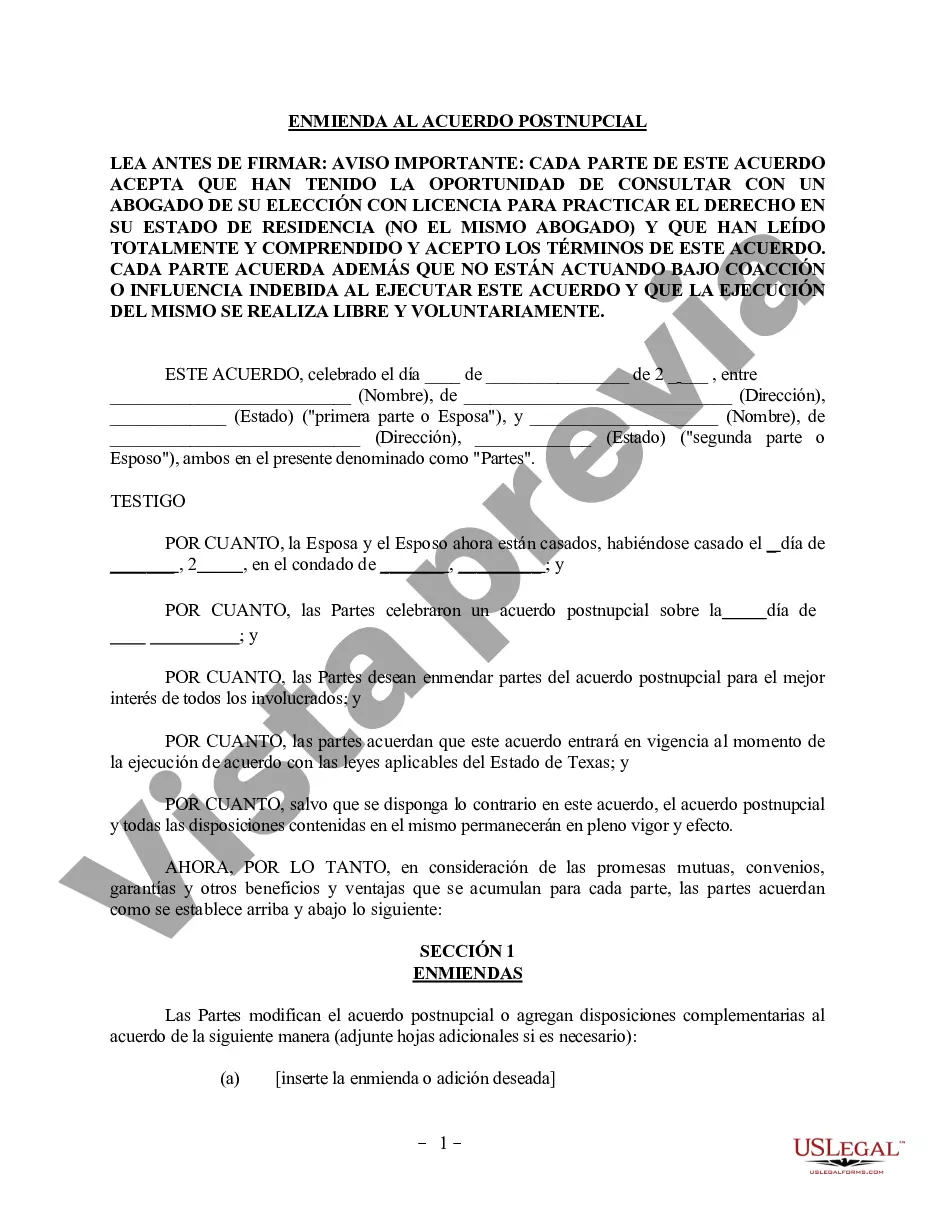

The McKinney Amendment to Postnuptial Property Agreement is a legal provision specific to the state of Texas that can significantly impact postnuptial agreements in terms of property ownership, division, and rights. This amendment, named after the state representative William N. McKinney, has introduced crucial changes aimed at protecting individuals and ensuring fair distribution of assets in case of divorce or death. In essence, the McKinney Amendment aims to safeguard the rights of spouses by allowing them to waive their community property rights on an individual asset basis. Under this amendment, couples have the option to modify their postnuptial property agreements to include specific terms regarding asset ownership and division, overriding the default community property laws of Texas. This allows spouses to customize their separation of property and protect individual assets from becoming community property in the future. There are different types of McKinney Amendments that can be made to a postnuptial property agreement, depending on the couple's preferences and circumstances. These may include: 1. Explicit Division of Assets: This type of McKinney Amendment clearly outlines the specific assets that will be considered as separate property for each spouse. It ensures that certain assets acquired during the marriage are protected as individual property and will not be subject to community property laws. 2. Future Income and Earnings: Some McKinney Amendments address the issue of post-marital income and earnings. These amendments can clarify whether income generated by either spouse after the postnuptial agreement will be treated as community property or separate property. 3. Business Ownership and Assets: In cases where one or both spouses own a business, a McKinney Amendment may be added to protect business interests. This can determine whether the business or its profits will remain separate property or become community property. 4. Inheritance and Gifts: Another common type of McKinney Amendment addresses the treatment of inheritance and gifts received by either spouse during the marriage. It can specify whether such assets or funds will be considered as separate property or subject to community property laws. 5. Debt Allocation: Some postnuptial agreements with a McKinney Amendment account for the allocation of debts in case of divorce or death. This ensures that certain debts or liabilities acquired during the marriage are attributed to the responsible spouse and do not become joint obligations. It is important to note that each McKinney Amendment must comply with Texas family law and be executed with the appropriate legal procedures and professional advice. Parties should consult their attorneys to ensure the validity and enforceability of any amendment to their postnuptial property agreement according to the McKinney Amendment provisions specific to the state of Texas.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.McKinney Enmienda al Acuerdo de Propiedad Posnupcial - Texas - Texas Amendment to Postnuptial Property Agreement

Description

How to fill out McKinney Enmienda Al Acuerdo De Propiedad Posnupcial - Texas?

Take advantage of the US Legal Forms and get immediate access to any form you require. Our beneficial platform with a large number of document templates makes it easy to find and obtain virtually any document sample you need. It is possible to save, fill, and certify the McKinney Amendment to Postnuptial Property Agreement - Texas in a few minutes instead of browsing the web for hours looking for a proper template.

Using our collection is an excellent way to improve the safety of your record submissions. Our experienced attorneys regularly review all the records to ensure that the forms are relevant for a particular state and compliant with new acts and regulations.

How can you get the McKinney Amendment to Postnuptial Property Agreement - Texas? If you have a profile, just log in to the account. The Download option will appear on all the samples you view. Moreover, you can get all the earlier saved records in the My Forms menu.

If you haven’t registered an account yet, stick to the instruction listed below:

- Open the page with the form you need. Make certain that it is the template you were looking for: verify its name and description, and take take advantage of the Preview option when it is available. Otherwise, make use of the Search field to find the needed one.

- Launch the downloading process. Click Buy Now and choose the pricing plan you like. Then, sign up for an account and process your order utilizing a credit card or PayPal.

- Download the document. Choose the format to obtain the McKinney Amendment to Postnuptial Property Agreement - Texas and revise and fill, or sign it according to your requirements.

US Legal Forms is probably the most extensive and trustworthy document libraries on the internet. We are always happy to help you in virtually any legal process, even if it is just downloading the McKinney Amendment to Postnuptial Property Agreement - Texas.

Feel free to make the most of our platform and make your document experience as straightforward as possible!