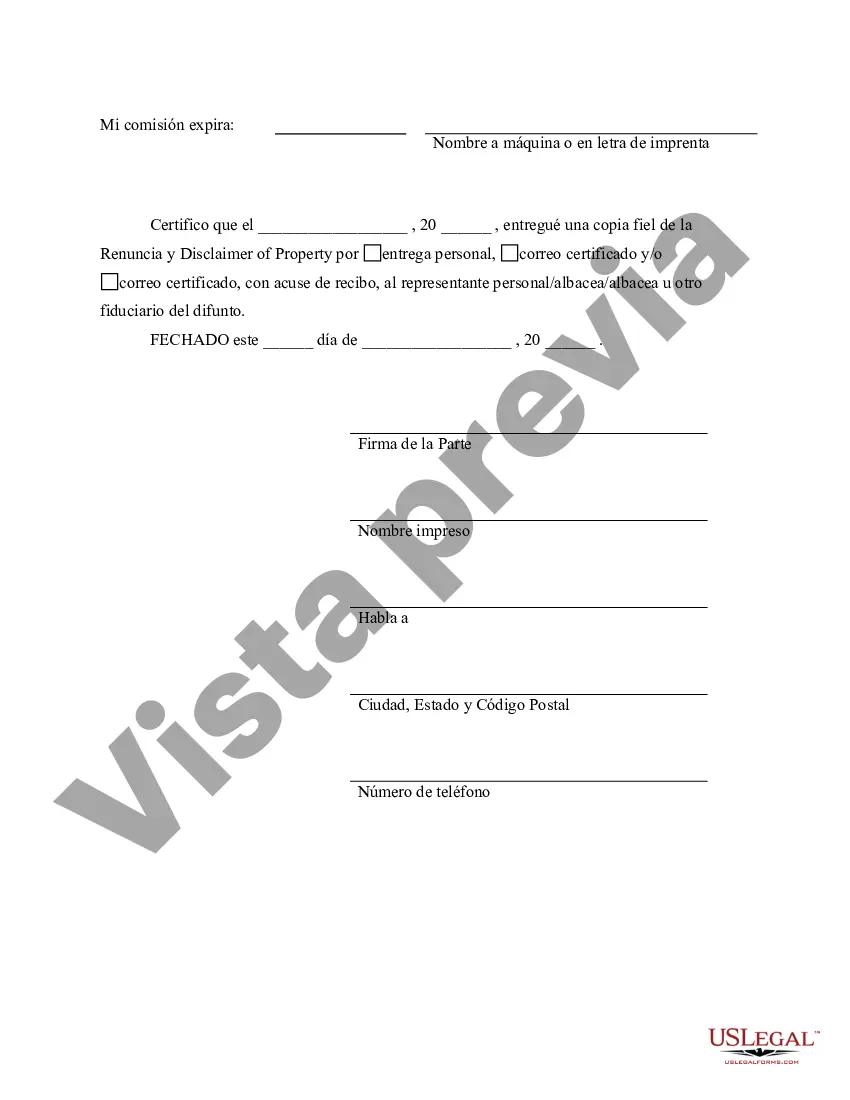

This form is a Renunciation and Disclaimer of Property acquired through Intestate Succession where the decedent died intestate and the beneficiary gained an interest in the property, but, will terminate a portion of or the entire interest in the property pursuant to the Texas Statutes, Chapter II. The property will pass to others as though the beneficiary predeceased the decedent. The form also contains a state specific acknowledgment and a certificate to verify delivery.

Title: Dallas, Texas Renunciation and Disclaimer of Property Received by Intestate Succession Description: In Dallas, Texas, a renunciation and disclaimer of property received by intestate succession refers to the legal process by which an heir or beneficiary voluntarily waives their right to inherit property from the deceased through laws of intestacy. This detailed description will provide insights into the various types of renunciations and disclaimers related to property received through intestate succession in Dallas, Texas. Types of Renunciations and Disclaimers: 1. Renunciation of Property: — An individual may choose to renounce their right to inherit the property received by intestate succession in Dallas, Texas. Renunciation means the voluntary act of giving up one's claim or share of the estate. — This renunciation allows the heir or beneficiary to effectively avoid the legal obligations and responsibilities associated with the inherited property, including any debts or liabilities attached to it. 2. Disclaimer of Property: — A disclaimer is another form of renunciation where an individual legally declines an inheritance received by intestate succession in Dallas, Texas. By disclaiming their interest in the property, they refuse to accept their entitlement. — This disclaimer is often done to avoid potential tax obligations or to ensure the estate passes to the next eligible individual as per the intestate succession laws. 3. Partial Renunciation or Disclaimer: — In some cases, an heir or beneficiary may choose to renounce or disclaim only a portion of the property received through intestate succession. This partial renunciation or disclaimer allows them to relinquish certain assets or liabilities while retaining others according to their preferences. 4. Timeframe for Renunciation or Disclaimer: — It is crucial to note that renunciation or disclaimer should be executed within a specific timeframe after the individual becomes aware of their entitlement to the property. — In Dallas, Texas, the renunciation or disclaimer must be filed in writing and delivered to the appropriate probate court within nine months from the date of the decedent's death or within six months from the date of the appointment of the executor or administrator of the estate. By understanding the various types of Dallas, Texas Renunciation and Disclaimer of Property received by Intestate Succession, individuals can make informed decisions regarding their inheritance. It is highly recommended seeking professional advice from an attorney regarding the specific legal requirements and implications associated with renouncing or disclaiming property received through intestate succession in Dallas, Texas.Title: Dallas, Texas Renunciation and Disclaimer of Property Received by Intestate Succession Description: In Dallas, Texas, a renunciation and disclaimer of property received by intestate succession refers to the legal process by which an heir or beneficiary voluntarily waives their right to inherit property from the deceased through laws of intestacy. This detailed description will provide insights into the various types of renunciations and disclaimers related to property received through intestate succession in Dallas, Texas. Types of Renunciations and Disclaimers: 1. Renunciation of Property: — An individual may choose to renounce their right to inherit the property received by intestate succession in Dallas, Texas. Renunciation means the voluntary act of giving up one's claim or share of the estate. — This renunciation allows the heir or beneficiary to effectively avoid the legal obligations and responsibilities associated with the inherited property, including any debts or liabilities attached to it. 2. Disclaimer of Property: — A disclaimer is another form of renunciation where an individual legally declines an inheritance received by intestate succession in Dallas, Texas. By disclaiming their interest in the property, they refuse to accept their entitlement. — This disclaimer is often done to avoid potential tax obligations or to ensure the estate passes to the next eligible individual as per the intestate succession laws. 3. Partial Renunciation or Disclaimer: — In some cases, an heir or beneficiary may choose to renounce or disclaim only a portion of the property received through intestate succession. This partial renunciation or disclaimer allows them to relinquish certain assets or liabilities while retaining others according to their preferences. 4. Timeframe for Renunciation or Disclaimer: — It is crucial to note that renunciation or disclaimer should be executed within a specific timeframe after the individual becomes aware of their entitlement to the property. — In Dallas, Texas, the renunciation or disclaimer must be filed in writing and delivered to the appropriate probate court within nine months from the date of the decedent's death or within six months from the date of the appointment of the executor or administrator of the estate. By understanding the various types of Dallas, Texas Renunciation and Disclaimer of Property received by Intestate Succession, individuals can make informed decisions regarding their inheritance. It is highly recommended seeking professional advice from an attorney regarding the specific legal requirements and implications associated with renouncing or disclaiming property received through intestate succession in Dallas, Texas.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.