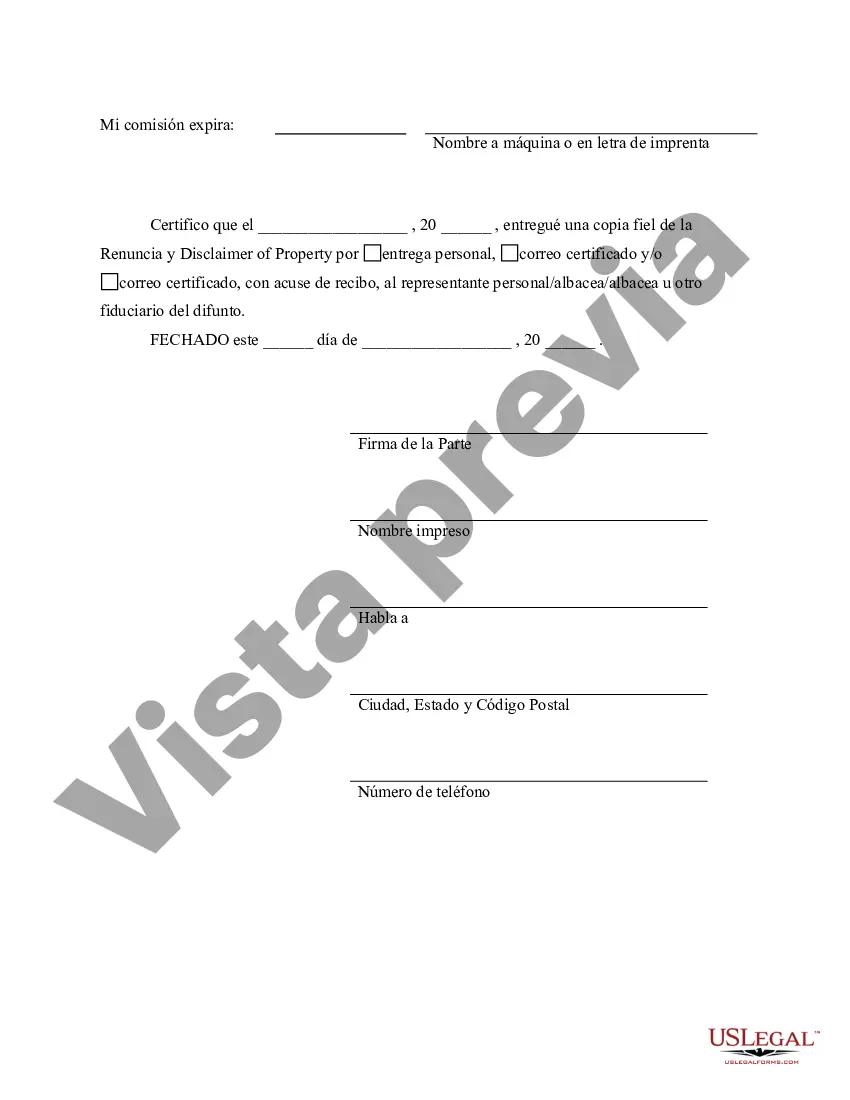

This form is a Renunciation and Disclaimer of Property acquired through Intestate Succession where the decedent died intestate and the beneficiary gained an interest in the property, but, will terminate a portion of or the entire interest in the property pursuant to the Texas Statutes, Chapter II. The property will pass to others as though the beneficiary predeceased the decedent. The form also contains a state specific acknowledgment and a certificate to verify delivery.

Frisco, Texas Renunciation and Disclaimer of Property received by Intestate Succession refers to the legal process by which an individual voluntarily relinquishes or disclaims their right to inherit or receive property from the estate of a deceased person who passed away without a valid will. It is an important legal tool that allows individuals to officially declare that they do not wish to accept their share of the deceased person's assets. There are two main types of Frisco, Texas Renunciation and Disclaimer of Property received by Intestate Succession: 1. Renunciation: This refers to the act of formally declining or rejecting the right to inherit or receive property from the intestate estate. The individual renouncing the property must do so in writing, filing a renunciation document with the appropriate court or probate authority. By renouncing their share, they effectively remove themselves from any rights, obligations, or responsibilities associated with the inherited assets. 2. Disclaimer: Similar to renunciation, a disclaimer is a legal mechanism where an individual voluntarily refuses to accept the property or inheritance. However, unlike renunciation, where the renouncing party typically has no prior interest or involvement with the assets, a disclaimer can be made by someone who may already have received their share of the inheritance but wishes to disclaim any further rights or entitlements. This can be done in situations where the beneficiary wants to pass on their inheritance to other family members, reduce taxes or liabilities associated with the assets, or simply avoid the responsibilities and complexities that come with managing the property. Renunciation and disclaimer of property received by intestate succession are essential legal processes that allow individuals in Frisco, Texas to control their rights and interests in inheritance matters. These mechanisms provide a means for beneficiaries to make informed decisions about their involvement with the assets and ensure that the property is properly distributed according to the intestate laws of the state. It is advisable to consult with an experienced attorney or probate professional when considering renunciation or disclaimer of property to understand the legal implications and ensure compliance with the necessary procedures.Frisco, Texas Renunciation and Disclaimer of Property received by Intestate Succession refers to the legal process by which an individual voluntarily relinquishes or disclaims their right to inherit or receive property from the estate of a deceased person who passed away without a valid will. It is an important legal tool that allows individuals to officially declare that they do not wish to accept their share of the deceased person's assets. There are two main types of Frisco, Texas Renunciation and Disclaimer of Property received by Intestate Succession: 1. Renunciation: This refers to the act of formally declining or rejecting the right to inherit or receive property from the intestate estate. The individual renouncing the property must do so in writing, filing a renunciation document with the appropriate court or probate authority. By renouncing their share, they effectively remove themselves from any rights, obligations, or responsibilities associated with the inherited assets. 2. Disclaimer: Similar to renunciation, a disclaimer is a legal mechanism where an individual voluntarily refuses to accept the property or inheritance. However, unlike renunciation, where the renouncing party typically has no prior interest or involvement with the assets, a disclaimer can be made by someone who may already have received their share of the inheritance but wishes to disclaim any further rights or entitlements. This can be done in situations where the beneficiary wants to pass on their inheritance to other family members, reduce taxes or liabilities associated with the assets, or simply avoid the responsibilities and complexities that come with managing the property. Renunciation and disclaimer of property received by intestate succession are essential legal processes that allow individuals in Frisco, Texas to control their rights and interests in inheritance matters. These mechanisms provide a means for beneficiaries to make informed decisions about their involvement with the assets and ensure that the property is properly distributed according to the intestate laws of the state. It is advisable to consult with an experienced attorney or probate professional when considering renunciation or disclaimer of property to understand the legal implications and ensure compliance with the necessary procedures.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.