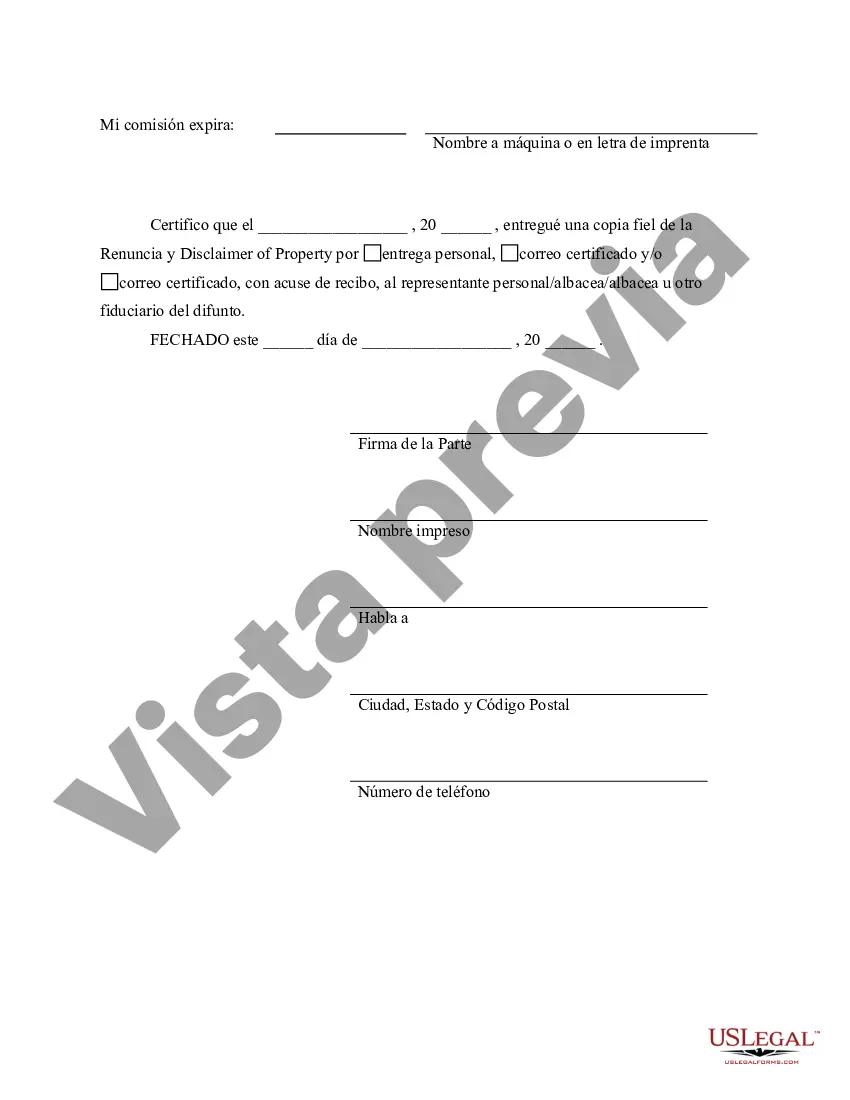

This form is a Renunciation and Disclaimer of Property acquired through Intestate Succession where the decedent died intestate and the beneficiary gained an interest in the property, but, will terminate a portion of or the entire interest in the property pursuant to the Texas Statutes, Chapter II. The property will pass to others as though the beneficiary predeceased the decedent. The form also contains a state specific acknowledgment and a certificate to verify delivery.

Irving Texas Renunciation and Disclaimer of Property Received by Intestate Succession In Irving, Texas, when an individual passes away without leaving behind a valid will or other estate planning documents, the distribution of their property and assets follows rules of intestate succession. However, there may be instances where beneficiaries would prefer not to accept the property they are entitled to as outlined by the laws. In such cases, the option of renunciation and disclaimer of property received through intestate succession becomes relevant. Renunciation and disclaimer involve the act of legally refusing to accept inherited property or assets. By doing so, the individual effectively relinquishes their rights to the said property, which will then be distributed according to the next principles of intestate succession. Irving, Texas, recognizes the importance of allowing individuals to have control over their inheritance choices and provides a process for renunciation and disclaimer. This legal process in Irving aims to ensure that beneficiaries are not burdened with property they do not wish to acquire due to various reasons such as financial considerations, conflicts of interests, or personal preferences. Renunciation and disclaimer offer beneficiaries the opportunity to decline the inheritance, allowing the property to pass directly to the next eligible heirs or beneficiaries in the line of intestate succession. There are different types of Irving Texas Renunciation and Disclaimer of Property received by Intestate Succession: 1. General Renunciation and Disclaimer: This type of renunciation and disclaimer involves a complete refusal of the inherited property. The beneficiary entirely disclaims all rights, title, and interest in the estate and does not receive any financial benefits or control over the property. 2. Partial Renunciation and Disclaimer: In some cases, beneficiaries may choose to renounce or disclaim only a portion of the received property. This option allows them to maintain some control or receive specific assets according to their preferences while relinquishing the rest. 3. Conditional Renunciation and Disclaimer: Beneficiaries may also renounce or disclaim the property subject to certain conditions or restrictions. These conditions could include the property being passed on to a specific individual or entity, or for the purpose of resolving potential conflicts within the estate. The process of renunciation and disclaimer in Irving, Texas requires compliance with specific legal formalities and deadlines. Beneficiaries must manifest their intention to renounce or disclaim the property in writing and within a specified timeframe following the decedent's passing. It is crucial to consult with an experienced estate planning attorney or legal professional who can guide beneficiaries through the required steps and ensure the renunciation or disclaimer is properly executed. In conclusion, Irving, Texas, provides beneficiaries of intestate successions the right to renounce and disclaim their inherited property through a legally recognized process. The ability to renounce or disclaim offers individuals the freedom to make informed decisions about their inheritance, ensuring that property is distributed according to their wishes or priorities. Understanding the different types of renunciation and disclaimer is vital for beneficiaries seeking to exercise this option effectively.Irving Texas Renunciation and Disclaimer of Property Received by Intestate Succession In Irving, Texas, when an individual passes away without leaving behind a valid will or other estate planning documents, the distribution of their property and assets follows rules of intestate succession. However, there may be instances where beneficiaries would prefer not to accept the property they are entitled to as outlined by the laws. In such cases, the option of renunciation and disclaimer of property received through intestate succession becomes relevant. Renunciation and disclaimer involve the act of legally refusing to accept inherited property or assets. By doing so, the individual effectively relinquishes their rights to the said property, which will then be distributed according to the next principles of intestate succession. Irving, Texas, recognizes the importance of allowing individuals to have control over their inheritance choices and provides a process for renunciation and disclaimer. This legal process in Irving aims to ensure that beneficiaries are not burdened with property they do not wish to acquire due to various reasons such as financial considerations, conflicts of interests, or personal preferences. Renunciation and disclaimer offer beneficiaries the opportunity to decline the inheritance, allowing the property to pass directly to the next eligible heirs or beneficiaries in the line of intestate succession. There are different types of Irving Texas Renunciation and Disclaimer of Property received by Intestate Succession: 1. General Renunciation and Disclaimer: This type of renunciation and disclaimer involves a complete refusal of the inherited property. The beneficiary entirely disclaims all rights, title, and interest in the estate and does not receive any financial benefits or control over the property. 2. Partial Renunciation and Disclaimer: In some cases, beneficiaries may choose to renounce or disclaim only a portion of the received property. This option allows them to maintain some control or receive specific assets according to their preferences while relinquishing the rest. 3. Conditional Renunciation and Disclaimer: Beneficiaries may also renounce or disclaim the property subject to certain conditions or restrictions. These conditions could include the property being passed on to a specific individual or entity, or for the purpose of resolving potential conflicts within the estate. The process of renunciation and disclaimer in Irving, Texas requires compliance with specific legal formalities and deadlines. Beneficiaries must manifest their intention to renounce or disclaim the property in writing and within a specified timeframe following the decedent's passing. It is crucial to consult with an experienced estate planning attorney or legal professional who can guide beneficiaries through the required steps and ensure the renunciation or disclaimer is properly executed. In conclusion, Irving, Texas, provides beneficiaries of intestate successions the right to renounce and disclaim their inherited property through a legally recognized process. The ability to renounce or disclaim offers individuals the freedom to make informed decisions about their inheritance, ensuring that property is distributed according to their wishes or priorities. Understanding the different types of renunciation and disclaimer is vital for beneficiaries seeking to exercise this option effectively.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.