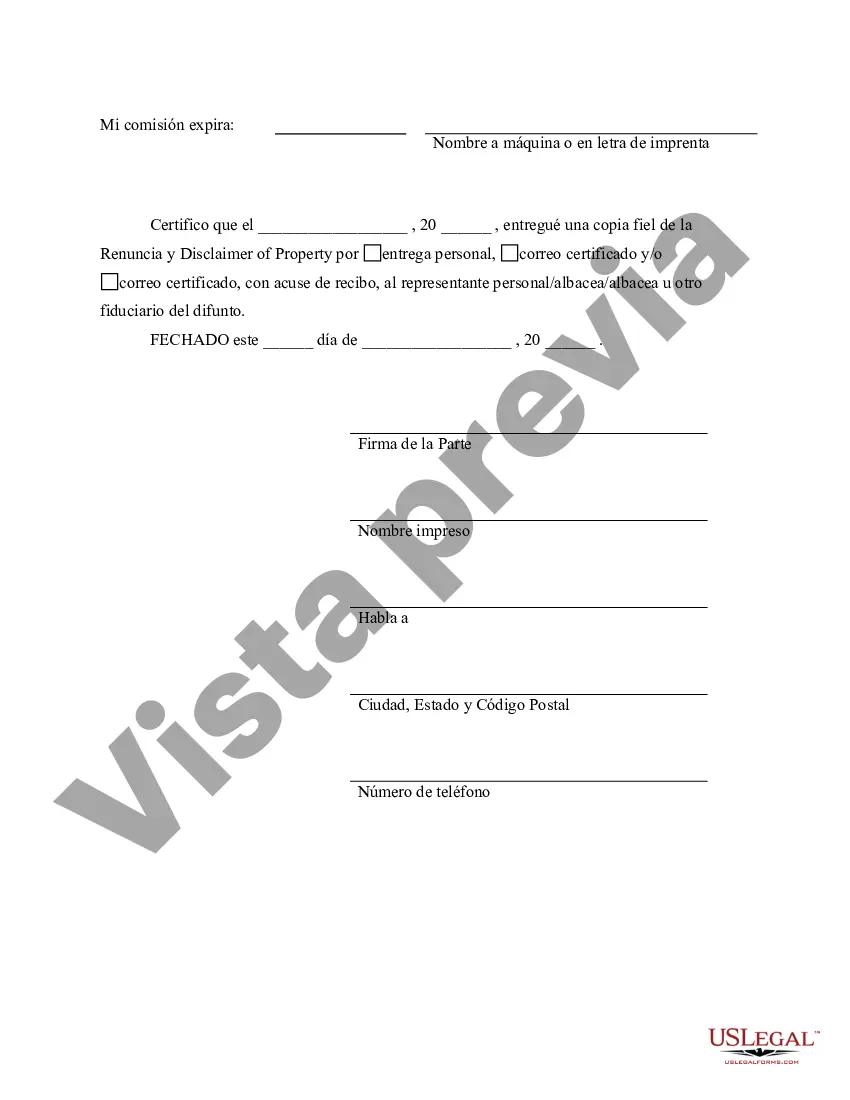

This form is a Renunciation and Disclaimer of Property acquired through Intestate Succession where the decedent died intestate and the beneficiary gained an interest in the property, but, will terminate a portion of or the entire interest in the property pursuant to the Texas Statutes, Chapter II. The property will pass to others as though the beneficiary predeceased the decedent. The form also contains a state specific acknowledgment and a certificate to verify delivery.

McKinney Texas Renunciation And Disclaimer of Property Received by Intestate Succession refers to the legal process in which an individual voluntarily gives up or relinquishes their right to inherit property that they would have received through intestate succession. Intestate succession occurs when a person dies without a valid will, and their property is distributed according to the state's laws of inheritance. The McKinney Texas Renunciation And Disclaimer of Property received by Intestate Succession can be classified into two types: 1. Formal Renunciation: This is a legally binding document that must be filed with the probate court within a specified period of time after the decedent's death. By formally renouncing their right to inherit, the individual is essentially stating that they do not wish to receive any portion of the decedent's property. 2. Informal Disclaimer: In some cases, an individual may choose to informally disclaim their right to inherit by simply not accepting or taking possession of the property. Unlike a formal renunciation, there is no need to file any legal documents with the court. However, it is advisable to consult with an attorney to ensure that the disclaimer is executed properly. The McKinney Texas Renunciation And Disclaimer of Property received by Intestate Succession is an important legal tool that allows individuals to decline their entitlement to an inheritance. There can be various reasons for renouncing or disclaiming property, such as avoiding tax consequences, preserving eligibility for government benefits, or resolving complex family dynamics. It is essential to note that renunciation and disclaimer of property must be made without any coercion or undue influence. Additionally, there may be specific time limits within which the renunciation or disclaimer must be submitted to the probate court, so it is crucial to consult with a knowledgeable attorney to understand and comply with the legal requirements. In conclusion, McKinney Texas Renunciation And Disclaimer of Property received by Intestate Succession are processes that provide individuals with the option to decline the inheritance they would be entitled to after someone dies without a will. By renouncing or disclaiming property, individuals can control the disposition of the assets and avoid potential legal complications.McKinney Texas Renunciation And Disclaimer of Property Received by Intestate Succession refers to the legal process in which an individual voluntarily gives up or relinquishes their right to inherit property that they would have received through intestate succession. Intestate succession occurs when a person dies without a valid will, and their property is distributed according to the state's laws of inheritance. The McKinney Texas Renunciation And Disclaimer of Property received by Intestate Succession can be classified into two types: 1. Formal Renunciation: This is a legally binding document that must be filed with the probate court within a specified period of time after the decedent's death. By formally renouncing their right to inherit, the individual is essentially stating that they do not wish to receive any portion of the decedent's property. 2. Informal Disclaimer: In some cases, an individual may choose to informally disclaim their right to inherit by simply not accepting or taking possession of the property. Unlike a formal renunciation, there is no need to file any legal documents with the court. However, it is advisable to consult with an attorney to ensure that the disclaimer is executed properly. The McKinney Texas Renunciation And Disclaimer of Property received by Intestate Succession is an important legal tool that allows individuals to decline their entitlement to an inheritance. There can be various reasons for renouncing or disclaiming property, such as avoiding tax consequences, preserving eligibility for government benefits, or resolving complex family dynamics. It is essential to note that renunciation and disclaimer of property must be made without any coercion or undue influence. Additionally, there may be specific time limits within which the renunciation or disclaimer must be submitted to the probate court, so it is crucial to consult with a knowledgeable attorney to understand and comply with the legal requirements. In conclusion, McKinney Texas Renunciation And Disclaimer of Property received by Intestate Succession are processes that provide individuals with the option to decline the inheritance they would be entitled to after someone dies without a will. By renouncing or disclaiming property, individuals can control the disposition of the assets and avoid potential legal complications.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.