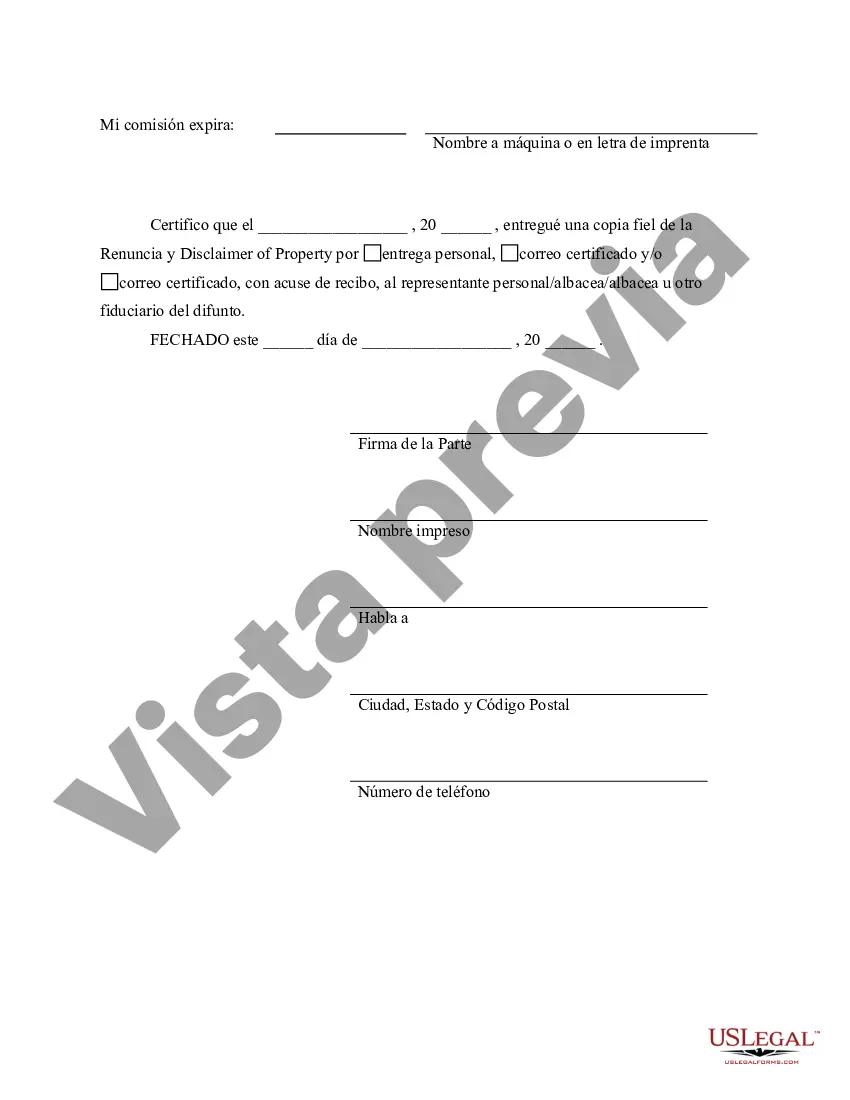

This form is a Renunciation and Disclaimer of Property acquired through Intestate Succession where the decedent died intestate and the beneficiary gained an interest in the property, but, will terminate a portion of or the entire interest in the property pursuant to the Texas Statutes, Chapter II. The property will pass to others as though the beneficiary predeceased the decedent. The form also contains a state specific acknowledgment and a certificate to verify delivery.

Odessa Texas Renunciation And Disclaimer of Property received by Intestate Succession is a legal process that allows individuals to decline or reject their rights to inherit property from the estate of a deceased person who did not leave a valid will. This renunciation and disclaimer can be a useful tool in estate planning, as it provides individuals with the freedom to disclaim their inheritance and direct it to other beneficiaries or avoid unintended tax consequences. In Odessa, Texas, there are two main types of Renunciation And Disclaimer of Property received by Intestate Succession: 1. Renunciation: Renunciation refers to the act of a potential heir giving up their right to inherit property from the intestate estate. This renunciation must be done in writing and signed by the intended renounced. By renouncing their inheritance, individuals are effectively stating that they do not wish to receive any portion of the intestate estate. 2. Disclaimer: A disclaimer is another legal tool used to decline an inheritance. Unlike a renunciation, a disclaimer allows the potential heir to refuse the inheritance after they have received it. This can be done within a certain time frame and must be done in writing. By disclaiming the property, the intended disclaim ant states that they do not wish to accept the inheritance, and it will pass on to the next eligible heir. Renunciation And Disclaimer of Property received by Intestate Succession can be particularly helpful in situations where beneficiaries may want to avoid potential liabilities, such as debts or taxes associated with the inherited property. It also allows them to redirect the property to other beneficiaries who may benefit more from the inheritance. It is important to note that the process for Renunciation And Disclaimer of Property received by Intestate Succession in Odessa, Texas, may have specific legal requirements and timelines that must be followed. Furthermore, it is advisable to seek guidance from an experienced estate planning attorney who can accurately guide potential heirs through the necessary steps to carry out a proper renunciation or disclaimer. Keywords: Odessa Texas, Renunciation And Disclaimer of Property, Intestate Succession, Renunciation, Disclaimer, inheritance, estate planning, beneficiaries, liabilities, debts, taxes, legal requirements, estate planning attorney, intestate estate.Odessa Texas Renunciation And Disclaimer of Property received by Intestate Succession is a legal process that allows individuals to decline or reject their rights to inherit property from the estate of a deceased person who did not leave a valid will. This renunciation and disclaimer can be a useful tool in estate planning, as it provides individuals with the freedom to disclaim their inheritance and direct it to other beneficiaries or avoid unintended tax consequences. In Odessa, Texas, there are two main types of Renunciation And Disclaimer of Property received by Intestate Succession: 1. Renunciation: Renunciation refers to the act of a potential heir giving up their right to inherit property from the intestate estate. This renunciation must be done in writing and signed by the intended renounced. By renouncing their inheritance, individuals are effectively stating that they do not wish to receive any portion of the intestate estate. 2. Disclaimer: A disclaimer is another legal tool used to decline an inheritance. Unlike a renunciation, a disclaimer allows the potential heir to refuse the inheritance after they have received it. This can be done within a certain time frame and must be done in writing. By disclaiming the property, the intended disclaim ant states that they do not wish to accept the inheritance, and it will pass on to the next eligible heir. Renunciation And Disclaimer of Property received by Intestate Succession can be particularly helpful in situations where beneficiaries may want to avoid potential liabilities, such as debts or taxes associated with the inherited property. It also allows them to redirect the property to other beneficiaries who may benefit more from the inheritance. It is important to note that the process for Renunciation And Disclaimer of Property received by Intestate Succession in Odessa, Texas, may have specific legal requirements and timelines that must be followed. Furthermore, it is advisable to seek guidance from an experienced estate planning attorney who can accurately guide potential heirs through the necessary steps to carry out a proper renunciation or disclaimer. Keywords: Odessa Texas, Renunciation And Disclaimer of Property, Intestate Succession, Renunciation, Disclaimer, inheritance, estate planning, beneficiaries, liabilities, debts, taxes, legal requirements, estate planning attorney, intestate estate.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.