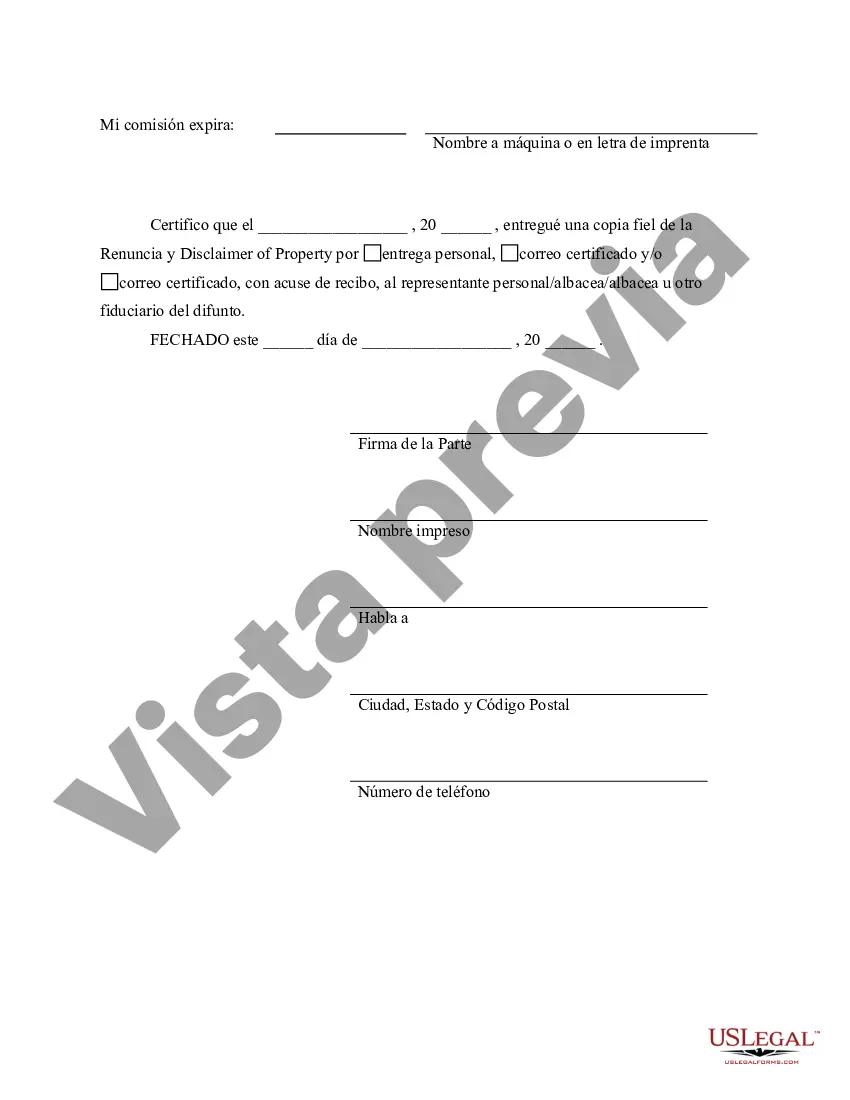

This form is a Renunciation and Disclaimer of Property acquired through Intestate Succession where the decedent died intestate and the beneficiary gained an interest in the property, but, will terminate a portion of or the entire interest in the property pursuant to the Texas Statutes, Chapter II. The property will pass to others as though the beneficiary predeceased the decedent. The form also contains a state specific acknowledgment and a certificate to verify delivery.

Sugar Land Texas Renunciation and Disclaimer of Property Received by Intestate Succession — A Detailed Description In Sugar Land, Texas, renunciation and disclaimer of property received by intestate succession refer to the legal process by which an individual relinquishes their right to inherit property from a deceased person who did not leave a valid will. This renunciation and disclaimer of property allows the disclaiming party to forego their claim to the inheritance, thereby allowing it to pass to an alternate beneficiary according to the laws of intestate succession. When an individual passes away without a will in Sugar Land, their assets and property are distributed among their heirs according to the state's intestacy laws. However, it is not uncommon for a potential heir to decline the inheritance due to various reasons such as personal preferences, financial considerations, or one's desire to maintain a certain tax status. Types of Sugar Land Texas Renunciation and Disclaimer of Property Received by Intestate Succession: 1. Partial Renunciation: In some cases, an heir may choose to renounce only a portion of the inheritance. This allows them to retain a specified share of the estate while disclaiming the rest. The renounced portion then passes to the next eligible heir or beneficiaries as determined by the Texas intestacy laws. 2. Full Renunciation: A full renunciation refers to when an heir disclaims their entire entitlement to the inheritance. By doing so, they forego their right to any part of the estate. Following the renunciation, the disclaimed property passes to the next eligible beneficiary in line according to the intestate succession laws. 3. Qualified Disclaimer: A qualified disclaimer occurs when an individual renounces their entitlement to inherit property within a certain timeframe and fulfills specific procedural requirements defined by federal and state laws. By meeting these requirements, the disclaiming party can ensure that the assets pass directly to the intended alternate beneficiary as if they were never entitled to the inheritance. 4. Conditional Renunciation: In some situations, an heir might renounce their right to inherit property based on certain conditions stipulated in the renunciation. These conditions could include considerations such as the property passing to a charitable organization or being allocated to a specific person or family member. It is crucial to note that the process of renunciation and disclaimer of property received by intestate succession in Sugar Land, Texas, must adhere to the legal requirements set forth by the state and federal laws. It is advisable for individuals considering renunciation or disclaimer to consult with an experienced estate attorney to guide them through the process and ensure compliance with all legal obligations. In conclusion, renunciation and disclaimer of property received by intestate succession in Sugar Land, Texas, provide individuals with the opportunity to voluntarily decline their right to inherit property from a deceased person who died without a will. Different types of renunciation, such as partial and full renunciations, as well as qualified disclaimers and conditional renunciations, offer individuals various options to shape the distribution of the estate and to preserve their financial and personal interests. Seeking legal advice is crucial to navigate these legal processes successfully.Sugar Land Texas Renunciation and Disclaimer of Property Received by Intestate Succession — A Detailed Description In Sugar Land, Texas, renunciation and disclaimer of property received by intestate succession refer to the legal process by which an individual relinquishes their right to inherit property from a deceased person who did not leave a valid will. This renunciation and disclaimer of property allows the disclaiming party to forego their claim to the inheritance, thereby allowing it to pass to an alternate beneficiary according to the laws of intestate succession. When an individual passes away without a will in Sugar Land, their assets and property are distributed among their heirs according to the state's intestacy laws. However, it is not uncommon for a potential heir to decline the inheritance due to various reasons such as personal preferences, financial considerations, or one's desire to maintain a certain tax status. Types of Sugar Land Texas Renunciation and Disclaimer of Property Received by Intestate Succession: 1. Partial Renunciation: In some cases, an heir may choose to renounce only a portion of the inheritance. This allows them to retain a specified share of the estate while disclaiming the rest. The renounced portion then passes to the next eligible heir or beneficiaries as determined by the Texas intestacy laws. 2. Full Renunciation: A full renunciation refers to when an heir disclaims their entire entitlement to the inheritance. By doing so, they forego their right to any part of the estate. Following the renunciation, the disclaimed property passes to the next eligible beneficiary in line according to the intestate succession laws. 3. Qualified Disclaimer: A qualified disclaimer occurs when an individual renounces their entitlement to inherit property within a certain timeframe and fulfills specific procedural requirements defined by federal and state laws. By meeting these requirements, the disclaiming party can ensure that the assets pass directly to the intended alternate beneficiary as if they were never entitled to the inheritance. 4. Conditional Renunciation: In some situations, an heir might renounce their right to inherit property based on certain conditions stipulated in the renunciation. These conditions could include considerations such as the property passing to a charitable organization or being allocated to a specific person or family member. It is crucial to note that the process of renunciation and disclaimer of property received by intestate succession in Sugar Land, Texas, must adhere to the legal requirements set forth by the state and federal laws. It is advisable for individuals considering renunciation or disclaimer to consult with an experienced estate attorney to guide them through the process and ensure compliance with all legal obligations. In conclusion, renunciation and disclaimer of property received by intestate succession in Sugar Land, Texas, provide individuals with the opportunity to voluntarily decline their right to inherit property from a deceased person who died without a will. Different types of renunciation, such as partial and full renunciations, as well as qualified disclaimers and conditional renunciations, offer individuals various options to shape the distribution of the estate and to preserve their financial and personal interests. Seeking legal advice is crucial to navigate these legal processes successfully.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.