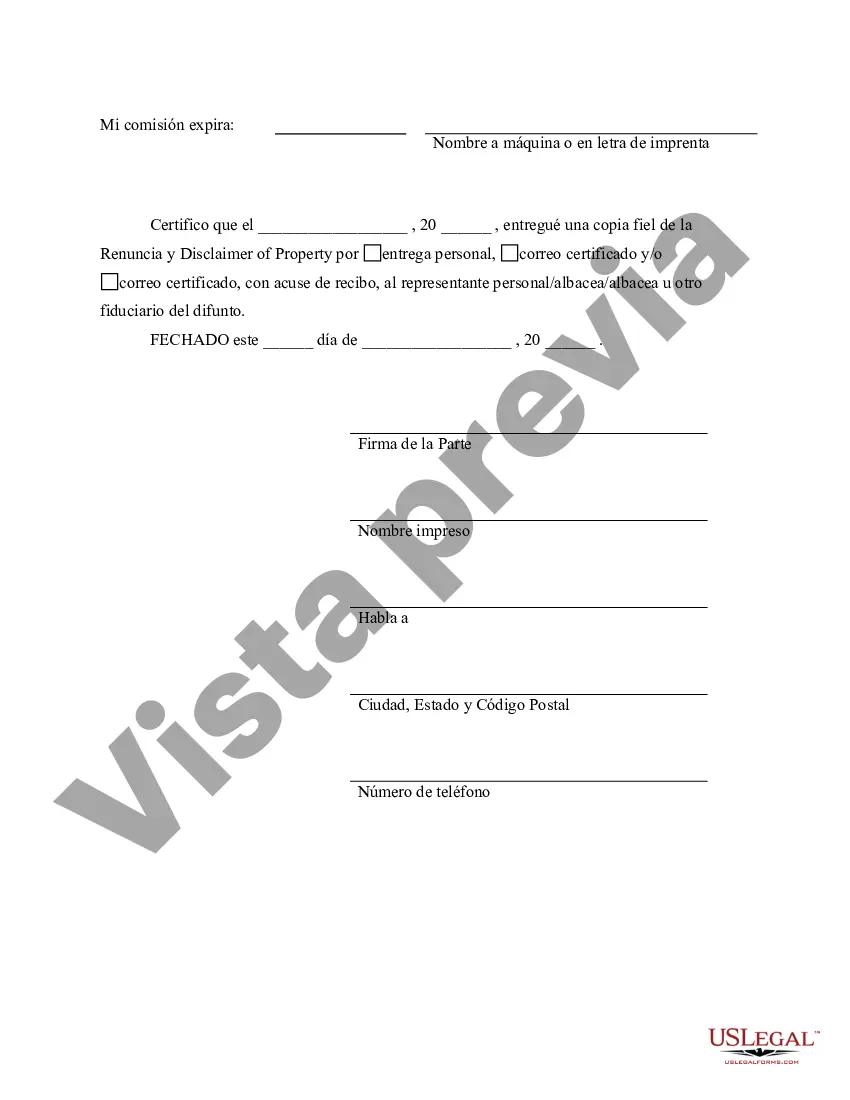

This form is a Renunciation and Disclaimer of Property acquired through Intestate Succession where the decedent died intestate and the beneficiary gained an interest in the property, but, will terminate a portion of or the entire interest in the property pursuant to the Texas Statutes, Chapter II. The property will pass to others as though the beneficiary predeceased the decedent. The form also contains a state specific acknowledgment and a certificate to verify delivery.

Wichita Falls Texas Renunciation And Disclaimer of Property received by Intestate Succession is a legal process that allows an individual to refuse or disclaim their right to inherit property from a deceased person who has passed away without a valid will (intestate). By renouncing or disclaiming the inherited property, the individual effectively rejects their entitlement, allowing it to pass to alternative heirs or beneficiaries according to state laws. In Wichita Falls, Texas, there are primarily two types of Renunciation And Disclaimer of Property received by Intestate Succession: 1. Partial Renunciation: This type of renunciation refers to relinquishing only a portion of the inherited property while accepting the remaining share. This option may be chosen when the inheritor desires to disclaim certain assets or possessions due to various reasons such as excessive taxation, financial liabilities, or simply not needing or wanting the particular property. 2. Full Renunciation: In this scenario, the individual renounces their entire entitlement to the property acquired through intestate succession. By doing so, the inheritor waives any rights, benefits, or responsibilities associated with the estate, allowing those assets to pass directly to the next eligible beneficiaries in line. The process for Renunciation And Disclaimer of Property received by Intestate Succession in Wichita Falls, Texas typically involves the following steps: 1. Understanding legal obligations: It is crucial for individuals to educate themselves about their rights, responsibilities, and potential consequences of initiating the renunciation process. Seeking legal advice from an estate attorney can help ensure a thorough understanding of the implications involved. 2. Drafting a renunciation document: A formal written renunciation document needs to be prepared, clearly stating the individual's intention to renounce their inheritance. This document must adhere to the legal requirements set forth by Texas state laws and be signed in the presence of appropriate witnesses. 3. Filing the renunciation: The completed renunciation document must be filed with the appropriate probate court handling the estate of the deceased individual. Timely submission within the specified deadlines is crucial to validate the renunciation. 4. Communication with other beneficiaries: It is important to inform other potential heirs or beneficiaries about the renunciation decision, as their inheritance rights may be directly affected. Transparency and open communication can help avoid conflicts or misunderstandings. 5. Impact on the estate: Once the renunciation is accepted by the court, the renouncing individual's share of the property will be treated as if they had predeceased the deceased individual. Consequently, the disclaimed assets pass to the alternative beneficiaries defined under Texas intestate succession laws, ensuring a smooth and orderly distribution of the estate. Renouncing or disclaiming property received by intestate succession in Wichita Falls, Texas can be a complex legal process. Consulting with an experienced estate attorney is highly advisable to navigate this procedure effectively, ensuring compliance with state laws and protecting the rights and interests of all parties involved.Wichita Falls Texas Renunciation And Disclaimer of Property received by Intestate Succession is a legal process that allows an individual to refuse or disclaim their right to inherit property from a deceased person who has passed away without a valid will (intestate). By renouncing or disclaiming the inherited property, the individual effectively rejects their entitlement, allowing it to pass to alternative heirs or beneficiaries according to state laws. In Wichita Falls, Texas, there are primarily two types of Renunciation And Disclaimer of Property received by Intestate Succession: 1. Partial Renunciation: This type of renunciation refers to relinquishing only a portion of the inherited property while accepting the remaining share. This option may be chosen when the inheritor desires to disclaim certain assets or possessions due to various reasons such as excessive taxation, financial liabilities, or simply not needing or wanting the particular property. 2. Full Renunciation: In this scenario, the individual renounces their entire entitlement to the property acquired through intestate succession. By doing so, the inheritor waives any rights, benefits, or responsibilities associated with the estate, allowing those assets to pass directly to the next eligible beneficiaries in line. The process for Renunciation And Disclaimer of Property received by Intestate Succession in Wichita Falls, Texas typically involves the following steps: 1. Understanding legal obligations: It is crucial for individuals to educate themselves about their rights, responsibilities, and potential consequences of initiating the renunciation process. Seeking legal advice from an estate attorney can help ensure a thorough understanding of the implications involved. 2. Drafting a renunciation document: A formal written renunciation document needs to be prepared, clearly stating the individual's intention to renounce their inheritance. This document must adhere to the legal requirements set forth by Texas state laws and be signed in the presence of appropriate witnesses. 3. Filing the renunciation: The completed renunciation document must be filed with the appropriate probate court handling the estate of the deceased individual. Timely submission within the specified deadlines is crucial to validate the renunciation. 4. Communication with other beneficiaries: It is important to inform other potential heirs or beneficiaries about the renunciation decision, as their inheritance rights may be directly affected. Transparency and open communication can help avoid conflicts or misunderstandings. 5. Impact on the estate: Once the renunciation is accepted by the court, the renouncing individual's share of the property will be treated as if they had predeceased the deceased individual. Consequently, the disclaimed assets pass to the alternative beneficiaries defined under Texas intestate succession laws, ensuring a smooth and orderly distribution of the estate. Renouncing or disclaiming property received by intestate succession in Wichita Falls, Texas can be a complex legal process. Consulting with an experienced estate attorney is highly advisable to navigate this procedure effectively, ensuring compliance with state laws and protecting the rights and interests of all parties involved.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.