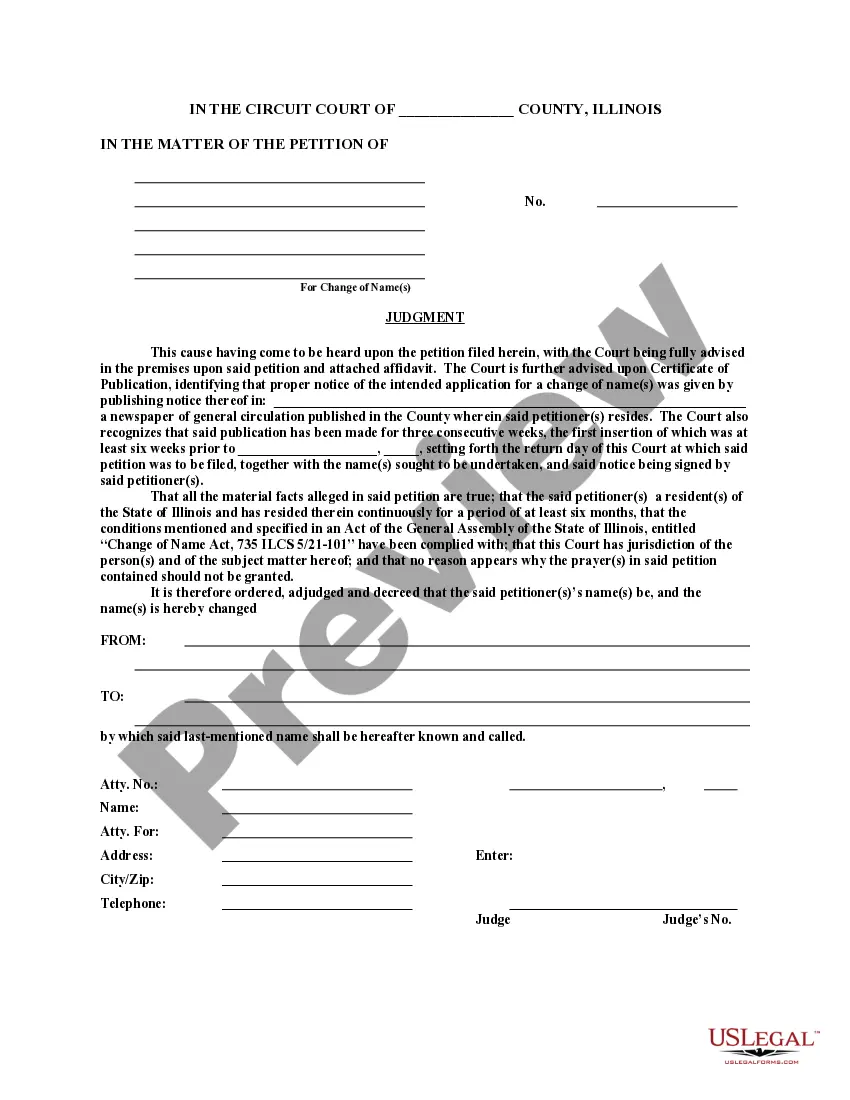

This detailed sample Texas Gift Deed (Individual to Individual)complies with Texas law. Adapt the language to fit your facts and circumstances. Available in Word and Rich Text formats.

Title: College Station Texas Gift Deed for Individual to Individual: A Comprehensive Guide Introduction: College Station, Texas, known for its vibrant community and illustrious educational institutions, offers a mechanism called the Gift Deed for Individuals to Individuals. This legal instrument allows individuals to transfer ownership of property or assets as a gift without monetary exchange. In this article, we will dive into the intricacies of College Station Texas Gift Deed for Individual to Individual, highlighting its significance, types, and key considerations. Keywords: College Station Texas, Gift Deed, Individual to Individual, legal instrument, property, assets, ownership transfer, monetary exchange. 1. Understanding College Station Texas Gift Deed for Individual to Individual: A College Station Texas Gift Deed for Individual to Individual is a legally binding document through which an individual willingly transfers ownership of property or assets to another person without expecting any payment in return. This type of deed is governed by the laws of Texas and ensures a smooth transfer of assets as a gift. Keywords: legally binding, ownership transfer, property, assets, Texas laws. 2. Types of College Station Texas Gift Deed for Individual to Individual: a) Real Estate Gift Deed: This type of gift deed pertains to the transfer of real estate properties, such as land, residential or commercial buildings, to an individual as a gift. It involves the transferor (gift or) relinquishing all present and future rights to the property. b) Personal Property Gift Deed: This category includes the transfer of personal belongings like vehicles, jewelry, antiques, art collections, or any other non-real estate assets from one individual to another without any exchange of funds. Keywords: Real Estate, Personal Property, transfer, gift or, present and future rights, belongings, non-real estate assets. 3. Key Considerations in College Station Texas Gift Deed: a) Eligibility: Both the gift or and the receiver must be legally eligible to participate in the gift deed. They should be of sound mind, adults according to Texas laws, and willing to transfer and accept ownership respectively. b) Legal Documentation: To ensure the validity of the gift deed, it must be drafted in writing, signed by the gift or, and notarized in accordance with Texas laws. Seek assistance from a legal professional to create a legally enforceable document. c) Tax Implications: The gift or should consult with a tax advisor to understand potential tax implications, as some gifts may be subject to federal gift tax or state-specific regulations. Keywords: eligibility, sound mind, adults, legal documentation, validity, notarized, legal professional, tax implications, federal gift tax, state-specific regulations. Conclusion: College Station Texas Gift Deed for Individual to Individual provides a legal framework for individuals to transfer property or assets as a gift without monetary exchange. While real estate and personal property gifts are the primary types, it is essential for both parties to understand the legal requirements, seek professional guidance, and consider any tax implications. By adhering to these considerations, individuals can successfully transfer ownership and nurture the spirit of giving in the College Station community. Keywords: legal framework, monetary exchange, real estate, personal property, legal requirements, professional guidance, tax implications, ownership transfer, College Station community.Title: College Station Texas Gift Deed for Individual to Individual: A Comprehensive Guide Introduction: College Station, Texas, known for its vibrant community and illustrious educational institutions, offers a mechanism called the Gift Deed for Individuals to Individuals. This legal instrument allows individuals to transfer ownership of property or assets as a gift without monetary exchange. In this article, we will dive into the intricacies of College Station Texas Gift Deed for Individual to Individual, highlighting its significance, types, and key considerations. Keywords: College Station Texas, Gift Deed, Individual to Individual, legal instrument, property, assets, ownership transfer, monetary exchange. 1. Understanding College Station Texas Gift Deed for Individual to Individual: A College Station Texas Gift Deed for Individual to Individual is a legally binding document through which an individual willingly transfers ownership of property or assets to another person without expecting any payment in return. This type of deed is governed by the laws of Texas and ensures a smooth transfer of assets as a gift. Keywords: legally binding, ownership transfer, property, assets, Texas laws. 2. Types of College Station Texas Gift Deed for Individual to Individual: a) Real Estate Gift Deed: This type of gift deed pertains to the transfer of real estate properties, such as land, residential or commercial buildings, to an individual as a gift. It involves the transferor (gift or) relinquishing all present and future rights to the property. b) Personal Property Gift Deed: This category includes the transfer of personal belongings like vehicles, jewelry, antiques, art collections, or any other non-real estate assets from one individual to another without any exchange of funds. Keywords: Real Estate, Personal Property, transfer, gift or, present and future rights, belongings, non-real estate assets. 3. Key Considerations in College Station Texas Gift Deed: a) Eligibility: Both the gift or and the receiver must be legally eligible to participate in the gift deed. They should be of sound mind, adults according to Texas laws, and willing to transfer and accept ownership respectively. b) Legal Documentation: To ensure the validity of the gift deed, it must be drafted in writing, signed by the gift or, and notarized in accordance with Texas laws. Seek assistance from a legal professional to create a legally enforceable document. c) Tax Implications: The gift or should consult with a tax advisor to understand potential tax implications, as some gifts may be subject to federal gift tax or state-specific regulations. Keywords: eligibility, sound mind, adults, legal documentation, validity, notarized, legal professional, tax implications, federal gift tax, state-specific regulations. Conclusion: College Station Texas Gift Deed for Individual to Individual provides a legal framework for individuals to transfer property or assets as a gift without monetary exchange. While real estate and personal property gifts are the primary types, it is essential for both parties to understand the legal requirements, seek professional guidance, and consider any tax implications. By adhering to these considerations, individuals can successfully transfer ownership and nurture the spirit of giving in the College Station community. Keywords: legal framework, monetary exchange, real estate, personal property, legal requirements, professional guidance, tax implications, ownership transfer, College Station community.