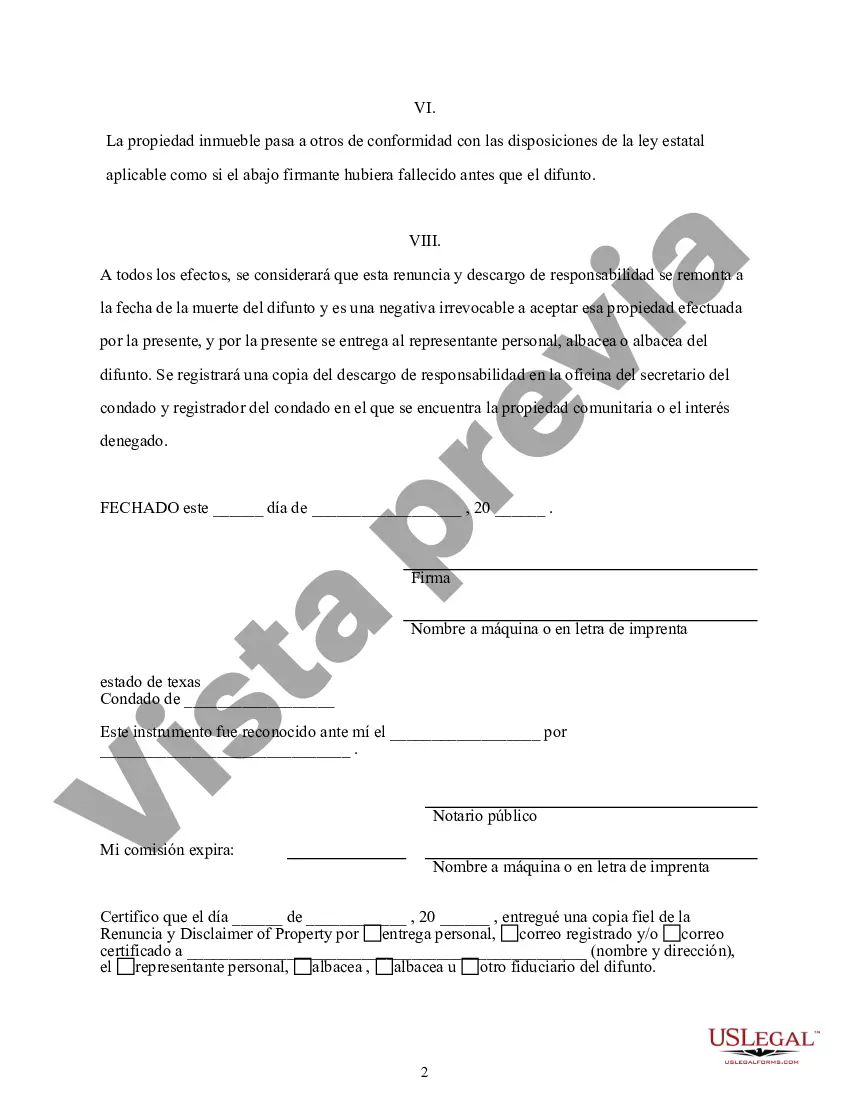

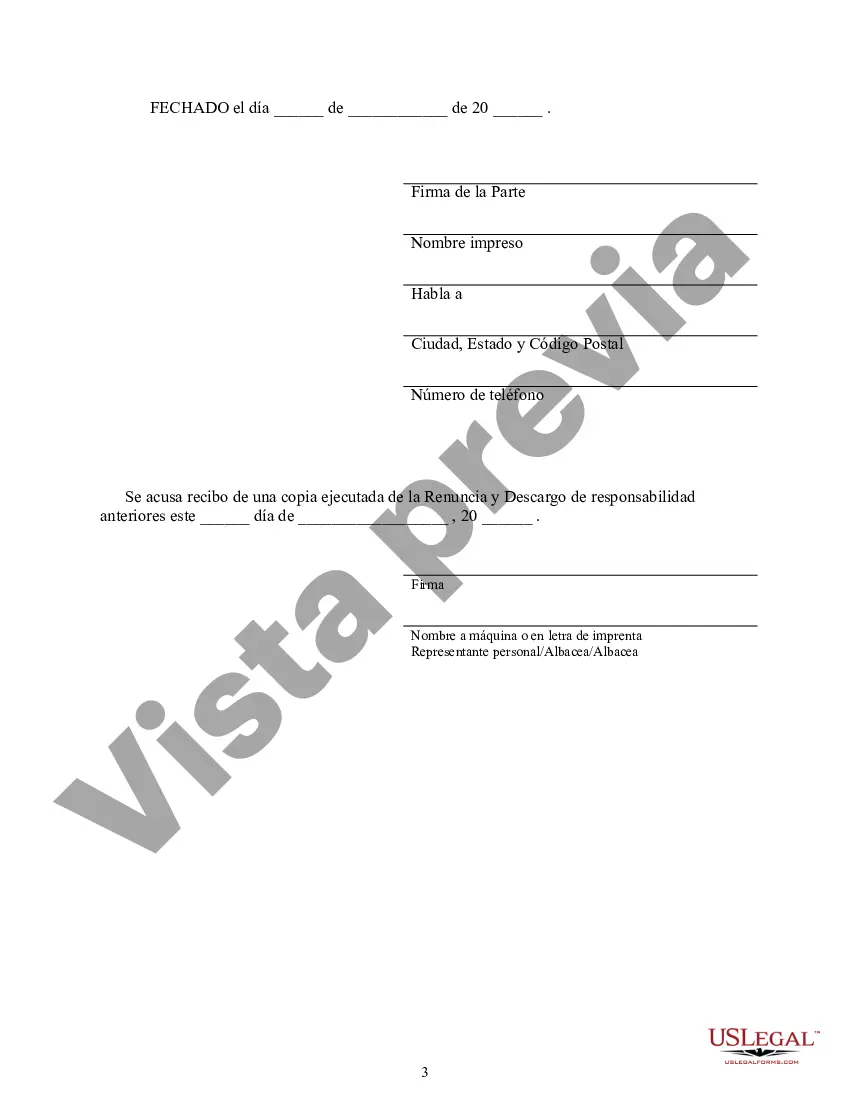

This form is a Renunciation and Disclaimer of a Community Property Interest, where the beneficiary gained an interest in the described community property upon the death of the decedent, but, pursuant to the Texas Statutes, Chapter II, the beneficiary has chosen to disclaim his/her rightful interest in the property. Therefore, the property will devolve to others as though the beneficiary predeceased the decedent. The form also includes a state specific acknowledgment and a certificate to verify the delivery of the document.

Austin Texas Renunciation And Disclaimer of Property — Community Property Interest refers to a legal process by which an individual voluntarily gives up their rights and interest in community property in Austin, Texas. Community property refers to assets and property acquired by a married couple during their marriage, excluding separate property. The renunciation and disclaimer process involves the complete or partial removal of an individual's stake in community property, allowing them to forfeit their rights and claim over certain assets or property. This process is typically carried out when the individual wishes to disclaim any ownership or control over community property, often in relation to the dissolution of a marriage, inheritance purposes, or to protect themselves from certain liabilities. There are a few different types of renunciation and disclaimer of property — community property interest in Austin, Texas. These include full renunciation, partial renunciation, and qualified renunciation. 1. Full Renunciation: In this type, the individual renounces their entire interest in the community property. By doing so, they surrender any claim or rights they may have had over the assets or property acquired during the marriage. 2. Partial Renunciation: Unlike full renunciation, partial renunciation allows the individual to disclaim only a portion of their interest in the community property. This is typically done when the individual wishes to retain a certain portion of the assets while giving up their claim to the rest. 3. Qualified Renunciation: In some cases, individuals may choose to engage in a qualified renunciation. This involves renouncing their interest in specific assets or property, rather than the entirety of community property. This is often done to protect themselves from liabilities associated with those particular assets. The process of renunciation and disclaimer of property — community property interest involves several crucial steps. Firstly, the individual must draft a written and signed renunciation document clearly stating their intention to renounce their interest in the community property. This document should include specific details about the property or assets being renounced, and it must be executed in accordance with the legal requirements of the state and local laws. Next, the renunciation document should be filed with the appropriate authority, such as the county clerk's office or the probate court. This ensures that the renunciation becomes a matter of public record, providing legal validity to the renounced property rights. It is important to note that renunciation and disclaimer of property — community property interest should be carried out with the assistance of an attorney to ensure legal compliance and protect the individual's rights. Additionally, it is advisable to consult a financial advisor or accountant to understand any potential tax implications or consequences of renouncing community property. Overall, Austin Texas Renunciation and Disclaimer of Property — Community Property Interest allows individuals the opportunity to relinquish their rights and interests in community property voluntarily. This can serve various purposes, such as the protection of assets, mitigating liabilities, or facilitating the legal processes surrounding marriage dissolution or inheritance.Austin Texas Renunciation And Disclaimer of Property — Community Property Interest refers to a legal process by which an individual voluntarily gives up their rights and interest in community property in Austin, Texas. Community property refers to assets and property acquired by a married couple during their marriage, excluding separate property. The renunciation and disclaimer process involves the complete or partial removal of an individual's stake in community property, allowing them to forfeit their rights and claim over certain assets or property. This process is typically carried out when the individual wishes to disclaim any ownership or control over community property, often in relation to the dissolution of a marriage, inheritance purposes, or to protect themselves from certain liabilities. There are a few different types of renunciation and disclaimer of property — community property interest in Austin, Texas. These include full renunciation, partial renunciation, and qualified renunciation. 1. Full Renunciation: In this type, the individual renounces their entire interest in the community property. By doing so, they surrender any claim or rights they may have had over the assets or property acquired during the marriage. 2. Partial Renunciation: Unlike full renunciation, partial renunciation allows the individual to disclaim only a portion of their interest in the community property. This is typically done when the individual wishes to retain a certain portion of the assets while giving up their claim to the rest. 3. Qualified Renunciation: In some cases, individuals may choose to engage in a qualified renunciation. This involves renouncing their interest in specific assets or property, rather than the entirety of community property. This is often done to protect themselves from liabilities associated with those particular assets. The process of renunciation and disclaimer of property — community property interest involves several crucial steps. Firstly, the individual must draft a written and signed renunciation document clearly stating their intention to renounce their interest in the community property. This document should include specific details about the property or assets being renounced, and it must be executed in accordance with the legal requirements of the state and local laws. Next, the renunciation document should be filed with the appropriate authority, such as the county clerk's office or the probate court. This ensures that the renunciation becomes a matter of public record, providing legal validity to the renounced property rights. It is important to note that renunciation and disclaimer of property — community property interest should be carried out with the assistance of an attorney to ensure legal compliance and protect the individual's rights. Additionally, it is advisable to consult a financial advisor or accountant to understand any potential tax implications or consequences of renouncing community property. Overall, Austin Texas Renunciation and Disclaimer of Property — Community Property Interest allows individuals the opportunity to relinquish their rights and interests in community property voluntarily. This can serve various purposes, such as the protection of assets, mitigating liabilities, or facilitating the legal processes surrounding marriage dissolution or inheritance.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.