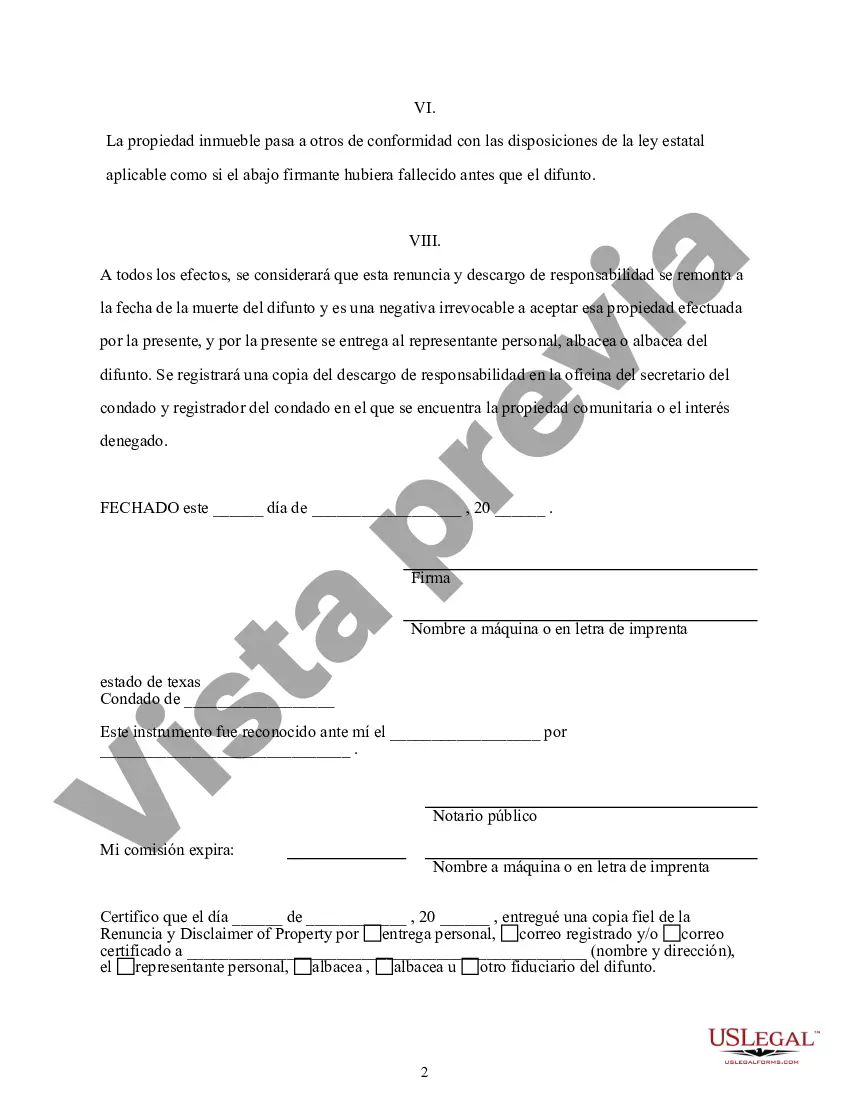

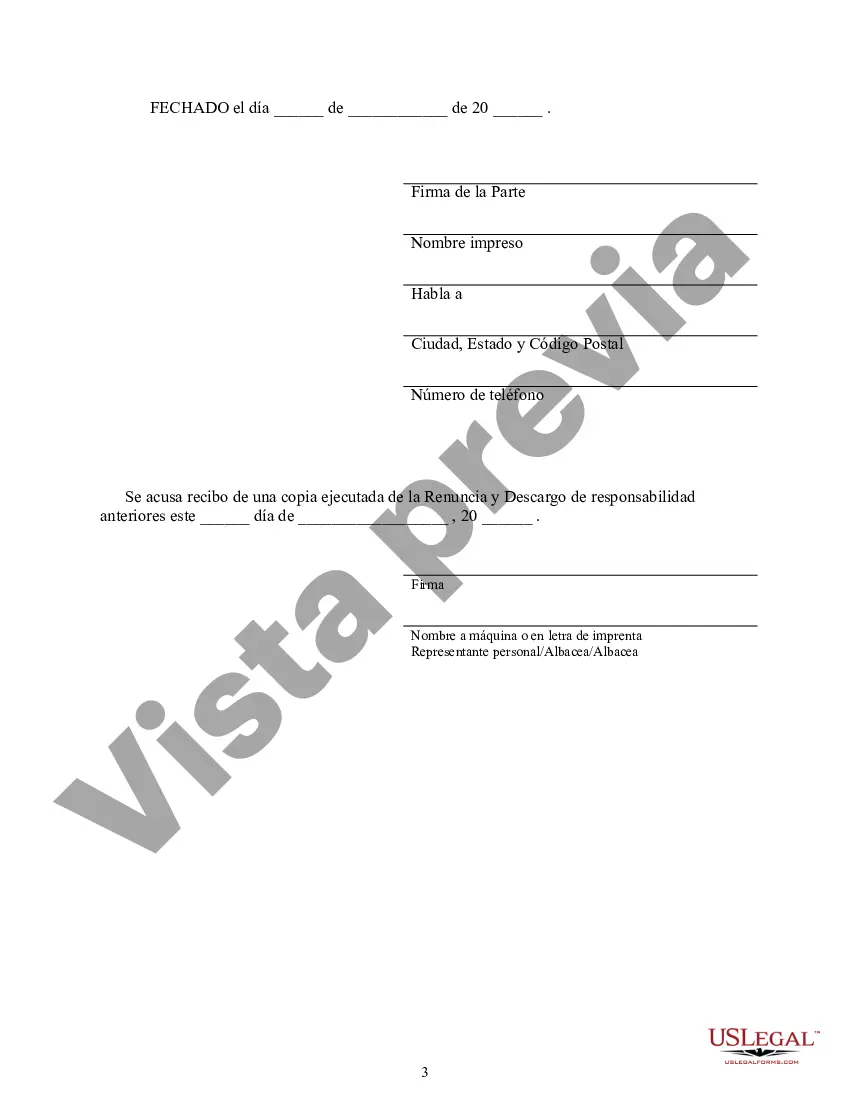

This form is a Renunciation and Disclaimer of a Community Property Interest, where the beneficiary gained an interest in the described community property upon the death of the decedent, but, pursuant to the Texas Statutes, Chapter II, the beneficiary has chosen to disclaim his/her rightful interest in the property. Therefore, the property will devolve to others as though the beneficiary predeceased the decedent. The form also includes a state specific acknowledgment and a certificate to verify the delivery of the document.

Harris County in Texas follows community property laws where spouses have equal ownership rights in property acquired during their marriage. However, there may be instances when one spouse wishes to renounce or disclaim their interest in a particular property. This is where the Harris Texas Renunciation and Disclaimer of Property — Community Property Interest comes into play. This legal document allows a spouse to formally renounce or disclaim their share of ownership in a specific property to the other spouse or any other designated person. The renunciation or disclaimer is typically made in writing and needs to adhere to specific guidelines set by the State of Texas. By filing the Harris Texas Renunciation and Disclaimer of Property — Community Property Interest, the spouse relinquishing their share effectively gives up any rights, claims, or interests they have in the property. The renouncing spouse will no longer have the ability to control or possess the property, nor will they be entitled to any proceeds or benefits resulting from it. There are various types of Harris Texas Renunciation and Disclaimer of Property — Community Property Interest depending on the specific circumstances: 1. Partial Renunciation: In this case, a spouse may choose to renounce only a portion of their community property interest in a certain property. This allows for the sharing of ownership rights between the renouncing spouse and the other party. 2. Full Renunciation: A spouse may decide to completely renounce their entire community property interest in a specific property. This relinquishes all rights, claims, and interests they have in the property, transferring complete ownership to the other spouse or designated individual. 3. Disclaiming Future Interests: This type of renunciation refers to the renunciation of any future interests or rights one might acquire in a property. It specifically includes any future community property that may arise due to changes in marital status or other legal circumstances. It is crucial to consult with an attorney to draft and execute the Harris Texas Renunciation and Disclaimer of Property — Community Property Interest correctly. The document should comply with all legal requirements and be notarized to ensure its validity and enforceability. Proper documentation and execution are essential in order to protect the rights and interests of all parties involved.Harris County in Texas follows community property laws where spouses have equal ownership rights in property acquired during their marriage. However, there may be instances when one spouse wishes to renounce or disclaim their interest in a particular property. This is where the Harris Texas Renunciation and Disclaimer of Property — Community Property Interest comes into play. This legal document allows a spouse to formally renounce or disclaim their share of ownership in a specific property to the other spouse or any other designated person. The renunciation or disclaimer is typically made in writing and needs to adhere to specific guidelines set by the State of Texas. By filing the Harris Texas Renunciation and Disclaimer of Property — Community Property Interest, the spouse relinquishing their share effectively gives up any rights, claims, or interests they have in the property. The renouncing spouse will no longer have the ability to control or possess the property, nor will they be entitled to any proceeds or benefits resulting from it. There are various types of Harris Texas Renunciation and Disclaimer of Property — Community Property Interest depending on the specific circumstances: 1. Partial Renunciation: In this case, a spouse may choose to renounce only a portion of their community property interest in a certain property. This allows for the sharing of ownership rights between the renouncing spouse and the other party. 2. Full Renunciation: A spouse may decide to completely renounce their entire community property interest in a specific property. This relinquishes all rights, claims, and interests they have in the property, transferring complete ownership to the other spouse or designated individual. 3. Disclaiming Future Interests: This type of renunciation refers to the renunciation of any future interests or rights one might acquire in a property. It specifically includes any future community property that may arise due to changes in marital status or other legal circumstances. It is crucial to consult with an attorney to draft and execute the Harris Texas Renunciation and Disclaimer of Property — Community Property Interest correctly. The document should comply with all legal requirements and be notarized to ensure its validity and enforceability. Proper documentation and execution are essential in order to protect the rights and interests of all parties involved.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.