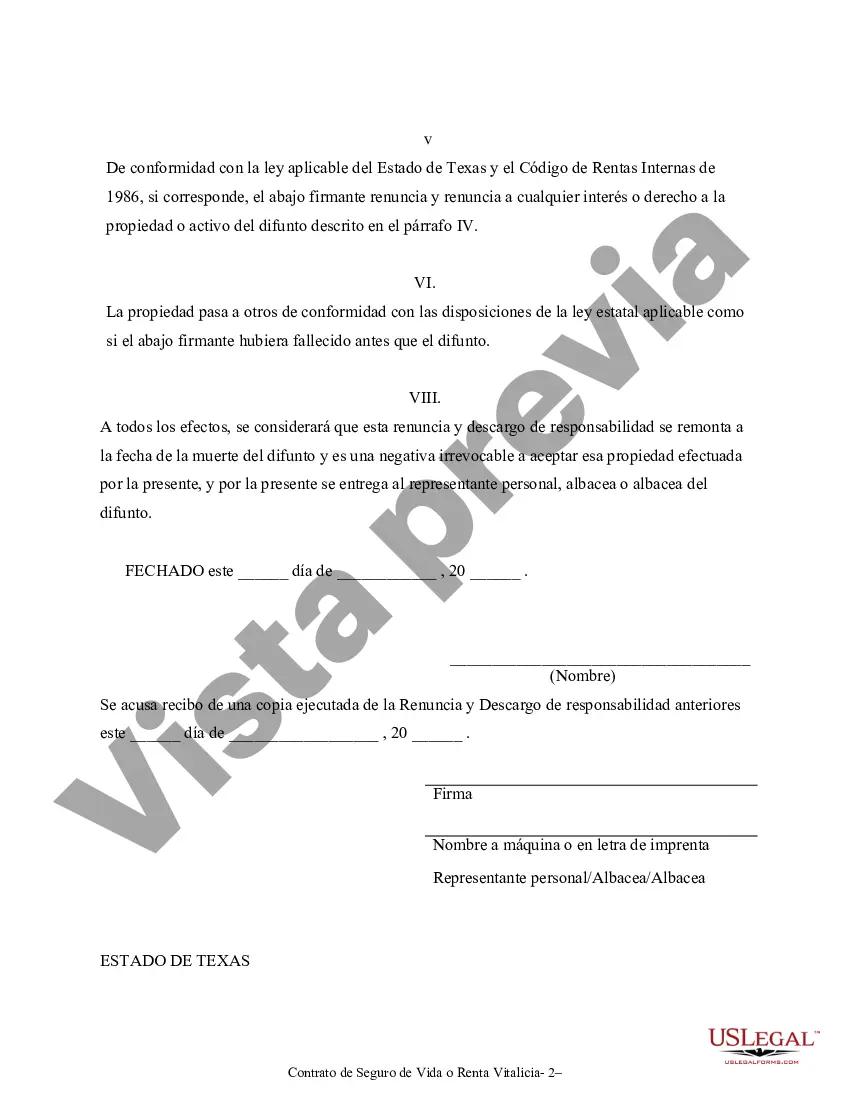

A Brownsville Texas Renunciation and Disclaimer of Property from Life Insurance or Annuity Contract is a legally binding document that allows individuals to formally decline or disclaim their rights and interests in a life insurance or annuity contract. This document can be used for various reasons such as to release any potential liabilities, avoid inheritance taxes, or simply to transfer ownership to another party. There are different types of Brownsville Texas Renunciation and Disclaimer of Property from Life Insurance or Annuity Contracts that can be utilized depending on the specific circumstances and goals of the individual involved. These types may include: 1. Irrevocable Renunciation and Disclaimer: This type of renunciation and disclaimer is permanent and cannot be reversed. By signing this document, the individual gives up any rights and claims they may have had on the life insurance or annuity contract. 2. Conditional Renunciation and Disclaimer: In this type of renunciation and disclaimer, certain conditions or requirements must be met before the renunciation takes effect. For example, the individual may renounce their rights if certain beneficiaries are named or if specific terms are met. 3. Partial Renunciation and Disclaimer: This form of renunciation and disclaimer allows the individual to disclaim only a part of their interest in the life insurance or annuity contract. They may choose to disclaim a specific portion or percentage of the policy while retaining ownership or interest in the remaining portion. 4. Disclaiming on Behalf of Others: In certain situations, a person may renounce or disclaim the rights of another individual who has passed away or is unable to do so themselves. This type of renunciation and disclaimer allows for the transfer of ownership or benefits to the intended recipient or alternate beneficiaries. When creating a Brownsville Texas Renunciation and Disclaimer of Property from Life Insurance or Annuity Contract, it is essential to consult with an attorney or legal professional who specializes in estate planning or contract law. They can provide guidance on the specific requirements, implications, and legalities involved in renunciation and disclaimer processes in Texas. It is crucial to understand that each individual's circumstances may vary, so seeking personalized legal advice is highly recommended.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Brownsville Texas Renuncia y Renuncia de Bienes del Seguro de Vida o Contrato de Renta Vitalicia - Texas Renunciation And Disclaimer of Property from Life Insurance or Annuity Contract

Description

How to fill out Brownsville Texas Renuncia Y Renuncia De Bienes Del Seguro De Vida O Contrato De Renta Vitalicia?

No matter the social or professional status, filling out legal forms is an unfortunate necessity in today’s professional environment. Very often, it’s practically impossible for a person with no legal education to draft this sort of papers from scratch, mostly due to the convoluted jargon and legal nuances they come with. This is where US Legal Forms comes in handy. Our service offers a massive collection with over 85,000 ready-to-use state-specific forms that work for pretty much any legal situation. US Legal Forms also is a great asset for associates or legal counsels who want to to be more efficient time-wise using our DYI forms.

No matter if you want the Brownsville Texas Renunciation And Disclaimer of Property from Life Insurance or Annuity Contract or any other document that will be good in your state or county, with US Legal Forms, everything is on hand. Here’s how you can get the Brownsville Texas Renunciation And Disclaimer of Property from Life Insurance or Annuity Contract in minutes using our trustworthy service. If you are already a subscriber, you can proceed to log in to your account to download the appropriate form.

However, in case you are unfamiliar with our library, ensure that you follow these steps prior to obtaining the Brownsville Texas Renunciation And Disclaimer of Property from Life Insurance or Annuity Contract:

- Be sure the form you have found is suitable for your area considering that the regulations of one state or county do not work for another state or county.

- Preview the form and go through a quick description (if available) of scenarios the document can be used for.

- In case the form you selected doesn’t meet your needs, you can start over and look for the suitable form.

- Click Buy now and pick the subscription plan you prefer the best.

- Log in to your account login information or create one from scratch.

- Choose the payment gateway and proceed to download the Brownsville Texas Renunciation And Disclaimer of Property from Life Insurance or Annuity Contract as soon as the payment is completed.

You’re all set! Now you can proceed to print out the form or fill it out online. Should you have any issues locating your purchased forms, you can quickly find them in the My Forms tab.

Regardless of what situation you’re trying to solve, US Legal Forms has got you covered. Try it out today and see for yourself.