Title: Understanding the Dallas Texas Renunciation and Disclaimer of Property from Life Insurance or Annuity Contract Introduction: In Dallas, Texas, individuals have the option to renounce or disclaim their rights to property from life insurance or annuity contracts. This legal process allows beneficiaries or potential recipients to forfeit their claim and avoid any associated liabilities. Understanding the different types of renunciation and disclaimer options available can be crucial for ensuring the proper handling of such assets. This article provides a comprehensive description of the Dallas Texas Renunciation and Disclaimer of Property from Life Insurance or Annuity Contract, highlighting key keywords such as renunciation, disclaimer, property, life insurance, and annuity contract. 1. Renunciation and Disclaimer Explained: The renunciation and disclaimer process involves voluntarily relinquishing one's rights to property inherited from a life insurance or annuity contract. Renunciation is typically executed by beneficiaries who wish to decline their interest in the assets, thereby transferring entitlement to the next eligible individual. A disclaimer, on the other hand, is often utilized when a recipient wants to refuse inheritance altogether, redirecting the property to contingent beneficiaries or allowing it to pass through intestate succession. 2. Dallas Texas Renunciation Process: When renouncing property in Dallas, Texas, the renouncing party must follow certain legal requirements. Initially, a written statement explicitly expressing renunciation intentions must be provided to the concerned entity, such as the insurance company or annuity provider. This document should include all relevant details, such as the renouncing party's name, contact information, and a clear declaration of renouncing rights. 3. Dallas Texas Disclaimer Process: To disclaim property from a life insurance or annuity contract in Dallas, Texas, a disclaimer must be prepared in writing and delivered to the appropriate parties within a specified timeframe. The disclaimer should encompass crucial information such as the disclaiming party's identification, details of the property being disclaimed, and an explicit statement expressing the disclaimer of any interest in the property. 4. Different Types of Renunciation/Disclaimer Scenarios: a) Partial Renunciation/Disclaimer: In certain cases, beneficiaries or recipients may choose to renounce or disclaim only a portion of their inheritance. This option enables them to retain a designated fraction of the assets while relinquishing the remaining portion. b) Conditional Renunciation/Disclaimer: Conditional renunciation or disclaimer refers to situations where the act is executed under specific circumstances. For example, a beneficiary may renounce or disclaim their inheritance if certain conditions or requirements are not met. 5. Implications of Renunciation/Disclaimer: Renunciation or disclaimer of property from a life insurance or annuity contract in Dallas, Texas, can have important legal and financial implications. It is crucial for individuals considering such actions to consult with an attorney or financial advisor to fully understand the consequences, including potential tax implications, for both themselves and any subsequent beneficiaries. Conclusion: The Dallas Texas Renunciation and Disclaimer of Property from Life Insurance or Annuity Contract provide individuals in Dallas with the option to decline or forfeit their entitlement to inherited assets. By understanding the various processes, types of renunciation or disclaimer scenarios, and associated implications, individuals can make well-informed decisions regarding the handling of life insurance or annuity contract proceeds. Seeking professional advice is highly recommended ensuring compliance with local laws and fulfill all necessary legal obligations.

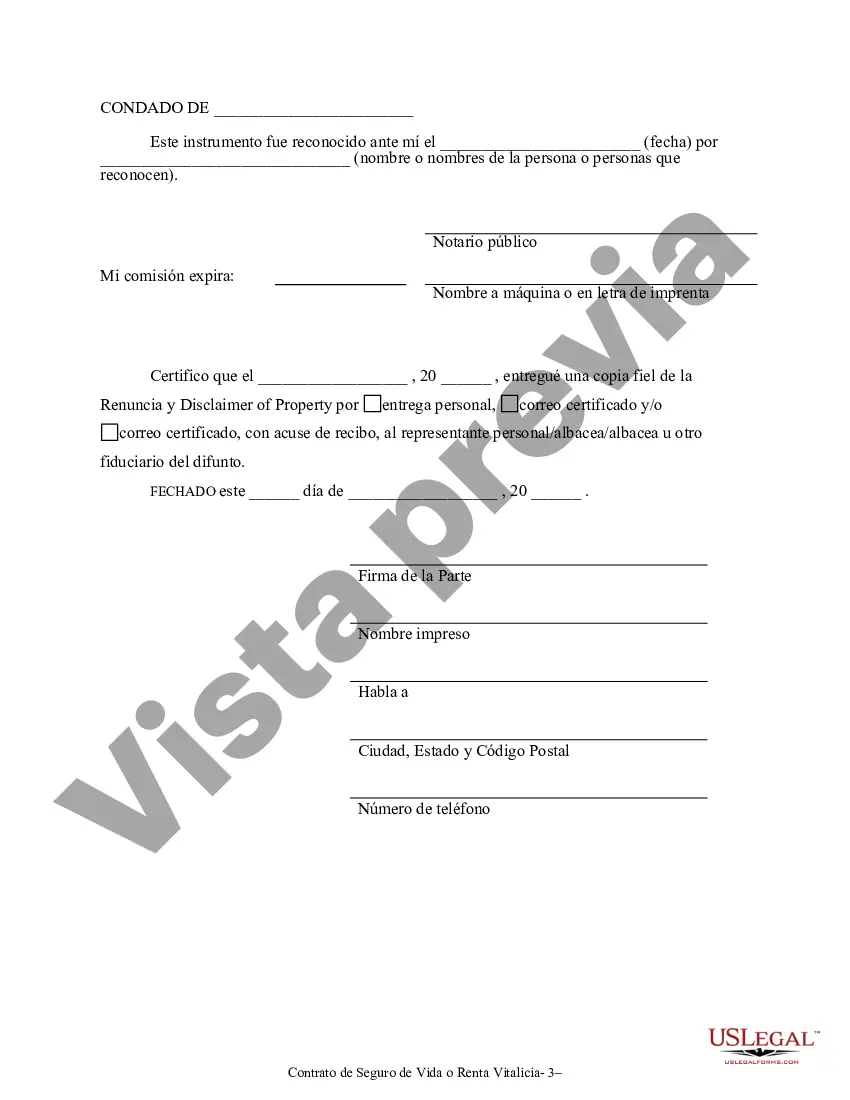

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Dallas Texas Renuncia y Renuncia de Bienes del Seguro de Vida o Contrato de Renta Vitalicia - Texas Renunciation And Disclaimer of Property from Life Insurance or Annuity Contract

Description

How to fill out Dallas Texas Renuncia Y Renuncia De Bienes Del Seguro De Vida O Contrato De Renta Vitalicia?

We always strive to minimize or prevent legal issues when dealing with nuanced legal or financial matters. To do so, we sign up for legal solutions that, as a rule, are extremely expensive. However, not all legal matters are equally complex. Most of them can be dealt with by ourselves.

US Legal Forms is an online collection of up-to-date DIY legal documents addressing anything from wills and powers of attorney to articles of incorporation and petitions for dissolution. Our platform helps you take your matters into your own hands without the need of using services of an attorney. We provide access to legal form templates that aren’t always openly accessible. Our templates are state- and area-specific, which significantly facilitates the search process.

Benefit from US Legal Forms whenever you need to find and download the Dallas Texas Renunciation And Disclaimer of Property from Life Insurance or Annuity Contract or any other form easily and securely. Simply log in to your account and click the Get button next to it. In case you lose the form, you can always re-download it in the My Forms tab.

The process is just as effortless if you’re unfamiliar with the website! You can create your account in a matter of minutes.

- Make sure to check if the Dallas Texas Renunciation And Disclaimer of Property from Life Insurance or Annuity Contract complies with the laws and regulations of your your state and area.

- Also, it’s imperative that you check out the form’s outline (if available), and if you notice any discrepancies with what you were looking for in the first place, search for a different template.

- As soon as you’ve made sure that the Dallas Texas Renunciation And Disclaimer of Property from Life Insurance or Annuity Contract is suitable for your case, you can choose the subscription option and proceed to payment.

- Then you can download the form in any available format.

For over 24 years of our presence on the market, we’ve helped millions of people by offering ready to customize and up-to-date legal documents. Make the most of US Legal Forms now to save time and resources!