Harris Texas Renunciation and Disclaimer of Property from Life Insurance or Annuity Contract: In Harris Texas, the Renunciation and Disclaimer of Property from Life Insurance or Annuity Contract is a legal process by which an individual voluntarily gives up their rights to property obtained through a life insurance or annuity contract. This renunciation and disclaimer can apply to various types of life insurance or annuity contracts, including term life insurance, whole life insurance, universal life insurance, and fixed or variable annuity contracts. Renunciation and disclaimer essentially mean rejecting or disclaiming any right, title, or interest in the property acquired from the aforementioned insurance or annuity contracts. By renouncing and disclaiming property, an individual is stating that they do not wish to receive any benefits, proceeds, or ownership of the property specified in the contract. This legal mechanism is particularly relevant in situations where an individual wishes to disassociate themselves from certain property, beneficiaries, or financial obligations associated with a life insurance or annuity contract. It can also be used when an individual wants to ensure that the proceeds from the contract are distributed to other named beneficiaries or parties. Types of Renunciation and Disclaimer of Property from Life Insurance or Annuity Contract: 1. Term Life Insurance Renunciation: This type of renunciation applies specifically to term life insurance contracts where an individual decides to give up their rights to any benefits or proceeds associated with the policy. 2. Whole Life Insurance Renunciation: This type of renunciation involves relinquishing ownership or rights to property obtained through a whole life insurance contract. It may include surrendering cash values, death benefits, or dividends received from the policy. 3. Universal Life Insurance Renunciation: Universal life insurance contracts allow for flexible premium payments and adjustable death benefits. Renouncing property acquired through a universal life insurance contract involves disclaiming rights to any cash values, death benefits, or premium payments made. 4. Fixed or Variable Annuity Contract Renunciation: Annuities are contracts that provide a stream of income during retirement or a specified period. Renouncing property obtained from a fixed or variable annuity contract involves rejecting any rights to income payments, accumulation values, or death benefits related to the annuity. It is important to note that the specifics of renunciation and disclaimer of property from life insurance or annuity contracts may vary depending on the terms and conditions of the individual contract, as well as applicable laws in Harris Texas. Seeking legal guidance and consulting with an attorney familiar with insurance and contract law is essential when considering renouncing or disclaiming property from such contracts.

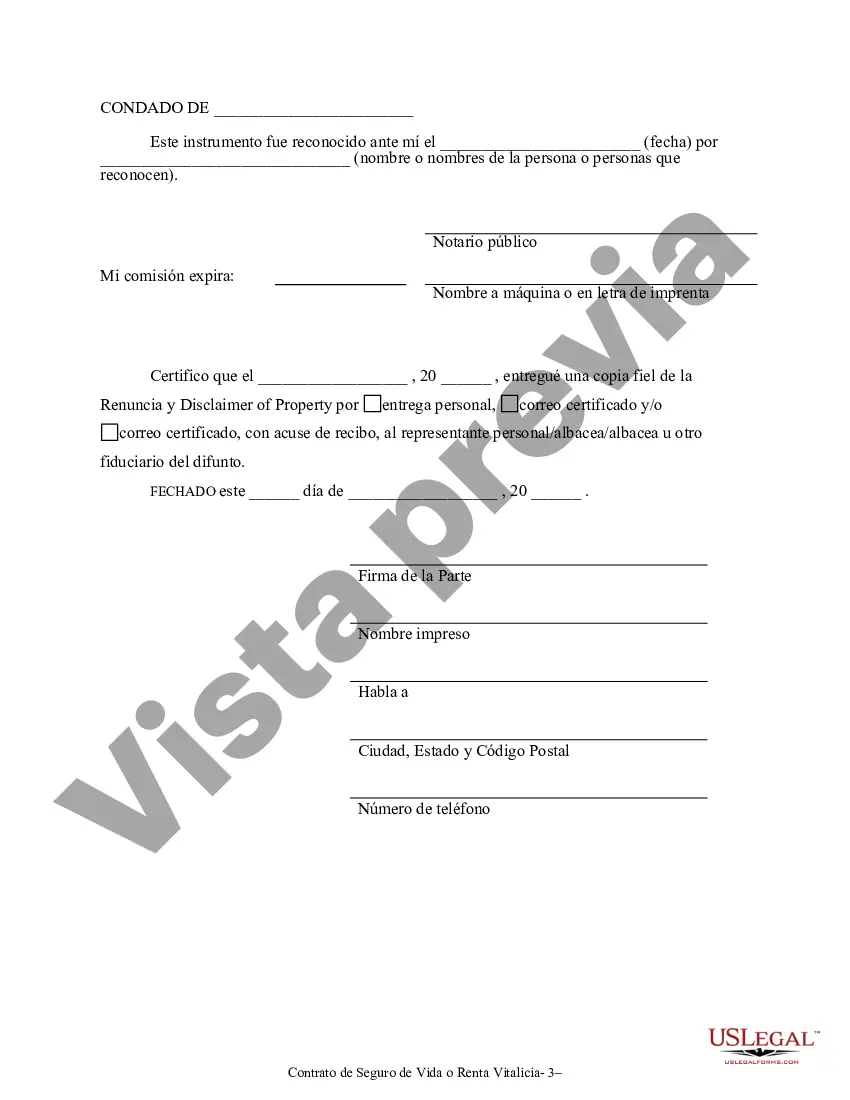

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Harris Texas Renuncia y Renuncia de Bienes del Seguro de Vida o Contrato de Renta Vitalicia - Texas Renunciation And Disclaimer of Property from Life Insurance or Annuity Contract

Description

How to fill out Harris Texas Renuncia Y Renuncia De Bienes Del Seguro De Vida O Contrato De Renta Vitalicia?

If you are looking for a relevant form template, it’s difficult to choose a more convenient platform than the US Legal Forms site – probably the most comprehensive online libraries. Here you can get thousands of form samples for business and personal purposes by categories and regions, or keywords. With the advanced search function, discovering the most recent Harris Texas Renunciation And Disclaimer of Property from Life Insurance or Annuity Contract is as easy as 1-2-3. Additionally, the relevance of each and every file is confirmed by a group of professional lawyers that regularly review the templates on our website and revise them according to the newest state and county requirements.

If you already know about our platform and have a registered account, all you should do to receive the Harris Texas Renunciation And Disclaimer of Property from Life Insurance or Annuity Contract is to log in to your profile and click the Download button.

If you utilize US Legal Forms for the first time, just follow the guidelines listed below:

- Make sure you have discovered the sample you need. Look at its explanation and make use of the Preview feature to explore its content. If it doesn’t meet your needs, use the Search field near the top of the screen to discover the needed document.

- Affirm your choice. Select the Buy now button. Following that, select the preferred pricing plan and provide credentials to sign up for an account.

- Process the financial transaction. Make use of your credit card or PayPal account to complete the registration procedure.

- Obtain the form. Indicate the file format and download it on your device.

- Make changes. Fill out, edit, print, and sign the acquired Harris Texas Renunciation And Disclaimer of Property from Life Insurance or Annuity Contract.

Every single form you add to your profile does not have an expiration date and is yours permanently. You can easily access them via the My Forms menu, so if you need to have an additional duplicate for editing or creating a hard copy, you may come back and export it once more at any time.

Take advantage of the US Legal Forms extensive catalogue to gain access to the Harris Texas Renunciation And Disclaimer of Property from Life Insurance or Annuity Contract you were seeking and thousands of other professional and state-specific samples on a single website!