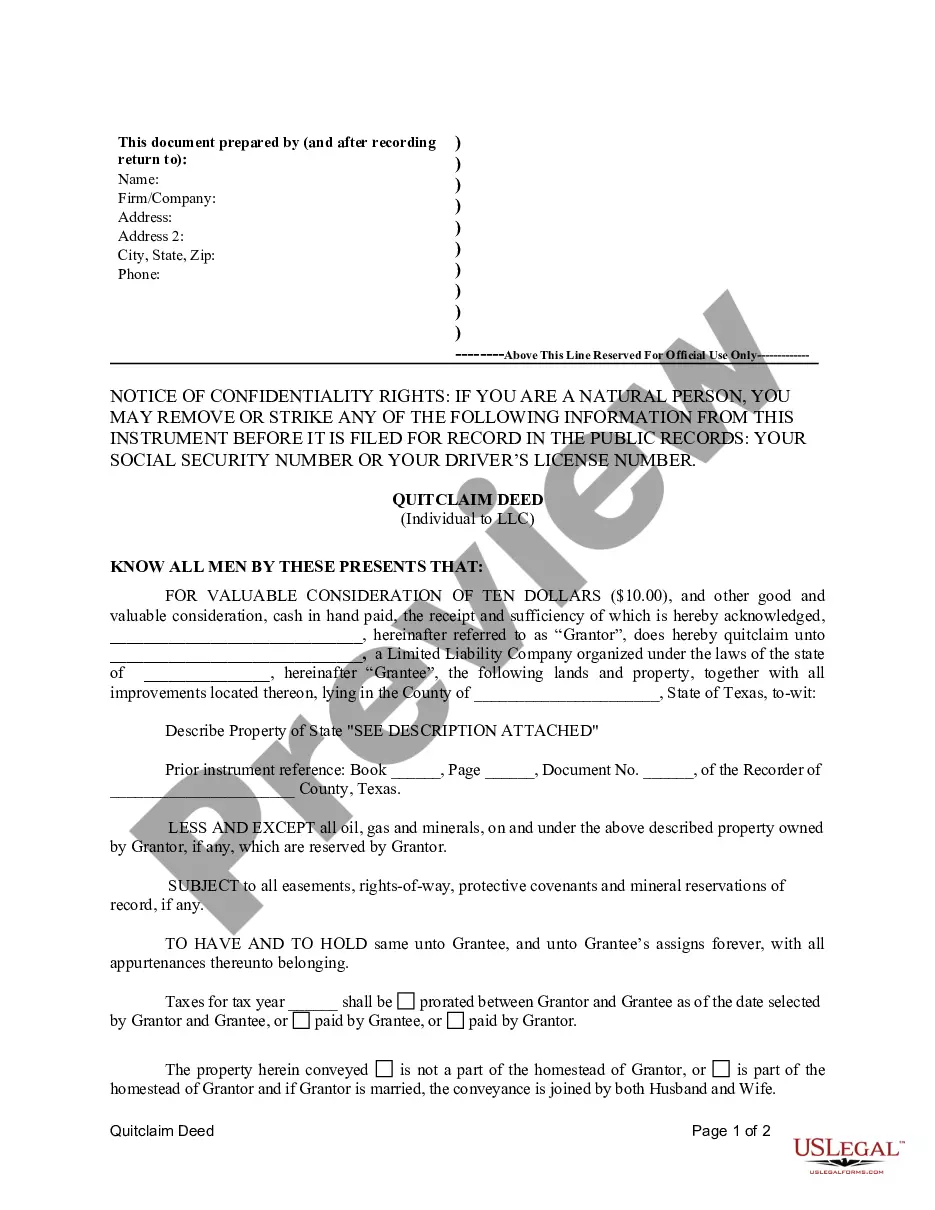

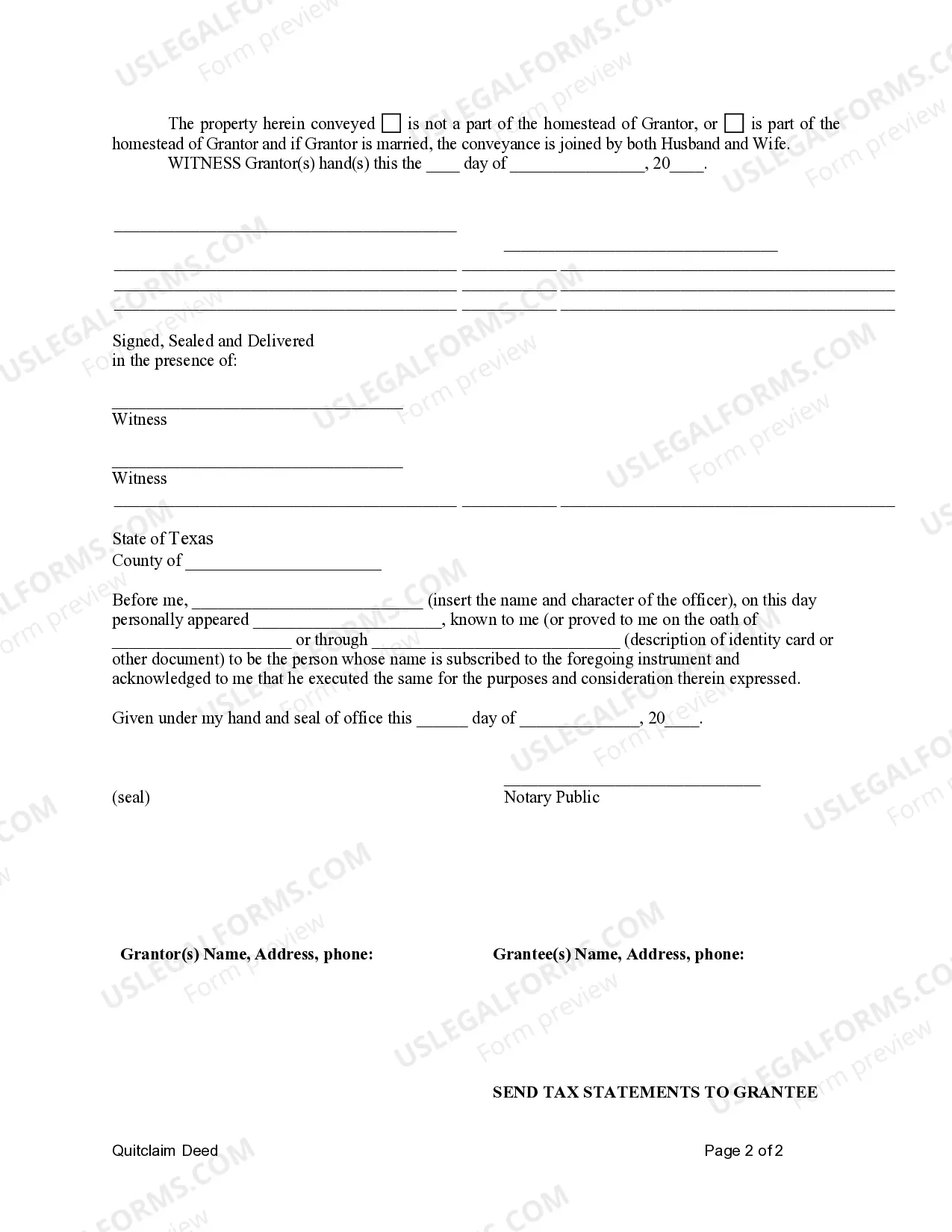

This Quitclaim Deed from Individual to LLC form is a Quitclaim Deed where the grantor is an individual and the grantee is a limited liability company. Grantor conveys and quitclaims the described property to grantee less and except all oil, gas and minerals, on and under the property owned by Grantor, if any, which are reserved by Grantor.

A Fort Worth Texas quitclaim deed from an individual to an LLC is a legal document used to transfer ownership of a property from an individual to a limited liability company (LLC) in the city of Fort Worth, Texas. This type of deed is commonly used when an individual wishes to transfer their personal property to a business entity they own or control. The quitclaim deed is a legal instrument that conveys the interest or claim that a person or party has in a property to another party. It is important to note that a quitclaim deed does not guarantee that the property is free of any liens or encumbrances. The transfer is made "as is," meaning that the individual making the transfer does not make any warranties or guarantees regarding the property's condition or title. There are different variations of the Fort Worth Texas quitclaim deed from individual to LLC, depending on specific circumstances or requirements. These variations may include: 1. Individual-to-LLC Transfer: This is the basic form of the quitclaim deed, where an individual transfers their ownership interest in a property to an LLC they own or control. This is often used when an individual desires to transfer a personal property asset into their business entity for various reasons, such as liability protection or tax benefits. 2. Transfer of Personal Residence: This specific type of quitclaim deed may be used when an individual wants to transfer their primary residence, located in Fort Worth, Texas, to an LLC that they own or control. This variation may have additional requirements or considerations compared to other types of transfers, such as compliance with Texas homestead laws and potential implications for property tax assessments. 3. Transfer of Rental Property or Investment Property: This type of quitclaim deed is used when an individual wishes to transfer a rental property or investment property in Fort Worth, Texas, to an LLC. This transfer can help separate personal and business assets, allowing for easier management and protection of the property. When preparing a Fort Worth Texas quitclaim deed from individual to LLC, it is crucial to follow the proper legal procedures and consult with an attorney experienced in real estate law. This ensures that all necessary requirements and obligations are met, and that the transfer of ownership is legal and binding. It is also important to conduct a thorough title search and due diligence to identify any potential issues or encumbrances on the property before completing the transfer.A Fort Worth Texas quitclaim deed from an individual to an LLC is a legal document used to transfer ownership of a property from an individual to a limited liability company (LLC) in the city of Fort Worth, Texas. This type of deed is commonly used when an individual wishes to transfer their personal property to a business entity they own or control. The quitclaim deed is a legal instrument that conveys the interest or claim that a person or party has in a property to another party. It is important to note that a quitclaim deed does not guarantee that the property is free of any liens or encumbrances. The transfer is made "as is," meaning that the individual making the transfer does not make any warranties or guarantees regarding the property's condition or title. There are different variations of the Fort Worth Texas quitclaim deed from individual to LLC, depending on specific circumstances or requirements. These variations may include: 1. Individual-to-LLC Transfer: This is the basic form of the quitclaim deed, where an individual transfers their ownership interest in a property to an LLC they own or control. This is often used when an individual desires to transfer a personal property asset into their business entity for various reasons, such as liability protection or tax benefits. 2. Transfer of Personal Residence: This specific type of quitclaim deed may be used when an individual wants to transfer their primary residence, located in Fort Worth, Texas, to an LLC that they own or control. This variation may have additional requirements or considerations compared to other types of transfers, such as compliance with Texas homestead laws and potential implications for property tax assessments. 3. Transfer of Rental Property or Investment Property: This type of quitclaim deed is used when an individual wishes to transfer a rental property or investment property in Fort Worth, Texas, to an LLC. This transfer can help separate personal and business assets, allowing for easier management and protection of the property. When preparing a Fort Worth Texas quitclaim deed from individual to LLC, it is crucial to follow the proper legal procedures and consult with an attorney experienced in real estate law. This ensures that all necessary requirements and obligations are met, and that the transfer of ownership is legal and binding. It is also important to conduct a thorough title search and due diligence to identify any potential issues or encumbrances on the property before completing the transfer.