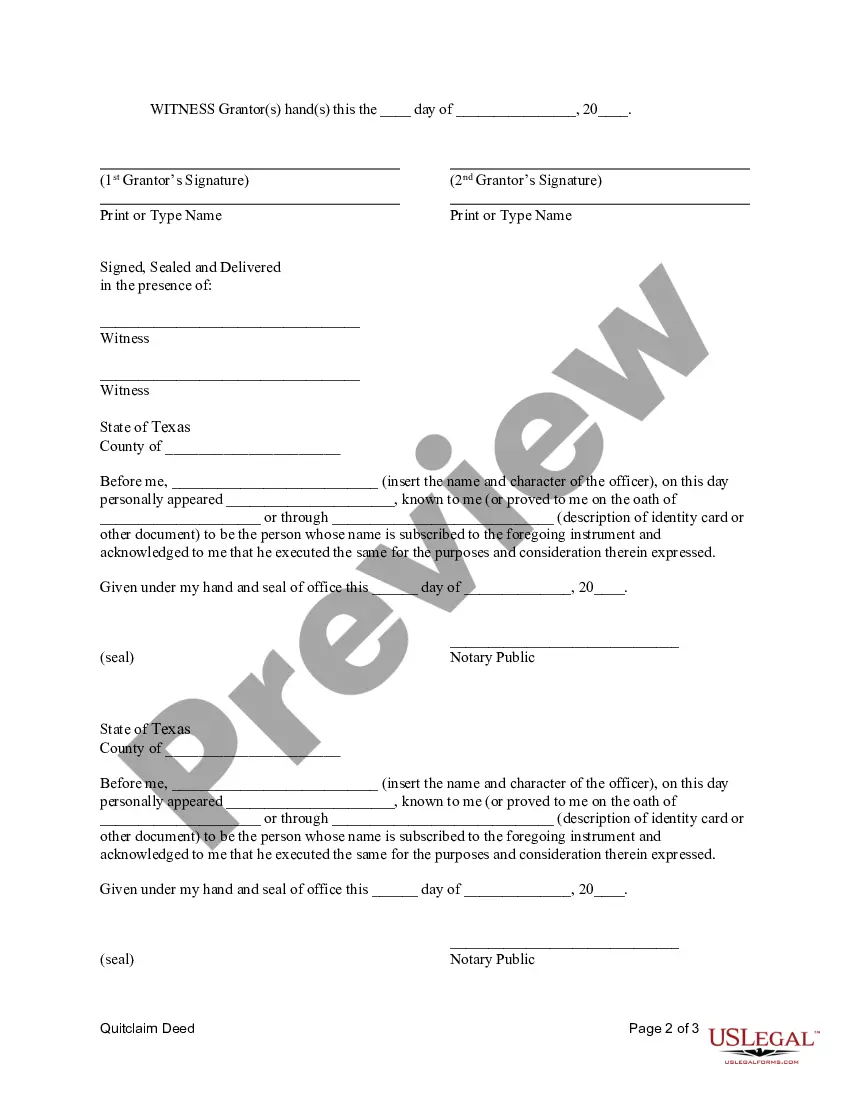

This Quitclaim Deed from Husband and Wife to Corporation form is a Quitclaim Deed where the grantors are husband and wife and the grantee is a corporation. Grantors convey and quitclaim the described property to grantees less and except all oil, gas and minerals, on and under the property owned by Grantors, if any, which are reserved by Grantors.

Abilene Texas Quitclaim Deed from Husband and Wife to Corporation is a legal document that serves as a means for transferring property ownership rights from a married couple to a corporation. This type of deed is commonly used when a husband and wife jointly own property and wish to transfer the property to a corporation they own or establish. This deed ensures a smooth transfer of ownership by releasing any ownership interest, rights, or claims the husband and wife may have on the property. It should be noted that a quitclaim deed does not provide any guarantee of clear title, and it only transfers the interest the couple has in the property at the time of transfer. There are different variations of Abilene Texas Quitclaim Deeds from Husband and Wife to Corporation, including: 1. Standard Abilene Texas Quitclaim Deed from Husband and Wife to Corporation: This is the most common type of quitclaim deed used to transfer property from a married couple to a corporation. It relinquishes the couple's interests and rights in favor of the corporation, clearly stating the intent of the transfer and the parties involved. 2. Abilene Texas Quitclaim Deed with Consideration: This type of quitclaim deed includes the exchange of consideration (money or value) between the couple and the corporation. It outlines the agreed-upon compensation for the property being transferred. 3. Abilene Texas Quitclaim Deed with Reservation of Rights: In some cases, a husband and wife may wish to transfer property to a corporation while reserving certain rights for themselves, such as the right to live on the property for a specific duration or to use certain parts of the property. This type of quitclaim deed specifies the reserved rights and their duration. 4. Abilene Texas Quitclaim Deed with Exception: This variation of the quitclaim deed is used when the couple wants to transfer the property to the corporation but exclude specific portions of the property from the transfer. The deed clearly specifies the sections or elements of the property being retained by the couple. It is essential to consult with a qualified attorney or legal professional to understand the specific requirements, legal implications, and potential tax consequences associated with the transfer of property using an Abilene Texas Quitclaim Deed from Husband and Wife to Corporation.Abilene Texas Quitclaim Deed from Husband and Wife to Corporation is a legal document that serves as a means for transferring property ownership rights from a married couple to a corporation. This type of deed is commonly used when a husband and wife jointly own property and wish to transfer the property to a corporation they own or establish. This deed ensures a smooth transfer of ownership by releasing any ownership interest, rights, or claims the husband and wife may have on the property. It should be noted that a quitclaim deed does not provide any guarantee of clear title, and it only transfers the interest the couple has in the property at the time of transfer. There are different variations of Abilene Texas Quitclaim Deeds from Husband and Wife to Corporation, including: 1. Standard Abilene Texas Quitclaim Deed from Husband and Wife to Corporation: This is the most common type of quitclaim deed used to transfer property from a married couple to a corporation. It relinquishes the couple's interests and rights in favor of the corporation, clearly stating the intent of the transfer and the parties involved. 2. Abilene Texas Quitclaim Deed with Consideration: This type of quitclaim deed includes the exchange of consideration (money or value) between the couple and the corporation. It outlines the agreed-upon compensation for the property being transferred. 3. Abilene Texas Quitclaim Deed with Reservation of Rights: In some cases, a husband and wife may wish to transfer property to a corporation while reserving certain rights for themselves, such as the right to live on the property for a specific duration or to use certain parts of the property. This type of quitclaim deed specifies the reserved rights and their duration. 4. Abilene Texas Quitclaim Deed with Exception: This variation of the quitclaim deed is used when the couple wants to transfer the property to the corporation but exclude specific portions of the property from the transfer. The deed clearly specifies the sections or elements of the property being retained by the couple. It is essential to consult with a qualified attorney or legal professional to understand the specific requirements, legal implications, and potential tax consequences associated with the transfer of property using an Abilene Texas Quitclaim Deed from Husband and Wife to Corporation.