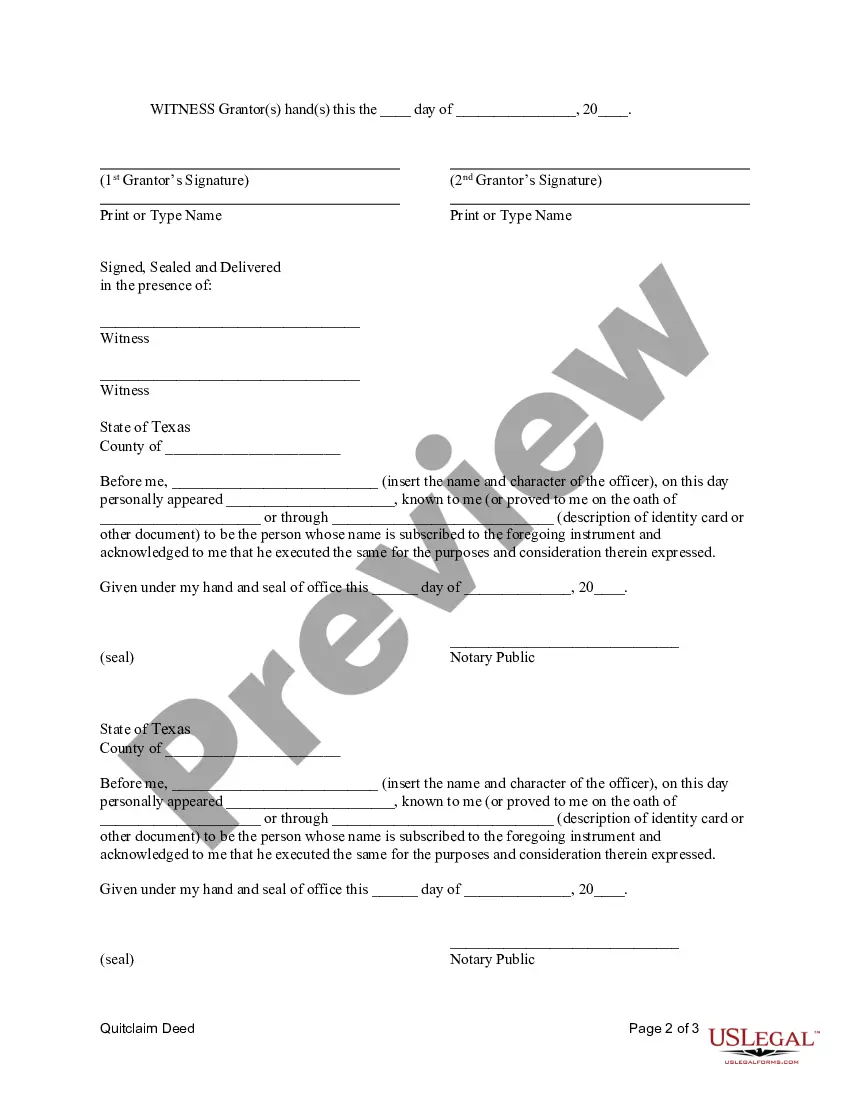

This Quitclaim Deed from Husband and Wife to Corporation form is a Quitclaim Deed where the grantors are husband and wife and the grantee is a corporation. Grantors convey and quitclaim the described property to grantees less and except all oil, gas and minerals, on and under the property owned by Grantors, if any, which are reserved by Grantors.

A Dallas Texas Quitclaim Deed from Husband and Wife to Corporation is a legally binding document that transfers the ownership of a real estate property from a married couple to a corporation. This type of deed is commonly used when a couple wishes to transfer their property into the name of their corporation for various reasons, such as tax benefits, liability protection, or business purposes. The Dallas Texas Quitclaim Deed from Husband and Wife to Corporation typically includes important information, such as the names and addresses of the husband and wife, the corporation's name, address, and any other identifying details. The deed will also contain a detailed legal description of the property being transferred, including its address, lot numbers, and boundaries. In Dallas, Texas, there are several variations of Quitclaim Deeds from Husband and Wife to Corporation, each catering to specific situations or requirements. Some examples include: 1. General Dallas Texas Quitclaim Deed from Husband and Wife to Corporation: This is the most common type of quitclaim deed, where the husband and wife transfer their property to the corporation without any warranties or guarantees of title. 2. Dallas Texas Special Warranty Quitclaim Deed from Husband and Wife to Corporation: This type of deed provides limited warranties to the corporation, assuring that the property is free from any encumbrances or claims that arose during the period of the husband and wife's ownership. 3. Dallas Texas Limited Liability Quitclaim Deed from Husband and Wife to Corporation: This variation of the quitclaim deed is specifically designed for situations where the husband and wife wish to transfer the property to their corporation while protecting their personal liability on any future claims or debts related to the property. 4. Dallas Texas Subject To Quitclaim Deed from Husband and Wife to Corporation: With this type of quitclaim deed, the husband and wife transfer the property to the corporation, but the corporation agrees to take ownership subject to any existing mortgages, liens, or encumbrances. It is important to note that the specific requirements, laws, and regulations concerning Quitclaim Deeds from Husband and Wife to Corporation may vary in different states and jurisdictions. It is always advisable to consult a qualified attorney or real estate professional to ensure compliance with local laws and to address any specific concerns or unique circumstances related to such property transfers in Dallas, Texas.A Dallas Texas Quitclaim Deed from Husband and Wife to Corporation is a legally binding document that transfers the ownership of a real estate property from a married couple to a corporation. This type of deed is commonly used when a couple wishes to transfer their property into the name of their corporation for various reasons, such as tax benefits, liability protection, or business purposes. The Dallas Texas Quitclaim Deed from Husband and Wife to Corporation typically includes important information, such as the names and addresses of the husband and wife, the corporation's name, address, and any other identifying details. The deed will also contain a detailed legal description of the property being transferred, including its address, lot numbers, and boundaries. In Dallas, Texas, there are several variations of Quitclaim Deeds from Husband and Wife to Corporation, each catering to specific situations or requirements. Some examples include: 1. General Dallas Texas Quitclaim Deed from Husband and Wife to Corporation: This is the most common type of quitclaim deed, where the husband and wife transfer their property to the corporation without any warranties or guarantees of title. 2. Dallas Texas Special Warranty Quitclaim Deed from Husband and Wife to Corporation: This type of deed provides limited warranties to the corporation, assuring that the property is free from any encumbrances or claims that arose during the period of the husband and wife's ownership. 3. Dallas Texas Limited Liability Quitclaim Deed from Husband and Wife to Corporation: This variation of the quitclaim deed is specifically designed for situations where the husband and wife wish to transfer the property to their corporation while protecting their personal liability on any future claims or debts related to the property. 4. Dallas Texas Subject To Quitclaim Deed from Husband and Wife to Corporation: With this type of quitclaim deed, the husband and wife transfer the property to the corporation, but the corporation agrees to take ownership subject to any existing mortgages, liens, or encumbrances. It is important to note that the specific requirements, laws, and regulations concerning Quitclaim Deeds from Husband and Wife to Corporation may vary in different states and jurisdictions. It is always advisable to consult a qualified attorney or real estate professional to ensure compliance with local laws and to address any specific concerns or unique circumstances related to such property transfers in Dallas, Texas.