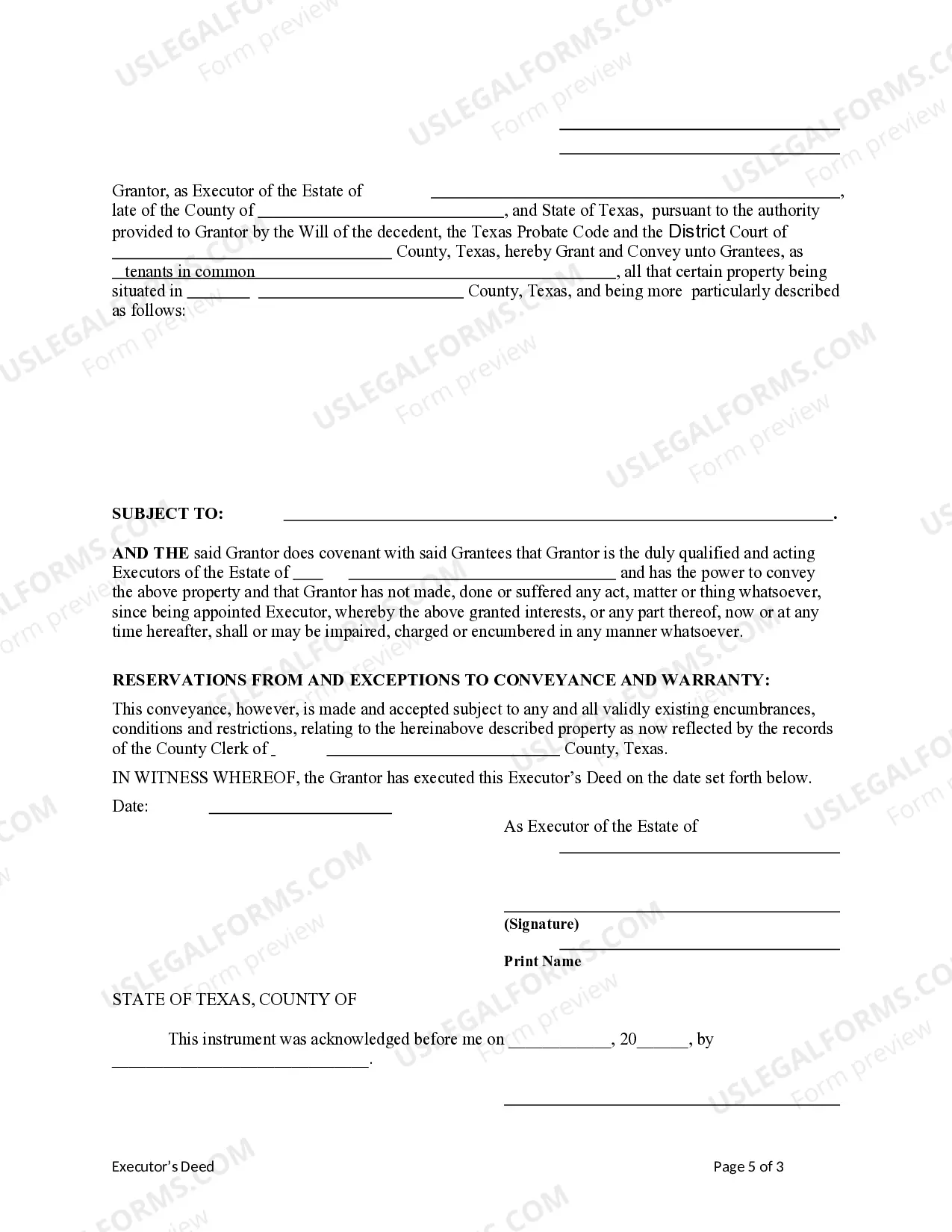

This form is an Executor's Deed where the Grantor is the executor of an estate and the Grantees are the beneficiaries or heirs of the estate. Grantor conveys the described property to the Grantees. This deed complies with all state statutory laws.

Title: Understanding Frisco Texas Executor's Deed — Estate to Five Beneficiaries: Types, Process & Key Considerations Introduction: In Frisco, Texas, the Executor's Deed — Estate to Five Beneficiaries is a legal instrument that allows executors to transfer ownership of a deceased person's property to multiple beneficiaries. This detailed guide aims to provide insights into the different types of executor's deeds available, the process involved, and important considerations. Types of Frisco Texas Executor's Deed — Estate to Five Beneficiaries: 1. General Executor's Deed: This type of deed is commonly used when the deceased individual has left a valid will, specifying the distribution of assets to multiple beneficiaries. The executor, appointed in the will itself, is authorized to transfer the property to the designated beneficiaries accordingly. 2. Independent Executor's Deed: When an independent executor is appointed by the deceased individual, this type of deed allows the property to be transferred to five beneficiaries without having to satisfy the court overseeing the probate process. This promotes a more efficient transfer of assets while ensuring the executor's fiduciary responsibilities are upheld. 3. Sale Executor's Deed: In situations where the property needs to be sold to divide the proceeds among the five beneficiaries, a sale executor's deed becomes necessary. This type of deed enables the executor to legally execute the sale of the property and distribute the proceeds among the beneficiaries as stipulated in the deceased person's will. 4. Partial Interests Executor's Deed: If the deceased person owned property with multiple co-owners, this type of executor's deed allows the executor to transfer the deceased individual's partial interest in the property to five beneficiaries while preserving the co-ownership structure. 5. Trust Property Executor's Deed: When property is owned by a trust and named as part of the estate, the executor's deed allows the transfer of ownership to the five beneficiaries as specified in the trust document. This type of deed helps ensure a smooth transfer of trust property and adherence to the trust's distribution guidelines. Process for Frisco Texas Executor's Deed — Estate to Five Beneficiaries: 1. Petition for Probate: The executor must file a petition with the local court to initiate probate proceedings. This involves providing necessary documentation, including the will, death certificate, and relevant estate information. 2. Court Appointment: Upon review of the petition, the court will appoint the executor as legally responsible for administering the estate and overseeing the property transfer process to the five beneficiaries. 3. Property Valuation: The executor is required to conduct a thorough valuation of the deceased person's property to accurately determine its worth and facilitate equitable distribution among the beneficiaries. 4. Title Search & Clearing: A title search is conducted to ensure there are no liens, encumbrances, or legal issues that could hinder the transfer of property to the beneficiaries. Necessary steps are taken to clear any identified issues. 5. Preparing the Executor's Deed: With the necessary documentation and court approval in place, the executor prepares the executor's deed, accurately reflecting the precise distribution of the property to the five beneficiaries. 6. Decoration & Distribution: The executed executor's deed is recorded with the appropriate county office to officially transfer ownership to the beneficiaries. The executor is then responsible for distributing the property or sale proceeds as outlined in the deed. Key Considerations for Frisco Texas Executor's Deed — Estate to Five Beneficiaries: 1. Executor Responsibilities: The executor has a fiduciary duty to act in the best interest of the estate and its beneficiaries. This includes impartially following the deceased person's wishes and ensuring proper valuation and distribution of assets. 2. Legal Guidance: Executors should seek professional legal advice to navigate the complex probate process, comply with state laws, and mitigate potential disputes among beneficiaries. 3. Taxes and Other Costs: Executors must account for any tax liabilities, outstanding debts, or other expenses that may arise during the probate process. These obligations should be addressed before distributing assets to the five beneficiaries. 4. Beneficiary Communication: Maintaining open and clear communication with the beneficiaries throughout the executor's deed process can help manage expectations and minimize potential conflicts. Conclusion: The Frisco Texas Executor's Deed — Estate to Five Beneficiaries serves as a crucial legal document for transferring property ownership from a deceased person to multiple beneficiaries. By understanding the various types of executor's deeds available, the process involved, and important considerations, executors can ensure a smooth and legally compliant distribution of assets. Seeking professional guidance remains essential to navigate the intricacies of the probate process in Frisco, Texas.Title: Understanding Frisco Texas Executor's Deed — Estate to Five Beneficiaries: Types, Process & Key Considerations Introduction: In Frisco, Texas, the Executor's Deed — Estate to Five Beneficiaries is a legal instrument that allows executors to transfer ownership of a deceased person's property to multiple beneficiaries. This detailed guide aims to provide insights into the different types of executor's deeds available, the process involved, and important considerations. Types of Frisco Texas Executor's Deed — Estate to Five Beneficiaries: 1. General Executor's Deed: This type of deed is commonly used when the deceased individual has left a valid will, specifying the distribution of assets to multiple beneficiaries. The executor, appointed in the will itself, is authorized to transfer the property to the designated beneficiaries accordingly. 2. Independent Executor's Deed: When an independent executor is appointed by the deceased individual, this type of deed allows the property to be transferred to five beneficiaries without having to satisfy the court overseeing the probate process. This promotes a more efficient transfer of assets while ensuring the executor's fiduciary responsibilities are upheld. 3. Sale Executor's Deed: In situations where the property needs to be sold to divide the proceeds among the five beneficiaries, a sale executor's deed becomes necessary. This type of deed enables the executor to legally execute the sale of the property and distribute the proceeds among the beneficiaries as stipulated in the deceased person's will. 4. Partial Interests Executor's Deed: If the deceased person owned property with multiple co-owners, this type of executor's deed allows the executor to transfer the deceased individual's partial interest in the property to five beneficiaries while preserving the co-ownership structure. 5. Trust Property Executor's Deed: When property is owned by a trust and named as part of the estate, the executor's deed allows the transfer of ownership to the five beneficiaries as specified in the trust document. This type of deed helps ensure a smooth transfer of trust property and adherence to the trust's distribution guidelines. Process for Frisco Texas Executor's Deed — Estate to Five Beneficiaries: 1. Petition for Probate: The executor must file a petition with the local court to initiate probate proceedings. This involves providing necessary documentation, including the will, death certificate, and relevant estate information. 2. Court Appointment: Upon review of the petition, the court will appoint the executor as legally responsible for administering the estate and overseeing the property transfer process to the five beneficiaries. 3. Property Valuation: The executor is required to conduct a thorough valuation of the deceased person's property to accurately determine its worth and facilitate equitable distribution among the beneficiaries. 4. Title Search & Clearing: A title search is conducted to ensure there are no liens, encumbrances, or legal issues that could hinder the transfer of property to the beneficiaries. Necessary steps are taken to clear any identified issues. 5. Preparing the Executor's Deed: With the necessary documentation and court approval in place, the executor prepares the executor's deed, accurately reflecting the precise distribution of the property to the five beneficiaries. 6. Decoration & Distribution: The executed executor's deed is recorded with the appropriate county office to officially transfer ownership to the beneficiaries. The executor is then responsible for distributing the property or sale proceeds as outlined in the deed. Key Considerations for Frisco Texas Executor's Deed — Estate to Five Beneficiaries: 1. Executor Responsibilities: The executor has a fiduciary duty to act in the best interest of the estate and its beneficiaries. This includes impartially following the deceased person's wishes and ensuring proper valuation and distribution of assets. 2. Legal Guidance: Executors should seek professional legal advice to navigate the complex probate process, comply with state laws, and mitigate potential disputes among beneficiaries. 3. Taxes and Other Costs: Executors must account for any tax liabilities, outstanding debts, or other expenses that may arise during the probate process. These obligations should be addressed before distributing assets to the five beneficiaries. 4. Beneficiary Communication: Maintaining open and clear communication with the beneficiaries throughout the executor's deed process can help manage expectations and minimize potential conflicts. Conclusion: The Frisco Texas Executor's Deed — Estate to Five Beneficiaries serves as a crucial legal document for transferring property ownership from a deceased person to multiple beneficiaries. By understanding the various types of executor's deeds available, the process involved, and important considerations, executors can ensure a smooth and legally compliant distribution of assets. Seeking professional guidance remains essential to navigate the intricacies of the probate process in Frisco, Texas.