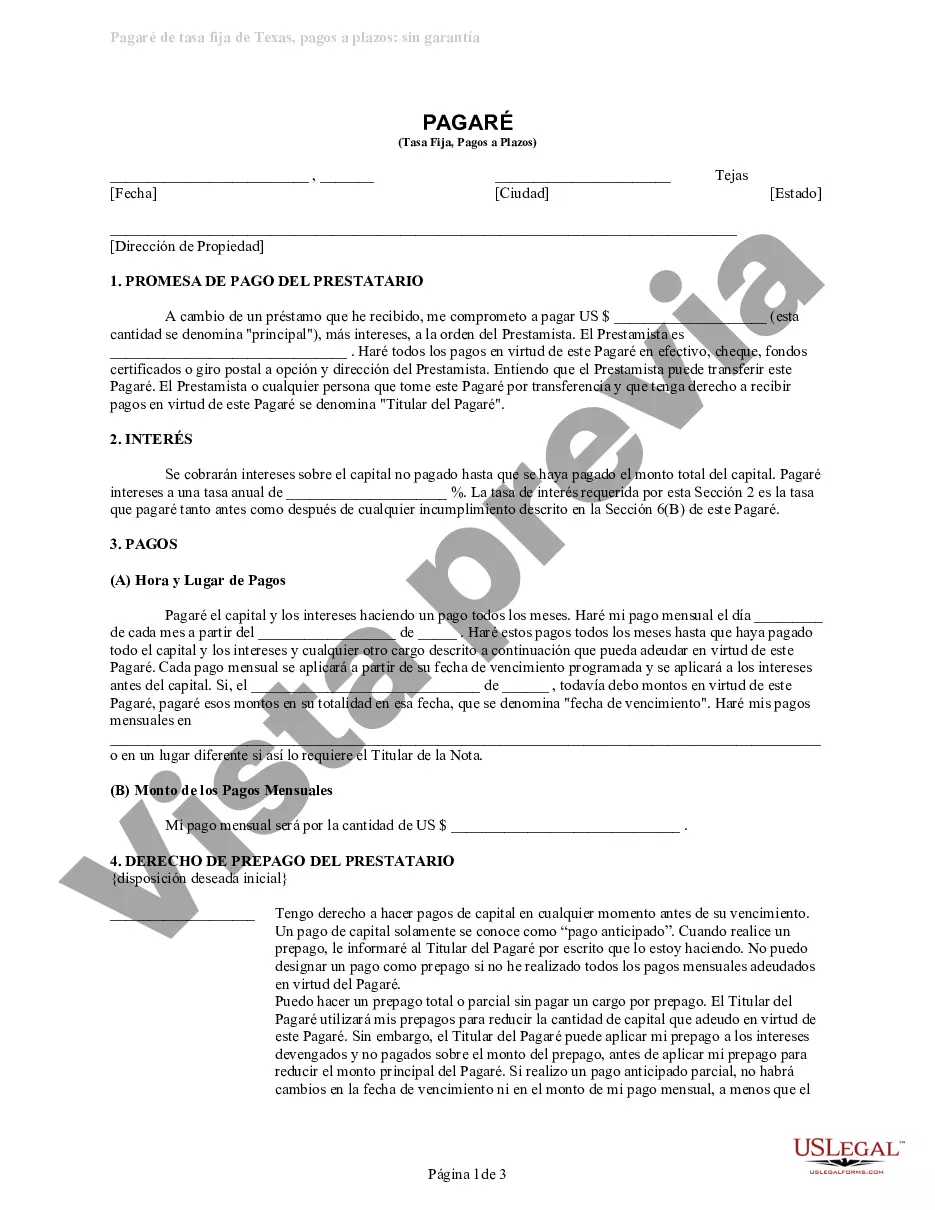

This detailed sample Promissory Note complies with Texas law. Adapt the language to fit your facts and circumstances. Available in Word and Rich Text formats.

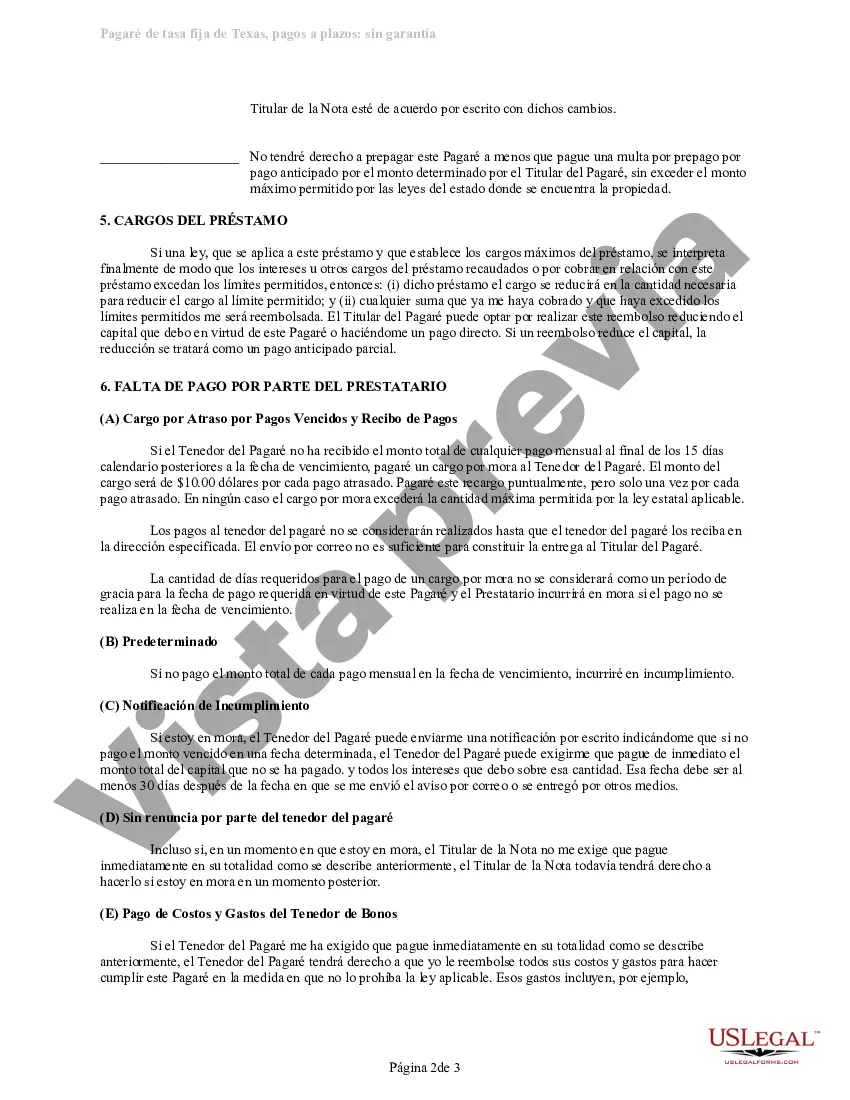

College Station, Texas Unsecured Promissory Note with Installment Payments — Fixed Rat— - Personal Signature Loan: Exploring Financial Options If you're seeking financial assistance in College Station, Texas, an Unsecured Promissory Note with Installment Payments — Fixed Rat— - Personal Signature Loan stands as a viable choice. With this type of loan, individuals can access funds without offering collateral, showcasing the convenience and flexibility it provides. Whether you need to cover education expenses, consolidate existing debts, or fulfill personal requirements, this loan caters to your specific needs. Different variations of the College Station, Texas Unsecured Promissory Note with Installment Payments — Fixed Rat— - Personal Signature Loan include: 1. College Station, Texas Unsecured Promissory Note with Monthly Installments: This option allows borrowers to repay the loan amount in equal monthly installments that remain consistent for the entire loan term. This structure ensures easier financial planning and management. 2. College Station, Texas Unsecured Promissory Note with Bi-monthly Installments: With this type of loan, borrowers make payments every two weeks. This accelerated payment frequency helps individuals repay the loan faster while reducing overall interest costs. 3. College Station, Texas Unsecured Promissory Note with Quarterly Installments: Ideal for borrowers who prefer extended repayment intervals, this loan option requires payments on a quarterly basis. It provides greater flexibility for those with irregular income streams or seasonal financial fluctuations. 4. College Station, Texas Unsecured Promissory Note with Semi-annual Installments: Designed for individuals who receive income semi-annually, this loan option grants borrowers the convenience of making payments every six months. This structure aligns with their financial capabilities and eases budget planning. Whether you opt for the monthly, bi-monthly, quarterly, or semi-annual installment payment plan, the interest rate remains fixed throughout the loan tenure. This stability gives borrowers peace of mind, as they don't have to worry about sudden fluctuations in their repayment obligations. Since this loan is a personal signature loan, the only requirement for eligibility is a signature as a form of commitment. No collateral is needed, making it an excellent choice for individuals who lack assets or prefer not to risk their possessions. To acquire this loan in College Station, Texas, approach reputable financial institutions or credit unions that offer personal loan products. They will guide you through the application process, assess your creditworthiness, and determine the loan amount and interest rate that best suit your financial profile. In conclusion, the College Station, Texas Unsecured Promissory Note with Installment Payments — Fixed Rat— - Personal Signature Loan presents a flexible and convenient financial solution. Its various installment plans offer tailored options to borrowers' distinct repayment preferences, ensuring its suitability for a wide range of needs. Consider exploring this loan option to address your financial requirements in College Station, Texas, today.College Station, Texas Unsecured Promissory Note with Installment Payments — Fixed Rat— - Personal Signature Loan: Exploring Financial Options If you're seeking financial assistance in College Station, Texas, an Unsecured Promissory Note with Installment Payments — Fixed Rat— - Personal Signature Loan stands as a viable choice. With this type of loan, individuals can access funds without offering collateral, showcasing the convenience and flexibility it provides. Whether you need to cover education expenses, consolidate existing debts, or fulfill personal requirements, this loan caters to your specific needs. Different variations of the College Station, Texas Unsecured Promissory Note with Installment Payments — Fixed Rat— - Personal Signature Loan include: 1. College Station, Texas Unsecured Promissory Note with Monthly Installments: This option allows borrowers to repay the loan amount in equal monthly installments that remain consistent for the entire loan term. This structure ensures easier financial planning and management. 2. College Station, Texas Unsecured Promissory Note with Bi-monthly Installments: With this type of loan, borrowers make payments every two weeks. This accelerated payment frequency helps individuals repay the loan faster while reducing overall interest costs. 3. College Station, Texas Unsecured Promissory Note with Quarterly Installments: Ideal for borrowers who prefer extended repayment intervals, this loan option requires payments on a quarterly basis. It provides greater flexibility for those with irregular income streams or seasonal financial fluctuations. 4. College Station, Texas Unsecured Promissory Note with Semi-annual Installments: Designed for individuals who receive income semi-annually, this loan option grants borrowers the convenience of making payments every six months. This structure aligns with their financial capabilities and eases budget planning. Whether you opt for the monthly, bi-monthly, quarterly, or semi-annual installment payment plan, the interest rate remains fixed throughout the loan tenure. This stability gives borrowers peace of mind, as they don't have to worry about sudden fluctuations in their repayment obligations. Since this loan is a personal signature loan, the only requirement for eligibility is a signature as a form of commitment. No collateral is needed, making it an excellent choice for individuals who lack assets or prefer not to risk their possessions. To acquire this loan in College Station, Texas, approach reputable financial institutions or credit unions that offer personal loan products. They will guide you through the application process, assess your creditworthiness, and determine the loan amount and interest rate that best suit your financial profile. In conclusion, the College Station, Texas Unsecured Promissory Note with Installment Payments — Fixed Rat— - Personal Signature Loan presents a flexible and convenient financial solution. Its various installment plans offer tailored options to borrowers' distinct repayment preferences, ensuring its suitability for a wide range of needs. Consider exploring this loan option to address your financial requirements in College Station, Texas, today.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.