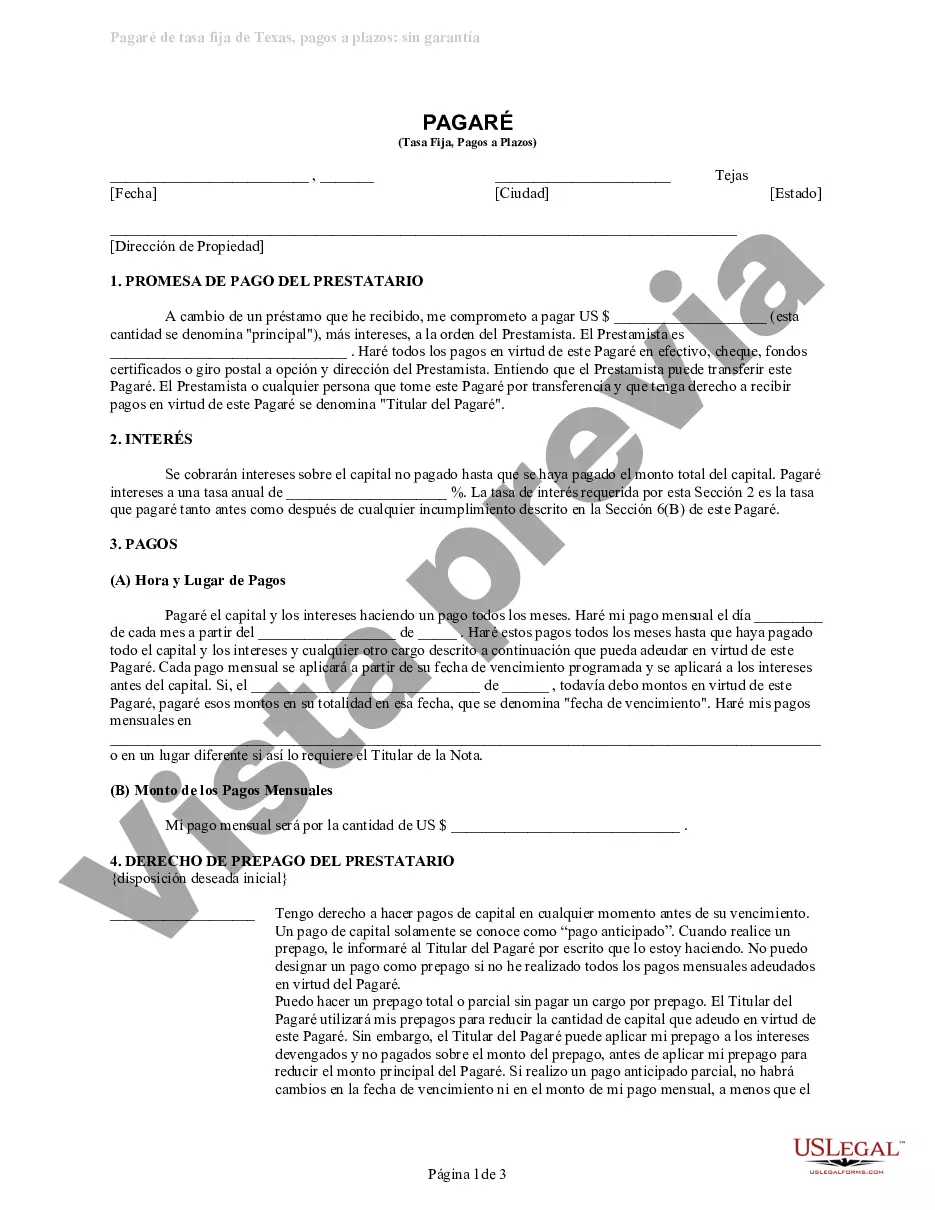

This detailed sample Promissory Note complies with Texas law. Adapt the language to fit your facts and circumstances. Available in Word and Rich Text formats.

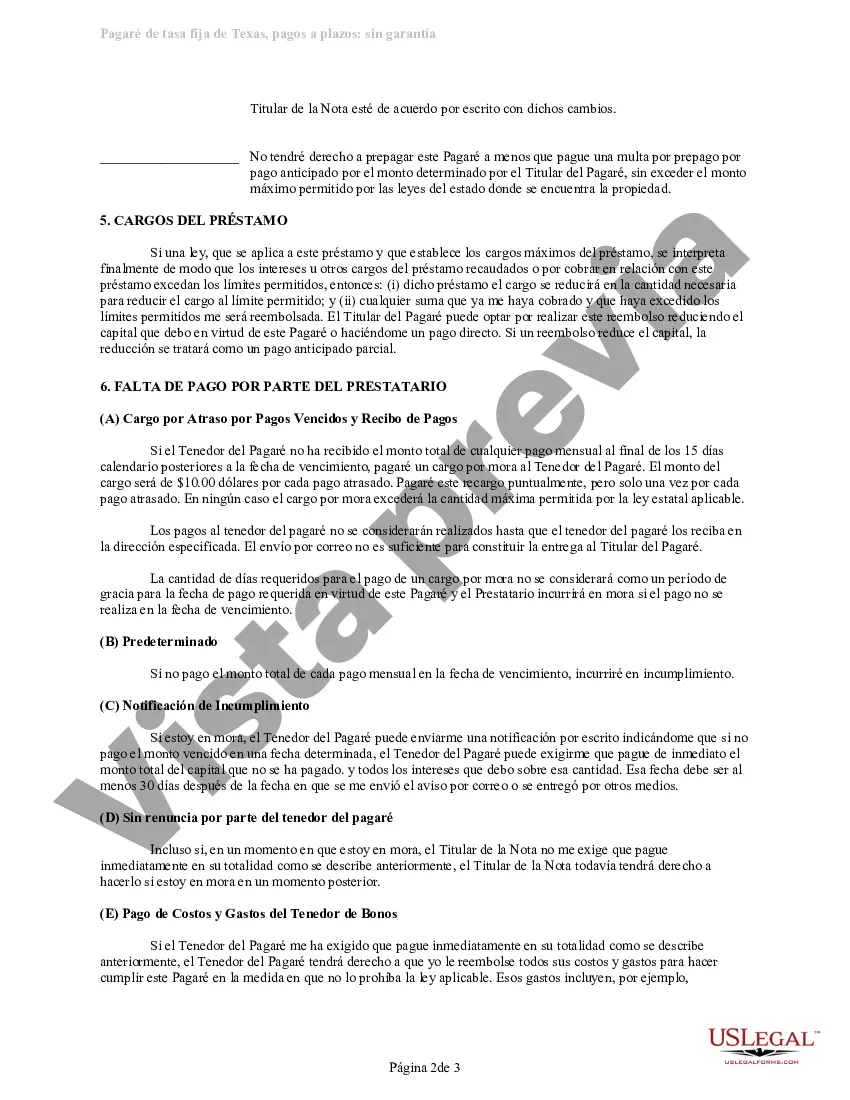

A Fort Worth Texas Unsecured Promissory Note with Installment Payments — Fixed Rat— - Personal Signature Loan is a legally binding document between a lender and a borrower in Fort Worth, Texas. This type of loan does not require any collateral to secure the loan, making it unsecured. The borrower agrees to repay the loan amount along with interest in regular installment payments over a specified period of time. Keywords: 1. Fort Worth Texas: This specifies the geographical location where the loan is originated, ensuring compliance with local laws and regulations. 2. Unsecured Promissory Note: This emphasizes that no collateral is required to secure the loan, making it solely based on the borrower's creditworthiness. 3. Installment Payments: This specifies that the loan will be repaid in regular, fixed payments over a scheduled period, generally monthly. 4. Fixed Rate: This implies that the interest rate on the loan remains constant throughout the repayment period, ensuring predictability for both parties involved. 5. Personal Signature Loan: This highlights that the loan is based solely on the borrower's personal creditworthiness and signature, without any need for co-signers or additional guarantees. Different types of Fort Worth Texas Unsecured Promissory Note with Installment Payments — Fixed Rat— - Personal Signature Loan may include varying terms and conditions, such as: 1. Loan Amount: The specific amount of money borrowed by the borrower, which may vary depending on individual circumstances. 2. Interest Rate: The fixed percentage rate at which interest will accrue on the loan amount over time. 3. Repayment Term: The duration within which the borrower is expected to fully repay the loan, which can vary from a few months to several years. 4. Late Payment Fees and Penalties: Specifies charges that may be incurred if the borrower fails to make timely payments. 5. Default Provisions: Outlines the lender's rights and actions in case of loan default, which may include demanding immediate repayment or legal actions. It's important for both the lender and borrower to carefully review and understand the terms and conditions of the Fort Worth Texas Unsecured Promissory Note with Installment Payments — Fixed Rat— - Personal Signature Loan before signing to ensure clarity and mutual agreement.A Fort Worth Texas Unsecured Promissory Note with Installment Payments — Fixed Rat— - Personal Signature Loan is a legally binding document between a lender and a borrower in Fort Worth, Texas. This type of loan does not require any collateral to secure the loan, making it unsecured. The borrower agrees to repay the loan amount along with interest in regular installment payments over a specified period of time. Keywords: 1. Fort Worth Texas: This specifies the geographical location where the loan is originated, ensuring compliance with local laws and regulations. 2. Unsecured Promissory Note: This emphasizes that no collateral is required to secure the loan, making it solely based on the borrower's creditworthiness. 3. Installment Payments: This specifies that the loan will be repaid in regular, fixed payments over a scheduled period, generally monthly. 4. Fixed Rate: This implies that the interest rate on the loan remains constant throughout the repayment period, ensuring predictability for both parties involved. 5. Personal Signature Loan: This highlights that the loan is based solely on the borrower's personal creditworthiness and signature, without any need for co-signers or additional guarantees. Different types of Fort Worth Texas Unsecured Promissory Note with Installment Payments — Fixed Rat— - Personal Signature Loan may include varying terms and conditions, such as: 1. Loan Amount: The specific amount of money borrowed by the borrower, which may vary depending on individual circumstances. 2. Interest Rate: The fixed percentage rate at which interest will accrue on the loan amount over time. 3. Repayment Term: The duration within which the borrower is expected to fully repay the loan, which can vary from a few months to several years. 4. Late Payment Fees and Penalties: Specifies charges that may be incurred if the borrower fails to make timely payments. 5. Default Provisions: Outlines the lender's rights and actions in case of loan default, which may include demanding immediate repayment or legal actions. It's important for both the lender and borrower to carefully review and understand the terms and conditions of the Fort Worth Texas Unsecured Promissory Note with Installment Payments — Fixed Rat— - Personal Signature Loan before signing to ensure clarity and mutual agreement.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.