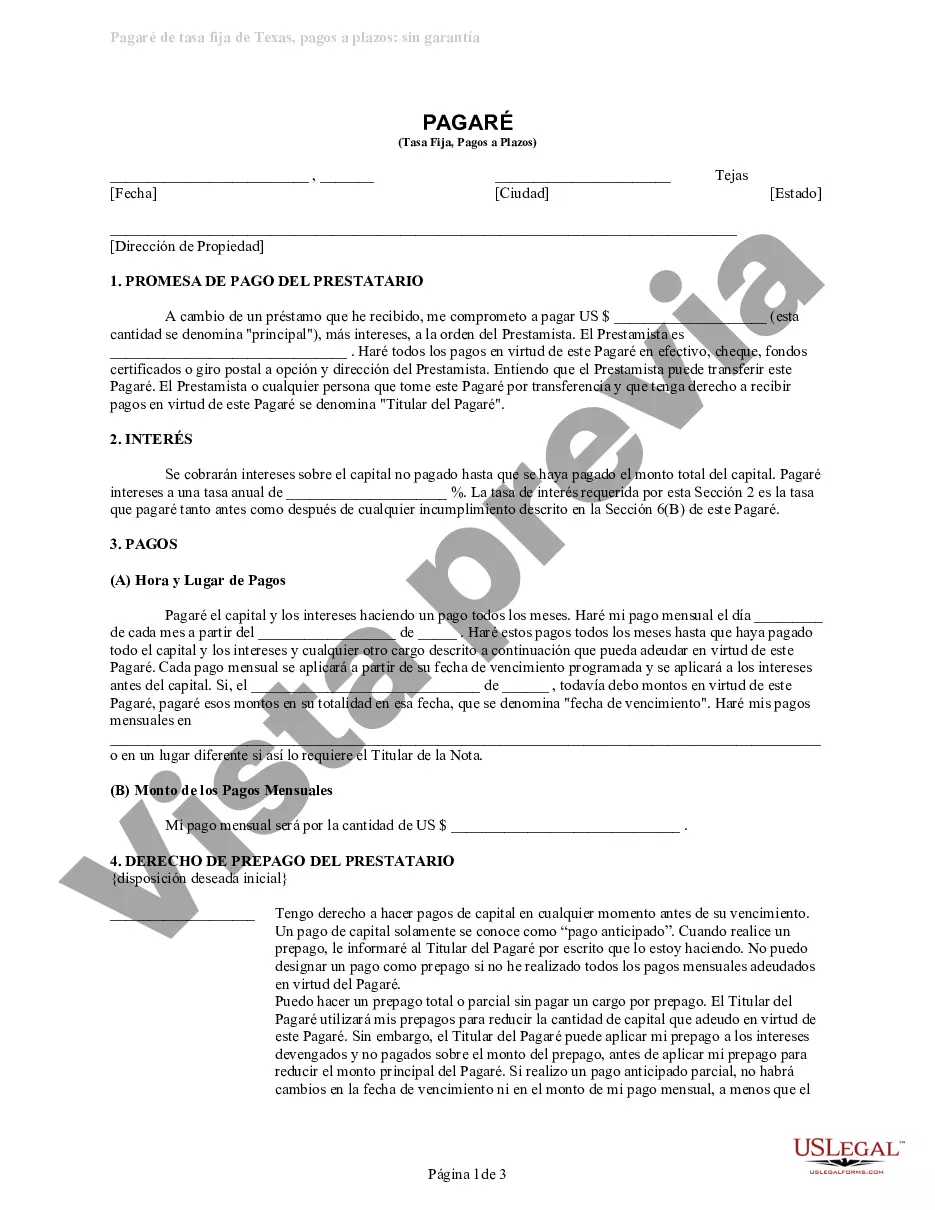

This detailed sample Promissory Note complies with Texas law. Adapt the language to fit your facts and circumstances. Available in Word and Rich Text formats.

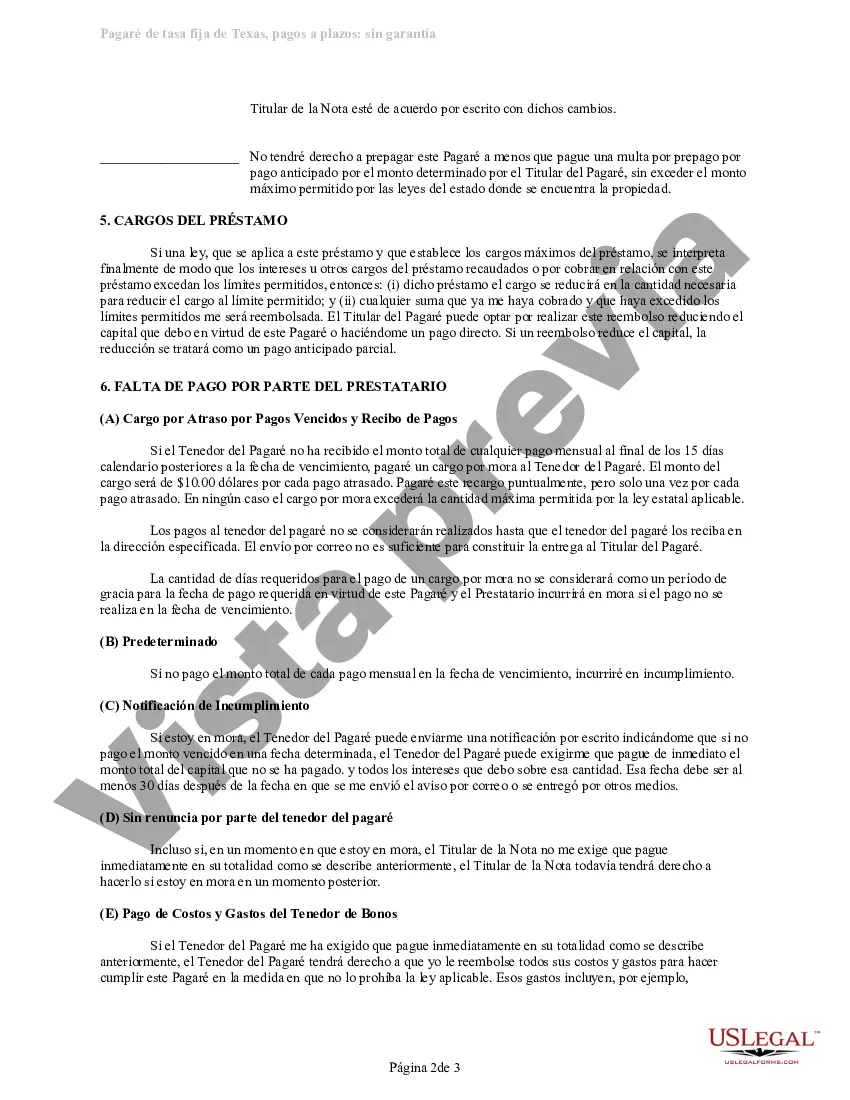

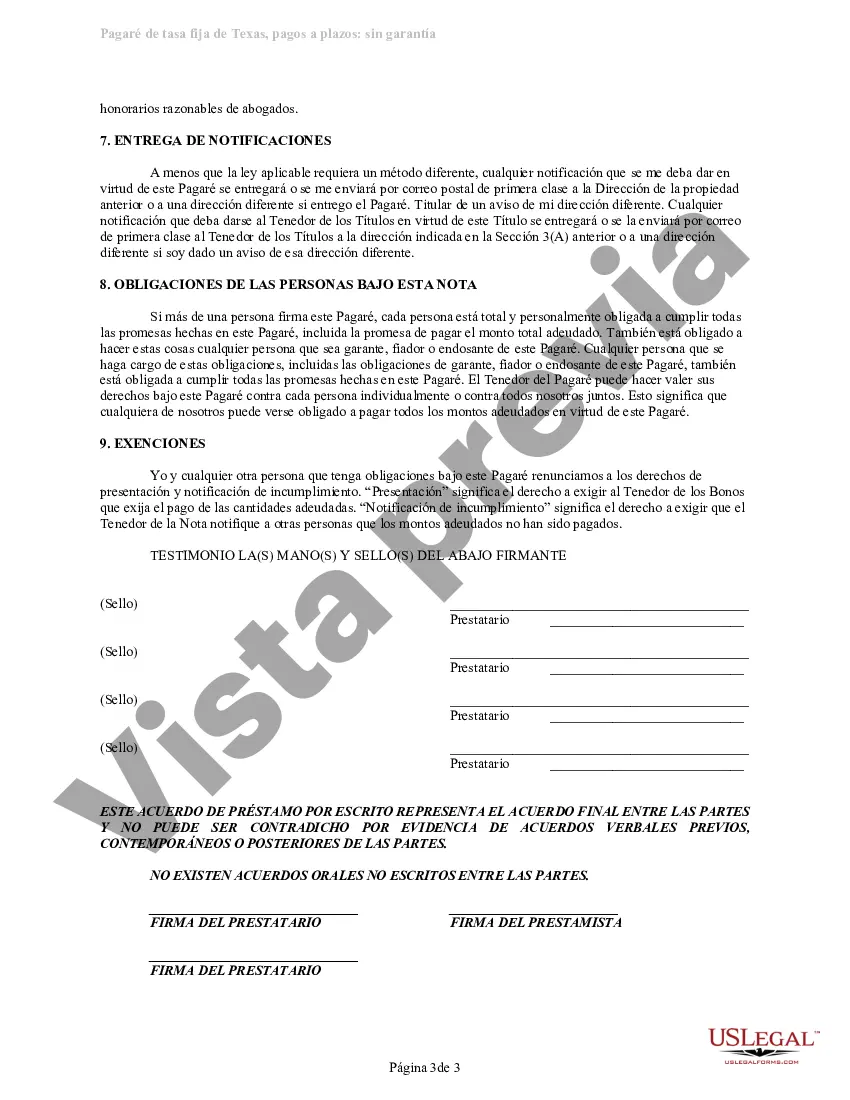

A Houston Texas Unsecured Promissory Note with Installment Payments — Fixed Rat— - Personal Signature Loan is a legally binding agreement between a lender and a borrower in Houston, Texas. This type of promissory note is designed for personal loans that do not require any collateral or security. The main feature of this promissory note is that it outlines the specific terms and conditions of the loan, including the principal amount borrowed, the fixed interest rate, the repayment period, and the installment payment schedule. The borrower agrees to make regular payments to the lender over a predetermined period until the entire loan amount, along with the accrued interest, is repaid in full. The fixed interest rate means that the rate charged on the loan remains constant throughout the repayment period. This provides stability to both the lender and the borrower, as neither party has to worry about fluctuations in interest rates. The borrower's personal signature serves as a guarantee of their commitment to repay the loan according to the agreed-upon terms. As there is no collateral involved, the lender relies solely on the borrower's creditworthiness and trustworthiness. Different types of Houston Texas Unsecured Promissory Note with Installment Payments — Fixed Rat— - Personal Signature Loan may include variations in repayment terms (such as the number of installments or the frequency of payments) or adjustments in interest rates based on certain factors like credit score or income level. Overall, this type of promissory note provides a straightforward and accessible borrowing option for individuals in Houston, Texas, allowing them to obtain personal loans without the need for collateral or security.A Houston Texas Unsecured Promissory Note with Installment Payments — Fixed Rat— - Personal Signature Loan is a legally binding agreement between a lender and a borrower in Houston, Texas. This type of promissory note is designed for personal loans that do not require any collateral or security. The main feature of this promissory note is that it outlines the specific terms and conditions of the loan, including the principal amount borrowed, the fixed interest rate, the repayment period, and the installment payment schedule. The borrower agrees to make regular payments to the lender over a predetermined period until the entire loan amount, along with the accrued interest, is repaid in full. The fixed interest rate means that the rate charged on the loan remains constant throughout the repayment period. This provides stability to both the lender and the borrower, as neither party has to worry about fluctuations in interest rates. The borrower's personal signature serves as a guarantee of their commitment to repay the loan according to the agreed-upon terms. As there is no collateral involved, the lender relies solely on the borrower's creditworthiness and trustworthiness. Different types of Houston Texas Unsecured Promissory Note with Installment Payments — Fixed Rat— - Personal Signature Loan may include variations in repayment terms (such as the number of installments or the frequency of payments) or adjustments in interest rates based on certain factors like credit score or income level. Overall, this type of promissory note provides a straightforward and accessible borrowing option for individuals in Houston, Texas, allowing them to obtain personal loans without the need for collateral or security.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.