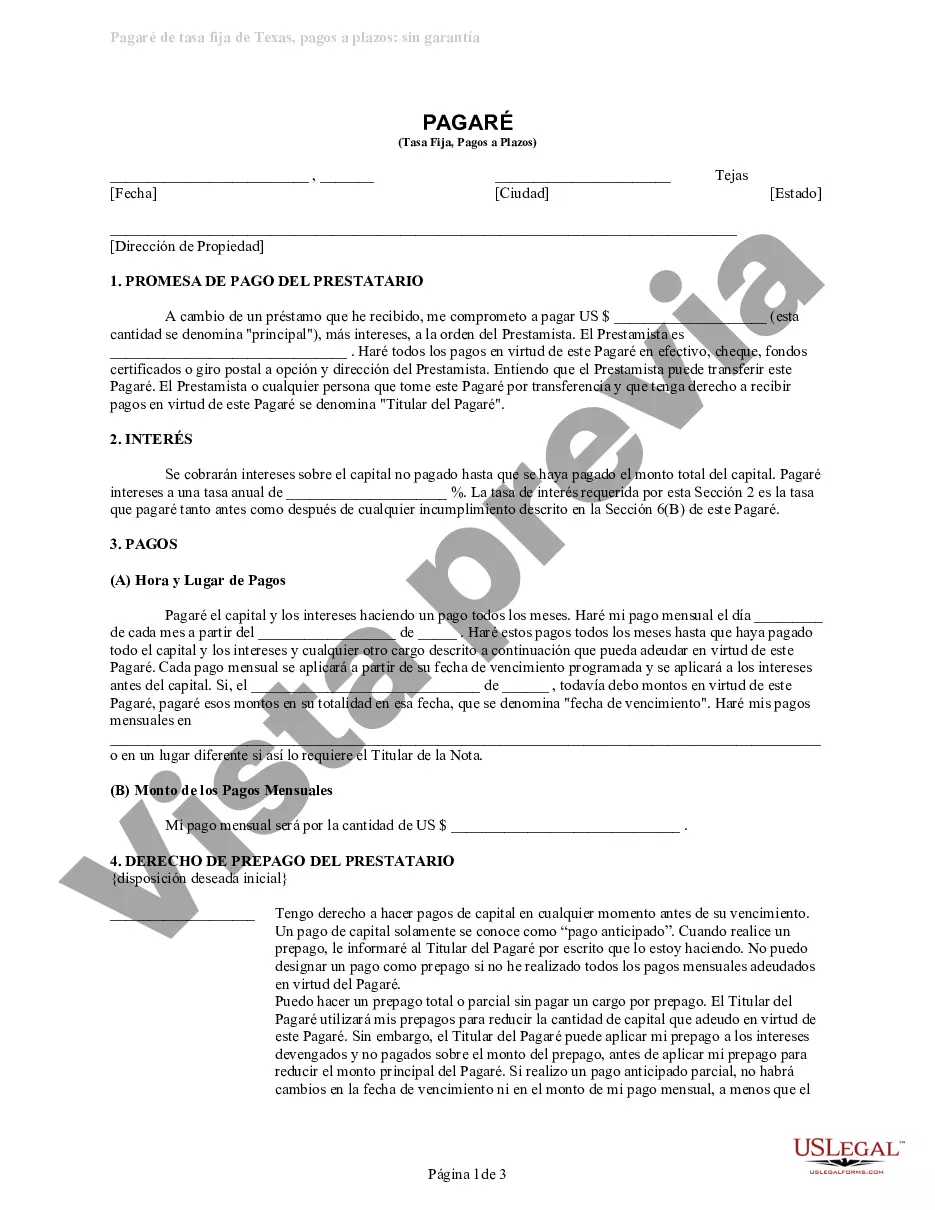

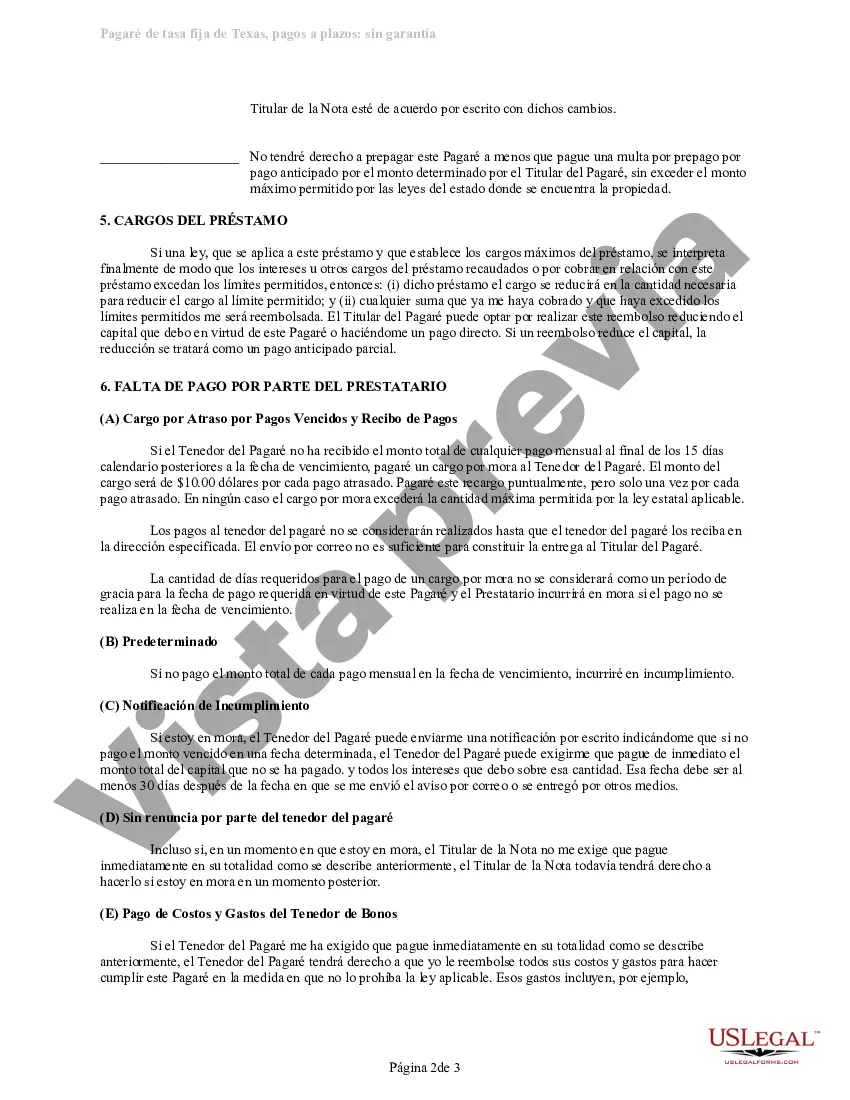

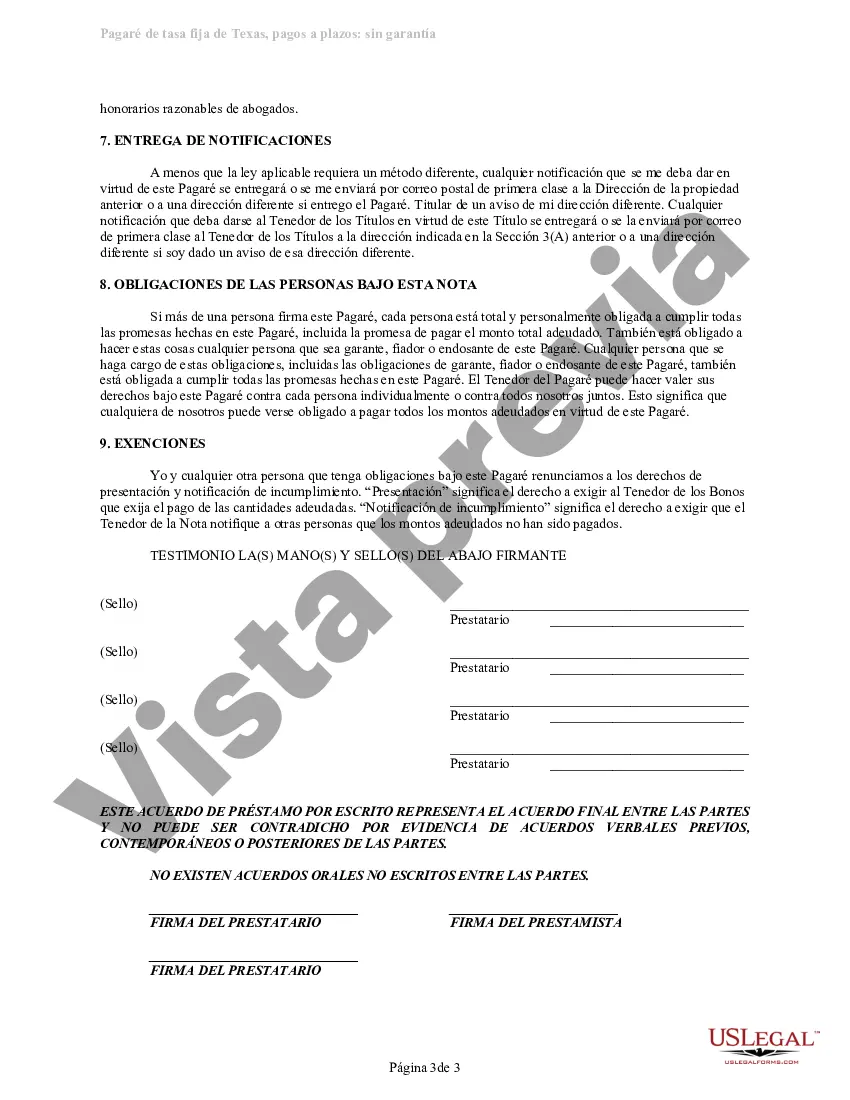

This detailed sample Promissory Note complies with Texas law. Adapt the language to fit your facts and circumstances. Available in Word and Rich Text formats.

Laredo Texas Unsecured Promissory Note with Installment Payments — Fixed Rat— - Personal Signature Loan A Laredo Texas Unsecured Promissory Note with Installment Payments — Fixed Rat— - Personal Signature Loan is a legal document that outlines the terms and conditions of a loan agreement between a lender and a borrower. This type of loan does not require any collateral; instead, it is solely based on the borrower's creditworthiness and ability to repay the loan. The key feature of this loan is that it involves installment payments, meaning the borrower repays the loan in periodic installments over a predetermined period. This allows borrowers to better manage their finances and make regular payments towards clearing their debt. The loan also comes with a fixed interest rate, which means the interest charged remains constant throughout the loan's duration. This provides borrowers with stability and predictability when it comes to their monthly payments, as they can accurately budget for their loan repayment. Some different types of Laredo Texas Unsecured Promissory Note with Installment Payments — Fixed Rat— - Personal Signature Loans can include: 1. Short-Term Personal Signature Loan: This type of loan typically has a shorter repayment period, usually ranging from a few months to a year. It is suitable for borrowers who need immediate funds for unforeseen expenses or emergencies. 2. Medium-Term Personal Signature Loan: This loan has a more extended repayment period, often between one and five years. It suits borrowers who require funds for larger expenses, such as home renovations or significant purchases. 3. Long-Term Personal Signature Loan: This loan extends beyond five years, making it ideal for borrowers who need substantial amounts of money for significant investments, such as starting a business or purchasing property. Regardless of the loan type, the Laredo Texas Unsecured Promissory Note with Installment Payments — Fixed Rat— - Personal Signature Loan includes essential information such as the loan amount, interest rate, repayment schedule, late payment penalties, loan duration, and details about the borrower and lender. Please note that this content is for informational purposes only and does not constitute legal advice. If you are considering obtaining a Laredo Texas Unsecured Promissory Note with Installment Payments — Fixed Rat— - Personal Signature Loan, it is essential to consult with a qualified legal professional to ensure compliance with relevant laws and regulations.Laredo Texas Unsecured Promissory Note with Installment Payments — Fixed Rat— - Personal Signature Loan A Laredo Texas Unsecured Promissory Note with Installment Payments — Fixed Rat— - Personal Signature Loan is a legal document that outlines the terms and conditions of a loan agreement between a lender and a borrower. This type of loan does not require any collateral; instead, it is solely based on the borrower's creditworthiness and ability to repay the loan. The key feature of this loan is that it involves installment payments, meaning the borrower repays the loan in periodic installments over a predetermined period. This allows borrowers to better manage their finances and make regular payments towards clearing their debt. The loan also comes with a fixed interest rate, which means the interest charged remains constant throughout the loan's duration. This provides borrowers with stability and predictability when it comes to their monthly payments, as they can accurately budget for their loan repayment. Some different types of Laredo Texas Unsecured Promissory Note with Installment Payments — Fixed Rat— - Personal Signature Loans can include: 1. Short-Term Personal Signature Loan: This type of loan typically has a shorter repayment period, usually ranging from a few months to a year. It is suitable for borrowers who need immediate funds for unforeseen expenses or emergencies. 2. Medium-Term Personal Signature Loan: This loan has a more extended repayment period, often between one and five years. It suits borrowers who require funds for larger expenses, such as home renovations or significant purchases. 3. Long-Term Personal Signature Loan: This loan extends beyond five years, making it ideal for borrowers who need substantial amounts of money for significant investments, such as starting a business or purchasing property. Regardless of the loan type, the Laredo Texas Unsecured Promissory Note with Installment Payments — Fixed Rat— - Personal Signature Loan includes essential information such as the loan amount, interest rate, repayment schedule, late payment penalties, loan duration, and details about the borrower and lender. Please note that this content is for informational purposes only and does not constitute legal advice. If you are considering obtaining a Laredo Texas Unsecured Promissory Note with Installment Payments — Fixed Rat— - Personal Signature Loan, it is essential to consult with a qualified legal professional to ensure compliance with relevant laws and regulations.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.