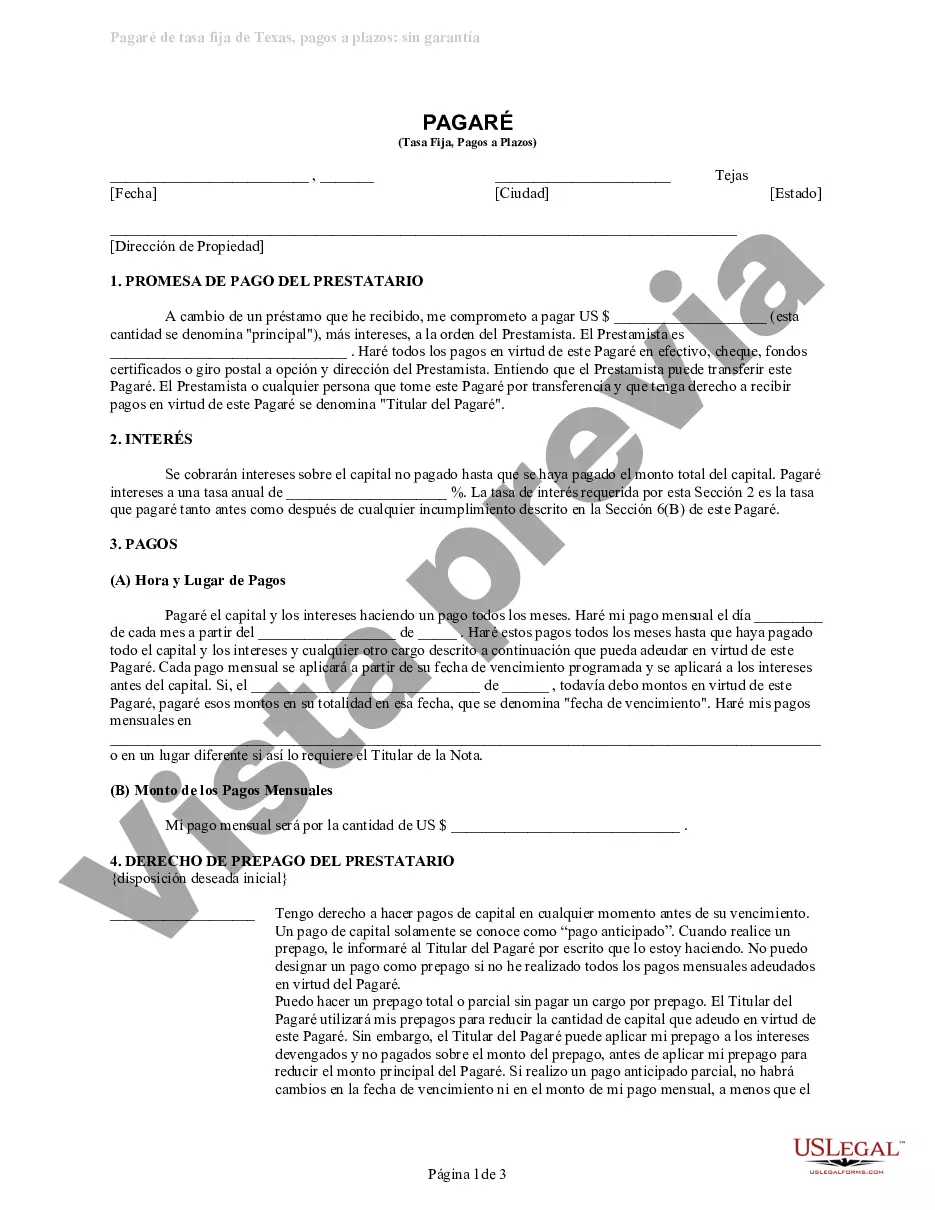

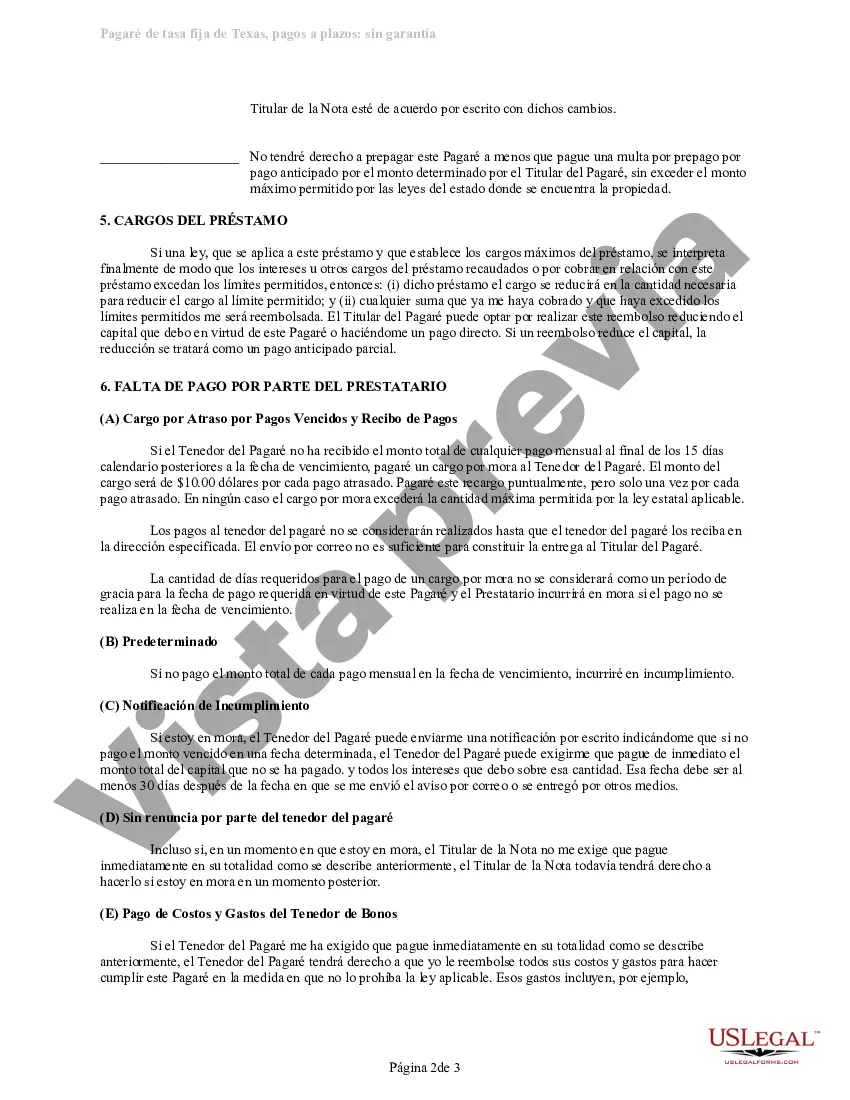

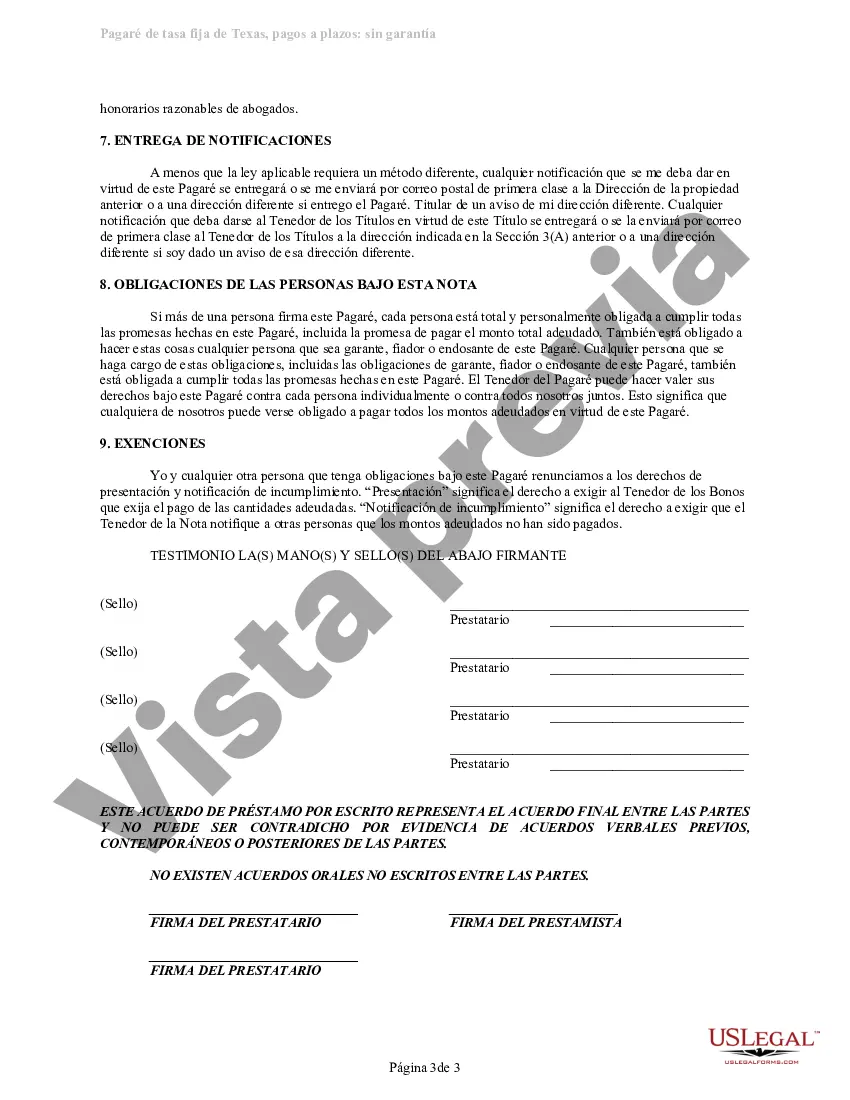

This detailed sample Promissory Note complies with Texas law. Adapt the language to fit your facts and circumstances. Available in Word and Rich Text formats.

A San Antonio Texas Unsecured Promissory Note with Installment Payments — Fixed Rat— - Personal Signature Loan is a legally binding agreement made between a lender and a borrower in San Antonio, Texas. This type of loan does not require any collateral, making it an unsecured loan. It involves the borrower promising to repay the lender a certain amount of money that is borrowed, along with any agreed-upon interest, over a specified period of time. The note typically includes details such as the names and addresses of both the lender and the borrower, the principal amount being borrowed, the interest rate, the repayment schedule, and any additional terms and conditions agreed upon by both parties. The loan is to be repaid in regular installments, which can be monthly, quarterly, or annually, depending on the agreed-upon terms. The fixed rate aspect signifies that the interest rate remains the same throughout the loan term, providing stability and predictability for both the lender and the borrower. The interest rate is typically determined based on various factors like the borrower's creditworthiness, the loan amount, and current market conditions. Moreover, the loan is classified as a personal signature loan, meaning it does not require any collateral such as a property or an asset to secure the loan. The borrower's signature serves as the guarantee for repayment. However, it is important to note that the lender may still conduct a credit check or evaluate the borrower's financial history to assess their ability to repay the loan. Different types of San Antonio Texas Unsecured Promissory Notes with Installment Payments — Fixed Rat— - Personal Signature Loan may include variations in loan terms, interest rates, repayment schedules, and additional clauses. These variations can be tailored to meet the specific needs and preferences of both the lender and the borrower. It is crucial for both parties to carefully review and understand all the terms and conditions outlined in the promissory note before signing to ensure a transparent and fair agreement.A San Antonio Texas Unsecured Promissory Note with Installment Payments — Fixed Rat— - Personal Signature Loan is a legally binding agreement made between a lender and a borrower in San Antonio, Texas. This type of loan does not require any collateral, making it an unsecured loan. It involves the borrower promising to repay the lender a certain amount of money that is borrowed, along with any agreed-upon interest, over a specified period of time. The note typically includes details such as the names and addresses of both the lender and the borrower, the principal amount being borrowed, the interest rate, the repayment schedule, and any additional terms and conditions agreed upon by both parties. The loan is to be repaid in regular installments, which can be monthly, quarterly, or annually, depending on the agreed-upon terms. The fixed rate aspect signifies that the interest rate remains the same throughout the loan term, providing stability and predictability for both the lender and the borrower. The interest rate is typically determined based on various factors like the borrower's creditworthiness, the loan amount, and current market conditions. Moreover, the loan is classified as a personal signature loan, meaning it does not require any collateral such as a property or an asset to secure the loan. The borrower's signature serves as the guarantee for repayment. However, it is important to note that the lender may still conduct a credit check or evaluate the borrower's financial history to assess their ability to repay the loan. Different types of San Antonio Texas Unsecured Promissory Notes with Installment Payments — Fixed Rat— - Personal Signature Loan may include variations in loan terms, interest rates, repayment schedules, and additional clauses. These variations can be tailored to meet the specific needs and preferences of both the lender and the borrower. It is crucial for both parties to carefully review and understand all the terms and conditions outlined in the promissory note before signing to ensure a transparent and fair agreement.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.