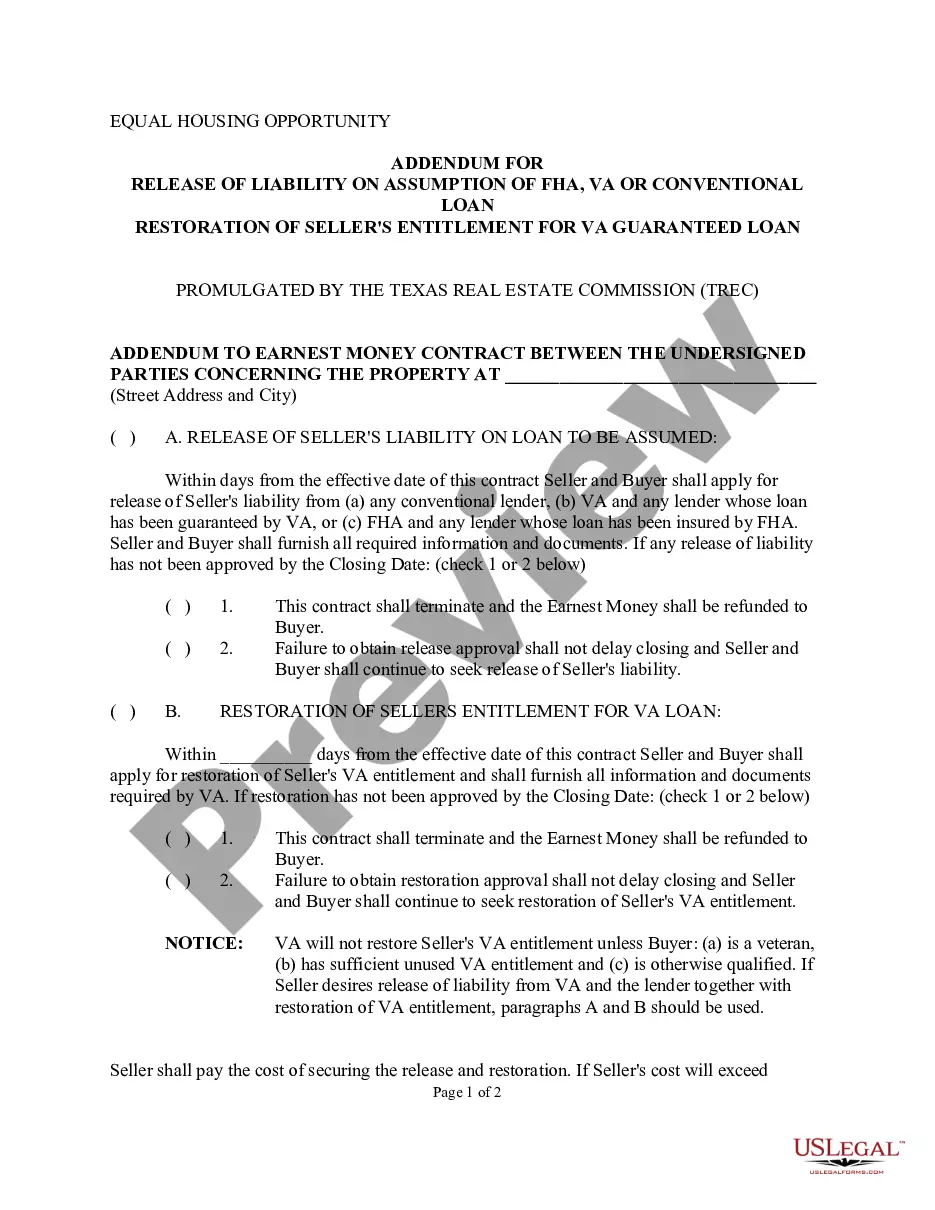

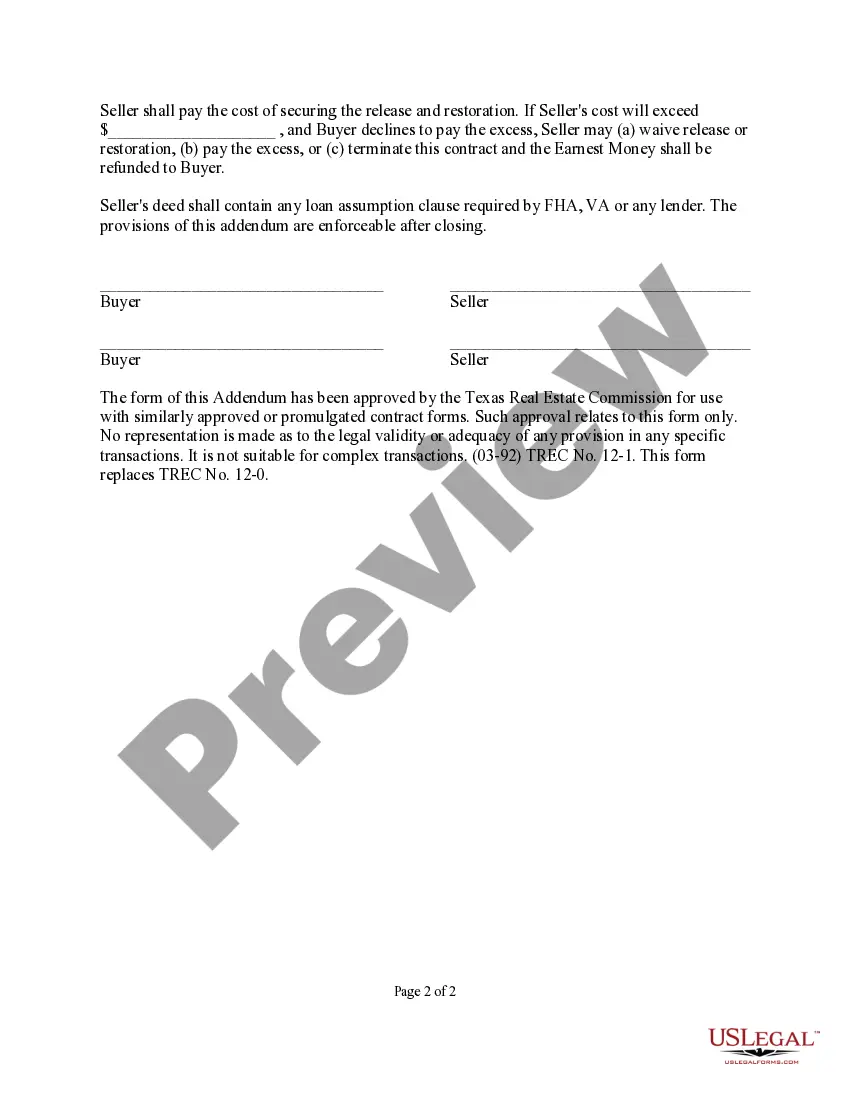

This detailed sample Addendum for Release of Liability on Assumption of FHA, VA or Conventional Loan, Restoration of Seller's Entitlement for VA Guaranteed Loan complies with Texas law. Adapt the language to fit your facts and circumstances. Available in Word and Rich Text formats.

The Dallas Texas Addendum for Release of Liability on Assumption of FHA, VA or Conventional Loan, Restoration of Seller's Entitlement for VA Guaranteed Loan is an essential document that ensures a smooth transfer of property ownership and financial responsibilities. This addendum is applicable when a buyer assumes an existing FHA, VA, or conventional loan and when a seller seeks to restore their entitlement for a VA guaranteed loan. It offers protection to both parties involved in the transaction. Assumption of an FHA, VA, or conventional loan occurs when a buyer takes over the existing mortgage on a property instead of obtaining a new loan. This transfer of liability requires the approval of the lender and the buyer's qualification to assume the loan. The Dallas Texas Addendum for Release of Liability ensures that the seller is released from any future obligations related to the assumed loan, liability, and responsibility for the property. When it comes to VA guaranteed loans, this addendum has an additional purpose. If the seller has previously used their VA entitlement to obtain a loan for the property being sold, the addendum addresses the restoration of their entitlement. This is crucial as restoration allows the seller to reuse their VA loan benefits in the future, which can be invaluable for veterans and active-duty military personnel. It is important to note that there may be variations of the Dallas Texas Addendum for Release of Liability on Assumption of FHA, VA, or Conventional Loan, Restoration of Seller's Entitlement for VA Guaranteed Loan. These variations may arise due to specific requirements and regulations set forth by the state, lenders, or other governing bodies. Some possible types of Dallas Texas Addendum for Release of Liability on Assumption of FHA, VA, or Conventional Loan, Restoration of Seller's Entitlement for VA Guaranteed Loan include: 1. FHA Addendum: This addendum is designed specifically for assumption of FHA loans, ensuring compliance with Federal Housing Administration guidelines and regulations within the state of Texas. 2. VA Addendum: This variation pertains specifically to VA guaranteed loans and covers the restoration of seller's entitlement as per the rules and regulations set by the Department of Veterans Affairs. 3. Conventional Loan Addendum: This addendum focuses on assumption of conventional loans and addresses the release of liability for the seller and the buyer's responsibility for the assumed loan. The Dallas Texas Addendum for Release of Liability on Assumption of FHA, VA or Conventional Loan, Restoration of Seller's Entitlement for VA Guaranteed Loan is a critical component of real estate transactions involving loan assumptions. It ensures that all parties involved understand their rights, responsibilities, and liabilities while complying with relevant laws and regulations. Seeking legal counsel and thorough review of the addendum is highly recommended protecting the interests of all parties involved.The Dallas Texas Addendum for Release of Liability on Assumption of FHA, VA or Conventional Loan, Restoration of Seller's Entitlement for VA Guaranteed Loan is an essential document that ensures a smooth transfer of property ownership and financial responsibilities. This addendum is applicable when a buyer assumes an existing FHA, VA, or conventional loan and when a seller seeks to restore their entitlement for a VA guaranteed loan. It offers protection to both parties involved in the transaction. Assumption of an FHA, VA, or conventional loan occurs when a buyer takes over the existing mortgage on a property instead of obtaining a new loan. This transfer of liability requires the approval of the lender and the buyer's qualification to assume the loan. The Dallas Texas Addendum for Release of Liability ensures that the seller is released from any future obligations related to the assumed loan, liability, and responsibility for the property. When it comes to VA guaranteed loans, this addendum has an additional purpose. If the seller has previously used their VA entitlement to obtain a loan for the property being sold, the addendum addresses the restoration of their entitlement. This is crucial as restoration allows the seller to reuse their VA loan benefits in the future, which can be invaluable for veterans and active-duty military personnel. It is important to note that there may be variations of the Dallas Texas Addendum for Release of Liability on Assumption of FHA, VA, or Conventional Loan, Restoration of Seller's Entitlement for VA Guaranteed Loan. These variations may arise due to specific requirements and regulations set forth by the state, lenders, or other governing bodies. Some possible types of Dallas Texas Addendum for Release of Liability on Assumption of FHA, VA, or Conventional Loan, Restoration of Seller's Entitlement for VA Guaranteed Loan include: 1. FHA Addendum: This addendum is designed specifically for assumption of FHA loans, ensuring compliance with Federal Housing Administration guidelines and regulations within the state of Texas. 2. VA Addendum: This variation pertains specifically to VA guaranteed loans and covers the restoration of seller's entitlement as per the rules and regulations set by the Department of Veterans Affairs. 3. Conventional Loan Addendum: This addendum focuses on assumption of conventional loans and addresses the release of liability for the seller and the buyer's responsibility for the assumed loan. The Dallas Texas Addendum for Release of Liability on Assumption of FHA, VA or Conventional Loan, Restoration of Seller's Entitlement for VA Guaranteed Loan is a critical component of real estate transactions involving loan assumptions. It ensures that all parties involved understand their rights, responsibilities, and liabilities while complying with relevant laws and regulations. Seeking legal counsel and thorough review of the addendum is highly recommended protecting the interests of all parties involved.