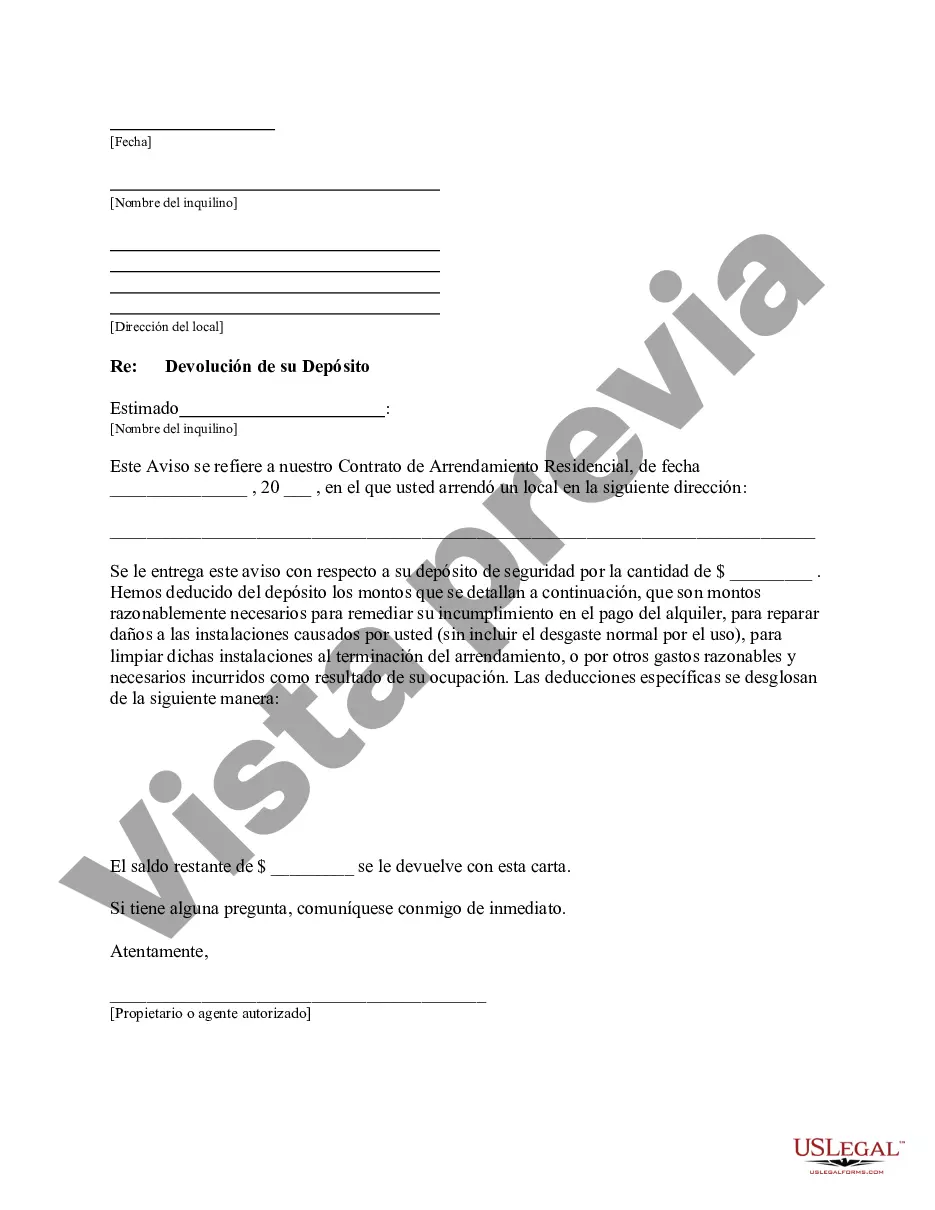

This is a letter informing Tenant that Landlord has deducted from the deposit the amounts itemized which are amounts either reasonably necessary to remedy default in the payment of rent, to repair damages to the premises caused by tenant, to clean such premises upon termination of the tenancy, or for other reasonable and necessary expenses incurred as the result of the tenant's occupancy.

A security deposit is a payment required by a landlord from a tenant to cover the expenses of any repairs of damages to the premises greater than normal "wear and tear." Everyday usage is normal wear and tear, but excess damage is a debated definition. A security deposit is not the same as rent. It is money that actually belongs to the tenant but is held by the landlord for tenant-caused damages and sometimes past-due rent. Without the agreement of the landlord, a security deposit may not legally be used as the last month's rent.

Laws vary by state, but some states place a limit on the amount of a security deposit that a landlord may charge. Some states also regulate where residential security deposits must be kept and when interest payments on the security deposits must be made to the tenant. State laws also define the time period after the tenant vacates within which the deposit must be returned to the tenant.

Title: Comprehensive Guide to the Harris Texas Letter from Landlord to Tenant Returning Security Deposit Less Deductions Introduction: The Harris Texas Letter from Landlord to Tenant Returning Security Deposit Less Deductions is a crucial document that outlines the process of returning the tenant's security deposit while deducting appropriate charges. This comprehensive guide will walk you through the essential components of this letter, including its purpose, legal obligations, common deductions, and examples of different types of Harris Texas Letter from Landlord to Tenant Returning Security Deposit Less Deductions. 1. Purpose of the Harris Texas Letter from Landlord to Tenant Returning Security Deposit Less Deductions: This document serves as a formal notification from the landlord to the tenant regarding the disposition of their security deposit. It outlines any deductions made to cover expenses beyond normal wear and tear during their tenancy. 2. Legal Obligations: As a landlord in Harris, Texas, it is crucial to adhere to the state's legal requirements when returning a tenant's security deposit. This includes providing a written itemization of deductions and returning the remaining deposit within a specific timeframe, as mandated by Texas law. 3. Essential Components of the Letter: — Landlord's Contact Information: Include your name, official address, phone number, and email for communication purposes. — Tenant's Contact Information: Include the tenant's name, current address, phone number, and email to ensure accurate correspondence. — Date of Letter: Clearly state the date the letter is being sent to establish a timeline. — Subject Line: Write a concise subject line indicating that the letter pertains to the return of the security deposit less deductions. — Opening Paragraph: Begin the letter by addressing the tenant courteously and confirming the purpose of the letter. — Security Deposit Details: List the original security deposit amount, the date it was received, and the term of the tenancy. — Deductions: Provide a detailed breakdown of any allowable deductions made from the security deposit, justified by actual expenses and receipts. — Remaining Balance: Calculate the final amount being returned to the tenant after deducting applicable charges. — Next Steps: Inform the tenant about how they will receive the refund (e.g., via check or direct deposit) and when they can expect to receive it. — Contact Information: Reiterate your contact information and encourage the tenant to reach out with any questions or concerns. 4. Common Deductions from the Security Deposit: — Unpaid Rent: If the tenant owes any outstanding rent, clearly itemize the amount and subtract it from the security deposit. — Damages and Repairs: Document any damages caused by the tenant and include an estimated cost of repairs or replacements. — Cleaning and Maintenance: Deduct costs for necessary cleaning or maintenance beyond normal wear and tear. — Unreturned Keys or Garage Door Openers: Deduct the cost of replacement for any unreturned keys or remotes provided by the landlord. 5. Different Types of Harris Texas Letters from Landlord to Tenant Returning Security Deposit Less Deductions: — Standard Security Deposit Deduction Letter: Used for deducting standard expenses, such as damages and unpaid rent. — Move-Out Inspection Letter: Provides a detailed inspection report, highlighting damages and deductions made. — Non-Compliance Deduction Letter: Used when the tenant has violated the lease agreement, resulting in additional charges. Conclusion: Mastering the process of creating a Harris Texas Letter from Landlord to Tenant Returning Security Deposit Less Deductions is essential for landlords to maintain transparency and compliance with the law. By following the guidelines and using appropriate templates, landlords can effectively communicate the deductions made from the security deposit, ensuring a smooth and fair transaction for both parties.Title: Comprehensive Guide to the Harris Texas Letter from Landlord to Tenant Returning Security Deposit Less Deductions Introduction: The Harris Texas Letter from Landlord to Tenant Returning Security Deposit Less Deductions is a crucial document that outlines the process of returning the tenant's security deposit while deducting appropriate charges. This comprehensive guide will walk you through the essential components of this letter, including its purpose, legal obligations, common deductions, and examples of different types of Harris Texas Letter from Landlord to Tenant Returning Security Deposit Less Deductions. 1. Purpose of the Harris Texas Letter from Landlord to Tenant Returning Security Deposit Less Deductions: This document serves as a formal notification from the landlord to the tenant regarding the disposition of their security deposit. It outlines any deductions made to cover expenses beyond normal wear and tear during their tenancy. 2. Legal Obligations: As a landlord in Harris, Texas, it is crucial to adhere to the state's legal requirements when returning a tenant's security deposit. This includes providing a written itemization of deductions and returning the remaining deposit within a specific timeframe, as mandated by Texas law. 3. Essential Components of the Letter: — Landlord's Contact Information: Include your name, official address, phone number, and email for communication purposes. — Tenant's Contact Information: Include the tenant's name, current address, phone number, and email to ensure accurate correspondence. — Date of Letter: Clearly state the date the letter is being sent to establish a timeline. — Subject Line: Write a concise subject line indicating that the letter pertains to the return of the security deposit less deductions. — Opening Paragraph: Begin the letter by addressing the tenant courteously and confirming the purpose of the letter. — Security Deposit Details: List the original security deposit amount, the date it was received, and the term of the tenancy. — Deductions: Provide a detailed breakdown of any allowable deductions made from the security deposit, justified by actual expenses and receipts. — Remaining Balance: Calculate the final amount being returned to the tenant after deducting applicable charges. — Next Steps: Inform the tenant about how they will receive the refund (e.g., via check or direct deposit) and when they can expect to receive it. — Contact Information: Reiterate your contact information and encourage the tenant to reach out with any questions or concerns. 4. Common Deductions from the Security Deposit: — Unpaid Rent: If the tenant owes any outstanding rent, clearly itemize the amount and subtract it from the security deposit. — Damages and Repairs: Document any damages caused by the tenant and include an estimated cost of repairs or replacements. — Cleaning and Maintenance: Deduct costs for necessary cleaning or maintenance beyond normal wear and tear. — Unreturned Keys or Garage Door Openers: Deduct the cost of replacement for any unreturned keys or remotes provided by the landlord. 5. Different Types of Harris Texas Letters from Landlord to Tenant Returning Security Deposit Less Deductions: — Standard Security Deposit Deduction Letter: Used for deducting standard expenses, such as damages and unpaid rent. — Move-Out Inspection Letter: Provides a detailed inspection report, highlighting damages and deductions made. — Non-Compliance Deduction Letter: Used when the tenant has violated the lease agreement, resulting in additional charges. Conclusion: Mastering the process of creating a Harris Texas Letter from Landlord to Tenant Returning Security Deposit Less Deductions is essential for landlords to maintain transparency and compliance with the law. By following the guidelines and using appropriate templates, landlords can effectively communicate the deductions made from the security deposit, ensuring a smooth and fair transaction for both parties.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.