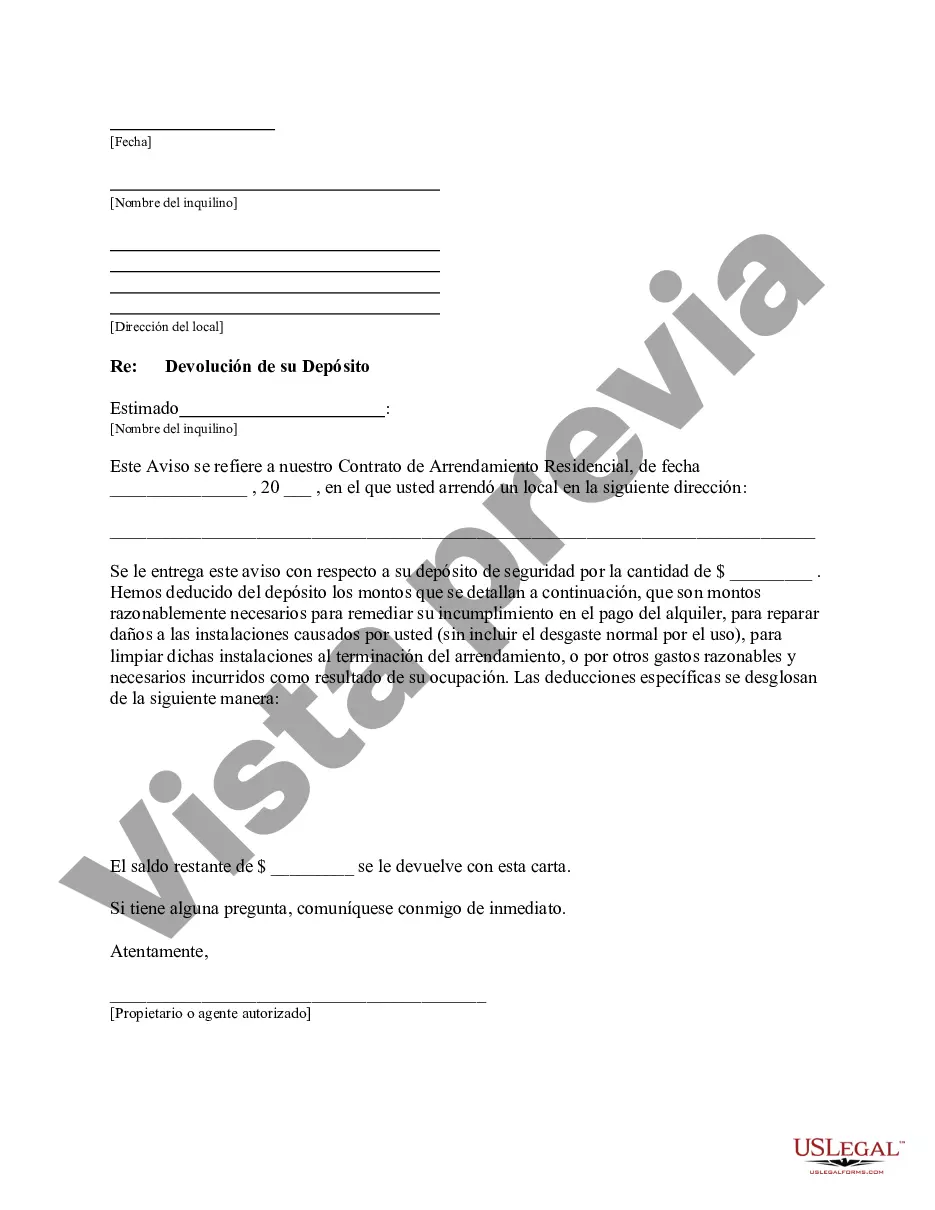

This is a letter informing Tenant that Landlord has deducted from the deposit the amounts itemized which are amounts either reasonably necessary to remedy default in the payment of rent, to repair damages to the premises caused by tenant, to clean such premises upon termination of the tenancy, or for other reasonable and necessary expenses incurred as the result of the tenant's occupancy.

A security deposit is a payment required by a landlord from a tenant to cover the expenses of any repairs of damages to the premises greater than normal "wear and tear." Everyday usage is normal wear and tear, but excess damage is a debated definition. A security deposit is not the same as rent. It is money that actually belongs to the tenant but is held by the landlord for tenant-caused damages and sometimes past-due rent. Without the agreement of the landlord, a security deposit may not legally be used as the last month's rent.

Laws vary by state, but some states place a limit on the amount of a security deposit that a landlord may charge. Some states also regulate where residential security deposits must be kept and when interest payments on the security deposits must be made to the tenant. State laws also define the time period after the tenant vacates within which the deposit must be returned to the tenant.

Title: Killeen, Texas Letter from Landlord to Tenant Returning Security Deposit Less Deductions: A Comprehensive Guide Introduction: Welcome to our detailed guide on the Killeen, Texas Letter from Landlord to Tenant returning security deposit less deductions. This document outlines the key elements that should be included in such a letter, providing clarity and transparency for both landlords and tenants. We will also explore some common variations of these letters based on different scenarios. 1. Key Components of a Killeen, Texas Letter from Landlord to Tenant Returning Security Deposit Less Deductions: a. Opening paragraph: Express appreciation for the tenancy and mention the purpose of the letter. b. Statement of return: Clearly state that the security deposit is being returned to the tenant, minus any authorized deductions as outlined in the lease agreement. c. Deductions breakdown: Detail specific deductions made, along with supporting documentation such as receipts or invoices. d. Calculation: Provide a clear breakdown of the calculations used to determine the deductions. e. Final refund amount: State the final amount to be refunded to the tenant after all deductions. f. Delivery method: Specify how the refund will be delivered — check, direct deposit, etc. g. Contact information: Include the landlord's contact details for any further queries. 2. Variations of Killeen, Texas Letter from Landlord to Tenant Returning Security Deposit Less Deductions: a. Letter for deductions related to cleaning expenses: If deductions are made for cleaning services, outline the specific areas cleaned and the related charges. b. Letter for deductions related to damages: Clearly list any damages incurred during the tenancy and the corresponding repair or replacement costs. c. Letter for deductions related to unpaid rent or fees: In case the security deposit is used to cover unpaid rent, utilities, or any outstanding fees, provide a detailed breakdown of these amounts. d. Letter for deductions related to breach of lease terms: If deductions are necessary due to a breach of lease terms, explain the specific violations and the associated costs. e. Letter for deductions related to unpaid utilities: If the security deposit is applied towards unpaid utility bills, specify the amounts owed and any late payment charges incurred. Conclusion: To foster a fair and transparent relationship between landlords and tenants in Killeen, Texas, the Letter from Landlord to Tenant Returning Security Deposit Less Deductions plays a crucial role. By following the outlined key components and considering the different variations based on specific scenarios, this letter ensures clear communication and mutual understanding regarding the security deposit refund process.Title: Killeen, Texas Letter from Landlord to Tenant Returning Security Deposit Less Deductions: A Comprehensive Guide Introduction: Welcome to our detailed guide on the Killeen, Texas Letter from Landlord to Tenant returning security deposit less deductions. This document outlines the key elements that should be included in such a letter, providing clarity and transparency for both landlords and tenants. We will also explore some common variations of these letters based on different scenarios. 1. Key Components of a Killeen, Texas Letter from Landlord to Tenant Returning Security Deposit Less Deductions: a. Opening paragraph: Express appreciation for the tenancy and mention the purpose of the letter. b. Statement of return: Clearly state that the security deposit is being returned to the tenant, minus any authorized deductions as outlined in the lease agreement. c. Deductions breakdown: Detail specific deductions made, along with supporting documentation such as receipts or invoices. d. Calculation: Provide a clear breakdown of the calculations used to determine the deductions. e. Final refund amount: State the final amount to be refunded to the tenant after all deductions. f. Delivery method: Specify how the refund will be delivered — check, direct deposit, etc. g. Contact information: Include the landlord's contact details for any further queries. 2. Variations of Killeen, Texas Letter from Landlord to Tenant Returning Security Deposit Less Deductions: a. Letter for deductions related to cleaning expenses: If deductions are made for cleaning services, outline the specific areas cleaned and the related charges. b. Letter for deductions related to damages: Clearly list any damages incurred during the tenancy and the corresponding repair or replacement costs. c. Letter for deductions related to unpaid rent or fees: In case the security deposit is used to cover unpaid rent, utilities, or any outstanding fees, provide a detailed breakdown of these amounts. d. Letter for deductions related to breach of lease terms: If deductions are necessary due to a breach of lease terms, explain the specific violations and the associated costs. e. Letter for deductions related to unpaid utilities: If the security deposit is applied towards unpaid utility bills, specify the amounts owed and any late payment charges incurred. Conclusion: To foster a fair and transparent relationship between landlords and tenants in Killeen, Texas, the Letter from Landlord to Tenant Returning Security Deposit Less Deductions plays a crucial role. By following the outlined key components and considering the different variations based on specific scenarios, this letter ensures clear communication and mutual understanding regarding the security deposit refund process.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.