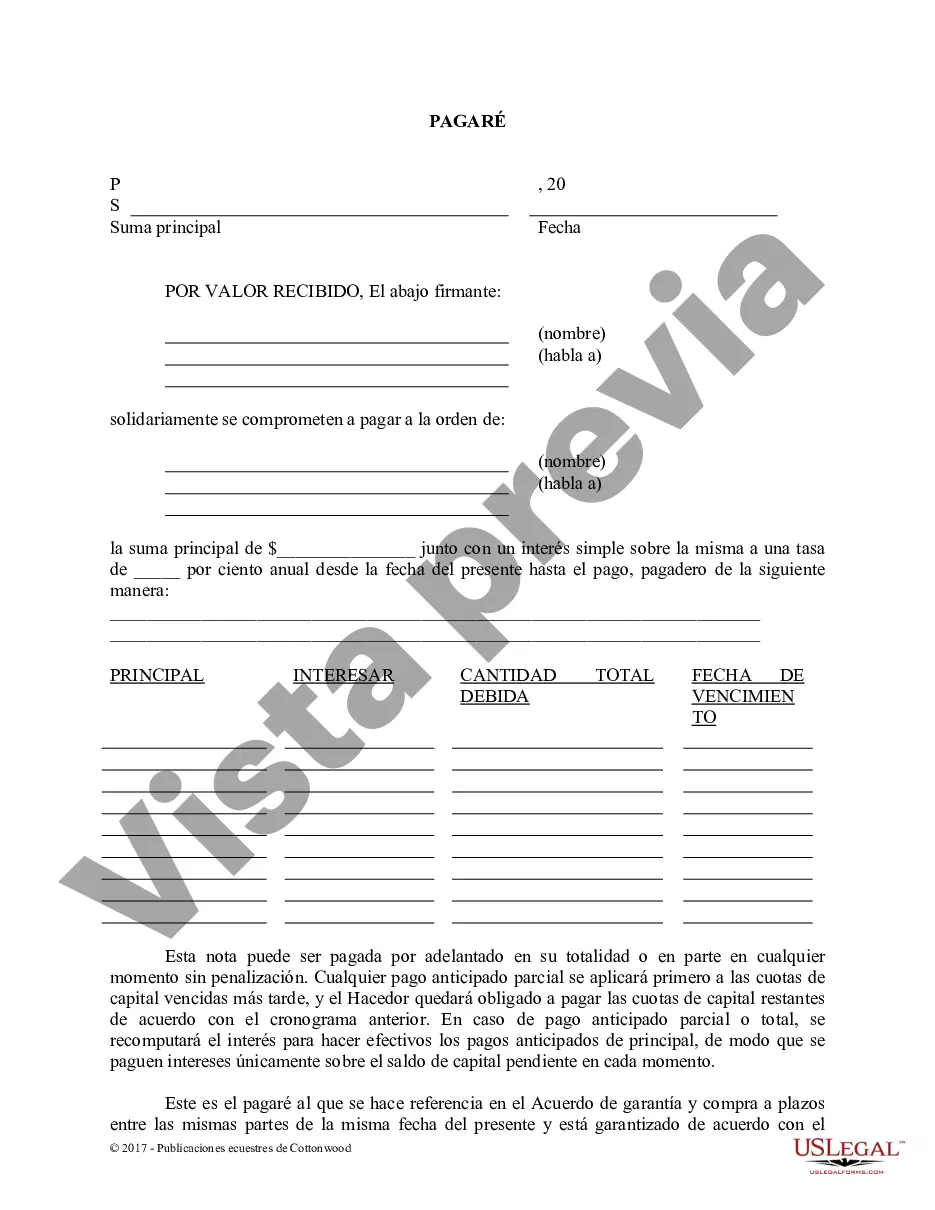

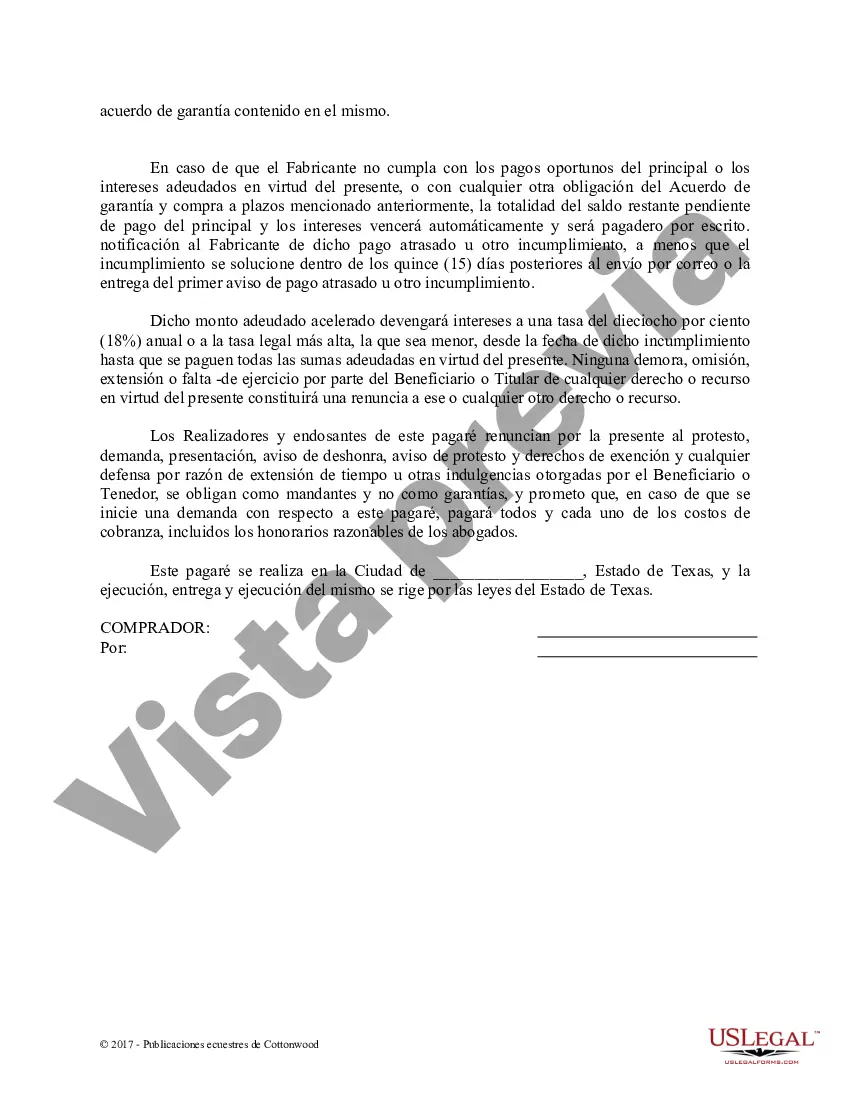

This is a promissory note for use in connection with the sale and purchase of a horse where financing is involved. It is a simple interest note that may be used in conjunction with an Installment Purchase and Security Agreement.

The Grand Prairie Texas Promissory Note — Horse Equine Forms is a legal document used in the state of Texas to record loan agreements between parties involved in the horse and equine industry. This detailed description will provide an overview of what this promissory note entails, including its purpose, key elements, and potential types that may exist. A promissory note is a written contract that outlines the terms and conditions of a loan or debt, typically between a lender and a borrower. In the context of the horse and equine industry, the Grand Prairie Texas Promissory Note — Horse Equine Forms specifically caters to loans related to horses, horse-related services, equipment, or other equine assets. The promissory note serves as evidence of the borrower's promise to repay the loan amount and any associated interest within a specified time frame. It provides legal protection for both parties involved and helps establish clear expectations and obligations. Key elements typically included in the Grand Prairie Texas Promissory Note — Horse Equine Forms include: 1. Identification of the parties: The names and contact information of both the lender (also referred to as the payee) and the borrower (also known as the maker) are clearly stated. This ensures that the note is legally binding between the correct parties. 2. Loan details: The promissory note outlines the principal loan amount, the date when the loan was made, and the agreed interest rate, if applicable. It may also specify any collateral being used to secure the loan, such as a horse or equipment. 3. Repayment terms: The note stipulates the repayment terms, including the amount of each payment, the due dates for payments, and the duration of the loan. It also defines any penalties or fees for late payments or default. 4. Rights and responsibilities: The Grand Prairie Texas Promissory Note — Horse Equine Forms may include clauses specifying the parties' rights and responsibilities, such as the borrower's responsibility for maintaining the horse or equipment and the lender's right to inspect or repossess the collateral in case of default. It's important to note that there may be different types of Grand Prairie Texas Promissory Note — Horse Equine Forms available, depending on specific loan scenarios or requirements. Some potential variations could include: 1. Horse Purchase Agreement Promissory Note: This type of promissory note is used when a borrower is purchasing a horse and requires a loan to complete the transaction. It may include additional clauses related to horse ownership, health guarantees, and registration. 2. Equine Services Promissory Note: This form is utilized when a borrower needs a loan to pay for horse-related services, such as training, veterinary care, or boarding. These forms may include provisions covering the specific services being rendered and any warranties or guarantees associated with them. 3. Equipment Financing Promissory Note: This variation of the note is used when the loan is specifically for the purchase or financing of equine equipment, such as trailers, saddles, or grooming supplies. It may specify the make, model, and condition of the equipment being financed. In conclusion, the Grand Prairie Texas Promissory Note — Horse Equine Forms is a legally binding document that outlines the terms and conditions of a loan agreement related to the horse and equine industry. It offers protection for both lenders and borrowers and helps ensure clear expectations and obligations. Depending on the specific loan scenario, various types of promissory notes, such as Horse Purchase Agreement Promissory Note, Equine Services Promissory Note, or Equipment Financing Promissory Note, may exist to cater to different needs within the industry.The Grand Prairie Texas Promissory Note — Horse Equine Forms is a legal document used in the state of Texas to record loan agreements between parties involved in the horse and equine industry. This detailed description will provide an overview of what this promissory note entails, including its purpose, key elements, and potential types that may exist. A promissory note is a written contract that outlines the terms and conditions of a loan or debt, typically between a lender and a borrower. In the context of the horse and equine industry, the Grand Prairie Texas Promissory Note — Horse Equine Forms specifically caters to loans related to horses, horse-related services, equipment, or other equine assets. The promissory note serves as evidence of the borrower's promise to repay the loan amount and any associated interest within a specified time frame. It provides legal protection for both parties involved and helps establish clear expectations and obligations. Key elements typically included in the Grand Prairie Texas Promissory Note — Horse Equine Forms include: 1. Identification of the parties: The names and contact information of both the lender (also referred to as the payee) and the borrower (also known as the maker) are clearly stated. This ensures that the note is legally binding between the correct parties. 2. Loan details: The promissory note outlines the principal loan amount, the date when the loan was made, and the agreed interest rate, if applicable. It may also specify any collateral being used to secure the loan, such as a horse or equipment. 3. Repayment terms: The note stipulates the repayment terms, including the amount of each payment, the due dates for payments, and the duration of the loan. It also defines any penalties or fees for late payments or default. 4. Rights and responsibilities: The Grand Prairie Texas Promissory Note — Horse Equine Forms may include clauses specifying the parties' rights and responsibilities, such as the borrower's responsibility for maintaining the horse or equipment and the lender's right to inspect or repossess the collateral in case of default. It's important to note that there may be different types of Grand Prairie Texas Promissory Note — Horse Equine Forms available, depending on specific loan scenarios or requirements. Some potential variations could include: 1. Horse Purchase Agreement Promissory Note: This type of promissory note is used when a borrower is purchasing a horse and requires a loan to complete the transaction. It may include additional clauses related to horse ownership, health guarantees, and registration. 2. Equine Services Promissory Note: This form is utilized when a borrower needs a loan to pay for horse-related services, such as training, veterinary care, or boarding. These forms may include provisions covering the specific services being rendered and any warranties or guarantees associated with them. 3. Equipment Financing Promissory Note: This variation of the note is used when the loan is specifically for the purchase or financing of equine equipment, such as trailers, saddles, or grooming supplies. It may specify the make, model, and condition of the equipment being financed. In conclusion, the Grand Prairie Texas Promissory Note — Horse Equine Forms is a legally binding document that outlines the terms and conditions of a loan agreement related to the horse and equine industry. It offers protection for both lenders and borrowers and helps ensure clear expectations and obligations. Depending on the specific loan scenario, various types of promissory notes, such as Horse Purchase Agreement Promissory Note, Equine Services Promissory Note, or Equipment Financing Promissory Note, may exist to cater to different needs within the industry.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.