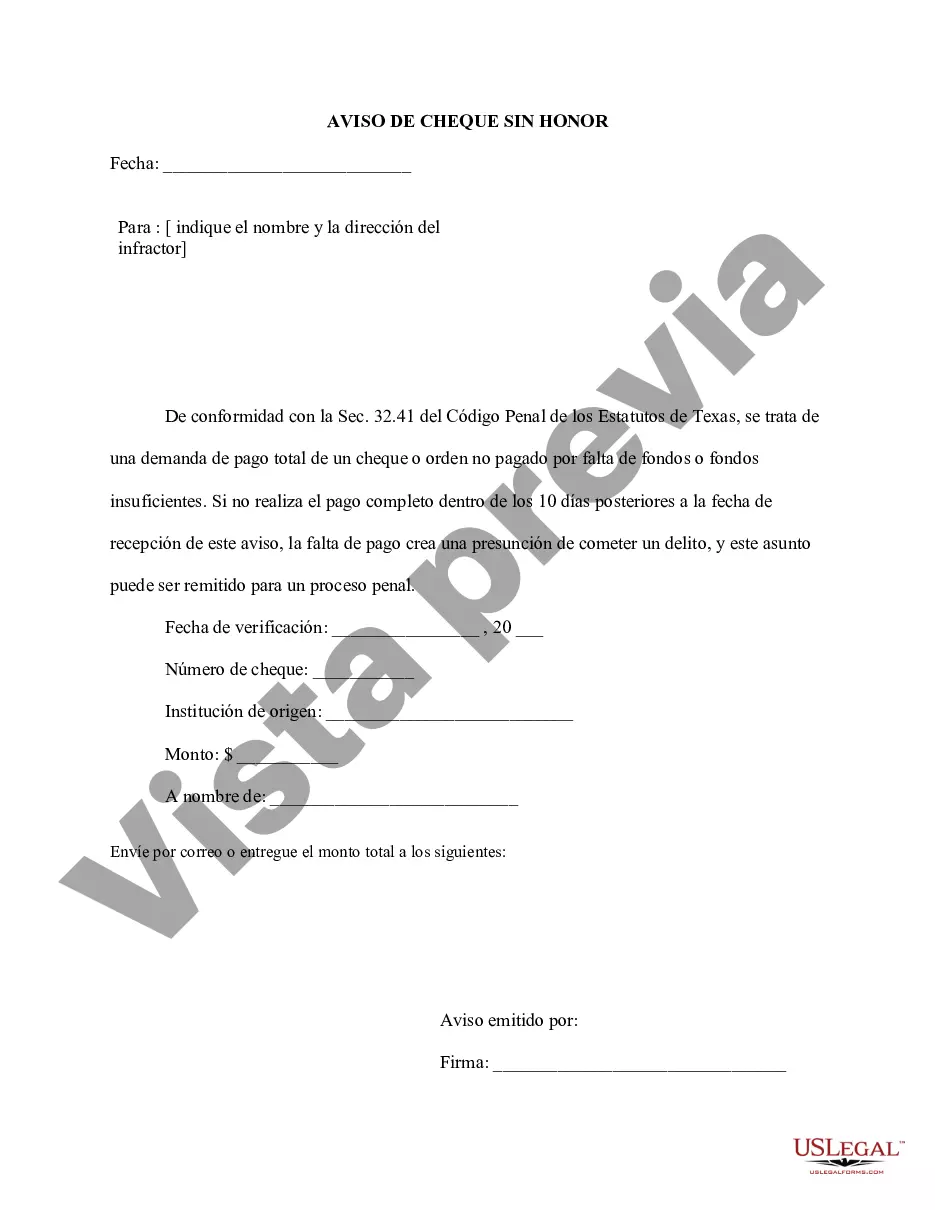

Arlington Texas Notice of Dishonored Check — Criminal Keywords: bad check, bounced check The Arlington Texas Notice of Dishonored Check — Criminal is a legal document used to inform individuals that a check they have issued has been dishonored or bounced by the bank due to insufficient funds, closed accounts, or other reasons. 1. Types of Dishonored Checks: a. Insufficient Funds: This occurs when the issuer's bank account does not have enough funds to cover the amount specified on the check. It is one of the most common reasons for a check to bounce. b. Closed Accounts: When the issuer's bank account has been closed before the check is presented for payment, the check will be dishonored. c. Postdated Checks: These are checks that have a future date specified by the issuer. If such a check is presented for payment before the specified date, it will be dishonored. d. Stolen or Forged Checks: In cases where checks are stolen or forged, the bank may dishonor them to protect the rightful account holder. 2. Arlington Texas Notice of Dishonored Check — Criminal: In Arlington, Texas, issuing a bad or bounced check is considered a criminal offense. Once a check is dishonored, the payee or the bank will typically send a Notice of Dishonored Check to the issuer, notifying them of the situation and demanding immediate payment of the check amount, plus any related fees and penalties. 3. Legal Consequences: If the recipient of the dishonored check does not receive satisfactory payment within a specified time frame, they may choose to pursue legal action. Depending on the circumstances, the issuer may face criminal charges, resulting in fines, penalties, or even imprisonment. In Arlington, Texas, the offense can be classified as a Class C misdemeanor if the amount is less than $20, while for amounts exceeding $20 but less than $500, it can be a Class B misdemeanor. For amounts over $500, it may be classified as a Class A misdemeanor or even a felony. 4. Resolving Dishonored Checks: Individuals who receive a Notice of Dishonored Check in Arlington, Texas, should take immediate action to rectify the situation. This may involve contacting the issuer to resolve the matter out of court, arranging for an alternative form of payment, or seeking the assistance of an attorney specializing in financial disputes. Remember, issuing bad or bounced checks can have severe consequences both legally and financially. It is crucial to ensure that there are sufficient funds in your account before issuing a check and to promptly resolve any issues that may arise to avoid significant penalties.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Arlington Texas Aviso de cheque sin fondos - Penal - Palabras clave: cheque sin fondos, cheque sin fondos - Texas Notice of Dishonored Check - Criminal - Keywords: bad check, bounced check

Description

How to fill out Arlington Texas Aviso De Cheque Sin Fondos - Penal - Palabras Clave: Cheque Sin Fondos, Cheque Sin Fondos?

Regardless of social or professional status, filling out law-related documents is an unfortunate necessity in today’s world. Too often, it’s practically impossible for a person with no legal background to draft such papers from scratch, mainly because of the convoluted terminology and legal nuances they involve. This is where US Legal Forms can save the day. Our platform provides a massive library with over 85,000 ready-to-use state-specific documents that work for practically any legal case. US Legal Forms also is a great asset for associates or legal counsels who want to save time utilizing our DYI forms.

Whether you require the Arlington Texas Notice of Dishonored Check - Criminal - Keywords: bad check, bounced check or any other paperwork that will be valid in your state or county, with US Legal Forms, everything is on hand. Here’s how you can get the Arlington Texas Notice of Dishonored Check - Criminal - Keywords: bad check, bounced check in minutes employing our reliable platform. If you are already a subscriber, you can go on and log in to your account to get the appropriate form.

Nevertheless, in case you are a novice to our platform, ensure that you follow these steps before obtaining the Arlington Texas Notice of Dishonored Check - Criminal - Keywords: bad check, bounced check:

- Ensure the form you have found is good for your location since the rules of one state or county do not work for another state or county.

- Preview the form and read a short outline (if provided) of scenarios the document can be used for.

- If the one you selected doesn’t suit your needs, you can start again and look for the necessary form.

- Click Buy now and choose the subscription option that suits you the best.

- Log in to your account login information or register for one from scratch.

- Choose the payment gateway and proceed to download the Arlington Texas Notice of Dishonored Check - Criminal - Keywords: bad check, bounced check once the payment is completed.

You’re good to go! Now you can go on and print out the form or complete it online. Should you have any problems getting your purchased documents, you can quickly access them in the My Forms tab.

Regardless of what situation you’re trying to sort out, US Legal Forms has got you covered. Try it out now and see for yourself.