Title: Understanding Tarrant Texas Notice of Dishonored Check — Criminal Proceedings Introduction: The Tarrant Texas Notice of Dishonored Check, also known as a bad check or bounced check, refers to a legal process initiated when an individual writes a check, and it fails to clear due to insufficient funds in their bank account. This article aims to provide a detailed description of this situation, including its implications, legal consequences, and potential penalties. 1. What is a Bad Check? A bad check is a term used when an individual writes a check to make a payment, but the funds in their bank account are not sufficient to cover the check amount. This can occur due to various reasons such as insufficient funds, account closure, or intentionally issuing a check without having the necessary funds. 2. Understanding Bounced Checks: A bounced check is another term used interchangeably with a bad check. It indicates that the check attempt has failed to clear due to non-sufficient funds (NSF) in the issuer's bank account. The bank returns the check to the payee, and the payee may then pursue legal action by sending a Tarrant Texas Notice of Dishonored Check. 3. Tarrant Texas Notice of Dishonored Check — Criminal Proceedings: When confronted with a bad or bounced check, the affected party (payee) in Tarrant County, Texas, may decide to pursue criminal charges against the issuer. This can be done by sending an official Notice of Dishonored Check, which serves as a legal notification to the check writer regarding their failure to fulfill their financial obligation. 4. Legal Consequences of a Dishonored Check: a) Penalties: In Texas, writing a bad check is a criminal offense. Issuing a bad check under $2,500 is considered a misdemeanor, while amounts exceeding $2,500 fall under a felony charge, carrying more severe penalties. b) Restitution and Fees: Apart from criminal charges, the check writer may be required to reimburse the payee for the check amount, including any legal fees, collection costs, and bank fees associated with the bounced check. c) Damage to Credit Rating: Bounced checks may also affect the issuer's credit score and reputation, as financial institutions and credit reporting agencies may record this information. 5. Different Types of Tarrant Texas Notice of Dishonored Check: While the main purpose of the Tarrant Texas Notice of Dishonored Check is to inform the check writer of their violations, there might be variations in these notices depending on the amount, repeated offenses, and other factors. Some common types include: a) Tarrant Texas Notice of Dishonored Check — First Offense b) Tarrant Texas Notice of Dishonored Check — Multiple Offenses c) Tarrant Texas Notice of Dishonored Check — Misrepresentation or Fraud Conclusion: Understanding the Tarrant Texas Notice of Dishonored Check is crucial for both payees and check writers. It serves as a legal notice for those who failed to honor their financial commitments and highlights the potential legal consequences. To avoid such situations, it is essential to ensure sufficient funds before issuing a check and promptly rectify any instances of returned checks.

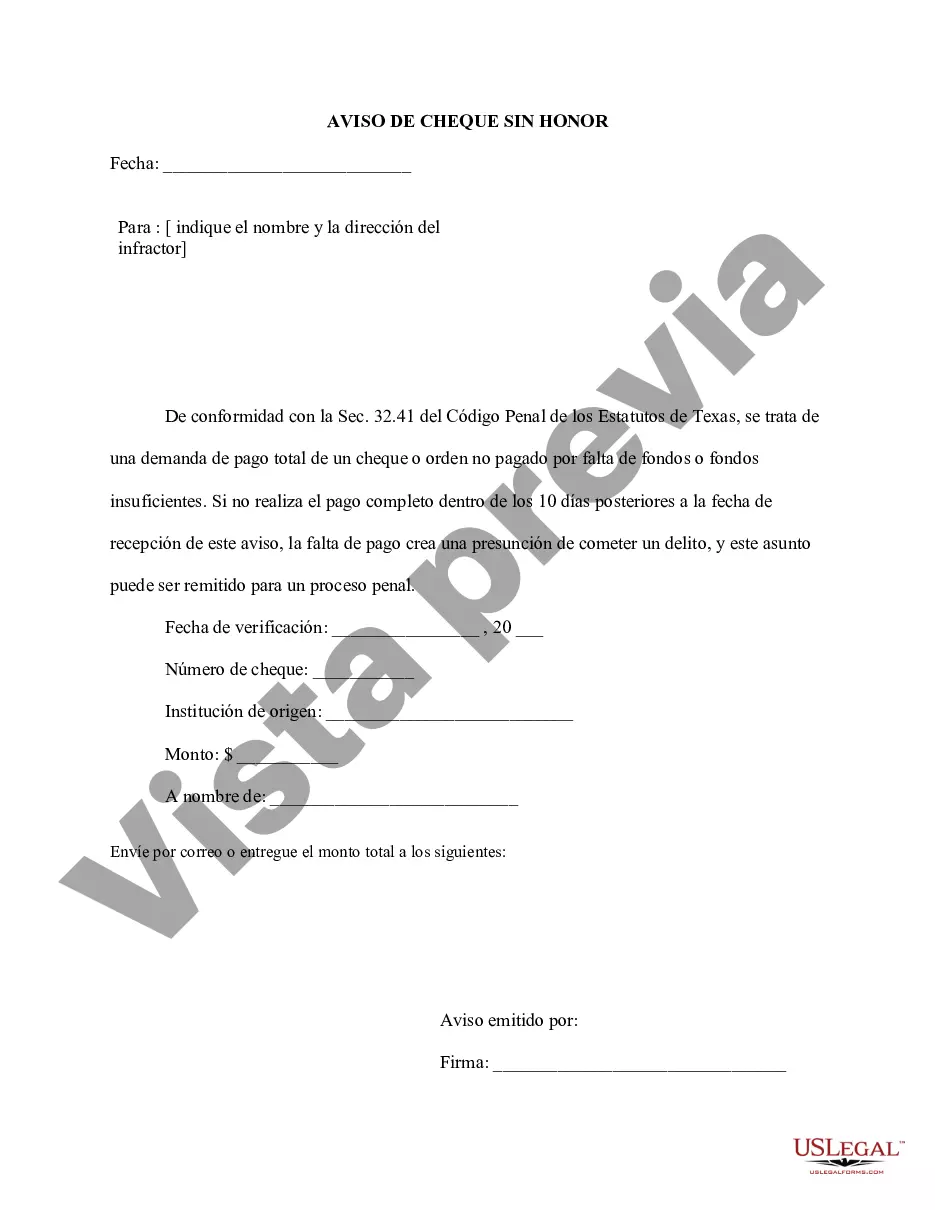

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Tarrant Texas Aviso de cheque sin fondos - Penal - Palabras clave: cheque sin fondos, cheque sin fondos - Texas Notice of Dishonored Check - Criminal - Keywords: bad check, bounced check

State:

Texas

County:

Tarrant

Control #:

TX-401N

Format:

Word

Instant download

Description

Formulario de aviso de cheque sin fondos.

Title: Understanding Tarrant Texas Notice of Dishonored Check — Criminal Proceedings Introduction: The Tarrant Texas Notice of Dishonored Check, also known as a bad check or bounced check, refers to a legal process initiated when an individual writes a check, and it fails to clear due to insufficient funds in their bank account. This article aims to provide a detailed description of this situation, including its implications, legal consequences, and potential penalties. 1. What is a Bad Check? A bad check is a term used when an individual writes a check to make a payment, but the funds in their bank account are not sufficient to cover the check amount. This can occur due to various reasons such as insufficient funds, account closure, or intentionally issuing a check without having the necessary funds. 2. Understanding Bounced Checks: A bounced check is another term used interchangeably with a bad check. It indicates that the check attempt has failed to clear due to non-sufficient funds (NSF) in the issuer's bank account. The bank returns the check to the payee, and the payee may then pursue legal action by sending a Tarrant Texas Notice of Dishonored Check. 3. Tarrant Texas Notice of Dishonored Check — Criminal Proceedings: When confronted with a bad or bounced check, the affected party (payee) in Tarrant County, Texas, may decide to pursue criminal charges against the issuer. This can be done by sending an official Notice of Dishonored Check, which serves as a legal notification to the check writer regarding their failure to fulfill their financial obligation. 4. Legal Consequences of a Dishonored Check: a) Penalties: In Texas, writing a bad check is a criminal offense. Issuing a bad check under $2,500 is considered a misdemeanor, while amounts exceeding $2,500 fall under a felony charge, carrying more severe penalties. b) Restitution and Fees: Apart from criminal charges, the check writer may be required to reimburse the payee for the check amount, including any legal fees, collection costs, and bank fees associated with the bounced check. c) Damage to Credit Rating: Bounced checks may also affect the issuer's credit score and reputation, as financial institutions and credit reporting agencies may record this information. 5. Different Types of Tarrant Texas Notice of Dishonored Check: While the main purpose of the Tarrant Texas Notice of Dishonored Check is to inform the check writer of their violations, there might be variations in these notices depending on the amount, repeated offenses, and other factors. Some common types include: a) Tarrant Texas Notice of Dishonored Check — First Offense b) Tarrant Texas Notice of Dishonored Check — Multiple Offenses c) Tarrant Texas Notice of Dishonored Check — Misrepresentation or Fraud Conclusion: Understanding the Tarrant Texas Notice of Dishonored Check is crucial for both payees and check writers. It serves as a legal notice for those who failed to honor their financial commitments and highlights the potential legal consequences. To avoid such situations, it is essential to ensure sufficient funds before issuing a check and promptly rectify any instances of returned checks.

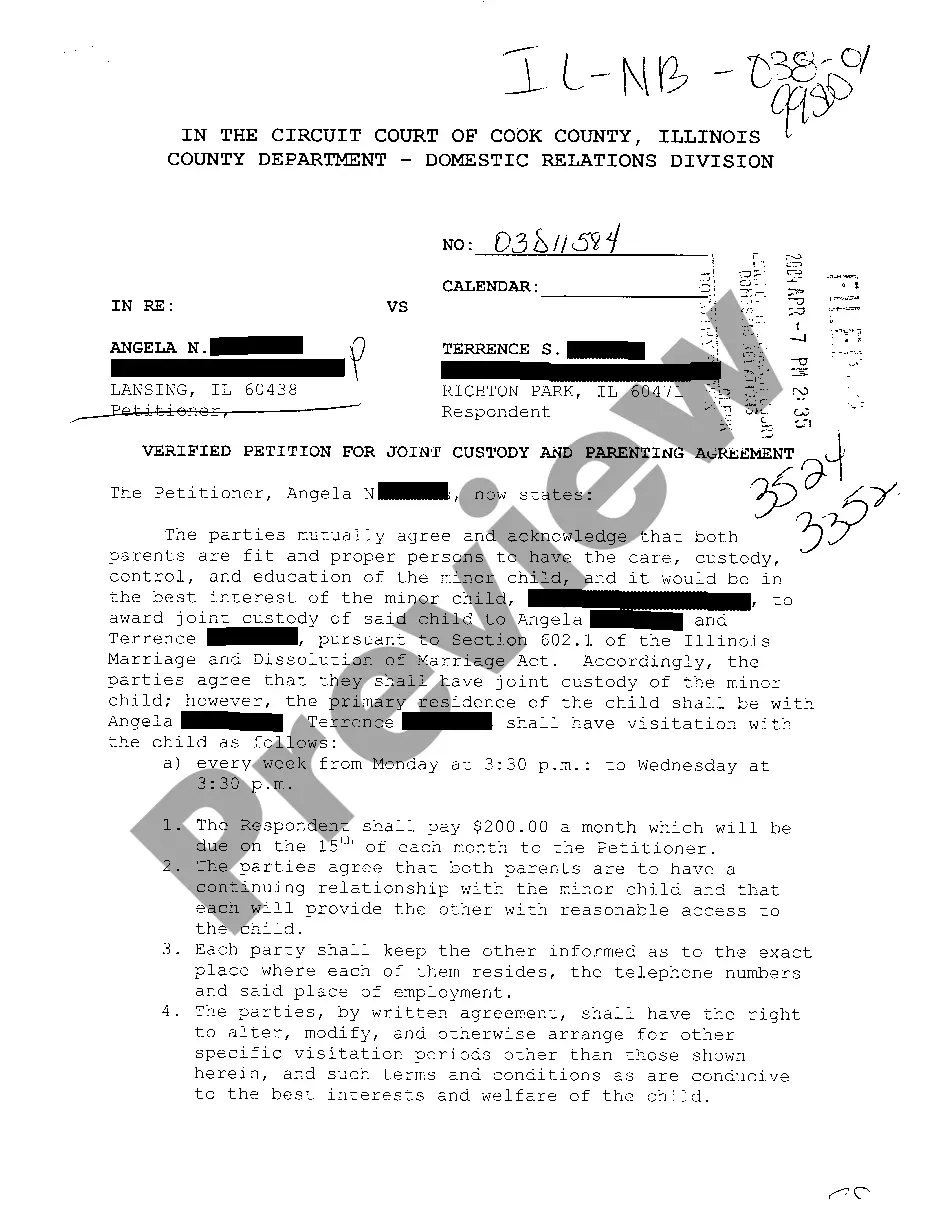

Free preview

How to fill out Tarrant Texas Aviso De Cheque Sin Fondos - Penal - Palabras Clave: Cheque Sin Fondos, Cheque Sin Fondos?

If you’ve already used our service before, log in to your account and save the Tarrant Texas Notice of Dishonored Check - Criminal - Keywords: bad check, bounced check on your device by clicking the Download button. Make certain your subscription is valid. If not, renew it in accordance with your payment plan.

If this is your first experience with our service, adhere to these simple steps to get your file:

- Ensure you’ve located the right document. Look through the description and use the Preview option, if available, to check if it meets your requirements. If it doesn’t fit you, utilize the Search tab above to obtain the appropriate one.

- Buy the template. Click the Buy Now button and choose a monthly or annual subscription plan.

- Create an account and make a payment. Utilize your credit card details or the PayPal option to complete the purchase.

- Get your Tarrant Texas Notice of Dishonored Check - Criminal - Keywords: bad check, bounced check. Pick the file format for your document and save it to your device.

- Complete your sample. Print it out or take advantage of professional online editors to fill it out and sign it electronically.

You have regular access to every piece of paperwork you have purchased: you can locate it in your profile within the My Forms menu anytime you need to reuse it again. Take advantage of the US Legal Forms service to quickly locate and save any template for your individual or professional needs!