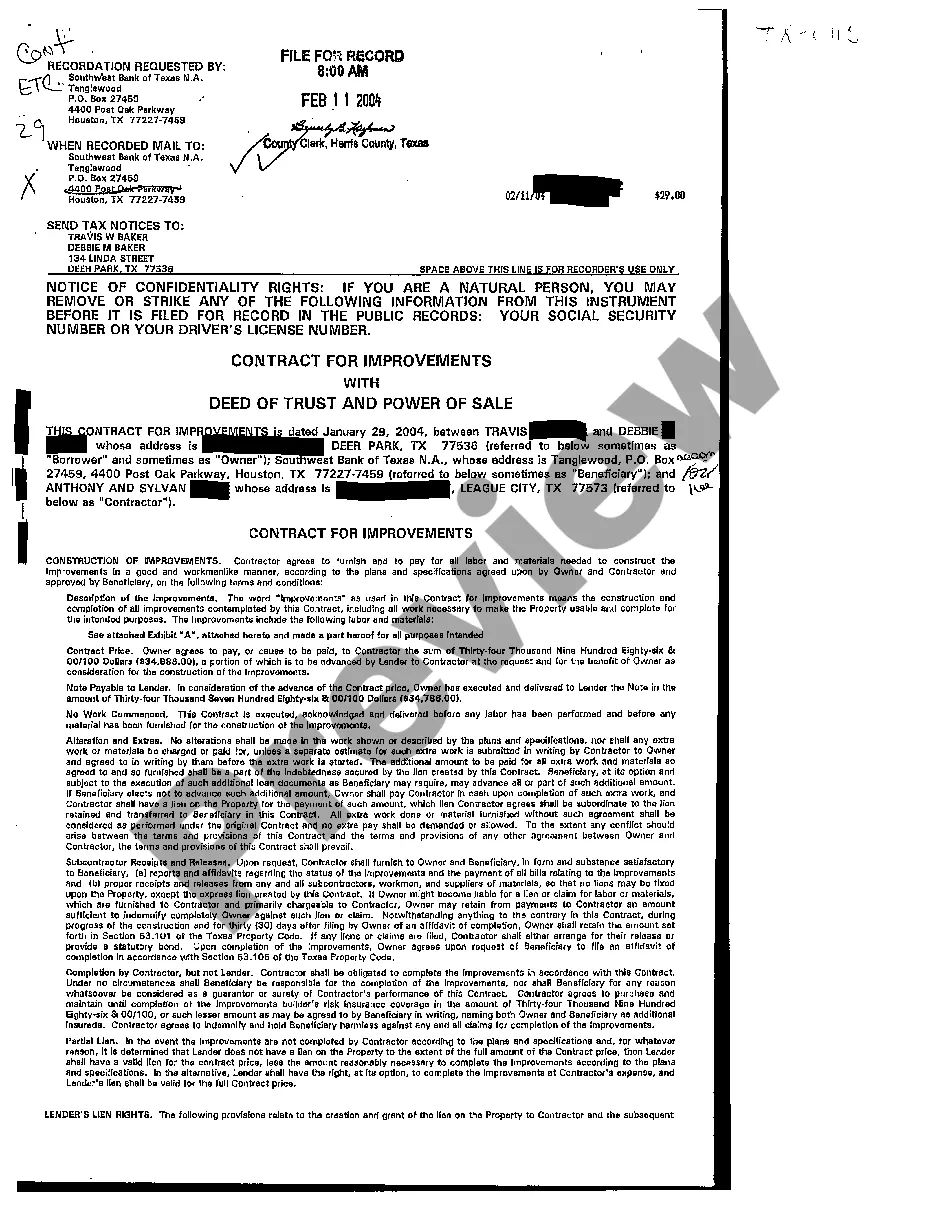

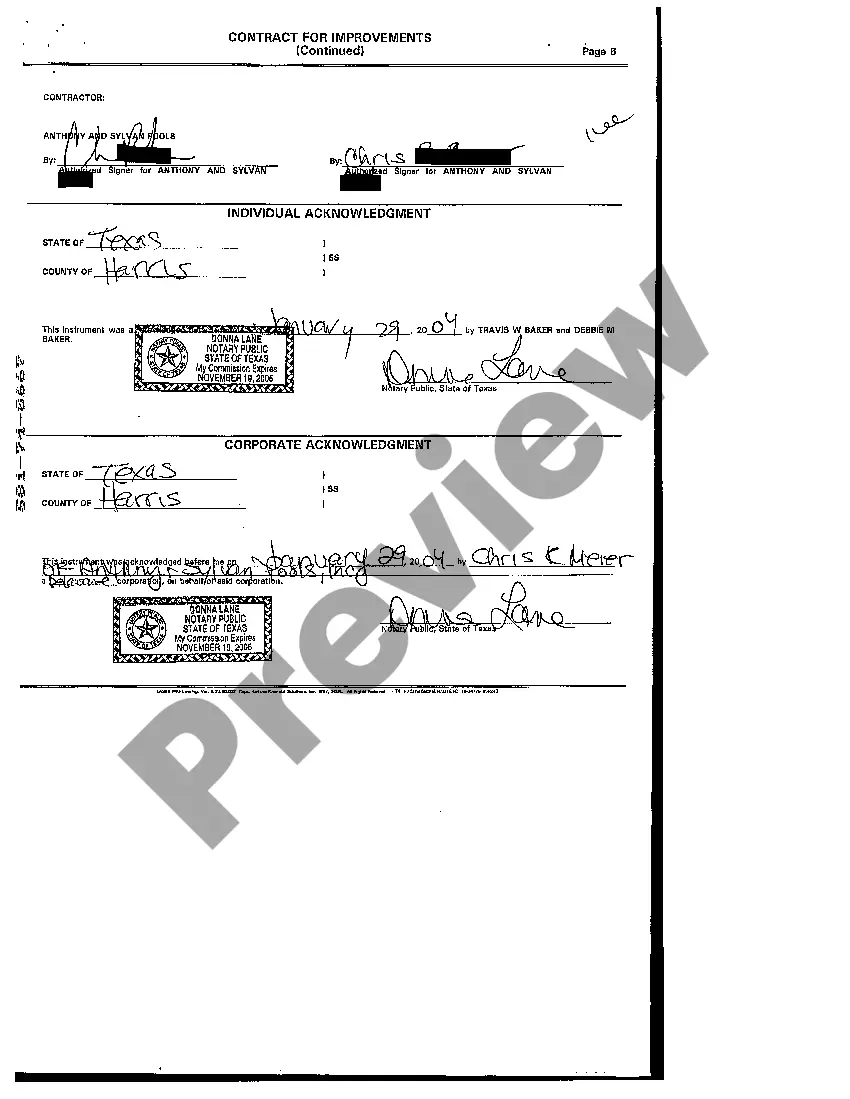

Beaumont Texas Contact for Improvements with Deed of Trust and Power to Sale If you are a property owner in Beaumont, Texas, planning to make improvements to your property and seeking financial assistance, it is essential to be knowledgeable about the Beaumont Texas Contact for Improvements with Deed of Trust and Power to Sale. This contact is crucial for individuals who wish to secure a loan for making improvements to their property while using their property as collateral. A deed of trust is a legal document that functions similarly to a mortgage, allowing a lender to use the property as security until the loan is repaid. It involves three parties: the borrower (property owner), the lender (typically a bank or financial institution), and a trustee, who holds the title on behalf of the lender until the loan is fully paid. In Beaumont, Texas, the deed of trust is often used when homeowners want to finance improvements to their property while retaining ownership. The Beaumont Texas Contact for Improvements with Deed of Trust and Power to Sale offers property owners a way to secure funds for improvements while providing assurance to the lender that their investment is adequately protected. By using their property as collateral, property owners can access loans at favorable interest rates, allowing them to enhance their property's value and potentially increase its marketability. The Power to Sale clause is an important element of the deed of trust. In the event of default on the loan, this clause grants the trustee the authority to sell the property without the need for a court proceeding. It provides a streamlined process for the lender to recover their investment quickly, while also protecting the rights of the borrower throughout the foreclosure process. Different types of Beaumont Texas Contact for Improvements with Deed of Trust and Power to Sale may vary based on individual lenders, loan terms, and specific property requirements. Some contacts may offer fixed or adjustable interest rates, various loan durations, or specific guidelines for property improvement projects. It is crucial for property owners to thoroughly research and compare different lenders to find the contact that best suits their needs and financial situation. Moreover, property owners should consult with legal professionals or mortgage specialists to gain a comprehensive understanding of the terms, conditions, and potential risks associated with signing a Beaumont Texas Contact for Improvements with Deed of Trust and Power to Sale. Understanding the legal implications and financial obligations is essential before proceeding with any loan agreement. In conclusion, the Beaumont Texas Contact for Improvements with Deed of Trust and Power to Sale provides property owners in Beaumont, Texas, the opportunity to secure loans for property improvements while leveraging their property as collateral. It is crucial to thoroughly research and compare different lenders, loan terms, and potential risks associated with the deed of trust. Seeking legal advice is highly recommended ensuring a clear understanding of the contact's terms and conditions.

Beaumont Texas Contact for Improvements with Deed of Trust and Power to Sale

Description

How to fill out Beaumont Texas Contact For Improvements With Deed Of Trust And Power To Sale?

If you are looking for a valid form template, it’s impossible to find a more convenient place than the US Legal Forms website – one of the most extensive libraries on the internet. Here you can find a large number of document samples for company and personal purposes by types and regions, or keywords. With the advanced search function, getting the most recent Beaumont Texas Contact for Improvements with Deed of Trust and Power to Sale is as easy as 1-2-3. Furthermore, the relevance of each and every file is proved by a team of professional attorneys that regularly check the templates on our website and update them according to the latest state and county requirements.

If you already know about our platform and have a registered account, all you need to get the Beaumont Texas Contact for Improvements with Deed of Trust and Power to Sale is to log in to your user profile and click the Download button.

If you make use of US Legal Forms the very first time, just follow the instructions listed below:

- Make sure you have discovered the sample you want. Read its explanation and use the Preview function to see its content. If it doesn’t suit your needs, use the Search option near the top of the screen to discover the needed record.

- Confirm your decision. Click the Buy now button. Next, select the preferred subscription plan and provide credentials to sign up for an account.

- Process the transaction. Use your bank card or PayPal account to complete the registration procedure.

- Obtain the form. Indicate the format and download it on your device.

- Make modifications. Fill out, revise, print, and sign the acquired Beaumont Texas Contact for Improvements with Deed of Trust and Power to Sale.

Every single form you add to your user profile has no expiration date and is yours permanently. It is possible to access them via the My Forms menu, so if you want to have an additional copy for editing or creating a hard copy, feel free to return and download it once again at any moment.

Take advantage of the US Legal Forms professional collection to get access to the Beaumont Texas Contact for Improvements with Deed of Trust and Power to Sale you were looking for and a large number of other professional and state-specific samples on a single website!