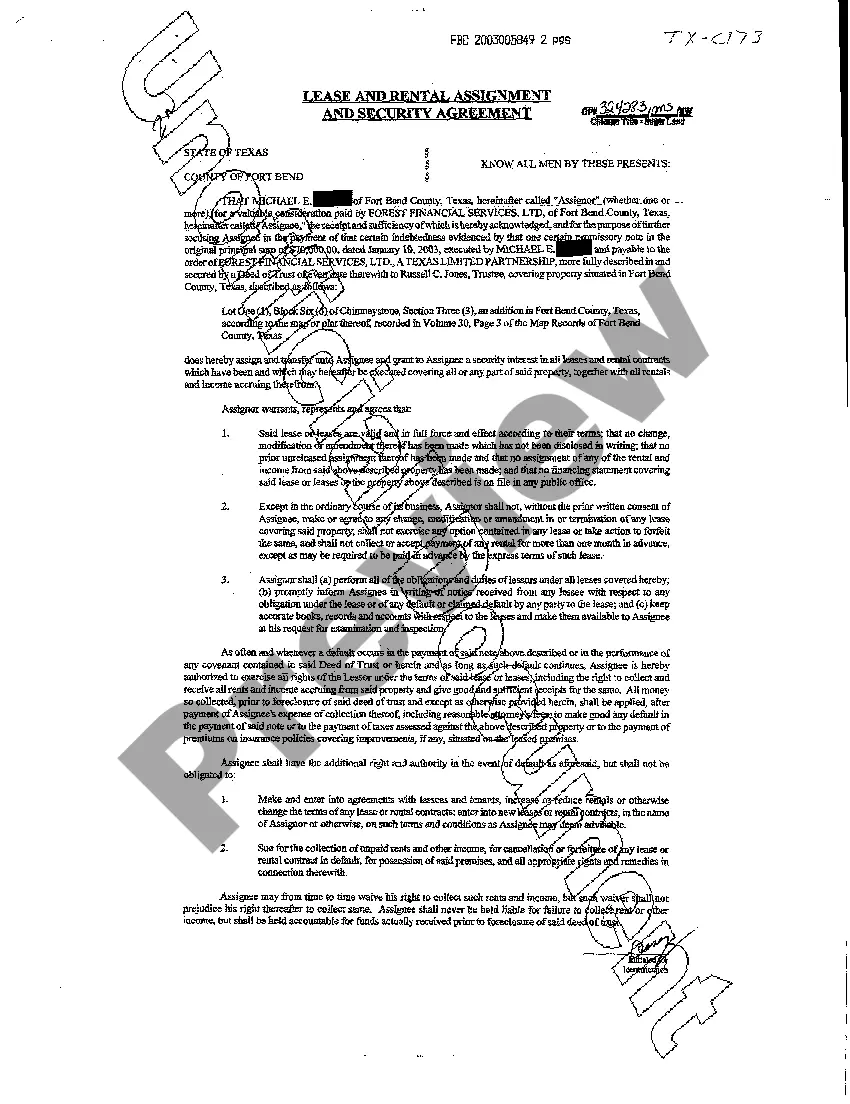

Carrollton Texas Lease and Rental Assignment as Security for Loan: Understanding the Basics and Types When it comes to financing options, securing a loan can be a common solution for individuals and businesses alike. In Carrollton, Texas, one way to obtain a loan is through a lease and rental assignment as security. This arrangement serves as an alternative method of collateral and offers lenders additional reassurance. In this article, we will delve into the details of Carrollton Texas Lease and Rental Assignment as Security for Loan, shedding light on its concept and various types. Lease and Rental Assignment as Security for Loan is a legal agreement where a borrower assigns their lease or rental income from a property as collateral to secure a loan. Instead of traditional collateral like property, vehicles, or investments, this arrangement relies on future cash flows generated from leasing or renting a property. This provides lenders with a steady income stream as insurance, reducing the risk associated with the loan. Types of Carrollton Texas Lease and Rental Assignment as Security for Loan: 1. Residential Property Assignment: This type of assignment involves residential properties such as houses, apartments, condos, or townhouses. Borrowers assign the income generated from leasing or renting out these properties to secure their loan. 2. Commercial Property Assignment: Commercial properties, including office spaces, retail stores, warehouses, and industrial facilities, can also serve as collateral for loans. Lenders evaluate the rental income potential and the borrower's ability to lease the property to determine the loan amount. 3. Mixed-Use Property Assignment: In Carrollton, Texas, mixed-use properties combining residential and commercial units have become increasingly popular. This type of assignment involves assigning both residential and commercial rental income to secure a loan. 4. Long-Term Lease Assignment: Instead of relying solely on short-term rentals, long-term leases can be utilized to secure loans. These agreements often span several years, providing lenders with a stable income stream and reducing the risk factor. It is crucial to note that Carrollton Texas Lease and Rental Assignment as Security for Loan is a legal process that requires careful consideration and expertise. Both borrowers and lenders must consult with legal professionals experienced in real estate and lending to ensure all requirements and regulations are met. In conclusion, Carrollton Texas Lease and Rental Assignment as Security for Loan offers borrowers an innovative way to secure loans by leveraging future rental income. It encompasses various types such as residential, commercial, mixed-use, and long-term leases. As this financial strategy gains popularity, it is essential for all parties involved to navigate the legal complexities. Always consult with professionals and approach this arrangement with thorough knowledge and understanding.

Carrollton Texas Lease and Rental Assignment as Security for Loan

Description

How to fill out Carrollton Texas Lease And Rental Assignment As Security For Loan?

Take advantage of the US Legal Forms and have immediate access to any form sample you want. Our beneficial platform with a huge number of documents allows you to find and get virtually any document sample you require. It is possible to export, fill, and certify the Carrollton Texas Lease and Rental Assignment as Security for Loan in a few minutes instead of browsing the web for many hours looking for a proper template.

Using our collection is a wonderful way to raise the safety of your document submissions. Our professional lawyers regularly review all the documents to make certain that the templates are relevant for a particular state and compliant with new laws and regulations.

How can you obtain the Carrollton Texas Lease and Rental Assignment as Security for Loan? If you already have a profile, just log in to the account. The Download button will be enabled on all the documents you look at. Furthermore, you can find all the earlier saved documents in the My Forms menu.

If you don’t have a profile yet, follow the tips listed below:

- Open the page with the template you require. Make certain that it is the template you were hoping to find: verify its title and description, and use the Preview option when it is available. Otherwise, use the Search field to find the needed one.

- Start the downloading procedure. Select Buy Now and choose the pricing plan you prefer. Then, sign up for an account and pay for your order using a credit card or PayPal.

- Export the file. Select the format to obtain the Carrollton Texas Lease and Rental Assignment as Security for Loan and change and fill, or sign it according to your requirements.

US Legal Forms is one of the most extensive and trustworthy template libraries on the web. Our company is always ready to assist you in virtually any legal process, even if it is just downloading the Carrollton Texas Lease and Rental Assignment as Security for Loan.

Feel free to make the most of our service and make your document experience as convenient as possible!