The Houston Texas Trust Agreement refers to a legally binding contract that is executed between a granter (the person transferring assets) and a trustee (the person responsible for managing the assets) in the city of Houston, Texas. It establishes the terms and conditions under which the trust is to be administered, outlining the duties, powers, and responsibilities of both the granter and the trustee. This agreement is governed by the laws of the state of Texas. A Houston Texas Trust Agreement can take different forms depending on its purpose and the assets involved. Some common types of trust agreements in Houston, Texas, include: 1. Revocable Living Trust: This type of trust agreement allows the granter to retain control over the assets during their lifetime. The granter can modify or revoke the trust at any time, making it flexible and adaptable to changing circumstances. Upon the granter's death, the trust becomes irrevocable, and the assets are distributed according to the terms set in the agreement, helping to avoid probate. 2. Irrevocable Trust: In an irrevocable trust agreement, the granter relinquishes all rights and control over the assets transferred to the trust. Once established, this type of trust cannot be modified or revoked without the consent of all beneficiaries named in the agreement. Irrevocable trusts are often used for tax planning, asset protection, or Medicaid eligibility purposes. 3. Testamentary Trust: A testamentary trust is created through a will and only becomes effective upon the death of the granter. In this type of trust agreement, the granter specifies the beneficiaries, trustees, and the terms and conditions for the trust's administration. Testamentary trusts are commonly used to provide for the care and management of assets for minor children or individuals with special needs. 4. Charitable Trust: This type of trust is established for charitable or philanthropic purposes. It allows the granter to make a significant contribution to a charitable organization while receiving certain tax benefits. Charitable trusts can be created during the granter's lifetime or through a will. Each type of Houston Texas Trust Agreement serves a specific purpose and offers distinct benefits and considerations. It is essential for individuals considering entering into a trust agreement to seek professional legal advice to ensure all legal requirements are met and their objectives are appropriately addressed.

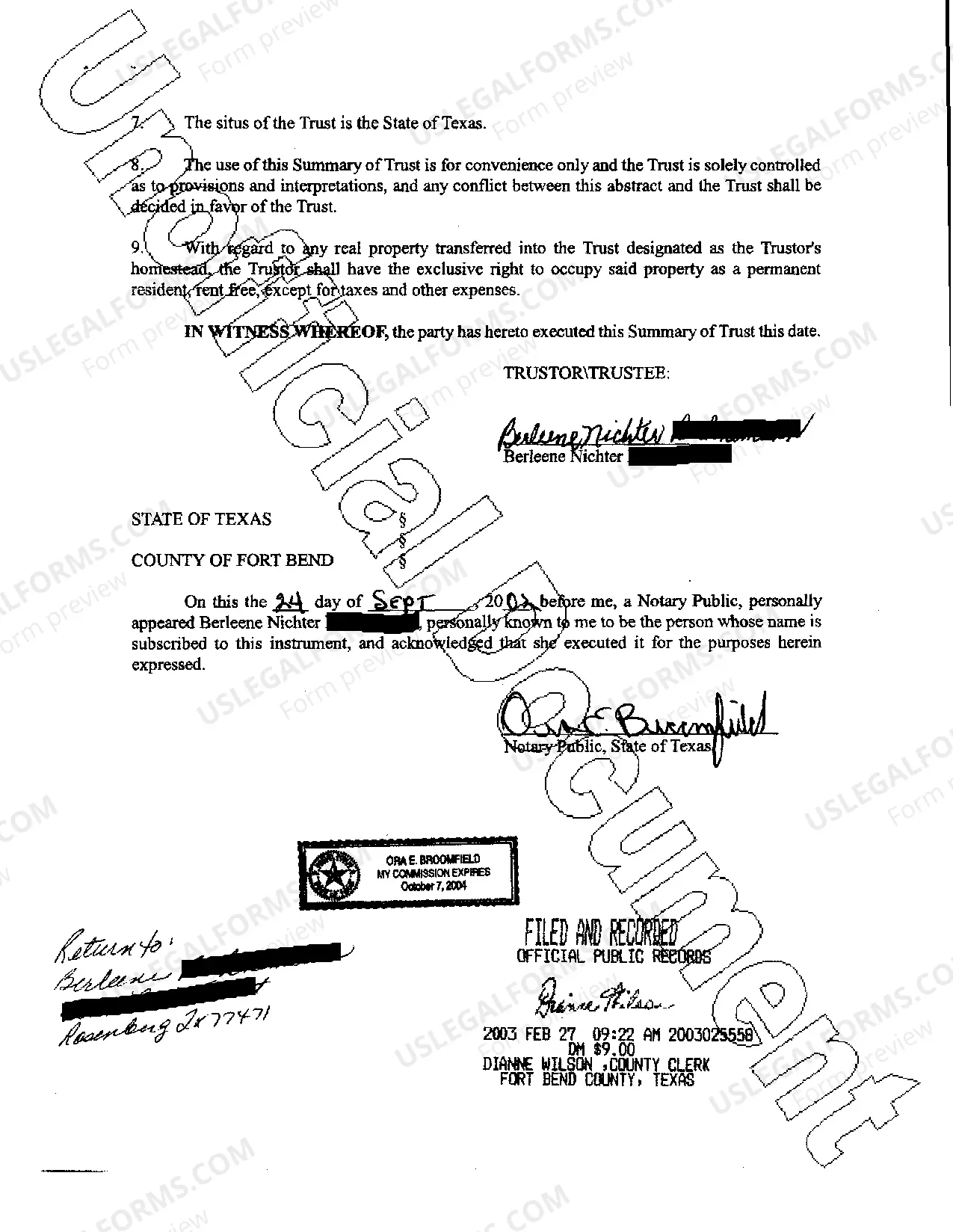

Houston Texas Trust Agreement

Description

How to fill out Houston Texas Trust Agreement?

We always want to reduce or avoid legal damage when dealing with nuanced law-related or financial affairs. To do so, we apply for attorney services that, usually, are extremely costly. Nevertheless, not all legal issues are equally complex. Most of them can be dealt with by ourselves.

US Legal Forms is a web-based catalog of updated DIY legal forms addressing anything from wills and powers of attorney to articles of incorporation and petitions for dissolution. Our library helps you take your affairs into your own hands without turning to an attorney. We offer access to legal document templates that aren’t always openly accessible. Our templates are state- and area-specific, which considerably facilitates the search process.

Benefit from US Legal Forms whenever you need to find and download the Houston Texas Trust Agreement or any other document quickly and securely. Simply log in to your account and click the Get button next to it. If you happened to lose the form, you can always download it again in the My Forms tab.

The process is just as effortless if you’re unfamiliar with the website! You can register your account within minutes.

- Make sure to check if the Houston Texas Trust Agreement complies with the laws and regulations of your your state and area.

- Also, it’s crucial that you check out the form’s description (if provided), and if you spot any discrepancies with what you were looking for in the first place, search for a different form.

- Once you’ve ensured that the Houston Texas Trust Agreement is proper for your case, you can select the subscription plan and make a payment.

- Then you can download the form in any suitable file format.

For over 24 years of our existence, we’ve helped millions of people by providing ready to customize and up-to-date legal forms. Make the most of US Legal Forms now to save efforts and resources!