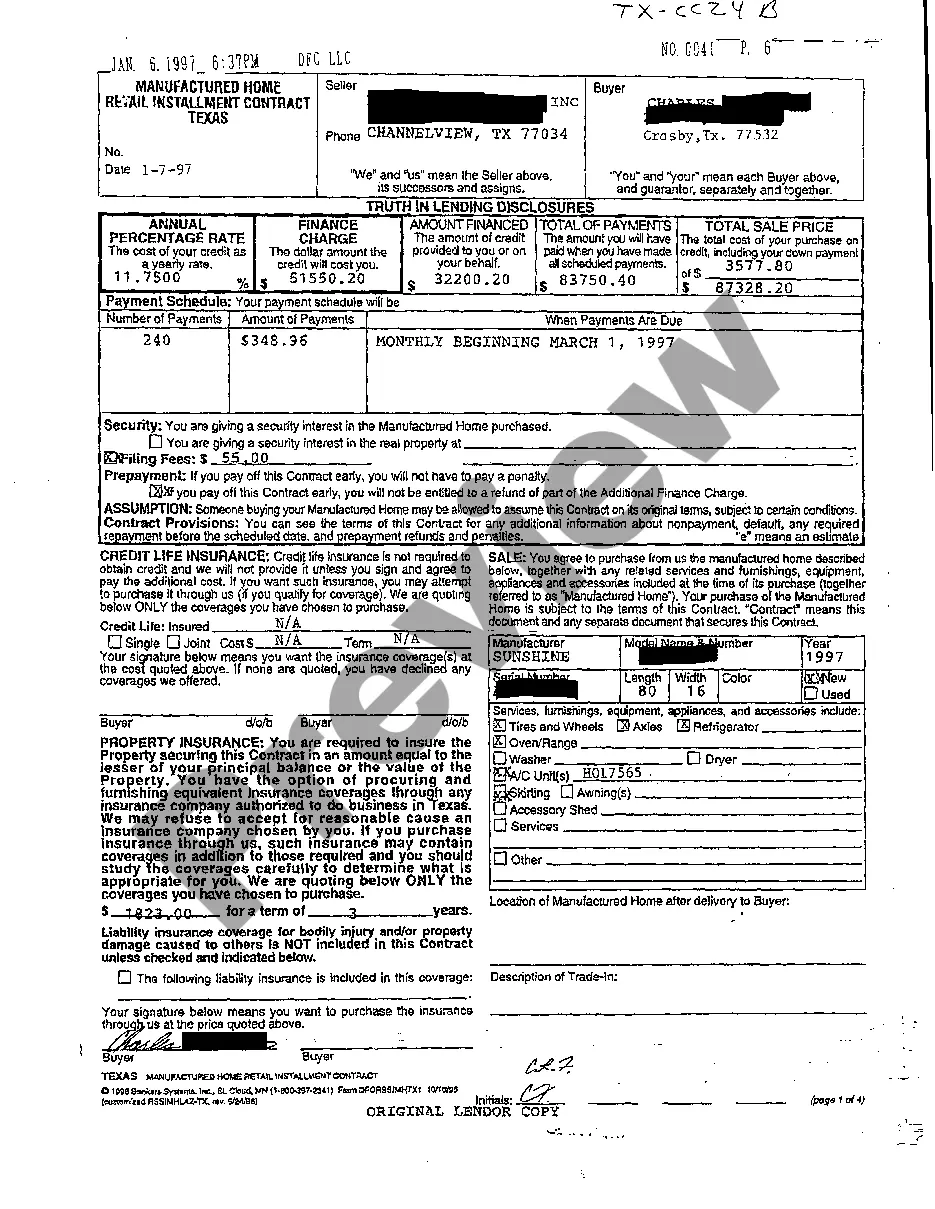

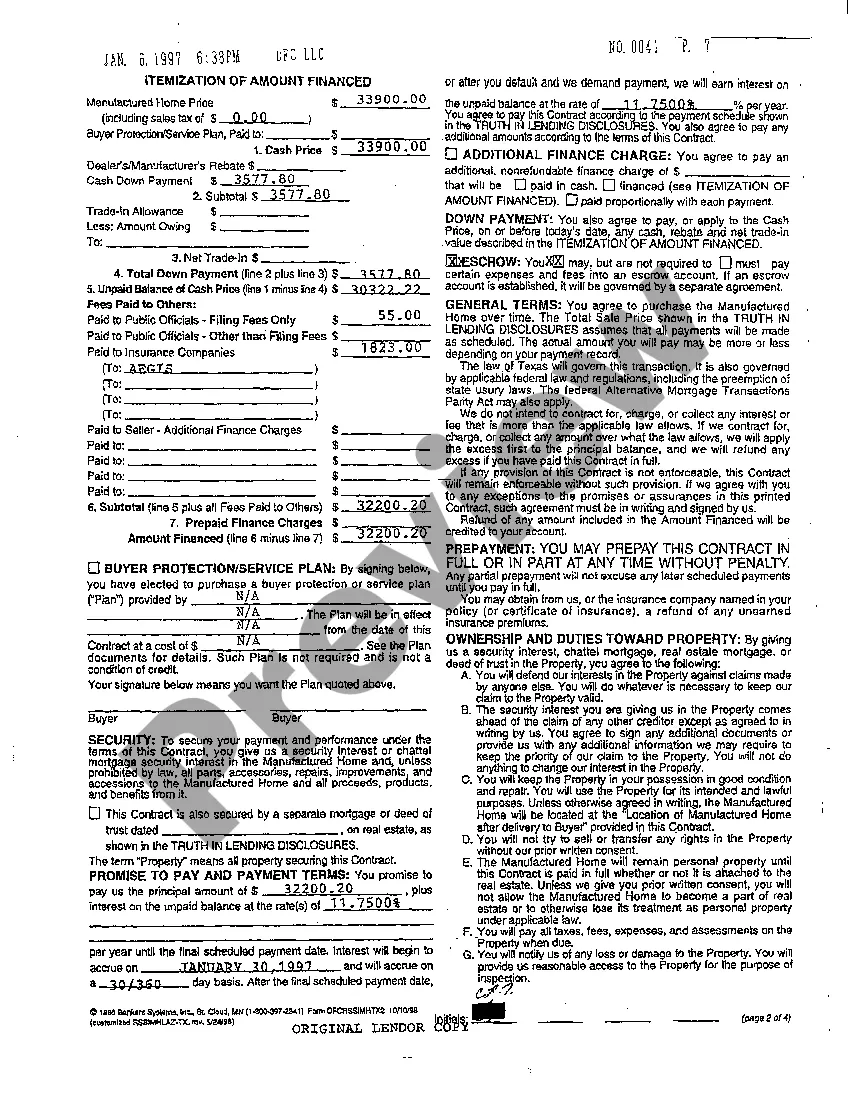

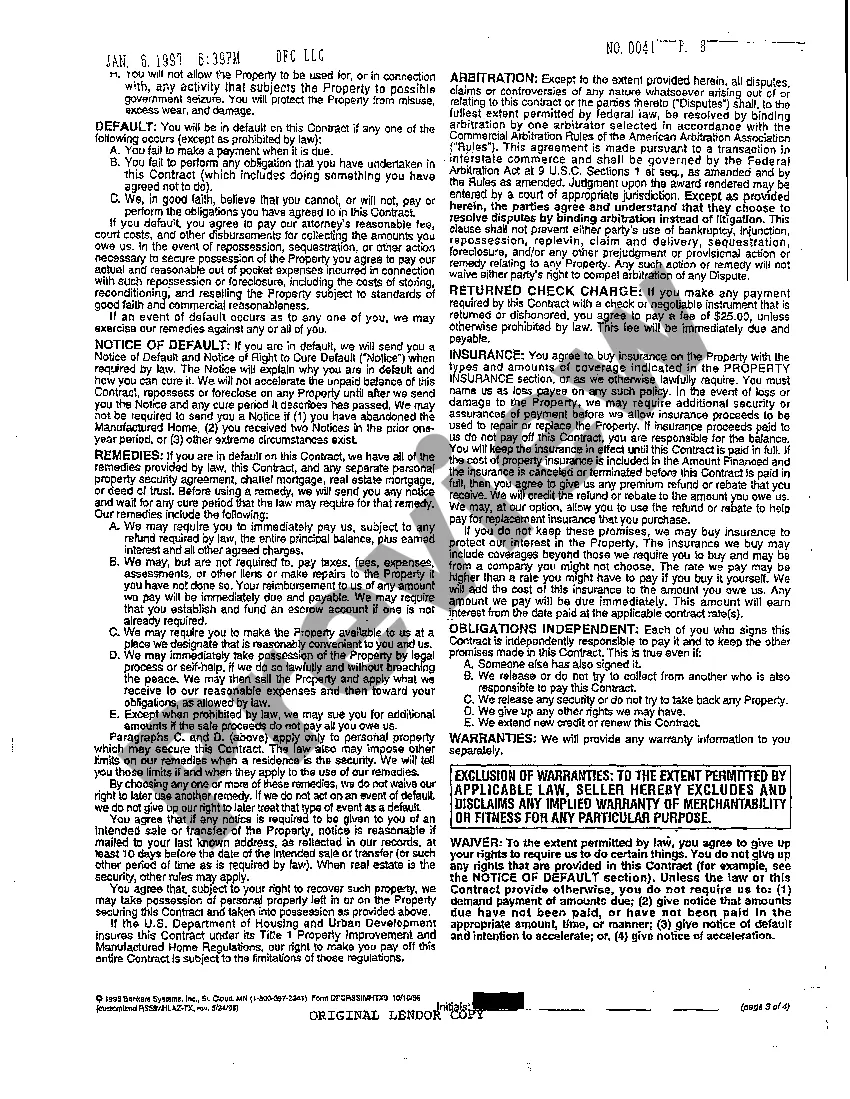

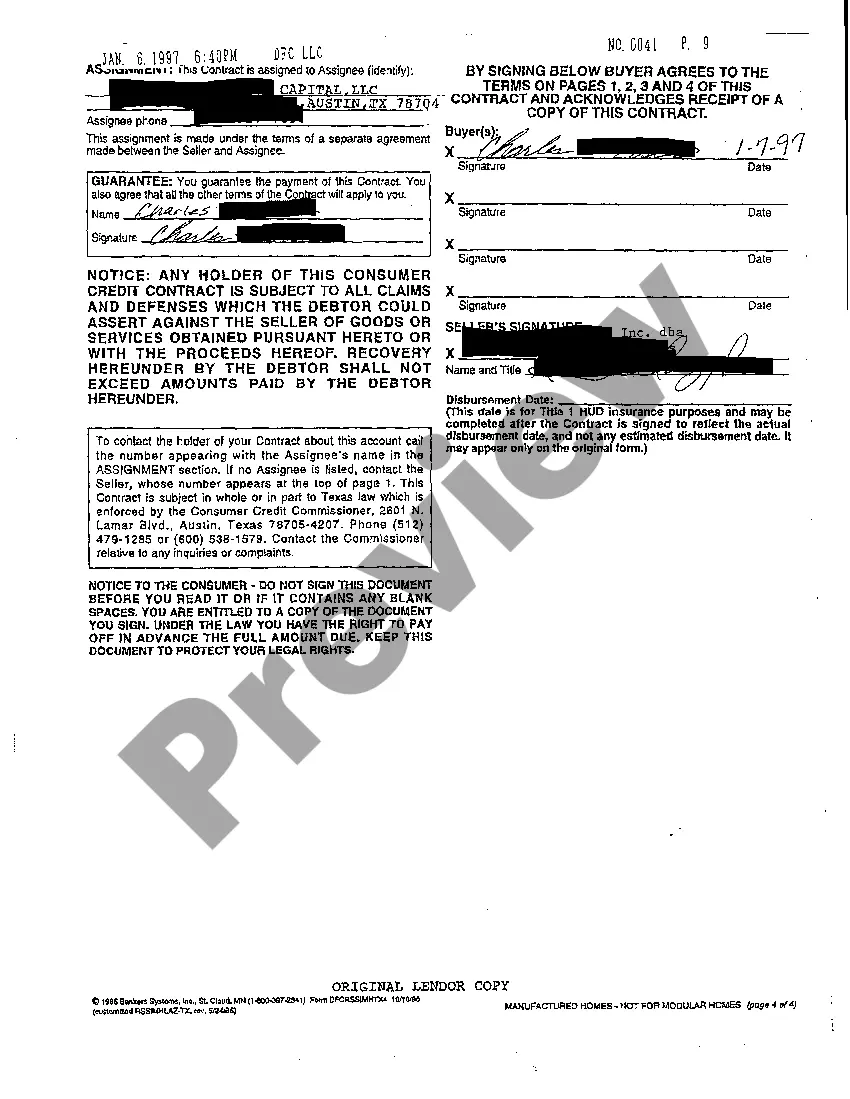

Frisco, a city located in the state of Texas, follows the regulations set forth by the Truth in Lending Act (TILL). The Truth in Lending Act is a federal law implemented to protect consumers by requiring lenders to provide clear and accurate information about the terms and costs associated with borrowing money. In the context of Frisco, Texas, the Frisco Truth In Lending Disclosures are the specific documents that lenders must provide to borrowers in accordance with the TILL. The Frisco Truth In Lending Disclosures serve as a means to ensure that individuals applying for loans or credit understand the terms of their financing agreement. These disclosures aim to provide transparency regarding the total cost of borrowing, interest rates, payment schedules, potential fees, and other essential information that borrowers need to make informed decisions. Typically, there are different types of Truth In Lending Disclosures that borrowers encounter throughout the loan application process in Frisco, Texas. These include: 1. Initial Disclosures: Within three business days of loan application submission, lenders are required to provide borrowers with initial disclosures. These include the loan amount, interest rate, annual percentage rate (APR), payment terms, and any other relevant terms specific to the loan product. 2. Closing Disclosures: Before the loan closing, lenders must furnish borrowers with closing disclosures. This document outlines the finalized terms and costs associated with the loan, including the amount financed, total payments, APR, closing costs, and any other fees that borrowers may incur. 3. Annual Percentage Rate (APR) Disclosures: Lenders must disclose the APR, a percentage that represents the total cost of borrowing per year, inclusive of fees and interest rates. APR disclosures help borrowers compare the costs of different loan offers and make informed decisions. 4. Variable Rate Disclosures: In cases where loans offered have variable interest rates, Frisco Truth In Lending Disclosures must notify borrowers of this fact. Variable rate disclosures detail the index on which the interest rate is based, any limitations or caps on interest rate fluctuations, and an estimate of potential payment changes. 5. Loan Estimate: Prior to loan consummation, lenders must provide borrowers with a Loan Estimate document. This disclosure includes details about the loan amount, interest rate, estimated monthly payments, closing costs, and other key features of the loan. It is important for Frisco, Texas residents to be aware of these Truth In Lending Disclosures as they provide significant information about the loans they are considering. By carefully reviewing and understanding these disclosures, borrowers can make informed choices regarding their financial well-being before proceeding with any loan or credit application.

Frisco Texas Truth In Lending Disclosures

State:

Texas

City:

Frisco

Control #:

TX-CC-24-03

Format:

PDF

Instant download

This form is available by subscription

Description

A03 Truth In Lending Disclosures

Frisco, a city located in the state of Texas, follows the regulations set forth by the Truth in Lending Act (TILL). The Truth in Lending Act is a federal law implemented to protect consumers by requiring lenders to provide clear and accurate information about the terms and costs associated with borrowing money. In the context of Frisco, Texas, the Frisco Truth In Lending Disclosures are the specific documents that lenders must provide to borrowers in accordance with the TILL. The Frisco Truth In Lending Disclosures serve as a means to ensure that individuals applying for loans or credit understand the terms of their financing agreement. These disclosures aim to provide transparency regarding the total cost of borrowing, interest rates, payment schedules, potential fees, and other essential information that borrowers need to make informed decisions. Typically, there are different types of Truth In Lending Disclosures that borrowers encounter throughout the loan application process in Frisco, Texas. These include: 1. Initial Disclosures: Within three business days of loan application submission, lenders are required to provide borrowers with initial disclosures. These include the loan amount, interest rate, annual percentage rate (APR), payment terms, and any other relevant terms specific to the loan product. 2. Closing Disclosures: Before the loan closing, lenders must furnish borrowers with closing disclosures. This document outlines the finalized terms and costs associated with the loan, including the amount financed, total payments, APR, closing costs, and any other fees that borrowers may incur. 3. Annual Percentage Rate (APR) Disclosures: Lenders must disclose the APR, a percentage that represents the total cost of borrowing per year, inclusive of fees and interest rates. APR disclosures help borrowers compare the costs of different loan offers and make informed decisions. 4. Variable Rate Disclosures: In cases where loans offered have variable interest rates, Frisco Truth In Lending Disclosures must notify borrowers of this fact. Variable rate disclosures detail the index on which the interest rate is based, any limitations or caps on interest rate fluctuations, and an estimate of potential payment changes. 5. Loan Estimate: Prior to loan consummation, lenders must provide borrowers with a Loan Estimate document. This disclosure includes details about the loan amount, interest rate, estimated monthly payments, closing costs, and other key features of the loan. It is important for Frisco, Texas residents to be aware of these Truth In Lending Disclosures as they provide significant information about the loans they are considering. By carefully reviewing and understanding these disclosures, borrowers can make informed choices regarding their financial well-being before proceeding with any loan or credit application.

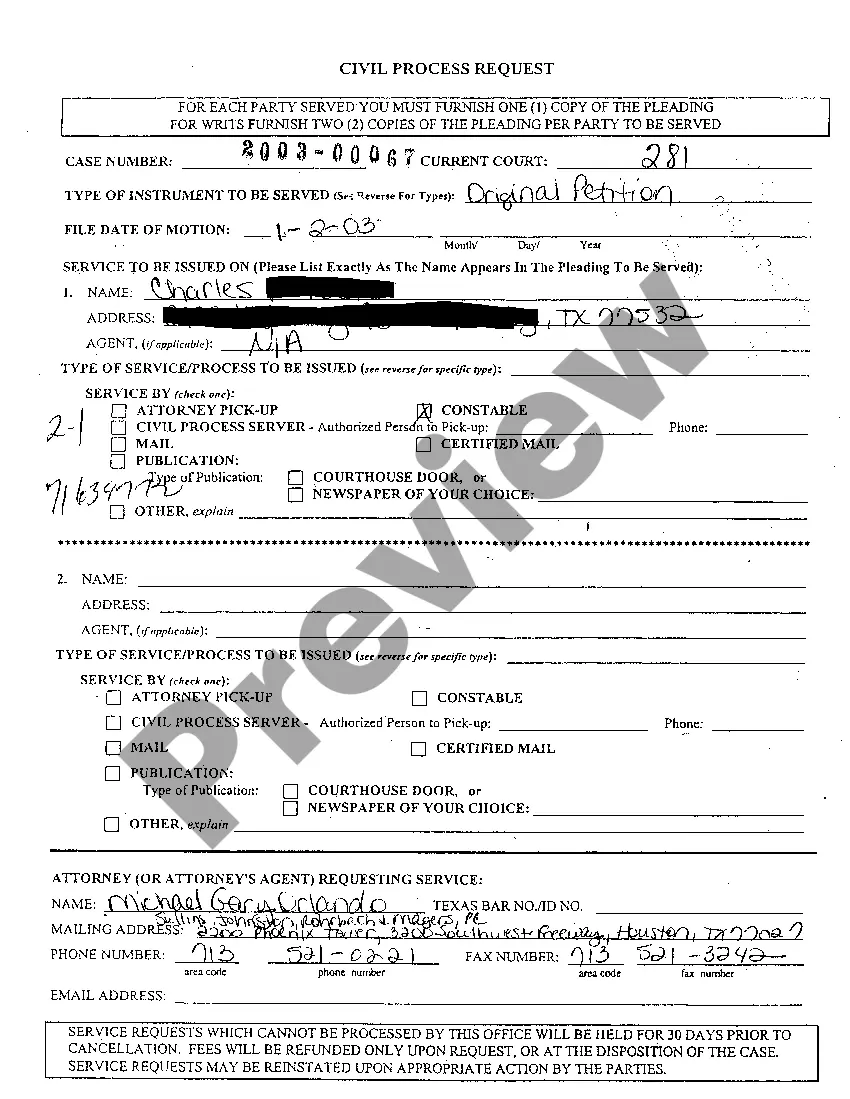

Free preview

How to fill out Frisco Texas Truth In Lending Disclosures?

If you’ve already utilized our service before, log in to your account and save the Frisco Texas Truth In Lending Disclosures on your device by clicking the Download button. Make sure your subscription is valid. If not, renew it according to your payment plan.

If this is your first experience with our service, adhere to these simple steps to obtain your file:

- Ensure you’ve found an appropriate document. Look through the description and use the Preview option, if any, to check if it meets your requirements. If it doesn’t suit you, use the Search tab above to find the appropriate one.

- Buy the template. Click the Buy Now button and pick a monthly or annual subscription plan.

- Create an account and make a payment. Utilize your credit card details or the PayPal option to complete the purchase.

- Get your Frisco Texas Truth In Lending Disclosures. Pick the file format for your document and save it to your device.

- Complete your sample. Print it out or take advantage of professional online editors to fill it out and sign it electronically.

You have permanent access to each piece of paperwork you have bought: you can find it in your profile within the My Forms menu whenever you need to reuse it again. Take advantage of the US Legal Forms service to easily locate and save any template for your personal or professional needs!