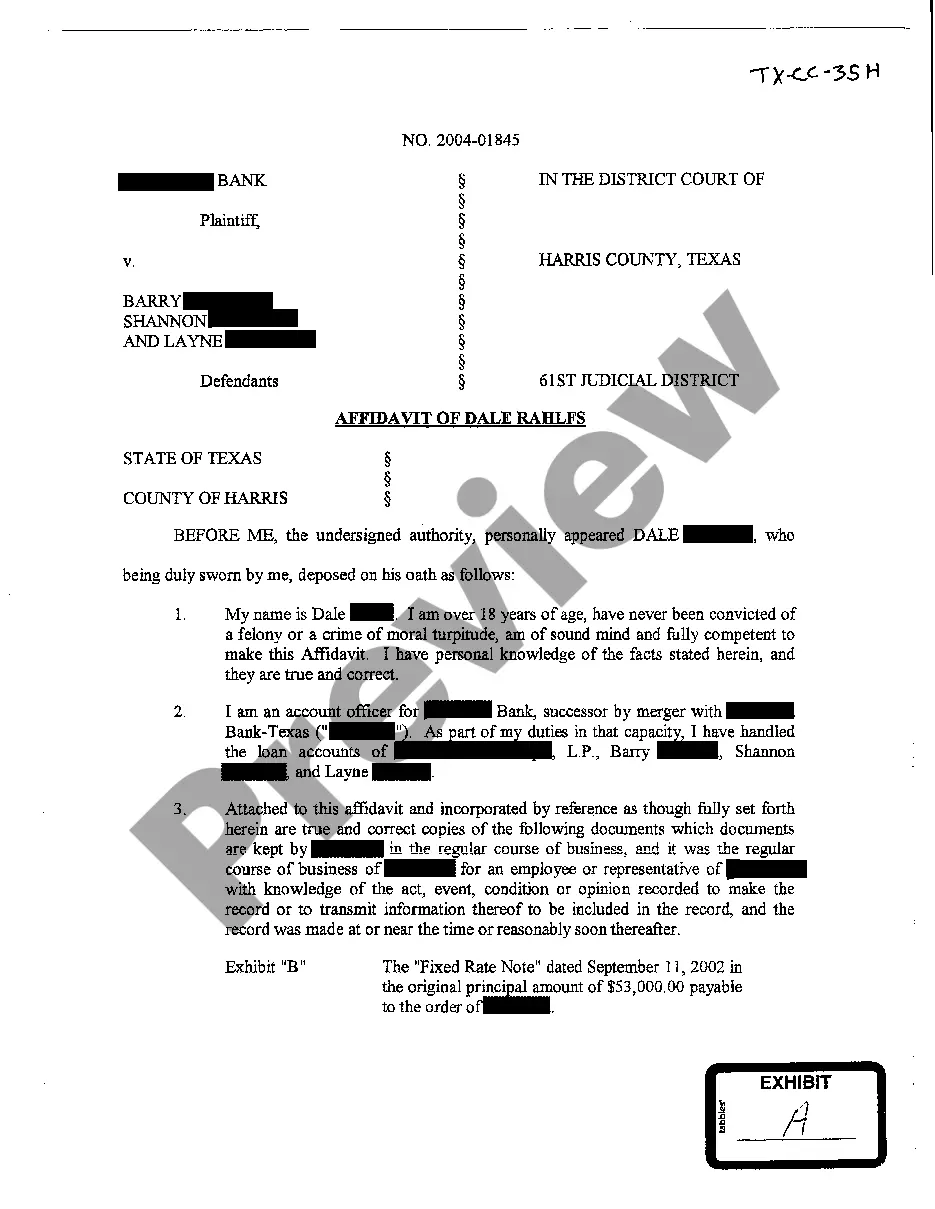

The Tarrant Texas Affidavit of Plaintiff detailing debt owed is a legal document that outlines the specific information regarding a debt that is owed by an individual or entity to the plaintiff, typically a creditor or a financial institution. This affidavit serves as evidence of the debt and is filed in court as part of a lawsuit to pursue collection or enforcement of the debt. In Tarrant County, Texas, there are different types of affidavits of plaintiff used to detail debt owed, including: 1. Tarrant Texas Affidavit of Plaintiff for Unpaid Credit Card Debt: This affidavit is specifically designed to outline the details of unpaid credit card debts. It includes information such as the name of the defendant, the amount owed, the date of last payment, and any applicable interest or fees. 2. Tarrant Texas Affidavit of Plaintiff for Unpaid Personal Loan Debt: This affidavit focuses on unpaid personal loan debts. It includes similar information as the credit card affidavit but is specific to personal loan transactions. 3. Tarrant Texas Affidavit of Plaintiff for Unpaid Mortgage Debt: This particular affidavit is used when pursuing unpaid mortgage debt owed by the defendant. It includes details about the mortgage loan, such as the property address, loan amount, outstanding balance, and any missed payments. 4. Tarrant Texas Affidavit of Plaintiff for Unpaid Auto Loan Debt: This affidavit is relevant when seeking payment for an unpaid auto loan. It includes specifics related to the auto loan agreement, such as the make and model of the vehicle, the loan amount, the remaining balance, and any defaulted or missed payments. Regardless of the specific type of debt, these affidavits serve to establish the creditor's claim and provide evidence to support their case in court. It is crucial for the plaintiff to accurately and thoroughly detail the debt owed in the affidavit to ensure a strong legal stance in pursuing the unpaid debt.

Tarrant Texas Affidavit of Plaintiff detailing debt owed

Description

How to fill out Tarrant Texas Affidavit Of Plaintiff Detailing Debt Owed?

Are you looking for a reliable and inexpensive legal forms supplier to buy the Tarrant Texas Affidavit of Plaintiff detailing debt owed? US Legal Forms is your go-to choice.

Whether you need a simple arrangement to set regulations for cohabitating with your partner or a package of documents to move your separation or divorce through the court, we got you covered. Our platform offers more than 85,000 up-to-date legal document templates for personal and company use. All templates that we offer aren’t generic and frameworked based on the requirements of particular state and area.

To download the form, you need to log in account, find the needed form, and hit the Download button next to it. Please keep in mind that you can download your previously purchased document templates anytime from the My Forms tab.

Is the first time you visit our website? No worries. You can create an account with swift ease, but before that, make sure to do the following:

- Check if the Tarrant Texas Affidavit of Plaintiff detailing debt owed conforms to the regulations of your state and local area.

- Go through the form’s description (if provided) to find out who and what the form is intended for.

- Start the search over in case the form isn’t good for your specific scenario.

Now you can register your account. Then choose the subscription plan and proceed to payment. As soon as the payment is completed, download the Tarrant Texas Affidavit of Plaintiff detailing debt owed in any provided format. You can return to the website when you need and redownload the form free of charge.

Getting up-to-date legal documents has never been easier. Give US Legal Forms a try now, and forget about wasting your valuable time learning about legal papers online for good.