Dallas Texas Complex Will With Credit Shelter Marital Trust For Large Estates is a legal arrangement designed to provide individuals in Dallas, Texas, with a comprehensive estate planning solution for their substantial assets and wealth. This complex will involves the creation of a credit shelter marital trust, which allows for the preservation and tax-efficient transfer of assets between spouses while effectively utilizing the estate tax exemption. The Dallas Texas Complex Will With Credit Shelter Marital Trust For Large Estates recognizes that individuals with significant assets require specialized estate planning strategies to protect their wealth and provide for their loved ones. This type of will is particularly relevant for high net worth individuals residing in Dallas, Texas, who aim to minimize estate taxes and maintain control over the distribution of their assets. The credit shelter marital trust established through this complex will allows the creator (also known as the granter or testator) to transfer assets to the trust while taking advantage of the estate tax exemption. By utilizing the exemption amount, an individual can effectively reduce the taxable value of their estate and potentially eliminate estate taxes for the surviving spouse and heirs. There are a few variations of the Dallas Texas Complex Will With Credit Shelter Marital Trust For Large Estates, each catering to specific needs and preferences. Some of these variations include: 1. TIP Trust: A Qualified Terminable Interest Property trust is designed to provide income for the surviving spouse while preserving the principal for the beneficiaries designated by the granter. This trust type ensures that the surviving spouse is financially secure while allowing the granter to control the ultimate distribution of assets. 2. Irrevocable Life Insurance Trust (IIT): This type of trust allows the granter to exclude the life insurance proceeds from their taxable estate, providing liquidity for estate taxes and other expenses. The IIT owns the life insurance policy, ensuring that the policy proceeds are distributed according to the granter's wishes. 3. Dynasty Trust: A dynasty trust is created to provide for multiple generations and preserve wealth within a family lineage. It is designed to minimize estate taxes and protects assets from creditors, divorces, and other threats. This type of trust can last for several generations, perpetuating the granter's wealth and values. 4. Charitable Remainder Trust (CRT): For individuals interested in philanthropy, a CRT can be established to provide income for the granter or other beneficiaries during their lifetime while supporting charitable causes. This trust type allows for tax deductions for charitable contributions and potentially reduces estate taxes. In conclusion, the Dallas Texas Complex Will With Credit Shelter Marital Trust For Large Estates is a comprehensive estate planning solution tailored for high net worth individuals in Dallas, Texas. It involves the creation of a credit shelter marital trust, which efficiently utilizes the estate tax exemption and allows for the preservation and transfer of assets. Depending on specific needs and goals, variations such as TIP trusts, Slits, dynasty trusts, and CRTs can provide additional benefits within this estate planning framework.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Dallas Texas Testamento complejo con refugio de crédito Fideicomiso matrimonial para grandes patrimonios - Texas Complex Will With Credit Shelter Marital Trust For Large Estates

Description

How to fill out Dallas Texas Testamento Complejo Con Refugio De Crédito Fideicomiso Matrimonial Para Grandes Patrimonios?

Finding verified templates specific to your local laws can be challenging unless you use the US Legal Forms library. It’s an online pool of more than 85,000 legal forms for both individual and professional needs and any real-life situations. All the documents are properly grouped by area of usage and jurisdiction areas, so searching for the Dallas Texas Complex Will With Credit Shelter Marital Trust For Large Estates gets as quick and easy as ABC.

For everyone already familiar with our catalogue and has used it before, obtaining the Dallas Texas Complex Will With Credit Shelter Marital Trust For Large Estates takes just a few clicks. All you need to do is log in to your account, pick the document, and click Download to save it on your device. The process will take just a few more steps to complete for new users.

Follow the guidelines below to get started with the most extensive online form catalogue:

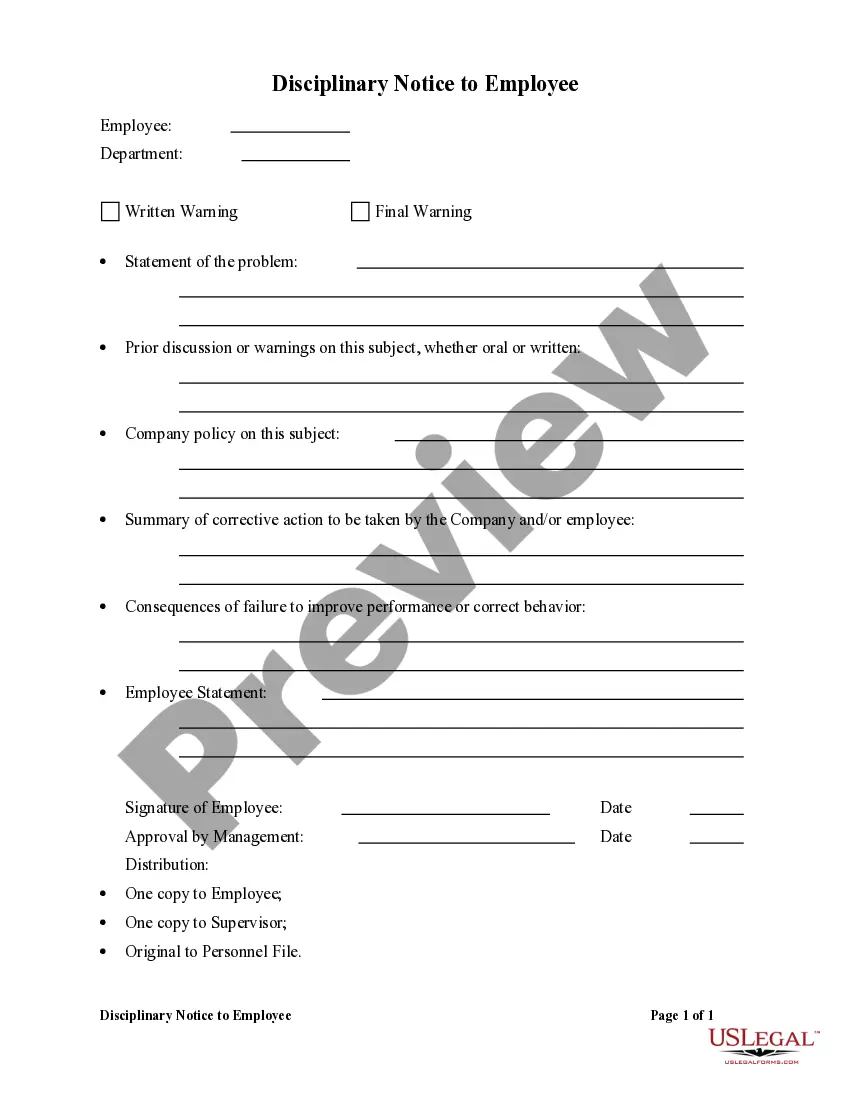

- Check the Preview mode and form description. Make sure you’ve selected the right one that meets your needs and fully corresponds to your local jurisdiction requirements.

- Search for another template, if needed. Once you see any inconsistency, utilize the Search tab above to find the right one. If it suits you, move to the next step.

- Purchase the document. Click on the Buy Now button and select the subscription plan you prefer. You should create an account to get access to the library’s resources.

- Make your purchase. Provide your credit card details or use your PayPal account to pay for the service.

- Download the Dallas Texas Complex Will With Credit Shelter Marital Trust For Large Estates. Save the template on your device to proceed with its completion and obtain access to it in the My Forms menu of your profile whenever you need it again.

Keeping paperwork neat and compliant with the law requirements has major importance. Benefit from the US Legal Forms library to always have essential document templates for any needs just at your hand!

Form popularity

FAQ

El testamento es un acto, o instrumento legal, mediante el cual una persona decide el destino de sus bienes y su patrimonio al momento de su fallecimiento. El testamento es un acto unilateral, formal y solemne, donde una persona expresa su voluntad respecto a como se dispondra de sus bienes tras su muerte.

¿Como se hace testamento? Para hacer testamento solo es necesario acudir con el DNI al notario mas cercano para dejar por escrito nuestra voluntad. El notario lo redactara por escrito reflejando con claridad el lugar, la fecha y la hora en que se ha otorgado.

Un testamento esta sujeto a una posible sucesion, un proceso judicial prolongado que es costoso y publico. Un fideicomiso no requiere revision ni aprobacion judicial, por lo que puede ahorrar dinero, tiempo y privacidad.

Contrato que le permite llevar a cabo la administracion de su patrimonio de acuerdo a su conveniencia, cuando falte, tendra la certeza que el Fiduciario cumpla las instrucciones que haya establecido en favor de sus beneficiarios en los porcentajes determinados, evitando juicios sucesorios.

¿ Que requisitos debe cumplir? El testador debe tener como minimo 18 anos de edad. El testador debe tener buena salud mental. Al redactarlo, debe escribir su nombre y apellidos como aparecen en su acta de nacimiento. El testamento debe precisar quien sera el albacea.

Cualquier persona de 18 anos de edad o mayor con suficiente capacidad mental puede hacer su propio testamento. Capacidad mental suficiente significa que la persona que hace el testamento: Comprende que hacer un testamento significa planear como distribuir los bienes despues de la muerte. Sabe que bienes tiene.

Los fideicomisos patrimoniales no cuentan como un testamento, la diferencia se da en que un fideicomiso permite que las propiedades se distribuyan a los beneficiarios sin tener que pasar por el proceso testamentario, adicionalmente, los fideicomisos son documentos mas privados.

Contar con, minimo, 17 anos cumplidos. Encontrarte en el pleno uso de tus facultades mentales. Declarar a quien ira dirigido tu inmueble, es decir, la o el heredero. En caso de nombrar a un heredero universal, se debe realizar una relacion de los bienes que dejara en herencia y su ubicacion.

¿COMO HACER SU PROPIO TESTAMENTO? Escriba cada palabra de su testamento con su puno y letra.Cancele cualquier testamento que haya escrito anteriormente.Haga un documento completo.Firme su nombre al pie de cada pagina.No necesita testigos que firmen su testamento holografo.

Un testamento esta sujeto a una posible sucesion, un proceso judicial prolongado que es costoso y publico. Un fideicomiso no requiere revision ni aprobacion judicial, por lo que puede ahorrar dinero, tiempo y privacidad.

Interesting Questions

More info

The basic information you need to know: Under State law, if you own property on an island or a county in Indiana and are an heir or executrix, you need to disclose any claim on the property you are named in the will. To find out if you have an active warrant out in your name in the state of Ohio, you can try a few different options. In Texas, a landlord can evict a tenant for a variety of reasons, including not paying rent on time or violating a portion of the lease or rental agreement. Island and mainland retreats to satisfy every design lover. The basic information you need to know: If you died without leaving an estate (no estate of dependents×, and your spouse's name is not included in the will or the testator's will (or the testator's will does not list your name×, and there might be a problem with finding the beneficiary of the estate, you can begin the process of dealing with that problem right then and there, without waiting until the time of the death.

Disclaimer

The materials in this section are taken from public sources. We disclaim all representations or any warranties, express or implied, as to the accuracy, authenticity, reliability, accessibility, adequacy, or completeness of any data in this paragraph. Nevertheless, we make every effort to cite public sources deemed reliable and trustworthy.