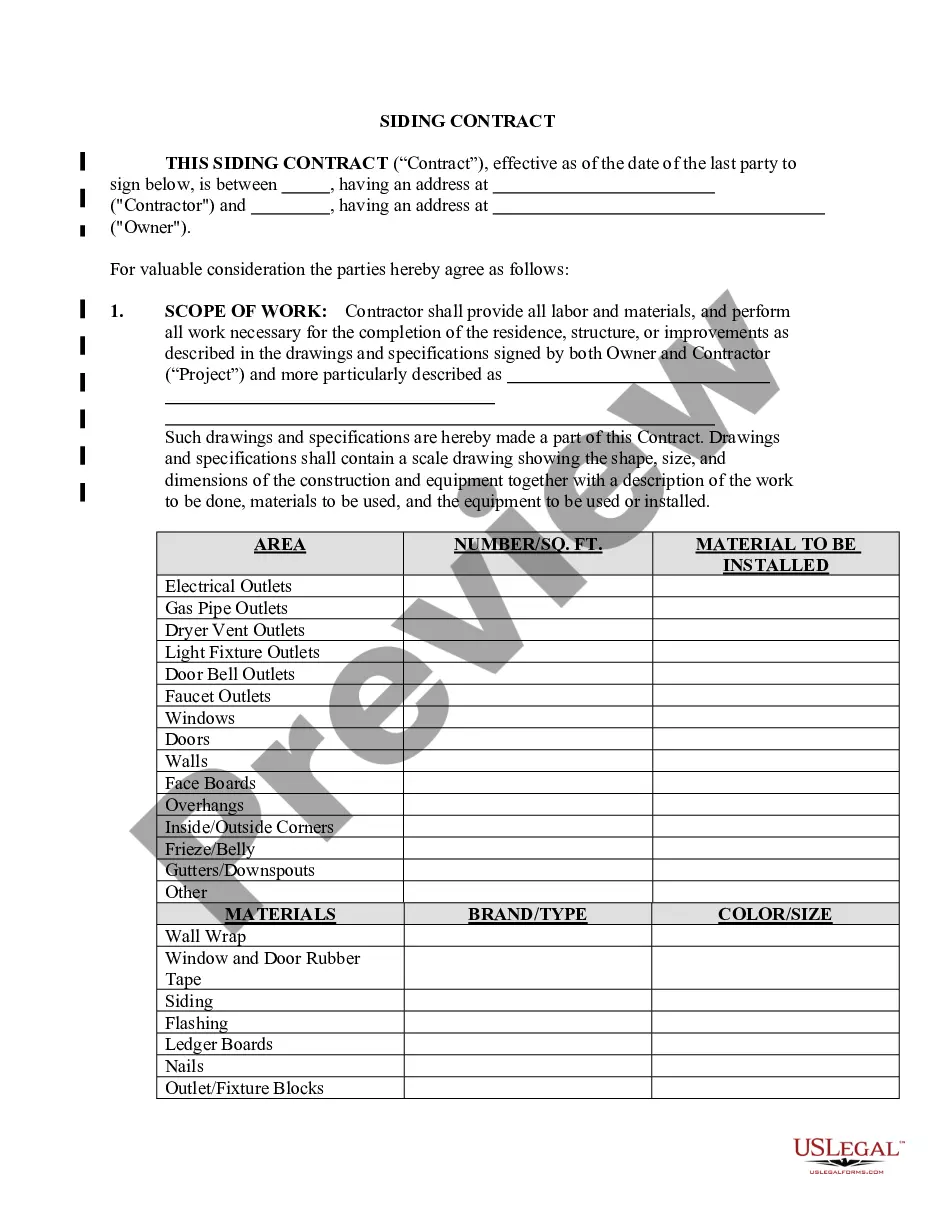

Pearland Texas Fideicomiso en Vida para Individuos Solteros, Divorciados o Viudos o Viudos sin Hijos - Texas Living Trust for Individual Who is Single, Divorced or Widow or Widower with No Children

Description

How to fill out Texas Fideicomiso En Vida Para Individuos Solteros, Divorciados O Viudos O Viudos Sin Hijos?

Are you searching for a dependable and cost-effective legal document provider to obtain the Pearland Texas Living Trust for Individuals Who Are Single, Divorced, or a Widow/Widower Without Children? US Legal Forms is your best option.

Whether you require a straightforward agreement to establish guidelines for living together with your partner or a collection of documents to facilitate your separation or divorce through the judiciary, we have you covered. Our platform offers over 85,000 current legal document templates for personal and business purposes. All the templates we provide are not generic and are tailored to meet the specifications of specific states and counties.

To retrieve the document, you must Log In to your account, find the desired template, and click the Download button adjacent to it. Please remember that you can access your previously purchased document templates at any time within the My documents section.

Is this your first visit to our website? No problem. You can create an account in just a few minutes, but first, ensure you do the following.

Now you can establish your account. Then select the subscription plan and move on to payment. Once the payment is completed, download the Pearland Texas Living Trust for Individuals Who Are Single, Divorced, or a Widow/Widower Without Children in any available format. You can revisit the site at any time and redownload the document at no additional cost.

Obtaining current legal documents has never been simpler. Try US Legal Forms today, and put an end to the hours spent searching for legal papers online once and for all.

- Verify that the Pearland Texas Living Trust for Individuals Who Are Single, Divorced, or a Widow/Widower Without Children complies with the laws of your state and local area.

- Review the form’s specifics (if available) to understand who and what the document is designed for.

- Start the search again if the template does not fit your legal needs.